The emergence of BNB as a global DeFi Infrastructure

What is the Binance ecosystem?

The crypto industry has grown at a heart-racing pace. Sector growth is evident not just in the number of conceived companies and projects but also in the size of some of those entities. Binance is one major player in the crypto space that looks back on massive growth and touts a broad range of components and products as well as its ecosystem.

One important component of Binance’s ecosystem is its asset, BNB, formerly known as Binance Coin, which is a cryptocurrency that was created by the Binance exchange and is traded under the symbol BNB. The native currency of Binance's blockchain, the BNB Smart Chain, BNB was originally based on the Ethereum network. The evolution of BNB goes in step with Binance’s overall expansion.

For a general overview of what BNB is, rather than an explanation of its uses, check out: What is Binance Coin (BNB) and how does it work?

History of BNB explained

Binance conducted an initial coin offering (ICO) in mid-2017, launching its centralized crypto exchange platform shortly after. The exchange launched with the BNB asset in token form — an ERC-20 token built on the Ethereum blockchain. During those early days, the token served as a way for Binance exchange users to pay less in trading fees.

Binance launched its blockchain mainnet in 2019, calling it the Binance Chain (BC). Following the launch, Binance called for a token swap during which users could switch out their ERC-20 BNB tokens for Binance Coin (now BNB) on the Binance Chain.

However, the Binance Chain lacked the versatility necessary for developers to build upon because it was constructed in a fashion that focused on performance for trading activity. Solving the issue of limited potential, Binance launched an additional blockchain called the Binance Smart Chain (now the BNB Smart Chain) in 2020. The blockchain runs parallel to BC, although it serves different purposes. The BNB Smart Chain has Ethereum Virtual Machine (EVM) functionality, for example, making it more versatile for building decentralized applications, or DApps.

What began as a simple utility token has grown into something far more sophisticated. The original aim of BNB was to achieve cheaper Binance trading costs, but that was only the beginning.

Currently, BNB has become a token that has its own blockchain and a wide range of applications. Binance Coin (now BNB) was first launched on Ethereum as an ERC-20 token but was subsequently moved to the Binance Chain (now the BNB Chain). It serves as the network's native token and supports the Binance Smart Chain (now the BNB Smart Chain).

However, to highlight decentralization, Binance has rebranded the blockchain that powers its site. The Binance Smart Chain and the Binance Chain were merged to form the BNB Chain, and Binance Coin was rebranded to BNB, which stands for “Build ’N Build.”

Apart from fuelling transactions on the BNB Chain, BNB also serves as a governance token, similar to how Ether (ETH) does on Ethereum. Participation in the BNB Chain's decentralized on-chain governance requires BNB ownership.

BNB uses

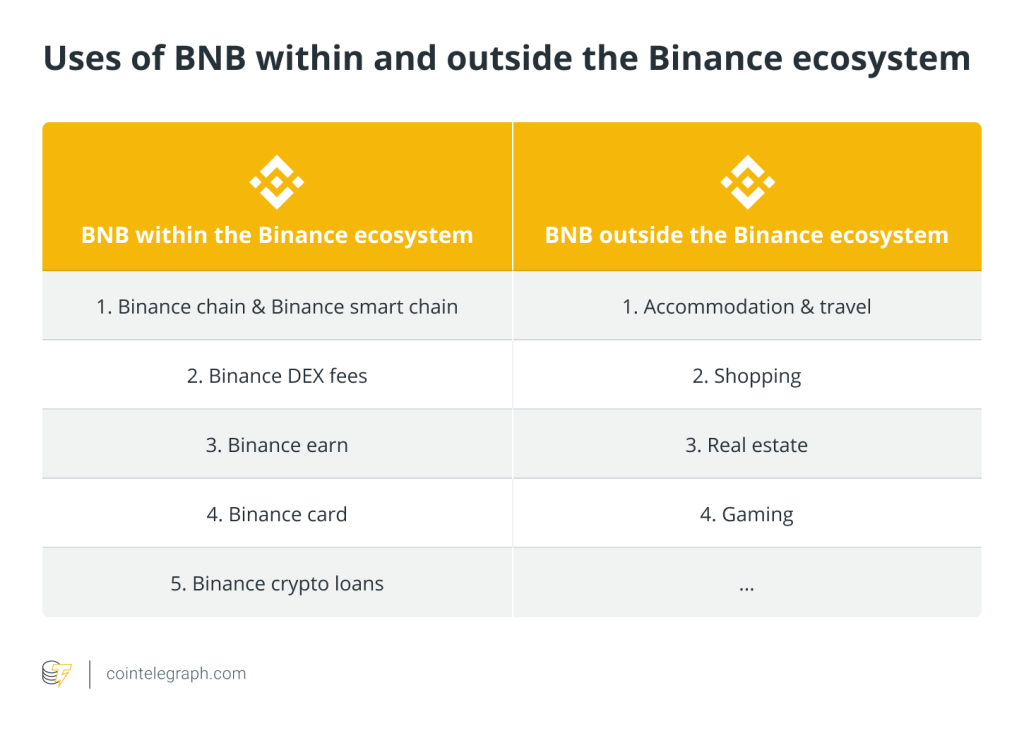

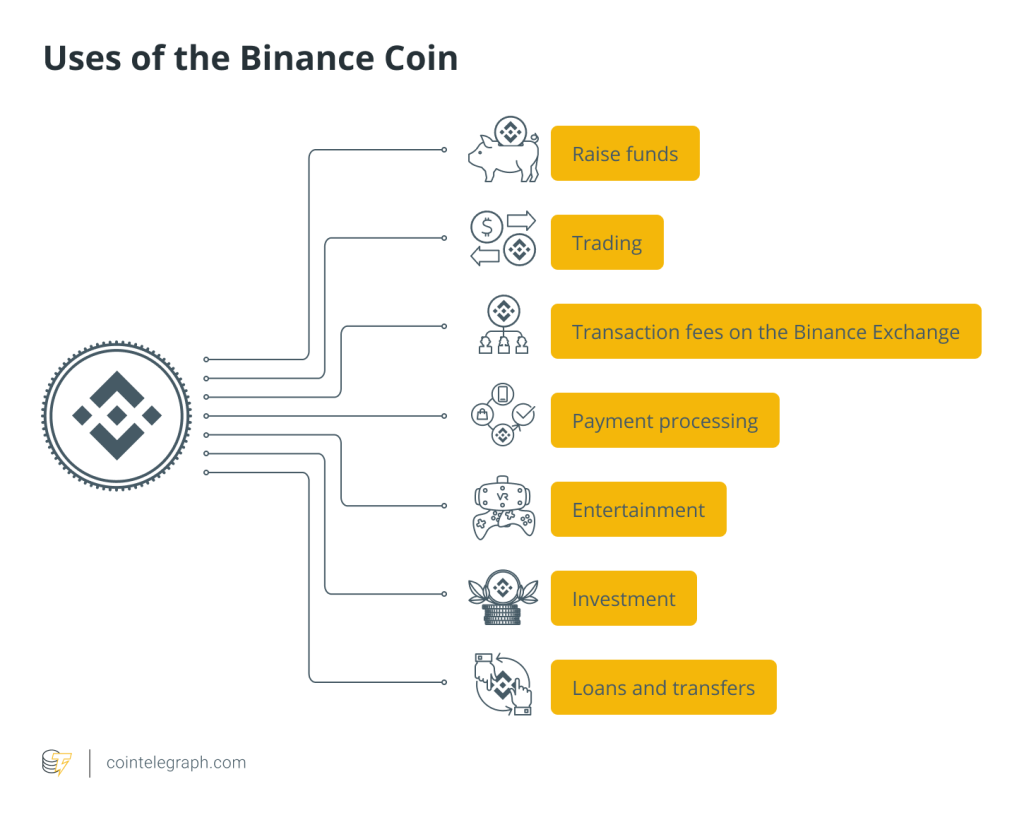

What is BNB used for? In short, a vast array of activities within Binance’s ecosystem. From usage as payment for fees on BNB’s blockchains (BC and BSC) to collateral on Binance’s lending platform. Interested entities can also simply use BNB for holding and transferring value.

Fee payments

BNB acts as a payment method by which participants pay for activities on the BNB Smart Chain. This can be as simple as paying fees to send a BNB transaction. A more complex usage of BNB as a fee payment might include paying for fees via BNB when using a DApp, such as a decentralized exchange (DEX) on BNB Smart Chain.

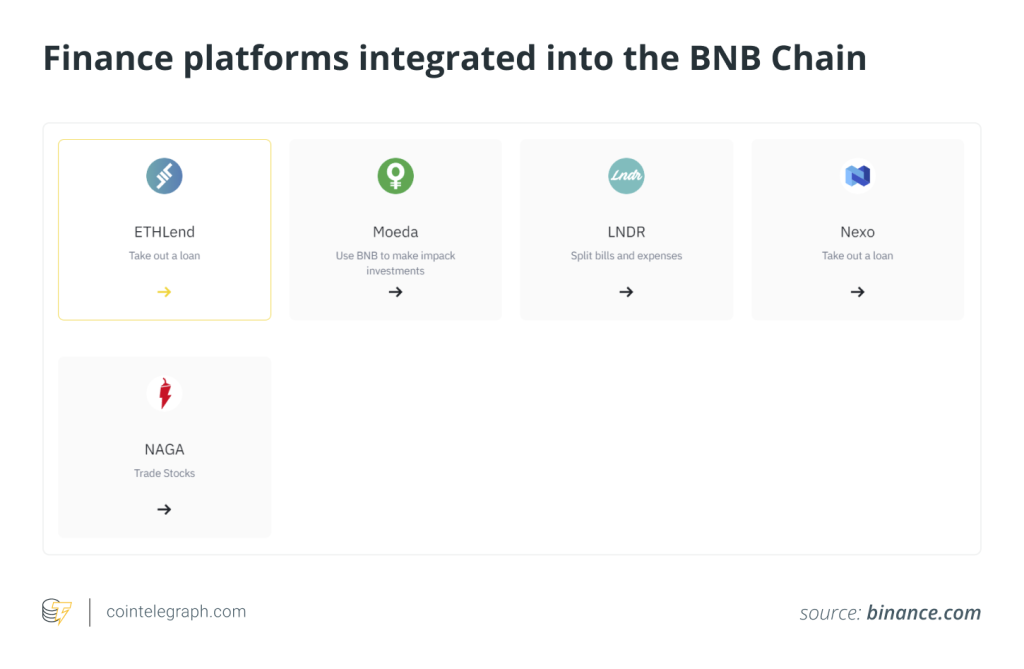

BNB is also available as a method of fee payment for trades on Binance’s decentralized exchange, Binance DEX, which was built on the BNB Chain. Hundreds of BNB Smart Chain initiatives are powered by BNB. It can be used for decentralized finance (DeFi), liquidity pools, DEX trading and nonfungible token (NFT) marketplace payments.

Additionally, customers of Binance’s centralized crypto exchange can use BNB to pay lesser fees on the platform. A certain setting on the platform means that trading fees will be taken from users’ BNB holdings on the exchange at a discounted fee rate. However, this function of BNB may be subject to change in 2022.

Value storage and transaction vehicle

At its core, BNB is a cryptocurrency that functions similarly to other crypto assets. It runs on blockchain technology, which enables holders to store the asset themselves in a compatible wallet without relying on a third party. Holders can also send the asset to other locations and people without involvement from an intermediary.

BNB’s price changes in value constantly — the result of multiple factors, which potentially include parties trading the asset for profit or using it for fees in the Binance ecosystem. Since the coin has value, as determined by the public’s demand for the asset matched with its supply, it can serve as a method of value storage and transfer.

This concept of personal wealth storage and transaction capabilities void of intermediaries can be considered as DeFi in its simplest form.

Is BNB a good investment? Historically, BNB rose significantly in price after 2017. However, that does not mean the future will come with further price increases for BNB. Everything comes with risks, and each crypto market participant should evaluate his or her situation, and make decisions appropriately while abiding by jurisdictional regulations.

Other BNB uses

Holders can also use BNB in a multitude of other ways, such as earning passive income. Binance has a subdivision of products under its Binance Earn wing.

The solutions essentially reward users with a varying array of percentage gains if they put their assets into one of the products. The options in the Binance Earn category work in different ways. For example, one of the options is a DeFi staking page that functions as a simplified on-ramp for staking different assets.

A number of the products under the Binance Earn wing provide options for utilizing BNB in some capacity. In addition, BNB can also be used as a form of payment via Binance Card (a crypto-powered Visa debit card) to pay for your shopping bills.

Furthermore, users can get immediate access to a simple and uncomplicated crypto loan with no hidden fees or penalties by using BNB as collateral. They can borrow Ether, Bitcoin (BTC), Binance USD (BUSD), Tether (USDT) and other cryptocurrencies with terms ranging from seven to 180 days.

Outside the Binance ecosystem, BNB can be used for making payments for accommodations, travel, shopping, real estate and gaming.

How to buy BNB

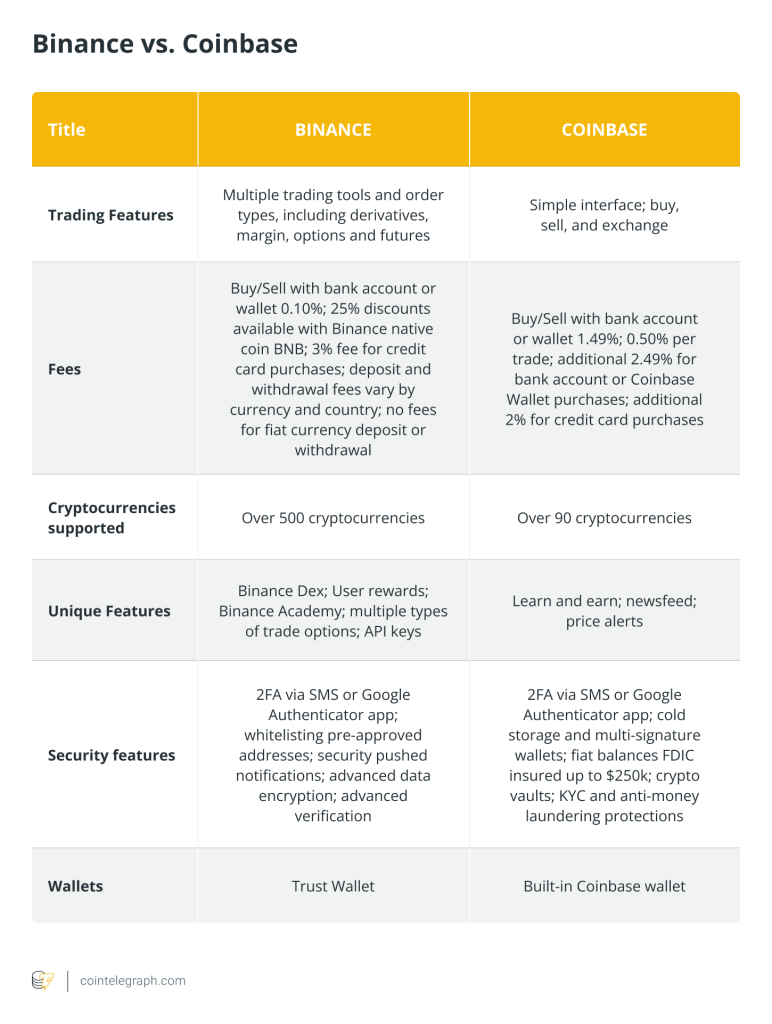

BNB is a well-known crypto asset, so buying some is not the hardest thing in the world. BNB seekers can buy the asset on Binance’s centralized crypto exchange, as well as Binance.US — Binance’s centralized exchange (CEX) for United States participants.

BNB is also available on other centralized crypto exchanges, as well as on Binance blockchain-based DEXs. Buying BNB on a centralized crypto exchange is similar to buying other assets such as Bitcoin on such a platform. Buying or selling BNB on a CEX will typically include signing up for an account on one of those platforms, which usually requires submitting information verifying your identity and creating a password — things of that nature.

DEXs differ significantly from centralized crypto trading platforms. Using a DEX typically involves no log-in process and no account creation. Instead, users connect with a compatible wallet that holds some of the assets that they may wish to trade. Trades generally involve direct transactions on the DEX’s related blockchain.

Regardless of the exchange used, it is important to be aware of applicable jurisdictional requirements and act accordingly.

Crypto moving forward

The crypto industry as a whole has expanded significantly over the years. The sector has gained sizable mainstream attention and usage. The industry has crafted numerous unique solutions with even greater far-reaching possibilities.

From the untapped potential of nonfungible tokens (NFTs) to the idea of finance without middlemen, the crypto space could significantly alter the world’s landscape. However, regulatory uncertainties have surfaced with such growth, adding question marks to the equation.

Similar to the crypto industry’s overall growth is the expansion of Binance. The company has introduced a substantial number of different products in many categories. Native blockchains, exchanges, digital asset borrowing and more are all categories in which Binance has become involved. BNB is notably relevant in this ecosystem.

However, regulatory waves have collided with Binance at times amid multiple jurisdictions expressing regulatory concern when it comes to the crypto company giant. Although the future is uncertain, Binance has communicated its intent on regulatory compliance efforts. That said, the future remains unknown.

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] There you can find 47645 additional Info to that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] There you will find 78092 additional Information on that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Here you can find 18897 additional Information to that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Here you will find 16749 additional Information to that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] There you will find 7431 more Info on that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/3546/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3546/ […]