GameFi and DeFi: What sets them apart?

GameFi and decentralized finance (DeFi) are two exciting subsectors within Web3. GameFi is the convergence of gaming and finance, while DeFi is the decentralized finance ecosystem. Both rely on blockchain technology and have the potential to revolutionize traditional gaming and financial services.

While GameFi and DeFi sound like completely different industries, they are increasingly converging with each other. Let’s understand what sets GameFi apart from DeFi in this article.

What is GameFi?

GameFi is the term used to describe games that use blockchain technology, nonfungible tokens (NFTs) and cryptocurrencies. These games allow players to earn rewards in the form of tokens or NFTs. Players can then use these rewards to purchase in-game assets, trade them with other players, or even cash them out for real-world money (fiat).

The first GameFi projects were casual games, often with bad gaming experiences, but the genre has improved rapidly in recent years. There is now a wide variety of Web3 games available, from collectible card games to complex role-playing games.

What is DeFi?

DeFi is a financial ecosystem that operates on blockchain technology and allows users to lend, borrow, trade and earn interest on their money without the need for a central authority. DeFi is still in its early stages, but it has the potential to revolutionize the financial services industry.

DeFi had a promising start when the Ethereum DeFi ecosystem grew exponentially through 2020 and 2021. However, since late 2021, the total value locked (TVL) of all chains has fallen from $175 billion to $37 billion.

DeFi has suffered through the crypto winter due to a lack of institutional adoption. This has been largely due to a lack of institutional processes, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. DeFi has seen several hacks and smart contract frauds, with users losing millions of dollars worth of assets over the last few years. Yet DeFi has several fundamental elements that can help create a new version of the banking system.

How GameFi and DeFi could interplay in a metaverse

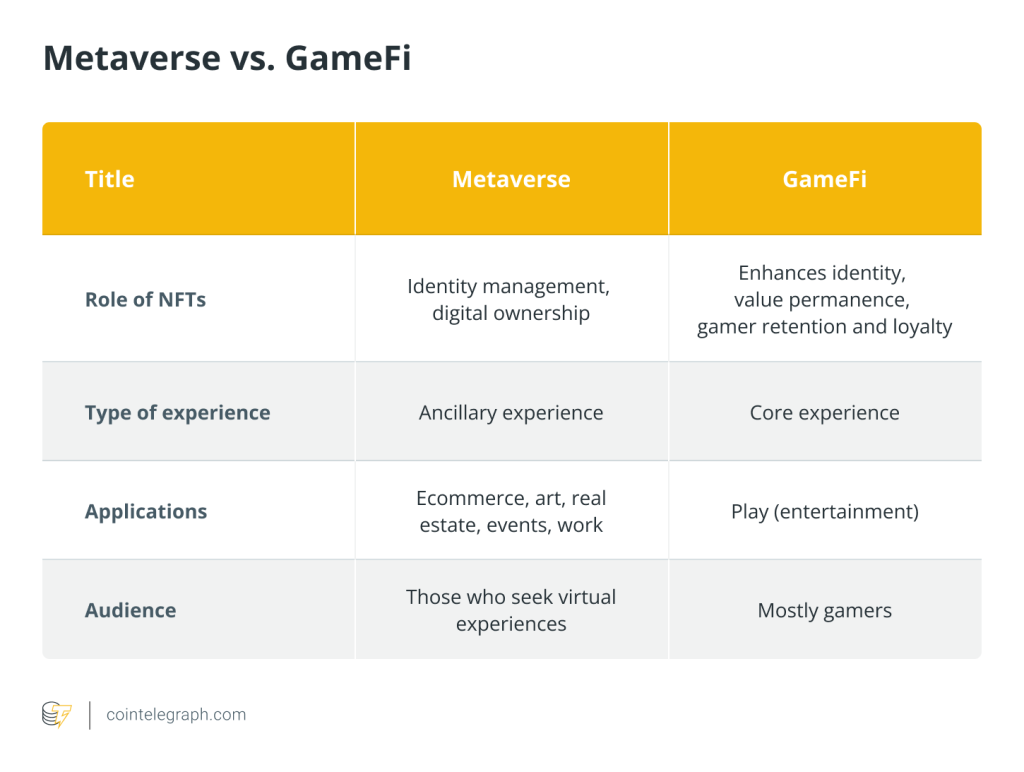

The metaverse is a virtual world that is being built on blockchain technology. Based on existing projects, such as Decentraland and The Sandbox, the metaverse can be defined as a new digital experience for gaming, social interaction and commerce.

GameFi and DeFi could play a major role in the metaverse. For example, games could be used to create virtual economies where players can earn rewards in the form of tokens or NFTs. DeFi protocols could be used to power these economies and provide players with access to financial services.

The metaverse is still in its early stages, but it has the potential to be a major new platform for GameFi and DeFi. These technologies could help create a more immersive and engaging metaverse experience while also making it more accessible and rewarding for users.

How are GameFi and DeFi converging?

GameFi and DeFi are converging in a number of ways. For example, many games now use DeFi protocols and integrated DeFi experiences, like lending, to power their economies. This allows players to earn rewards in the form of tokens or NFTs, which they can then use to participate in DeFi activities such as lending, borrowing and trading. For instance, games such as StepN and Walken, despite losing users in the bear market, have been building in DeFi features.

On the other hand, DeFi projects are increasingly incorporating gamification elements into their platforms to attract users, make DeFi more accessible and engaging, and increase user retention of DeFi offerings. For example, some DeFi projects offer users the ability to earn rewards by playing games or completing quests.

The potential of GameFi and DeFi

The convergence of GameFi and DeFi has the potential to create a new, exciting and innovative gaming and financial ecosystem. The potential market for GameFi and DeFi is enormous. The global gaming market (Web2) is estimated to be worth $175 billion, while the global financial market is worth trillions of dollars. If GameFi and DeFi can capture even a small fraction of these markets, they could have a major impact on the world.

According to a report by CoinMarketCap, venture capital (VC) investments in GameFi and DeFi have increased significantly since 2020. In 2020, VC investments in GameFi and DeFi totaled $3.1 billion. This figure increased to $25.2 billion in 2021, and it is expected to reach $100 billion by 2025.

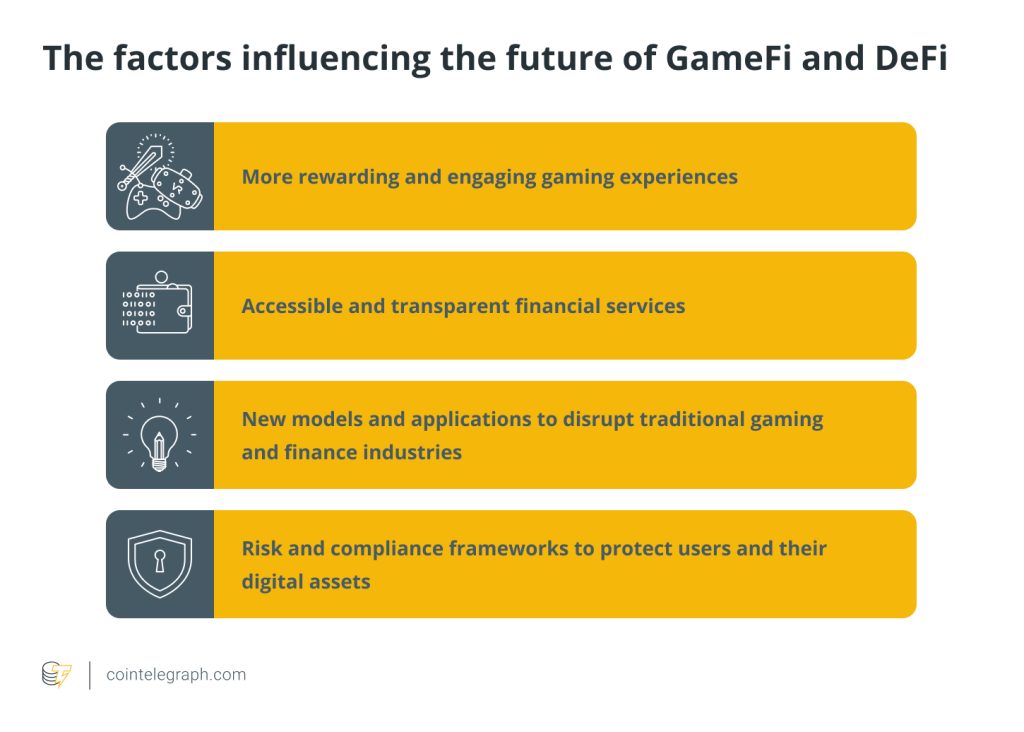

The future of GameFi and DeFi depends on a few factors:

GameFi should continue to grow in popularity in the coming years. As more and more people become familiar with blockchain technology and NFTs, they will be drawn to the opportunity to earn rewards by playing games. As more people become frustrated with the traditional financial system, they will look for alternative ways to manage their money. DeFi offers a decentralized and transparent way to do so.

The metaverse could be a major driver of growth for both GameFi and DeFi and a point of convergence between these two sectors within Web3. Since the exponential growth of metaverses in 2021, several tech giants, including Meta and Apple, have rolled out products to help with the development of this ecosystem, helping the trend further.

The metaverse is a natural fit for GameFi, as players can have differentiated experiences by playing games in the metaverse. As a result, GameFi would be the experiential layer, while DeFi would become the economic layer in the future of the metaverse.

Written by Arunkumar Krishnakumar

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Here you will find 70601 additional Info to that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Here you will find 84119 more Information on that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Here you will find 554 additional Information to that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Here you will find 88696 more Information to that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/3771/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3771/ […]