Overview of Stablecoin Regulation Worldwide: Key Points and Trends Across Major Countries and Regions

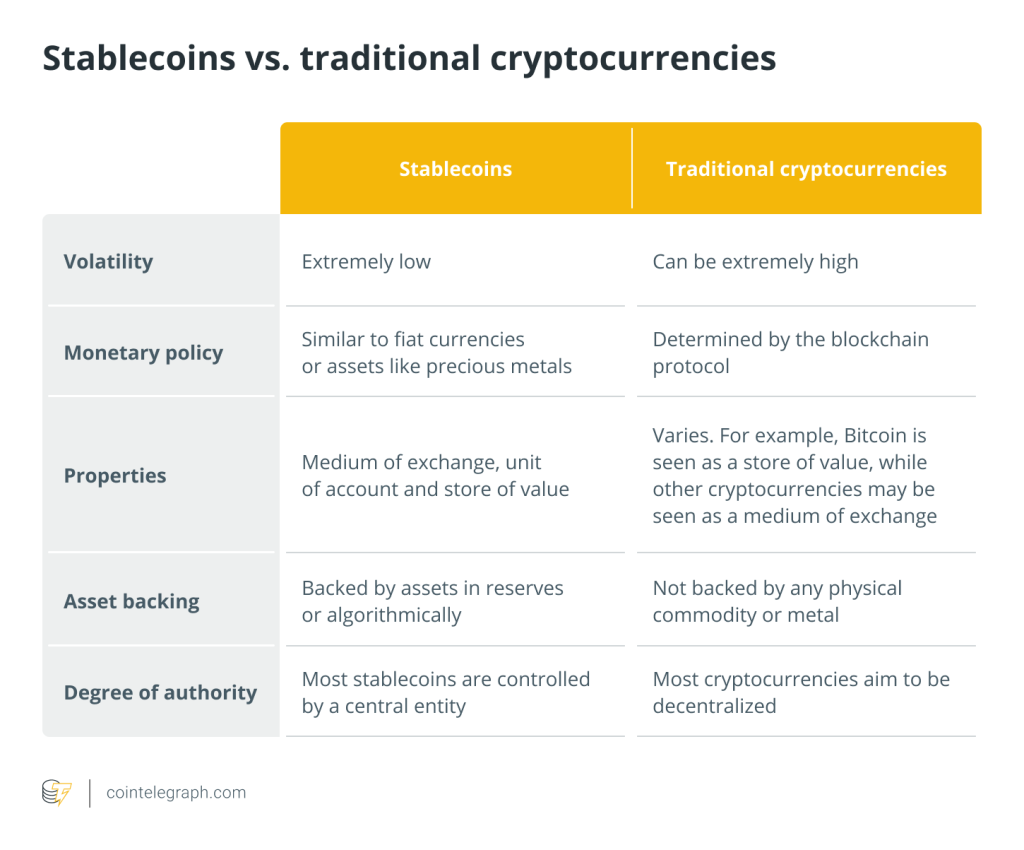

Stablecoins are cryptocurrencies whose value is pegged to various assets, such as another currency like the U.S. dollar or the price of a commodity like gold. Additionally, they can be categorized into distinct asset classes under the diverse regulatory frameworks of various countries. For instance, in Japan, USDT is categorized as a "Digital money-like type", whereas algorithmic stablecoins are labeled as "Crypto-assets type". At present, Singapore has established a relatively detailed regulatory framework for stablecoins. Japan has implemented more stringent regulations, whereas the European Union has adopted a comprehensive regulatory framework. In Hong Kong and the United States, regulatory frameworks are largely in place, with expectations of imminent legislative implementation.

Singapore

On August 15, 2023, the Monetary Authority of Singapore (MAS) released its finalized regulatory framework for overseeing stablecoins in Singapore, establishing its position as one of the pioneering jurisdictions globally to incorporate stablecoins within its domestic regulatory framework. Here are the regulatory highlights from MAS:

Regarding the anchor currency and issuing entity, MAS' stablecoin regulatory framework applies to single-currency stablecoins (SCS) pegged to the Singapore Dollar (SGD) or any G10 currency issued within Singapore. MAS challenges the conventional notion that a nation's currency solely symbolizes its sovereignty by permitting stablecoins to be pegged to the currencies of other countries, marking a significant breakthrough. When it comes to issuing entities, they fall into two categories: banks and non-bank financial institutions (NBFIs). According to the MAS stablecoin regulatory framework, non-bank issuers are mandated to maintain a minimum stablecoin circulation of SGD 5 million. These issuers must also apply for a Major Payment Institution (MPI) license under the Payment Services Act 2019 (PS Act). Failure to meet these requirements places them outside the scope of stablecoin regulation, and they are only obligated to comply with the Digital Payment Token (DPT) provisions of the PS Act. On the other hand, banks are required to issue stablecoins with 100% asset collateralization. It's worth noting that banks are exempt from the requirement to apply for an MPI license. MAS has clarified that the Banking Act already mandates that banks meet the relevant standards.

In terms of reserve management, MAS has established comprehensive regulations, with a primary focus on the following areas:

Composition of Assets: MAS mandates that reserves can only be invested in cash, cash equivalents, or bonds with remaining maturity of no more than three months.Meanwhile, MAS requires the issuing entity to be government agencies/central banks or international institutions with a credit rating of AA- or above.

Fund Custody: MAS mandates that issuers must establish a trust and set up a segregated account to ensure the separation of their assets from reserves. Fund custodians must meet specified qualifications, including financial institutions holding custody service licenses in Singapore or overseas institutions with branches in Singapore and credit ratings of A- or higher.

Day-to-day Management: MAS mandates that the daily market value of reserves must exceed 100% of the circulation size of SCS. During redemption, reserves must be redeemed at face value, with the redemption period not exceeding 5 days. Monthly audit reports must also be published on the official website.

MAS has laid out qualifications for stablecoin issuers in three main areas:

Base Capital Requirement: Similar to the Basel Accords' capital requirement for banks, MAS specifies that stablecoin issuers must maintain capital of at least SGD 1 million or 50% of their annual operating expenses (OPEX).

Solvency Requirements: MAS stipulates that stablecoin issuers must hold liquid assets exceeding 50% of their annual operating expenses or meet the scale necessary for standard asset withdrawals, which must be independently verified. Notably, MAS has explicitly defined the categories of liquid assets, primarily including cash, cash equivalents, government bonds, significant certificates of deposit, and money market funds.

Business Restriction Requirements: Stablecoin issuers cannot participate in activities such as lending, staking, trading, and asset management, nor hold shares in any other entity. However, they are permitted to engage in stablecoin custody and transfer business. It's important to note that MAS explicitly prohibits stablecoin issuers from offering interest to users through activities like lending, staking, and asset management. Nevertheless, other companies, including sister companies that stablecoin issuers do not hold shares in, may provide similar services for stablecoins.

The United States

Currently, there is no clear stablecoin-related policy and regulation in the United States. The congressional hearing held on May 18, 2023, represented a significant milestone in shaping U.S. regulatory efforts and policy direction regarding stablecoins. During this hearing, both the Democrats and the Republicans presented their respective proposed regulatory frameworks. Despite ongoing disagreements between the parties, substantial consensus has been reached on various aspects of regulation.

In this draft of legislation put forth by the Republican Party, stablecoin issuers are granted the freedom to choose their registration state without requiring approval from the Federal Reserve. This approach preserves the authority of state regulators, allowing each state to establish its own standards. Issuers will have a 180-day period to submit all necessary registration materials to federal regulatory agencies. Proponents of this bill argue that it will prevent a "race to the bottom" and align with the existing dual federal/state banking regulatory framework in the United States.

In the Democratic proposal led by Representative Maxine Waters, the Federal Reserve assumes a prominent role. The Democrats suggest granting state regulatory agencies the power to approve issuer registrations, while the Federal Reserve retains the authority to approve or deny federal registrations. The Democratic Party places significant emphasis on issuer qualifications. For example, it stipulates that issuers should be federally insured depositary institutions. It is expected that provisions will be introduced requiring stablecoin issuers and/or distributors to comply with certain Know Your Customer (KYC) rules and anti-money laundering standards.

Currently, a consensus has been reached in the following areas: the composition of stablecoin reserves (consisting of cash, short-term Treasury bonds, and central bank reserve deposits); the requirement for issuer registrations to be approved or rejected within a 90-day timeframe; recognition of stablecoins as non-securities, allowing the SEC to assume a secondary role in this domain.

Furthermore, on July 28, 2023, the U.S. House Financial Services Committee passed several financial-related bills, including the "Clarity for Payment Stablecoins Act of 2023," the "Keep Your Coins Act of 2023," and five others. These bills aim to provide regulatory oversight for the issuance of payment stablecoins and ensure that cryptocurrency users can store their assets in self-hosted wallets. Additionally, there are several other cryptocurrency bills currently under deliberation in Congress, each receiving varying levels of support. For instance, the "Stablecoin TRUST Act" and the "Stablecoin Innovation and Protection Act," which focus on stablecoin regulation, were introduced in December 2022 but have made little progress since then.

Hong Kong

On January 31, 2023, the Hong Kong Monetary Authority (HKMA) released a detailed 36-page document titled "Conclusion of Discussion Paper on Crypto-assets and Stablecoins." This document provided an overview of the regulatory approach concerning cryptocurrencies and stablecoins in Hong Kong.

To be more specific, the HKMA will adopt a risk-based approach in scoping stablecoin structures for regulation under the proposed regime. The HKMA aims to regulate various activities related to stablecoins, including the establishment and maintenance of rules governing stablecoins; the issuance, creation, or destruction of in-scope stablecoins; and the stabilization and reserve management arrangements of in-scope stablecoins (whether or not such arrangements are provided by the issuer).

The document also stipulates that the value of the reserve assets of a stablecoin arrangement should meet the value of the outstanding stablecoins at all times. The reserve assets should be of high quality and high liquidity. Stablecoins that derive their value based on arbitrage or algorithm will not be accepted. Stablecoin holders should be able to redeem the stablecoins into the referenced fiat currency at par within a reasonable period. The regulated entities should not conduct activities that deviate from their principal business as permitted under their relevant licenses. For example, wallet operators should not engage in lending activities. Furthermore, the document indicates that the target implementation date is set for 2023 – 2024.

The European Union

The European Parliament adopted the EU Markets in Crypto Assets Regulation (MiCA) on April 20, 2023. MiCA is a comprehensive and far-reaching law. In this discussion, we will focus solely on the elaboration of stablecoins.

Regarding stablecoins, MiCA classifies them into two subcategories: e-money tokens (EMTs) and asset-referenced tokens (ARTs). Under the MiCA framework, EMTs are crypto-assets that aim to maintain a stable value by referencing the value of one legal tender. For instance, stablecoins like USDC, USDT, and EUROC fall into this category. EMT issuers are required to maintain a specific level of capital reserves, and institutions deemed "significant" are subjected to additional regulatory provisions and oversight by the European Banking Authority (EBA).

Meanwhile, MiCA's ART framework essentially serves as a response by the European Union to the concerns raised by projects like Facebook's abandoned Diem token. ART is a token designed to stabilize its value by referencing or pegging it to a basket of currencies, commodities, crypto assets, or other non-fiat currency assets. The classification offers stablecoin issuers clear guidelines for compliance. Yet, the effectiveness of MiCA hinges on the execution of these standards. In addition, MiCA stipulates that stablecoins are obligated to maintain adequate reserves and adhere to specified transaction limits. For example, stablecoins like USDC must hold ample reserves to meet redemption demands during substantial withdrawal events. Furthermore, larger-scale stablecoins are restricted by a daily transaction cap of €200 million ($220 million).

Japan

On June 3, 2022, the Japanese parliament passed a law regulating stablecoins, which clarified their legal status and effectively categorized them as digital currencies. This legislation positioned Japan as one of the first major economies to establish a regulatory framework for stablecoins. On April 7, 2023, the Japanese government issued a white paper on Web 3.0, outlining regulatory measures for NFTs and stablecoins. The new white paper emphasizes the importance of preparing the environment for stablecoin registration and establishing a self-regulatory organization. It also suggests the development of proposals for yen-backed stablecoins. However, the white paper highlights that approvals for banks and insurance companies entering the industry remain unclear and recommends that the government should provide clear guidelines.

On June 1, 2023, Japan enacted the "Revised Payment Service Act," officially categorizing stablecoins as a novel form of "electronic means of payment." This move significantly bolstered the legal standing of stablecoins within the Japanese legal framework and instituted comprehensive regulations governing their issuance and utilization within Japan.

The "Revised Payment Service Act" classifies digital currencies into two distinct categories: the "Digital money-like type" and the "Crypto-assets type." The primary focus of this revision lies in the distinct categorization of the former. Stablecoins, such as USDT, backed by fiat currencies, fall into the "Digital money-like type" category, with their trades considered foreign currency transactions. Consequently, the issuance of such stablecoins is restricted to domestic banks, money transfer service providers, and trust companies. Furthermore, the new regulations outline specific guidelines for issuers and agents, clearly stating that only agents with an electronic payment license are eligible to participate in the issuance of such stablecoins.

The oversight of stablecoins issued overseas is primarily conducted through local agents operating within Japan. These agents bear the responsibility of safeguarding client assets, and the Financial Services Agency (FSA) retains the authority to request transfer records for anti-money laundering purposes. In contrast, algorithmic stablecoins fall into the "Crypto-assets type" category and are subject to the same management practices as other digital currencies.

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] There you can find 7748 more Info on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Here you will find 8246 additional Info on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] There you can find 93337 more Information on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Here you can find 37887 additional Information on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Here you will find 18070 additional Info to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] There you will find 98343 additional Information on that Topic: x.superex.com/academys/deeplearning/1981/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/deeplearning/1981/ […]