Dogecoin (DOGE) vs. Ethereum (ETH): The ultimate comparison

At a time when no financial news is complete without cryptocurrencies, it's no surprise if you're tempted to try your hand. But for your dabbling in cryptocurrencies to have a reasonable chance to succeeding, you must choose them according to your risk-return tradeoff.

You're mistaken if you think all cryptocurrencies have the same kind of applications. Rather, each has its distinct applications, advantages and disadvantages, and the right coin for you depends on your specific circumstances. To understand these applications better, let’s understand how Dogecoin (DOGE) and Ether (ETH), two popular coins popular, work.

What is Dogecoin?

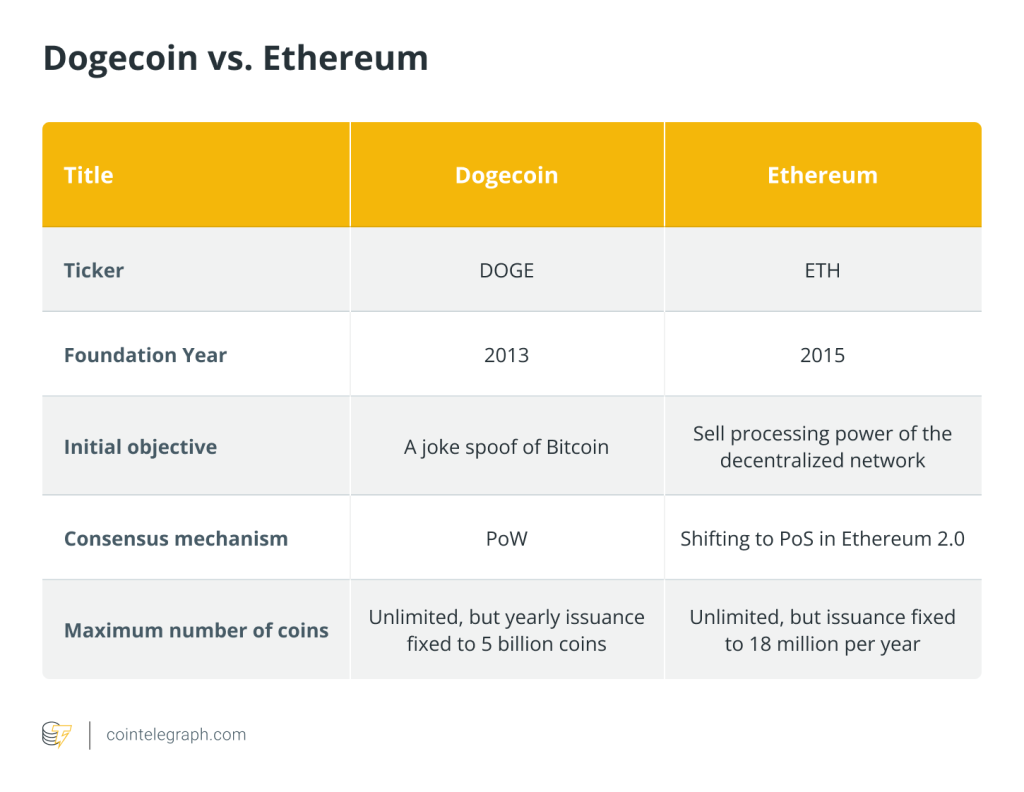

Created as a spoof of Bitcoin (BTC) and the doge meme, Dogecoin was created by software engineers Billy Marcus and Jackson Palmer in late 2013. The word “doge,” which describes a Shiba Inu dog, was deliberately misspelled while naming the cryptocurrency.

The rise of Dogecoin’s value is generally attributed to the sentiments of its fan club and the tweets of Elon Musk. Unlike other frontline coins, Dogecoin lacks any actual use case advantage and is accepted at few merchant outlets.

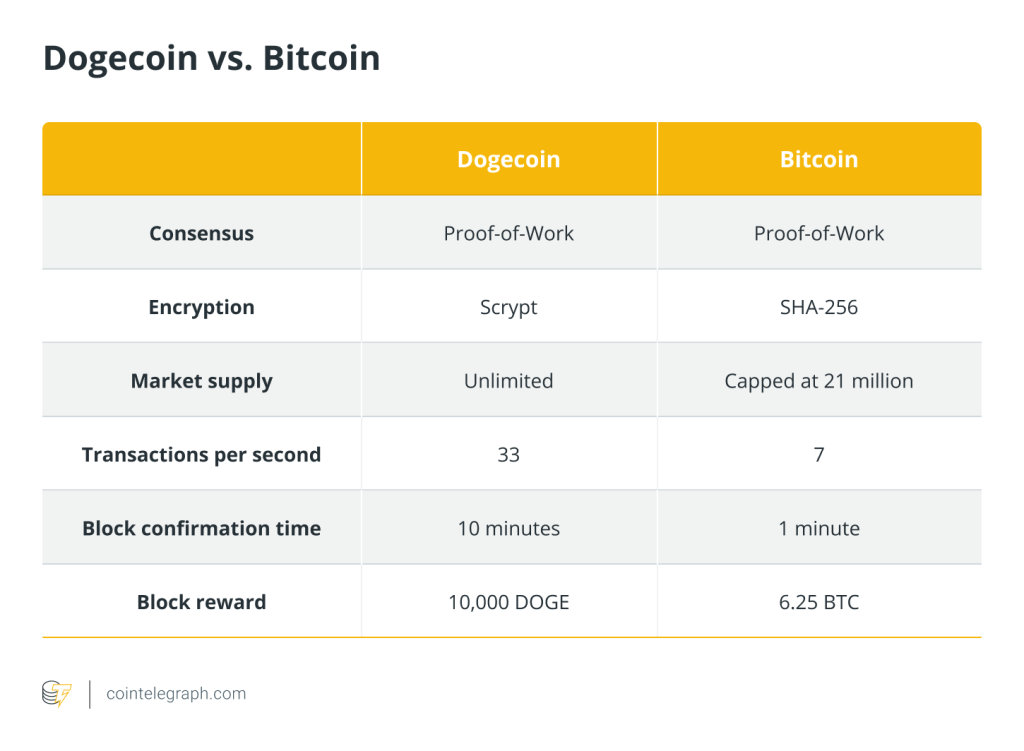

Dogecoin is mined through a proof-of-work (PoW) consensus algorithm, although it has plans to make the transition to the proof-of-stake (PoS) consensus mechanism. Miners are rewarded with DOGE for their contribution; namely, creating blocks. Unlike Bitcoin, there is no restriction on the number of coins that can be mined every day, making it an inflationary cryptocurrency instead of deflationary crypto like BTC.

Though Dogecoin uses the PoW mining mechanism, it works a bit differently than that in BTC. Dogecoin uses Scrypt, a hashing algorithm that is less complex than SHA-256, which is used in BTC mining. A hashing algorithm is a kind of random code generator that uses a specific technique to generate a fixed-length code. Moreover, Dogecoin and Litecoin (LTC) share a common algorithm, which enables “merged mining,” allowing miners to simultaneously mine both coins without impacting operational efficiency.

What is Ethereum?

Technically, Ethereum is a blockchain while Ether is the native cryptocurrency. ETH is the second most popular currency after BTC. The Ethereum blockchain has had a role in revolutionizing many new areas of decentralized finance (DeFi) like DApps. It powers dynamic DeFi and nonfungible token (NFT)-based applications.

When Ethereum started, it was a PoW blockchain but it is in the process of shifting to a more efficient PoS mechanism, called a consensus layer upgrade. Ethereum’s consensus layer will use the PoS consensus method to verify transactions via staking.

A consensus layer is a multi-phase upgrade for augmenting the network's scalability and security. The upgrade is scheduled to be completed by 2023. It will substantially increase the network's transaction speed while bringing down its transaction costs.

Of late, the burgeoning gas costs in Ethereum became a cause of concern post surge in DeFi and NFT-related activity. In March 2022, the average transaction fee was around $15, which was simply too high for anyone looking to execute a transaction, particularly one of a smaller denomination.

As the second largest blockchain that is decentralized in real terms, Ethereum facilitates the frictionless functioning of the smart contracts and applications residing on it. Ethereum-based applications are known to run without fraud, any third-party interference or centralized control.

Is Dogecoin a good investment?

In any cryptocurrency investment, you need to take into account various key factors, such as the use cases of the project, the support of the community and the team behind the project. While Dogecoin lacks a proper use case, it does have strong community support.

In the world of digital coins, the Dogecoin community stands out for being unique. When it comes to organized action, such as supporting individual athletes and sports teams, the Dogecoin community has always joined hands. The community has been instrumental in drumming up support and encouraging investors.

As in all cryptocurrency investments, the decision eventually settles down to individual preferences and one’s trading strategies. While taking any decision, you need to be aware of the volatile nature of DOGE, just like you would with any other digital coin. That said, due diligence before investing is important.

How to buy Dogecoin?

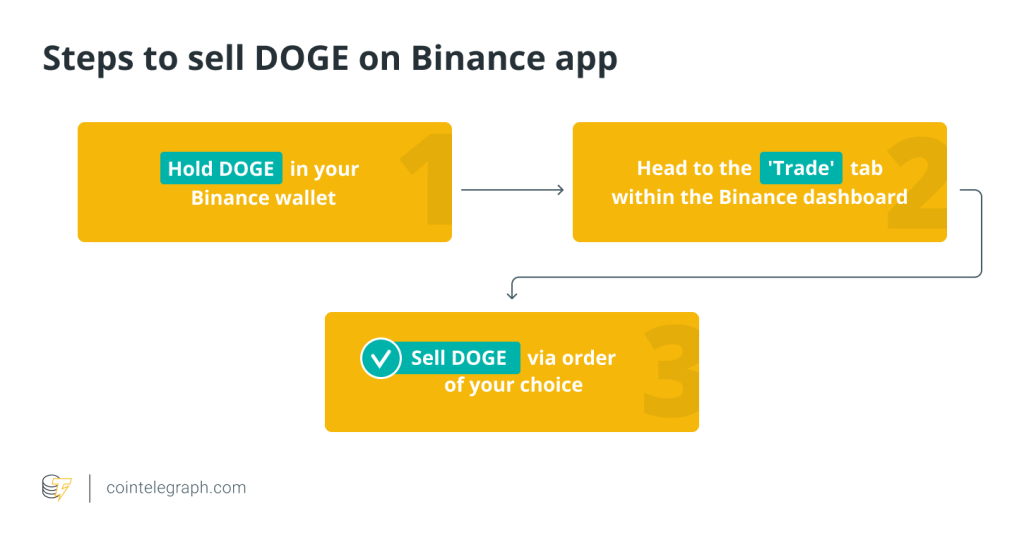

The process of buying Dogecoin resembles purchasing other cryptocurrencies. You need to find an exchange where DOGE is available and then a wallet where you can store the currency. Dogecoin can be bought with your fiat currency or swapped with any other cryptocurrency you might be have.

If you're already in cryptocurrency trading, you might have a wallet that supports Dogecoin. However, if you're a newbie to crypto investing or your existing wallet doesn't support DOGE, you'll need to find a suitable crypto wallet before buying Dogecoin.

You might choose a software program for a crypto wallet or a piece of hardware. To protect your Dogecoin, you may even decide to create paper wallets for storing. Depending on your convenience, you could decide on any of these, though most people choose software programs.

Is Ethereum a good investment?

ETH is among the most well-known digital coins; however, if you're new to the arena, you may be wondering whether Ethereum is good enough for investment. A cryptocurrency with a market cap of $143.50 billion may be a worthy option to be explored.

You may want to invest in ETH because of its consensus layer upgrade. A successful transition will strengthen its position as the cornerstone of DeFi operations and is also likely to push up the price of Ethereum.

The use of blockchain technology is steadily increasing in the real world and Ethereum is a major first-generation blockchain. While Bitcoin is the first and most well-known blockchain, Ethereum stands right after. It’s the foundation of a huge array of DeFi applications and metaverses. As these applications slowly get integrated with the mainstream, Ethereum will become an integral part.

Facilitating applications like online payments, loan distribution, insurance, no-barred trading, and more, Ethereum has got all it needs to be a part of the new age economy. Ethereum has fructified the tokenization of artwork, mortgages, patents, person-to-person (P2P) transactions, voting and a bunch of other routine tasks.

Ethereum is the blockchain that introduced smart contracts, which are self-propelled computer programs. This has taken the concept of digital ownership to a different pedestal. It's also decentralized in real terms because of the sheer number of validators.

How to buy Ethereum?

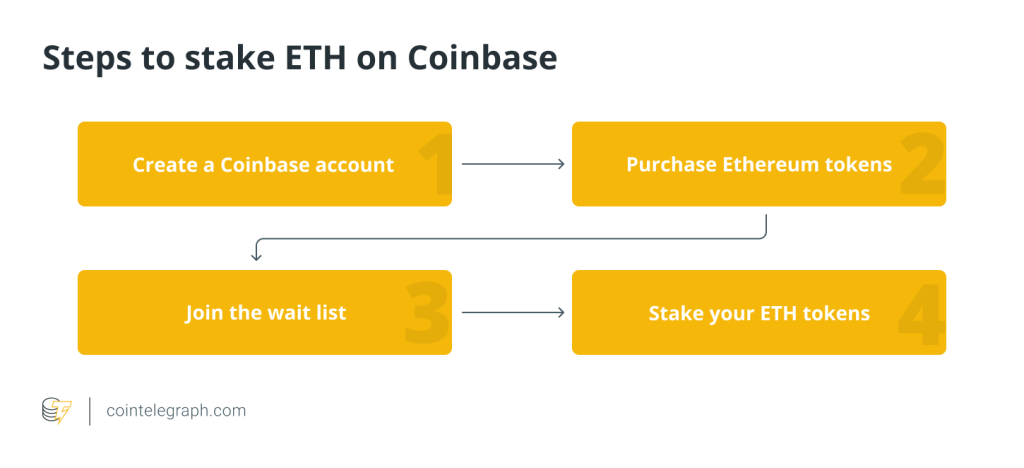

To buy Ethereum, the first step is to create an account with an exchange that lists Ether. It isn't going to be a problem as ETH is among the most prominent digital coins, although you might want to take into account factors like fees and the time they've been running their operations.

You'll also need a wallet to which you can transfer Ether. This should also be hassle-free as you can reasonably expect every wallet around to support Ether.

Dogecoin vs. Ethereum: Pros vs cons

Let's first talk about the advantages and disadvantages of investing in Dogecoin and then Ethereum:

Dogecoin

Pros

-

Transaction costs are lower than those of cryptocurrencies like Ether, Litecoin, Stellar (XLM) and many others.

-

Dogecoin has strong community support. If the community has brought it this far, it might take it ahead as well!

-

For people looking for fun experiments in crypto, Dogecoin is a good option.

Cons

-

Dogecoin lacks real-life use cases, making it difficult for it to prosper in the long run.

-

Dogecoin rides sentiments and not substance.

-

The cryptocurrency lacks acceptance outside its fan club.

-

The number of transactions on Dogecoin per second is just 33, which is too low compared to blockchains like Solana (SOL), which processes 50,000 transactions per second.

Ethereum

Pros

-

Ethereum is easier to mine than PoW cryptocurrencies such as Dogecoin.

-

Ethereum has a large support base, thanks to the sheer number of validators on its network.

-

Thousands of validators across the globe mean that Ethereum is decentralized in real terms.

-

Ethereum is never down, thanks to its support base worldwide.

-

Ethereum is the foundation blockchain of thousands of DApps. As of May 2020, there were more than 2800 decentralized applications on the blockchain.

Cons

-

Ethereum has no upper cap on the number of tokens minted. Over time, it’s bound to build inflation as the number of tokens in circulation grows rapidly.

-

The gas fee often becomes a pain, discouraging users of DApps as well as traders.

-

Currently, Ethereum executes around 30 transactions per second, which is too low; Ethereum 2.0, however, is expected to boost it to 100,000 transactions per second.

Dogecoin vs. Ethereum: The road ahead

Regardless of whether you’re buying Dogecoin or Ethereum, one thing you can be sure of is you will need to comply with more regulations on exchanges. In almost all countries, exchanges are required to follow Know Your Customer (KYC) or Anti-Money Laundering (AML) practices. Account holders will need to share documents to verify their identities and addresses.

The crypto market is something no one can predict with a degree of assurance. The best way to move ahead is to factor in the fundamentals of both cryptocurrencies and inputs at the time of investment, and take an optimal decision. If you're willing to stay invested in the market for a long term and diversify your portfolio, you can expect to do reasonably well.

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Here you can find 3324 additional Info to that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Here you will find 93923 more Information to that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Here you can find 69057 additional Info on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Here you can find 63118 additional Information to that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Here you will find 1993 more Information on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Here you can find 79233 additional Info to that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] There you can find 37948 more Info on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] There you will find 36716 more Info on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Here you will find 11280 more Info to that Topic: x.superex.com/academys/beginner/3578/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/3578/ […]