What is Bitcoin Halving and Its Chain Effect?

Abstract

Mining serves two crucial roles on the Bitcoin blockchain: validating transactions and creating new Bitcoins.

Essentially, Bitcoin halvings periodically regulate the issuance of cryptocurrencies in the Bitcoin ecosystem through

coding.

For Bitcoin miners, when a halving event occurs, the mining rewards given to them are reduced by half. This

reduction in mining rewards translates to an increase in mining costs. Over time, the increasing costs have

transformed Bitcoin mining into a highly specialized industry with substantial entry barriers.

For investors, an increase in the average cost of producing a single Bitcoin brought by the BTC halving becomes a

crucial reference to evaluate the price and value of Bitcoin. Furthermore, the historical total mining cost in PoW can

also be used as a reference for the overall valuation of Bitcoin.

According to statistical data, each halving drives a bull run in the Bitcoin market. However, the amount of time it

takes for BTC to reach a new high after each halving has shown a progressive increase, potentially attributed to the

expanding size and maturation of the Bitcoin ecosystem.

Indeed, for other popular Proof-of-Work (PoW) cryptocurrencies, the halving events can still have a positive impact

on their ecosystems, albeit not as pronounced as that of Bitcoin. Litecoin (LTC) serves as a notable example in this

regard, where the approach of the Litecoin halving event has triggered whales movements.

How will halving events impact the Bitcoin ecosystem?

In the previous article, we covered the concepts of "Bitcoin halving" and "Bitcoin mining". Now, let's dive into what

kind of impact the halving event will have on the Bitcoin ecosystem and all parties involved.

For the Bitcoin network, mining serves two crucial roles: validating transactions and creating new Bitcoins. Essentially, Bitcoin's halving events serve as a cyclical mechanism to regulate the issuance of the cryptocurrencies in the Bitcoin

system through coding. Similar to the Federal Reserve's cycles of interest rate hikes and cuts, the halving events occur periodically to facilitate macroeconomic adjustments. However, there is a fundamental distinction between the two.

The Federal Reserve operates within a centralized inflationary economic model, whereas Bitcoin operates on a

decentralized deflationary economic model. Despite this difference, each round of macroeconomic adjustment carries significant implications for all participants within the Bitcoin ecosystem.

With the halving of mining rewards, miners are likely to face a decline in profitability. If the Bitcoin price remains

unchanged, mining machines with lower performance and efficiency will incur losses. Over time, this can lead to the

elimination and shutdown of these less efficient and unprofitable mining machines, similar to phase out of the

outdated production capacity. To put it simply, Bitcoin halving leads to an increase in the mining cost, subsequently

raising the entry barrier. Initially, Bitcoin mining could be performed using personal computers. However, it has since transformed into a highly specialized industry with substantial entry barriers.

For investors, the halving of mining rewards in the Bitcoin network leads to an increase in the average cost of

producing a single Bitcoin. This new cost becomes a crucial reference for investors to evaluate the price and value of Bitcoin. Additionally, the historical total mining cost of PoW can be used as a reference to assess the overall valuation of Bitcoin. It provides an objective "real value level" that is independent of individual confidence or subjective ideas.

By offering a solid value reference, it helps mitigate extreme price swings. As a result, the price of Bitcoin is less

prone to abrupt crashes overnight or skyrocketing surges in a day. In simple terms, Bitcoin is often considered

undervalued by many investors when its price falls below the mining cost. In such cases, bargain hunters may inject

funds into the market, providing support for Bitcoin's price. Conversely, when Bitcoin's price significantly exceeds the mining cost, investors may perceive it as overvalued, which can create a psychological expectation to sell and exit the market. Overall, the mining cost of Bitcoin plays a crucial role in determining its price, serving as a fundamental basis for the cryptocurrency's value and preventing it from deviating excessively from its intrinsic value.

What is Bitcoin halving?

As mentioned earlier, the halving of Bitcoin's mining rewards every four years serves as a cyclical regulation

mechanism for the Bitcoin network's monetary deflation policy. This mechanism directly impacts miner incentives,

which in turn leads to an increase in the production cost of Bitcoin. Consequently, the increased production cost of

Bitcoin will influence investors' psychological expectations and trigger fluctuations in the market, ultimately

contributing to the formation of bull or bear markets. Specifically, when the price of Bitcoin drops to a certain level, individual and institutional investors often take advantage of the opportunity to buy the bottom and accumulate more Bitcoin at a lower cost. This influx of buying activity is what characterizes a bear market. Conversely, in the bull

market, as the price of Bitcoin rises to a certain level, some investors may begin to take profits, leading to selling

pressure and potentially contributing to a market correction or bubble burst.

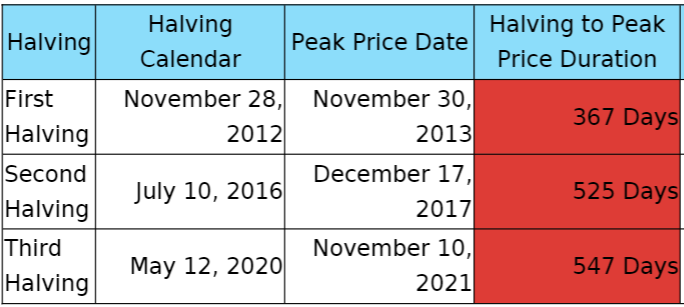

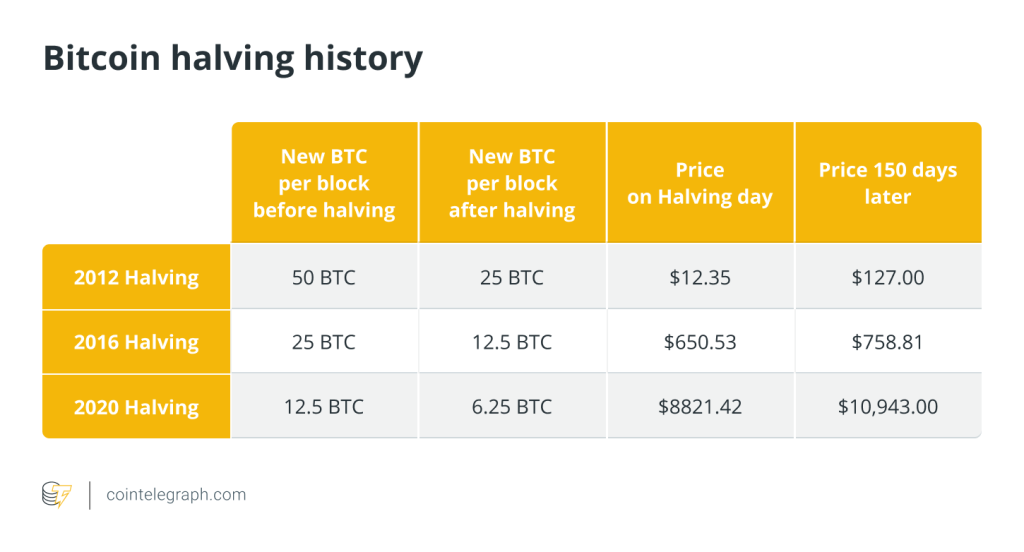

Since its inception in 2009, Bitcoin has experienced three halvings. The first three halvings occurred on November 28, 2012, July 10, 2016, and May 12, 2020. During these events, the block rewards were reduced from the original 50

Bitcoins per block to 25, 12.5, and 6.25 Bitcoins per block respectively. To provide a comprehensive illustration of the Bitcoin halving cycle, we have compiled statistics on the halving dates, the dates when the price reached its peak

following each halving, and the duration in days between the halving and the peak price. See the following table for more details:

Table: Timeline for Bitcoin's Halving Cycle (Source: Huobi Learn)

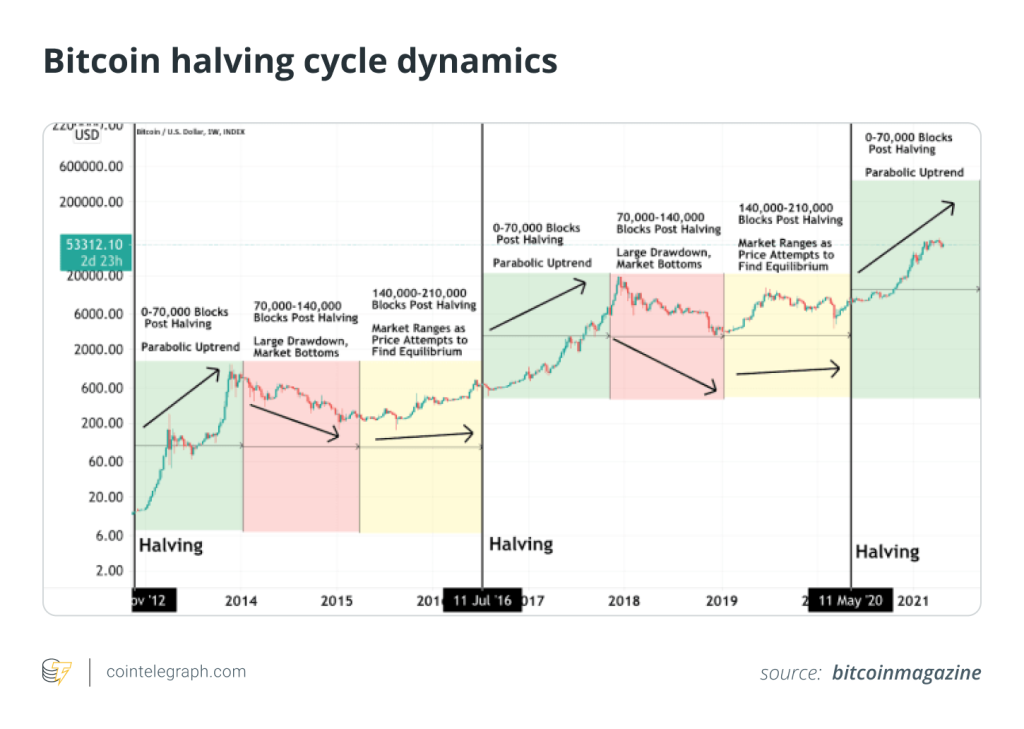

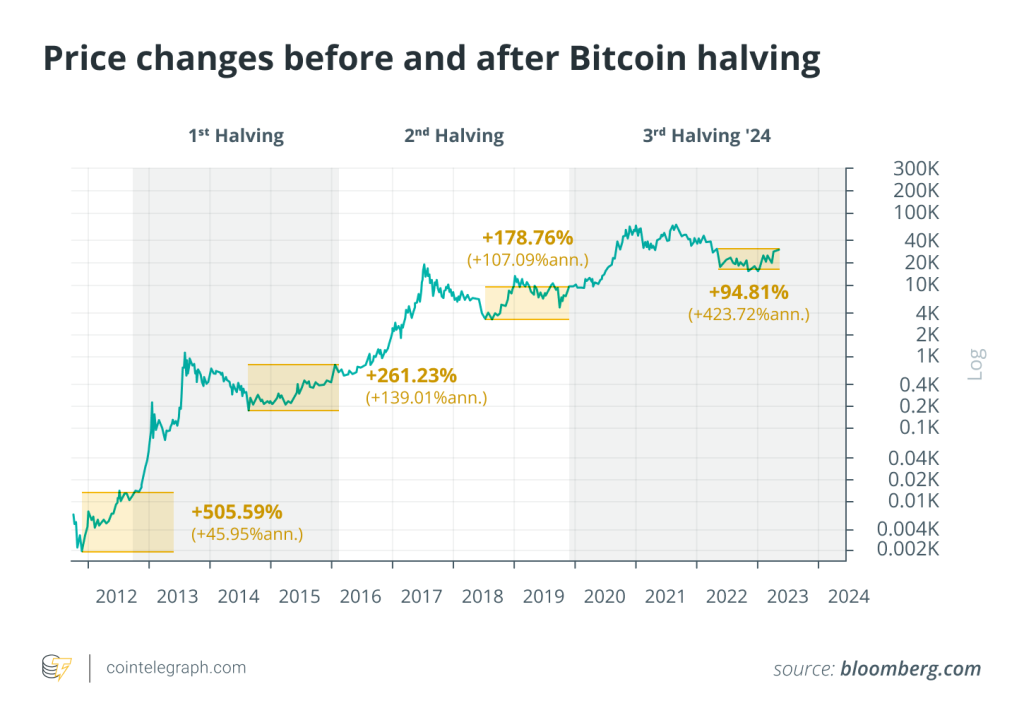

Table 1 shows that Bitcoin tends to enter an upward cycle following each halving. Furthermore, examining the data

on the number of days between the peak and the halving, we can see that this duration increases with each halving.

Specifically, the time span between the peak price and the halving is longer for the third halving compared to the

second. This may be related to Bitcoin's growing market cap. As Bitcoin's market cap increases, its volatility decreases. Meanwhile, it requires a larger influx of funds to drive a bull market upswing, which in turn leads to a proportionally

longer duration to reach its peak price.

Whales enter the market as Litecoin halving approaches

As mentioned in the previous article, apart from Bitcoin, other cryptocurrencies such as LTC, BCH, BSV, DASH, ETC

also undergo halving or reduction cycles. While the impact of the halving cycle on these cryptocurrencies may not be as pronounced as it is for Bitcoin, it still exerts a cyclical effect on their ecosystems to some degree. While the halving events for most of the cryptocurrencies mentioned earlier are scheduled for next year, the halving of LTC is expected

to take place on August 3, 2023. As the halving event approaches, data indicates that speculation has already

increased among LTC holders, especially whales. According to Santiment data, the distribution of Litecoin's supply

reveals that specific Litecoin whales have been accumulating the cryptocurrency during the period of price decline. In the last ten days of June 2023, addresses holding between 10,000 to 100,000 LTC and those holding between

1,000,000 to 10,000,000 LTC have consistently increased their LTC holdings.

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] There you will find 14256 additional Info to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] There you will find 86931 more Info to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] There you will find 56637 more Information to that Topic: x.superex.com/academys/deeplearning/1989/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/deeplearning/1989/ […]