Trading Strategy Part II: How to Profit by Following Whales

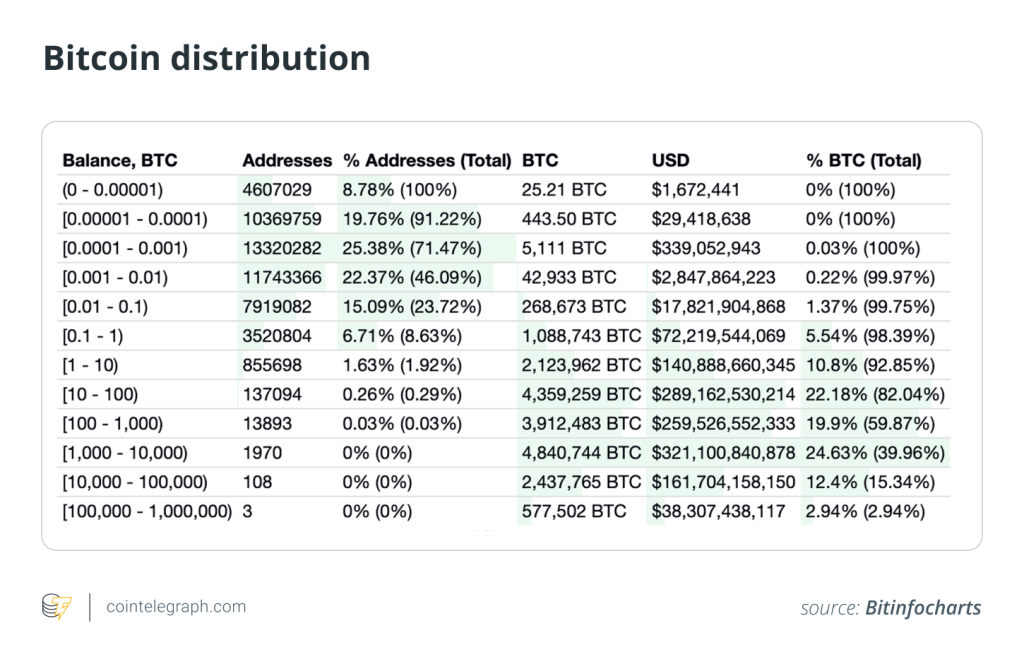

In the financial market, the 80/20 rule often holds true, where retail investors tend to lose money when competing against institutional players. The same principle applies to the crypto market. Whales and institutions have more chips and resources as well as better access to insider information. Therefore, following whales and institutions can help retail investors better navigate the crypto market. Thanks to blockchain's transparency, it's easier for investors to track whales. Leveraging such transparency can be an effective trading strategy.

Following whales for better opportunities

Bitcoin has undergone a surge since early this year, rising to almost $30,000 from around $16,000. In fact, this rally is evident by observing on-chain data.

According to the data analysis provided by Lookonchain, the market rises when a mysterious fund deposits stablecoin to exchanges, and experiences a volatile correction when the injection stops. From January 9 to 25, the fund transferred $632 million worth of USDC from Circle to exchanges, driving up the prices of ETH and other cryptocurrencies. On February 1, the fund withdrew $31.34 million worth of USDC from Circle and deposited the assets to Coinbase, Kraken, and Binance after converting them into USDT. This occurred just four hours before the FOMC meeting, and the ETH and BTC prices saw a significant rise subsequently. Although mainstream cryptocurrencies, including ETH and BTC, began to fall after February 1, the fund didn't halt its capital injection into the crypto market. Instead, its address "0x308F" has moved $155 million worth of USDC from Circle to exchanges since February 10. According to Circle's USDC deposit and withdrawal data, between February 10 and 16, several funds and institutions withdrew around $1.6 billion from the platform while only depositing about $200 million. This directly contributed to the substantial price surge of Bitcoin and Ethereum. (The mysterious fund's address: https://etherscan.io/address/0x308fc89f45694646097c635eb5b3737c931ad253#tokentxn)

How to track whale trades

Whales typically refer to traders with significant capital and influence in the crypto market. Their trades may cause dramatic market fluctuations. However, following whales requires caution, as market changes are unpredictable and can lead to losses. Here are some of the methods and tips for tracking whale trades.

Monitoring market activity: First, watch the market closely, especially assets where whales might be active. This can be done by using market analysis tools like Debank and Etherscan, as well as liquidity indicators and other data on trading platforms.

Spotting whale signals: As whale trades may cause sharp price movements, try to find unusual fluctuations or increased trading volume in price charts – these could be signs of whale activity. Robots offering timely abnormal data can be found on Twitter, such as @glassnodealerts, @whale_alert, and @lookonchain.

Choosing entry points carefully: Select a proper entry point after identifying potential whale trades. This could be at the correction after a price surge or slump, or after the volatility caused by the whale subsides.

Implementing strict risk management: Given the high risk arising from following whales, strict risk management is crucial. Ensure that stop-loss orders are in place to protect against price reversals.

Trading in both directions: Consider adopting a straddle trade strategy, which allows you to trade regardless of the direction of price movements. This helps provide profit opportunities in different market conditions.

Conducting thorough research: Performing a deeper analysis of whales' behavior and motives can help you better understand their trading strategies and patterns, as well as market signals and sentiment indicators.

Avoid blindly following: While following whales can be a reasonable strategy, avoid blindly copying every trade they make. Their behavior could be influenced by various factors, including risk tolerance, holding strategies, and market developments.

Classification and review of on-chain whale addresses

After going through the methods and tips for tracking whales, let's look at some renowned crypto influencers' addresses for you to follow.

Addresses of renowned crypto influencers

Vitalik Buterin

0x220866b1a2219f40e72f5c628b65d54268ca3a9d

0xab5801a7d398351b8be11c439e05c5b3259aec9b

0x1db3439a222c519ab44bb1144fc28167b4fa6ee6

Cryptopunk Big Collector: 0x577ebc5de943e35cdf9ecb5bbe1f7d7cb6c7c647

Synthetix founder Kain: 0x42f9134e9d3bf7eee1f8a5ac2a4328b059e7468c

Shixing "Discus Fish" Mao

0x6e9fe041e0ba8c2af35215d900d188d53d7a9b41

0xca436e14855323927d6e6264470ded36455fc8bd

Early 0xb1 DeFi influencer: 0xb1adceddb2941033a090dd166a462fe1c2029484

Advanced NFT player MEV Collecto: 0x5338035c008ea8c4b850052bc8dad6a33dc2206c

Advanced NFT player Pranksy:

0xd387a6e4e84a6c86bd90c158c6028a58cc8ac459

0xc79b1cb9e38af3a2dee4b46f84f87ae5c36c679c

Anonymous whale: 0x6cf9aa65ebad7028536e353393630e2340ca6049

Early NFT cryptopunk loot player: 0x577eBC5De943e35cdf9ECb5BbE1f7D7CB6c7C647

Justin Sun

0x3ddfa8ec3052539b6c9549f12cea2c295cff5296;

0x85560dbef2533eec139b3e206b119fd700f90262

Feng Bo: 0x5338035c008ea8c4b850052bc8dad6a33dc2206c

NFT player @MEV Collecto (Twitter): 0xd2db6c5e613c0e1ce63c7a15045e8d163a3fc576

Wang Feng, founder of Mars Finance and the NFT trading platform Element: 0xd387a6e4e84a6c86bd90c158c6028a58cc8ac459

NFT player Pranksy: 0xc79b1cb9e38af3a2dee4b46f84f87ae5c36c679c

Meme tokens player: 0xb20bf6d7f60059dd5de46f3f0f32665a259ea6c0

Institutional investors

Ethereum Foundation: 0xde0b295669a9fd93d5f28d9ec85e40f4cb697bae

a16z: 0x05e793ce0c6027323ac150f6d45c2344d28b6019

Multicoin Capital: 0xc8d328b21f476a4b6e0681f6e4e41693a220347d

ParaFi

0xd9b012a168fb6c1b71c24db8cee1a256b3caa2a2

0x4655b7ad0b5f5bacb9cf960bbffceb3f0e51f363

0x5028d77b91a3754fb38b2fbb726af02d1fe44db6

Arca

0xe05a884d4653289916d54ce6ae0967707c519879

CMS

0xafa64cca337efee0ad827f6c2684e69275226e90

Leading ETH accounts: https://etherscan.io/accounts

USDT holder addresses on Ethereum

https://etherscan.io/token/0xdac17f958d2ee523a2206206994597c13d831ec7#balances

USDC holder addresses on Ethereum

https://etherscan.io/token/0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48#balances

Real-time on-chain data monitoring: https://twitter.com/lookonchain

References

Review of Wale Addresses: https://mirror.xyz/0xzsc.eth/eScAIAAahR0QJDs7SkU7btsbI1dSHljvUq7K-KDhdQk

Tracking holdings of prominent whales: https://dune.com/0xBi/0xBi

Etherscan: https://etherscan.io/

… [Trackback]

[…] There you will find 97873 additional Information on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] There you will find 3071 more Information to that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Here you can find 29599 additional Info to that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] There you will find 7155 more Information on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Here you can find 51378 more Information to that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Here you can find 72272 more Info on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Here you will find 36827 additional Info on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/deeplearning/2017/ […]

… [Trackback]

[…] There you will find 38106 additional Info to that Topic: x.superex.com/academys/deeplearning/2017/ […]