Litecoin (LTC): A beginner's guide to the peer-to-peer cryptocurrency

What is Litecoin (LTC) and how does it work?

Litecoin (LTC) is widely considered to be the first alternative cryptocurrency. It was launched on October 13, 2011, to be “the silver to Bitcoin’s gold,” and is still one of the largest peer-to-peer (P2P) cryptocurrencies by market capitalization. It uses blockchain technology to keep track of all transactions in a decentralized, public ledger.

Just like Bitcoin (BTC), Litecoin runs on an open-source blockchain that isn’t controlled by any central authority. Every Litecoin node operator has a copy of each blockchain to ensure that new transactions do not contradict its transaction history, and miners help process new transactions by including them in newly mined blocks.

Both BTC and LTC can be mined, which can result in orphaned blocks. Orphaned blocks are formed when two miners mine a block at nearly the same time, both of which are initially accepted by the chain, which then rejects one. Segregated Witness (SegWit) is used to limit the number of orphaned blocks caused by the low block confirmation time.

Atomic Swaps is another Litecoin concept that adds interoperability to the blockchain, allowing for trading multiple cryptocurrencies without actually having to exchange them.

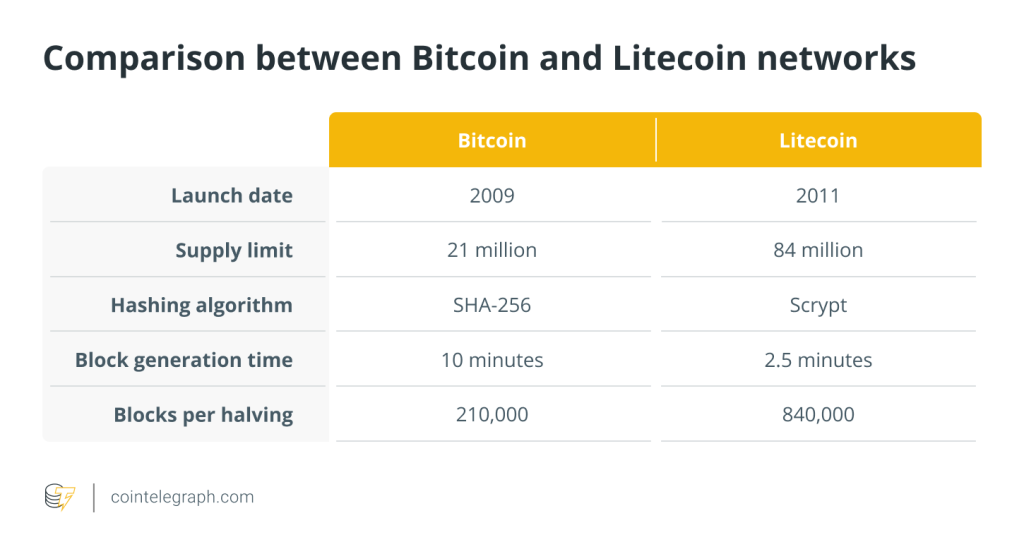

Litecoin and Bitcoin do have a few key differences. Transactions are faster on Litecoin and the cryptocurrency has a larger supply. It uses a different hashing algorithm to keep mining fair for everyone, and these differences are believed to have helped LTC succeed and remain one of the top cryptocurrencies throughout the years.

In this article, you will find answers to various questions surrounding Litecoin, such as how do you buy, store and mine Litecoin? Is Litecoin proof-of-work (PoW) or proof-of-stake (PoS)? And is Litecoin a good investment?

Is Litecoin truly decentralized?

No central authority can freeze your money in Litecoin because it is an entirely decentralized network. Only users have control and decision-making authority over their money.

As a result, Litecoin can be used as a peer-to-peer (P2P) payment system to pay people all over the world without the need for an intermediary. It can also be used as a haven or as part of a diversified cryptocurrency portfolio.

But, is Litecoin safer than Bitcoin? It certainly is! Because no one is doing forks of Litecoin without relay protection, it is probably safer than Bitcoin. However, liquidity is essential for grown institutions, and Bitcoin is far more liquid than Litecoin.

Litecoin history: Who created Litecoin and why?

Litecoin was created by Massachusetts Institute of Technology graduate Charlie Lee. Lee is a former Google engineer who became interested in Bitcoin in 2011 and would, after creating Litecoin, join cryptocurrency exchange Coinbase as director of engineering in 2013.

After joining the crypto exchange, Lee largely set aside the development of Litecoin. At the time, he said he believed it was important to help people “own Bitcoin and hold Bitcoin” as Litecoin “wasn’t ready” to grow.

In late 2017, Lee left the company to pursue LTC’s development full time. Now, he serves as the managing director of the Litecoin Foundation, a non-profit dedicated to supporting the cryptocurrency.

In December 2017, he revealed that he was selling and donating all of his LTC, as he was often accused of tweeting about the cryptocurrency for personal benefit. Litecoin was then trading at an all-time high at around $350, and Lee’s move was widely criticized.

But why was Litecoin created? In an announcement by Litecoin’s creator published in October 2011 on the Bitcointalk forum, Lee noted that he wanted “to make a coin that is silver to Bitcoin’s gold,” using the best innovations of Bitcoin and other alternative cryptocurrencies active at the time.

The cryptocurrency came to be after Lee was “playing around with the Bitcoin codebase” in a bid to create a fork of the Bitcoin blockchain. According to him, it was “mainly a fun side project” at first, but it evolved later on.

Litecoin stood out from other alternative cryptocurrencies because of its innovations, including a combination of faster block propagation speeds and the use of the Scrypt hashing algorithm. It also largely avoided something called a premine, which allows the creators of a blockchain-based cryptocurrency to mine coins before the project is launched to the public. Premining was originally used as a way to reward the project’s creators and to fund its development.

At the time, a lot of community members wanted alternative currencies with a fair launch, similar to the launch Bitcoin had. When Litecoin launched, Lee addressed these concerns, saying that one person or a group controlling a large number of coins and using them as they see fit “is against the decentralized vision of Bitcoin.”

A week before LTC launched, Lee released its source code and binary so people could test mining it before it went live. The time of launch was decided through a poll on the Bitcointalk forum so members could choose the time “that best” suited them. Everyone was able to start mining at the same time, as they knew the launch date and only had to make a simple change to their files to start mining real LTC.

Still, Litecoin came with a small premine. A total of 150 LTC were premined as the genesis block — the first one on the network — and two subsequent blocks to confirm were initially mined its validity. When Litecoin launched, the reward for mining one block was 50 LTC, which was essentially worthless at the time.

Is Litecoin proof-of-work (PoW) or proof-of-stake (PoW)?

As mentioned before, Litecoin is a mining-based altcoin, and such coins use the PoW consensus method to validate their transactions.

Essentially, PoW requires one party to demonstrate to all other network participants that a certain amount of computing effort has been undertaken. Unlike Bitcoin, which employs the SHA-256 PoW hashing method, Litecoin uses the Scrypt PoW technique, which is less resource-intensive.

Scrypt’s key derivation function was, according to Tarsnip, developed “for use in the Tarsnap online backup system and is designed to be more secure against hardware brute-force attacks than alternative functions.”

Litecoin vs. Bitcoin: What’s the difference?

While Litecoin was launched to be the digital “silver,” just like BTC, it’s a blockchain-based P2P cryptocurrency that was designed to address some perceived shortcomings in Bitcoin.

It aimed to make it easier for merchants to accept LTC payments by making transactions faster than on the Bitcoin blockchain. On average, one Litecoin block takes two and a half minutes to be mined, a quarter of Bitcoin’s 10 minutes. This means that merchants that take only secure transactions do not have to wait a full hour for six confirmations on the network.

While there is a security trade-off here, merchants can also wait for additional network confirmations to be more secure while using Litecoin. Because blocks are four times faster on Litecoin, the difficulty of mining on its network adjusts faster, roughly every three and a half days.

To mimic Bitcoin’s generation trajectory, Litecoin’s halving events were altered as well. While Bitcoin generation halves every 210,000 blocks, Litecoin generation halves every 840,000 blocks. Similarly, to ensure that the last Litecoin is mined at the time the last Bitcoin is mined, LTC’s supply is capped at 84 million coins.

While Bitcoin uses an SHA-256 hashing algorithm, Litecoin uses a Scrypt hashing algorithm, a password-key derivation function. Scrypt was developed specifically to avoid potential attacks through the use of specialized mining hardware, such as application-specific circuits (ASICs), as it was originally believed that Bitcoin would be vulnerable to such attacks.

Litecoin’s consensus algorithm is memory intensive in a bid to thwart a potential mining arms race. In practice, that arms race never occurred and specialized mining hardware has been developed to be used on the Litecoin network.

Litecoin adopts new features

The cryptocurrency’s initial efforts have been backed by the implementation of several features that were also proposed and later on implemented on the Bitcoin network. These improvements often look to help ensure that the network can scale to accommodate more transactions per second, without sacrificing decentralization and to ensure privacy while transacting.

SegWit

Bitcoin and Litecoin are somewhat similar and as such, both can have the same upgrades. Litecoin often adopts these first, as a major error on its network would cause less damage than on the Bitcoin network. Litecoin’s market capitalization has historically dwarfed that of Bitcoin.

One of the first features implemented on the Litecoin blockchain before being added to Bitcoin was Segregated Witness. Although SegWit was first proposed for Bitcoin in 2015, Litecoin adopted the technology first. After no major incidents were seen on LTC, the technology was then added to Bitcoin.

SegWit essentially helps a cryptocurrency scale by “segregating” the digital signature data on each transaction (the witness) outside of it, having better usage of the limited space. It was developed to address Bitcoin’s scalability issues.

Litecoin adopted SegWit in early 2017, and because of the success the feature had on its blockchain, its implementation gained support for Bitcoin. Initially, SegWit was adopted on Litecoin rapidly, much more so than on the Bitcoin blockchain. Its adoption has grown gradually on both networks.

Lightning Network

The Lightning Network is a scaling solution that essentially creates an extra layer on top of a cryptocurrency’s blockchain, in which transactions are fast and fees are minuscule. That extra layer consists of user-generated payment channels. It was originally designed to be implemented on the Bitcoin blockchain.

Like SegWit, the network was first implemented on Litecoin, which many used to test Lightning Network in a real economic environment. The layer-2 scaling solution is controversial. According to critics, it pushes users to non-custodial wallets on which users would have to run their node.

Litecoin’s Lightning Network adoption has been somewhat slow while Bitcoin’s Lightning Network adoption grew exponentially in its initial months. The reason for the slowdown on LTC may be the base layer’s already low transaction fees.

The first-ever off-chain atomic swap between the Bitcoin and Litecoin Lightning Networks was completed in 2017. Charlie Lee suggested that Litecoin could onboard users onto the Lightning Network when the Bitcoin blockchain is congested and fees are high.

MimbleWimble

The MimbleWimble protocol is a modified implementation of the PoW algorithm, underpinning a cryptocurrency’s blockchain. It prevents individual inputs and outputs related to transactions from being identified, enhancing privacy and obfuscating traceability.

Litecoin has launched a MimbleWimble testnet in October 2020, and its lead developer has been focusing on making it easier for “non-technical Litecoin users” to begin testing it. It’s worth noting that there is no consensus on which is the best way to use the MimbleWimble protocol on Litecoin or Bitcoin.

Some developers believe that merging MimbleWimble with the Bitcoin protocol could lead to undesirable outcomes and would be too difficult. As a result, some have suggested it could be implemented as a sidechain to Litecoin or Bitcoin.

What is Litecoin used for?

Litecoin was one of the first successful alternative cryptocurrencies and over time, it was criticized for lacking a clear value proposition. As it has a finite supply and has been marketed as the “silver to Bitcoin’s gold,” it has attracted users.

Litecoin’s inflation is controlled through a halving mechanism. Since it was created back in 2011, its blockchain has been proven secure enough to avoid 51% attacks, which occur when a mining entity or entities manage to have over 51% of the computing power that secures the network and use it to alter the blockchain’s history.

Its reliability is a major factor playing in its favor. Because it hasn’t suffered any major exploits, it is indeed seen as a reliable cryptocurrency that can be used to transact at a relatively low cost and in that sense, is the “silver” of the cryptocurrency world.

The cryptocurrency is now also popular among investors and traders who rely on its limited supply and issuance reductions to speculate on its price. Given its reliability, LTC may be used in a portfolio to give investors exposure to the crypto market’s movements without any negative surprises.

Maintaining privacy on the Litecoin network is much easier than on networks with higher transaction fees, as the cost of moving funds around is lower. It’s also used to pay for goods and services, with most cryptocurrency payment processors supporting it.

Litecoin is a highly liquid cryptocurrency available on most major cryptocurrency exchanges, making it ideal for traders. As transactions on its network are relatively cheap, some even use it to move funds between different exchanges or lending platforms to avoid high transaction fees on networks such as Bitcoin or Ethereum.

The Litecoin network consistently processes over 100,000 transactions per day and usually has between 200,000 and 300,000 active addresses. While it isn’t as popular as the Bitcoin network, its usability seems undeniable.

Litecoin halving

The number of created Litecoin awards every block is halved during a Litecoin halving event. Litecoin halving, which takes place about every four years, maintains the currency's purchasing power since it is a scarce asset with 84 million coins in circulation.

In August 2015, the first Litecoin price halving took place. The first block reward for miners was 50 LTC; this was subsequently decreased to 25 LTC, and in August 2019, the mining reward for Litecoin decreased from 25 to 12.5 LTC. On August 6th, 2023, the incentive is anticipated to be halved once again, going from 12.5 to 6.25 LTC.

Because numerous popular Litecoin mining equipment will face difficulty producing enough LTC to cover electricity expenses, Litecoin halving events are anticipated to influence miners' enthusiasm for mining. Additionally, Litecoin's price may be significantly affected by the halving process. Generally, if the supply of LTC is decreased, the market value would rise or vice versa.

How to mine Litecoin?

ASIC mining machines in which mining software is pre-installed can be used to mine Litecoin. On the contrary, if you're mining using a central processing unit (CPU) or graphical processing unit (GPU), you'll have to pick your own program while keeping security in mind.

Malware could be included in a software product. You should also be on the lookout for other shady, if not malevolent, activities. After you've settled on your mining equipment, you'll need to pick whether you'll mine solo or in a pool.

You run the risk of going a long time without discovering a block if you mine alone. However, if you locate a block mining solo, you keep the entire 25 Litecoin plus fees. Please note that it is only possible if you have a significant amount of hash power (multiple ASICs).

In addition, you have virtually no chance of ever earning any LTC if you mine alone using a GPU or CPU. Pool mining is better than solo mining; however, rewards are distributed to the pool participants based on the hash power they contributed.

How to buy and store Litecoin?

If you plan to buy Litecoin from exchanges like Coinbase or Binance rather than mining it, you need to set up an account with the exchange of your choice. Security, fees and ease of use are the various metrics you can gauge before choosing an exchange.

After your account is verified, decide the amount of LTC you want to buy. The exchange you choose determines the buying procedure and accepted payment options (such as debit/credit card, bank transfer). Select Litecoin from the “Buy” menu once the funds are available.

Enter the amount you wish to buy and check the transaction preview to see the costs and the quantity of Litecoin you'll receive. Confirm the transaction if you're happy with everything.

Finally, you might want to look into crypto wallets to store your cryptocurrency. Many investors retain their cryptocurrency on the exchange where they purchased it, but transferring it to a crypto wallet provides additional security. For instance, you can also install the Litecoin wallet on your iPhone or Android phone to keep track of your LTC.

How to stake Litecoin and earn money?

In 2020, the Litecoin PoS network was launched, a unique take on the Bitcoin codebase, with significant performance and consensus enhancements. Validators staking LTCP must stake matured coins because it is a proof-of-stake system. Additionally, the coins to be staked must be in address/transaction types that are compatible.

To begin staking your coins, you'll need a wallet with some LTC in it, as well as a network account — all of which are free! You can stake your coins by putting them into a staking pool on exchanges that provide staking services. As a result, you'll be able to validate blocks and earn newly created Litecoin.

Should you buy Litecoin?

Litecoin may not be the top cryptocurrency right now, but it has always shown significant technological advancements, making it a viable investment.

A smart investment is a project that continues to innovate and evolve. But, as always, please beware, and you should do your due diligence and never invest more than you can afford to lose.

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Here you will find 11762 additional Info on that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Here you can find 51620 more Information to that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/3711/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3711/ […]