What is Lybra Finance? The future of interest-bearing stablecoins in DeFi

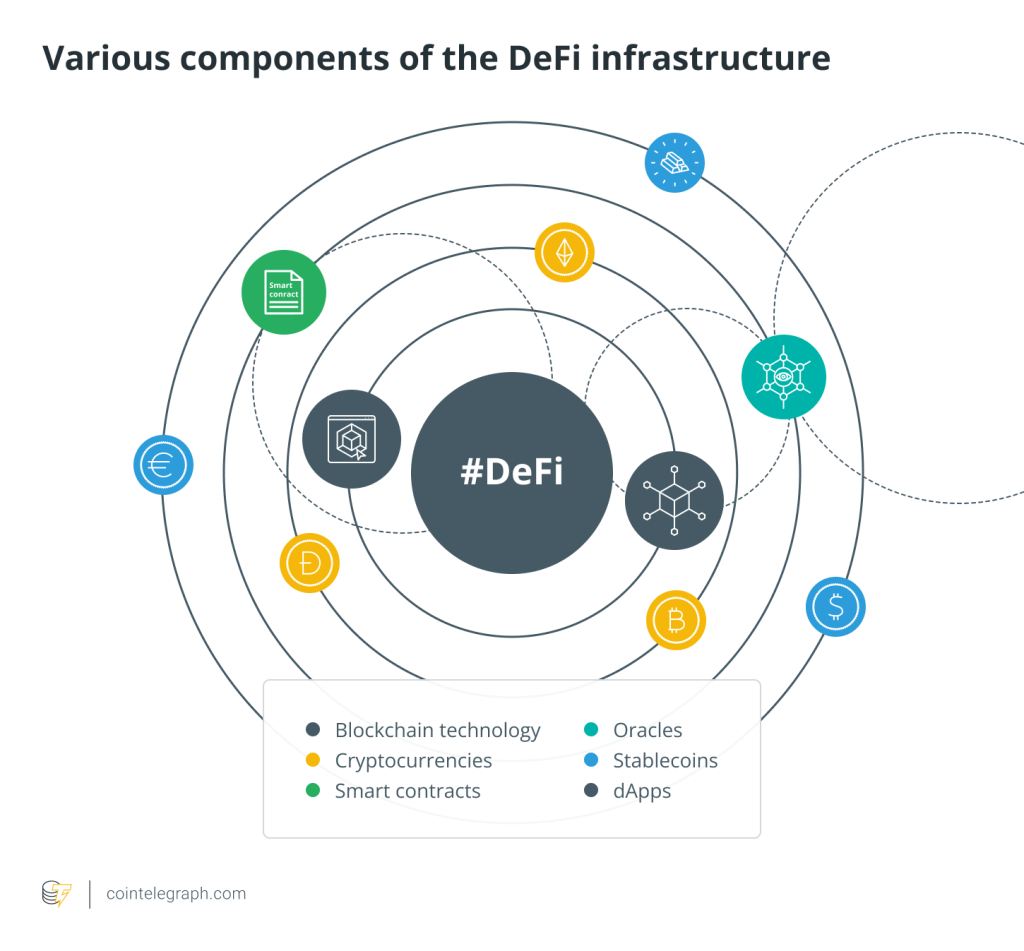

Where do you go for DeFi yield opportunities? One option is Lybra Finance, a decentralized platform that gives access to Liquid Staking Tokens (LSTs) — primarily focused on ETH — to offer fresh opportunities in decentralized finance (DeFi).

eUSD and peUSD, two interest-bearing stablecoins created by the platform, offer real yield to those who hold them. Unlike traditional stablecoins, eUSD stands out by providing an impressive annual yield, made possible through the strategic use of LSTs as collateral.

As Lybra Finance continues to evolve, particularly with its V2 upgrades, the platform is considered by some to be a hub for DeFi innovation.

TL;DR

-

DeFi innovator: Lybra Finance offers Liquid Staking Tokens (LSTs), focusing on Ethereum for enhanced yield opportunities.

-

Unique stablecoins: Lybra Finance's stablecoins, eUSD and peUSD, are unique in the stablecoin market due to their ability to generate real yield.

-

Interest-bearing eUSD: Unlike typical stablecoins, eUSD provides an impressive annual yield, leveraging LSTs as collateral for this unique benefit.

-

V2 upgrades: Lybra Finance's V2 upgrades could bring new innovations, enhancing user autonomy and protocol safety.

-

LSTs for liquidity and yield: Lybra Finance's LSTs could answer the ETH staking problem, making it possible to create liquidity and earn returns.

Get started

What is Lybra Finance?

Lybra Finance is an Omnichain LST-backed yield-bearing stablecoin solution, marking a significant milestone in the DeFi landscape.

Lybra Finance has developed LSTs with ETH as a core component. These tokens are an effective solution to the issue some crypto enthusiasts face — the need to decide between staking ETH for rewards and keeping liquidity for other yield-generating activities. LSTs measure the value of staked ETH and provide a new source of liquidity, offering users even more ways to generate yield.

One of the major benefits of Lybra Finance is its interest-earning eUSD stablecoin. Unlike other traditional stablecoins that are designed to maintain a 1:1 value of fiat currencies such as USD, eUSD offers a stable store of value and liquidity. Meanwhile, eUSD has the added advantage of providing interest, protecting it from devaluation caused by inflation.

Lybra Finance's eUSD is unique in its approach to resolving this issue. Using ETH and other LSTs as collateral can offer its holders a steady revenue source. This is something traditional stablecoins couldn't do because of their limited issuance and collateralization procedures.

This progressive strategy not only increases the value of LSTs but also offers a rewarding and practical option in the stablecoin industry, granting stability and growth to its users.

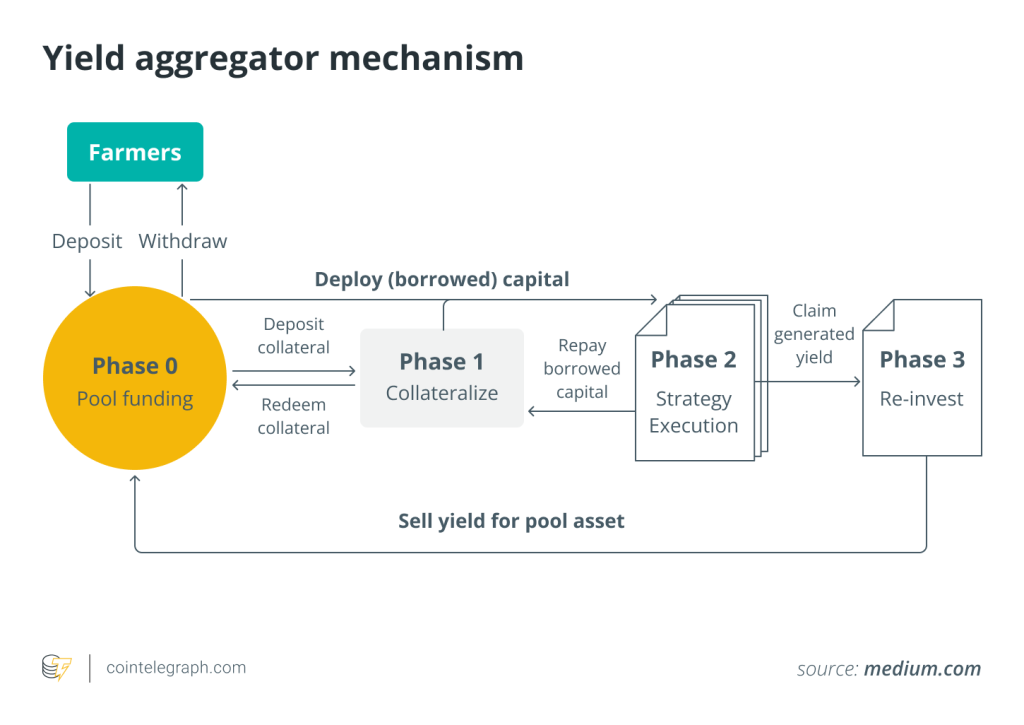

What yield generation opportunities does Lybra offer?

Lybra Finance offers an opportunity for yield generation within the DeFi landscape. This happens primarily through its innovative use of LSTs and the introduction of its interest-bearing stablecoin, eUSD.

Real yield through eUSD

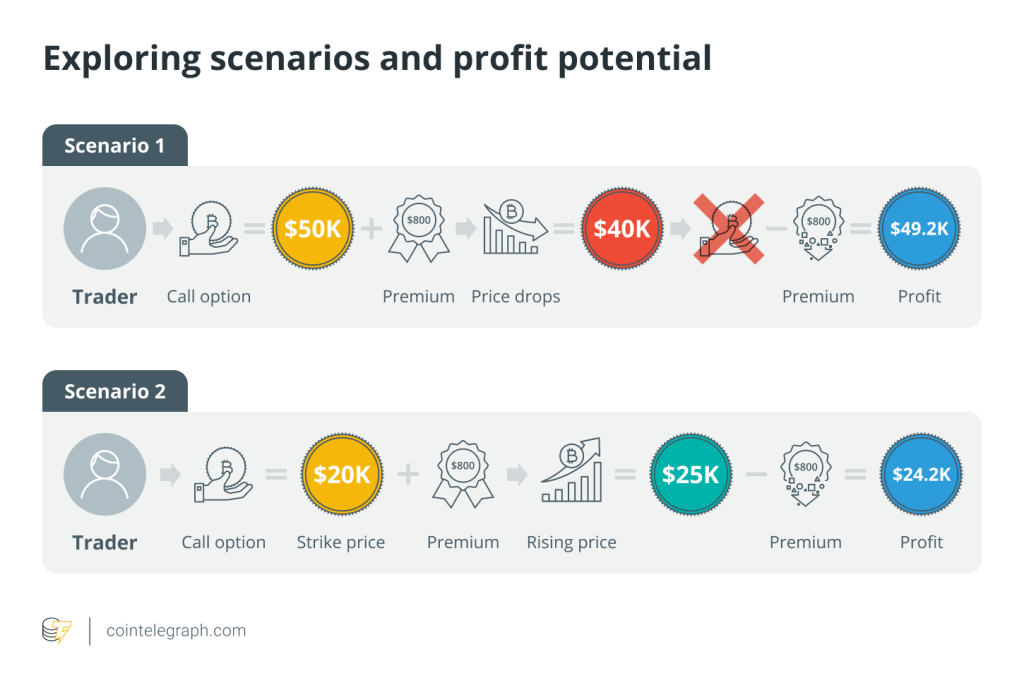

Lybra Finance gives users the unique opportunity to receive income from their ETH or rebase LSTs deposits. By generating eUSD from these assets, users can get a return of up to 8%. This return is derived from the LST income that's generated from the deposited collateral and then given out to those holding eUSD.

LSTs as a source of passive returns

LSTs present an opportunity to earn passive returns from staked ETH and enable further yield-bearing activities through the use of the tokens. This approach helps to solve the longstanding dilemma between staking for rewards and maintaining liquidity for other yield-generating activities.

Interest-bearing stablecoins

By creating eUSD, Lybra Finance has provided a solution to the issue of traditional stablecoins not generating interest, which leads to their holders facing depreciation because of inflation. eUSD consists of ETH, stETH, and other LSTs and still provides the same key characteristics as traditional stablecoins, but with the added interest bonus. This has closed the gap between stablecoins and interest generation, making eUSD an alternative.

What features are introduced in Lybra V2?

Lybra Finance's V2 upgrade introduces various expanded features and enhancements, significantly broadening its scope and functionality in the DeFi space. The V2 iteration focuses on increasing user autonomy, enhancing protocol safety, and offering more flexibility. Here are the key features of Lybra V2:

Diversified collateral assets

Lybra V2 extends the ways LSTs can be used as collateral. This upgrade introduces rETH and WBETH as new collateral options for minting eUSD and peUSD, providing users with greater flexibility and choice. This expanded collateral base could attract a broader pool of users and enhance user interaction with the protocol.

Introduction of peUSD

Lybra Finance is introducing peUSD, a DeFi utility version of eUSD, to its Omnichain ecosystem which will augment the platform's utility and versatility. Additionally, users can convert eUSD to peUSD without losing the gains made on their eUSD holdings. This could improve the protocol's robustness and help promote the stability of the protocol's funds.

Enhanced DAO governance and community engagement

V2 amplifies the impact of the Lybra Finance DAO, granting esLBR token holders the ability to take part in DAO protocol oversight. This involves casting votes on protocol plans and selecting favored minting pools for higher emissions. Such involvement and authorization of the community are core principles of Lybra Finance.

Innovative bounty programs

The V2 update introduces the Advanced Vesting Bounty and dLP Bounty programs, allowing users to purchase esLBR at a discount using either LBR or eUSD. These programs are designed to incentivize participation on the platform.

Stability Fund and additional revenue streams

The V2 update has brought with it a Stability Fund to maintain the eUSD peg and guarantee the stablecoin's robustness. Meanwhile, potential additional sources of revenue for the protocol have been established, such as service fees from the flow of eUSD and payments of peUSD debts, which are given to esLBR holders. This connects the incentives of the protocol with its token owners, further improving the platform's financial structure.

What are LSTs, and what's their role in Lybra Finance?

As introduced above, LSTs — or Liquid Staking Tokens — are emerging as a significant innovation in the DeFi space, offering both liquidity and yield generation opportunities. It's important to understand the purpose and operation of LSTs in the framework of Lybra Finance.

How LSTs function

Staking ETH in Ethereum pools is made more favorable with the introduction of LSTs, which demonstrate the worth of a user's staked ETH. This opens up new avenues of liquidity and additional potential yield. Stakers no longer have to choose between staking ETH for rewards and maintaining liquidity for other revenue-generating activities.

Since LSTs are tradable, they allow users to stake ETH to earn passive returns and employ them in various DeFi applications, presenting a fix for the staked ETH liquidity challenge.

Categories of LSTs

LSTs can be classified into two groups: Rebase LSTs and Non-Rebase (Value-Accruing) LSTs. With Rebase LSTs, staking rewards increase the amount of tokens an individual holds, while Non-Rebase LSTs see their value rise. Despite the availability of both types, Lido's stETH — a rebase token — has a considerable market share and has been the predominant token in the ecosystem.

Market landscape

Key players like Lido, Coinbase, and Rocket Pool primarily dominate the LST market. Lido’s stETH holds the majority market share, showcasing the significant impact of these tokens in the DeFi ecosystem.

Potential of LSTs

Despite the increased attention focused on LSTs, a large amount of ETH remains unutilized, suggesting there are still untapped opportunities in the LST market. Strengthening the practicality of LSTs is critical for increasing the Total Value Locked (TVL) of the ETH staked and realizing the full advantages they provide regarding liquidity and yield generation.

How are LSTs categorized?

LSTs are split into two types: Rebase LSTs and Non-Rebase (Value-Accruing) LSTs. Each type plays a distinct role in the DeFi ecosystem, offering various opportunities for yield generation and liquidity.

Rebase LSTs

-

Function: Rebase LSTs increase the number of tokens in a holder's wallet as staking rewards increase.

-

Market presence: Though only a few LSTs in the top 10 by TVL use the rebase model, they dominate due to significant market shares, like Lido’s stETH.

Non-Rebase (Value-Accruing) LSTs

-

Function: These LSTs increase in value but not in number as staking rewards accumulate, removing the need to transfer additional tokens.

-

Examples: Non-rebase LSTs include WBETH from Binance, rETH from Rocket Pool, and swETH from Swell.

Many believe that the market potential of LSTs is significant, as demonstrated by several key factors:

-

DeFi dominance: Liquid staking is the largest category in DeFi for TVL, amounting to $22.4 billion at the start of 2024. Of this figure, over 92% relates to Ethereum.

-

Innovative yield strategies: LSTs like stETH, rETH, WBETH, and cbETH are used for inventive yield strategies in the LSTfi sector of DeFi.

-

Sector diversity: The LST market features a variety of players, ranging from liquid staking pioneers like Lido to centralized services like Coinbase and Binance. There are also numerous lending services, stablecoins, indices, and yield aggregators.

-

Market centralization concerns: The concentration of the market in the hands of a limited few has caused issues concerning the potential centralized nature of DeFi. This has given way to the development of new protocols that emphasize decentralization.

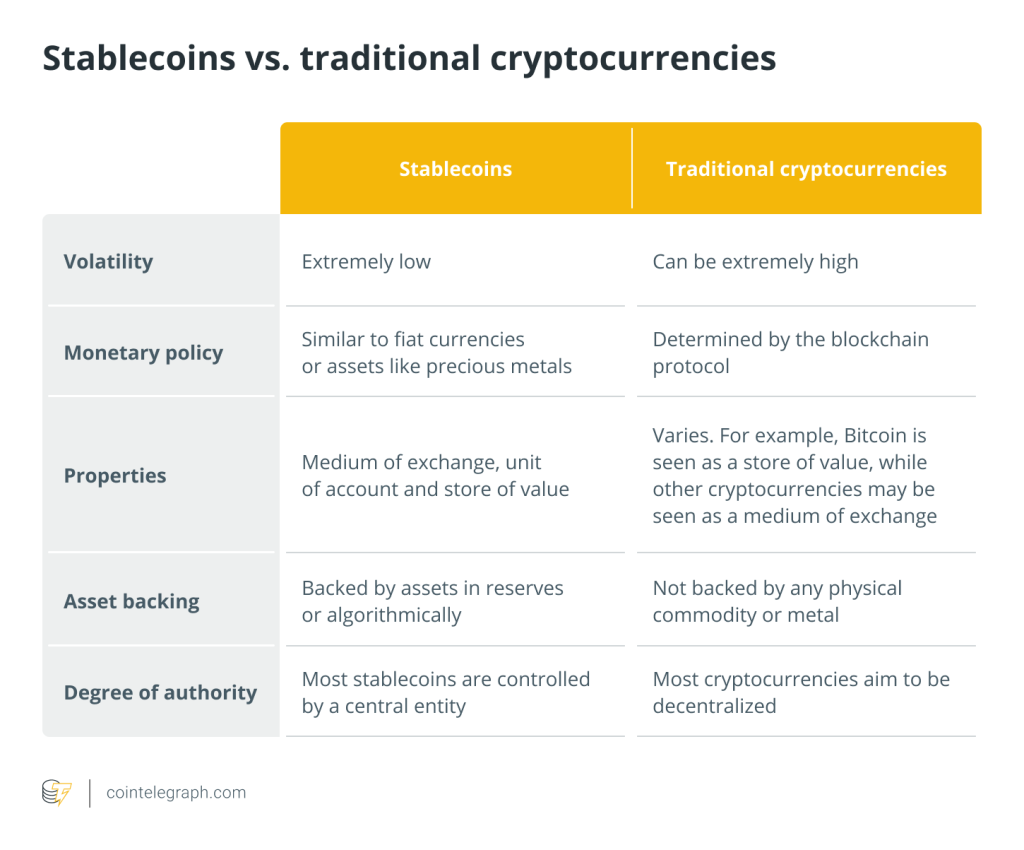

What differentiates Lybra Finance's stablecoins from others in the market?

Lybra Finance stands out from the competition for its handling of stablecoins, particularly eUSD. Here are some of the ways eUSD is unique:

Interest-bearing capability

Unlike most stablecoins, eUSD is designed to generate interest for its holders. Traditional stablecoins, whether fiat-collateralized or crypto-collateralized, typically don't offer interest. This means holders of these stablecoins don't earn additional income and are susceptible to inflation-related depreciation. eUSD addresses this limitation by providing a mechanism for stablecoin holders to earn interest, thereby preserving and enhancing their purchasing power over time.

Collateralization with LSTs

eUSD is collateralized by ETH, stETH, and other LSTs — a novel approach in the stablecoin arena. Using LSTs not only underpins the stability of eUSD but also helps it to harness the high yields provided by the LST revenue model. This strategy results in a stablecoin that's secure, price-stable, and capable of delivering consistent interest income to its holders.

Bridging the gap in the stablecoin market

With the advent of eUSD, Lybra Finance is helping to fulfill the needs of those searching for both safety and stability. Combining traditional stablecoin features with appealing yield-generating options, many consider eUSD to be a more desirable and useful option within the stablecoin market.

Lybra Finance's eUSD offers the ability to earn interest and enables the usage of LSTs for collateralization. This modernizes the stablecoin concept to better meet the requirements and desires of DeFi users.

The final word

Lybra Finance offers unique yield opportunities through its use of LSTs, focusing on Ethereum (ETH). The platform has revolutionized how users interact with DeFi, providing new avenues for earning and liquidity.

-

Innovative stablecoins: Lybra Finance introduces eUSD and peUSD, two interest-bearing stablecoins. Unlike traditional stablecoins, eUSD offers an annual yield, a feature enabled by using LSTs as collateral. This approach provides both a stable store of value and a source of income, addressing the issue of devaluation due to inflation.

-

DeFi innovation hub: With its V2 upgrades, Lybra Finance is evolving, positioning itself as a contributor to DeFi innovation. These upgrades expand the platform's capabilities, enhancing user autonomy and protocol safety.

-

LSTs' role and potential: Lybra Finance's LSTs solve the dilemma of staking ETH for rewards or liquidity by representing the value of staked ETH.

-

Distinctive stablecoin features: What sets Lybra Finance's stablecoins apart is their ability to generate interest. eUSD is a stable income source, backed by ETH and other LSTs.

Lybra Finance merges the stability of traditional stablecoins with the profitability of interest-bearing assets, creating a unique offering in the DeFi market.

Get started

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] There you will find 93058 more Information on that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] There you will find 47151 additional Info to that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Here you will find 40179 additional Info to that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Here you will find 17072 more Information on that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Here you can find 36424 additional Information to that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Here you can find 32724 additional Information on that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] There you will find 57471 additional Information to that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] There you can find 36514 more Info to that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/deeplearning/1735/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/deeplearning/1735/ […]