Algorand (ALGO): A beginner's guide to the decentralized blockchain technology

Algorand blockchain explained

Algorand is an autonomous, decentralized blockchain network. It offers a wide range of secure, efficient and scalable applications. It was built for the financial future and the world's first pure proof-of-stake (PoS) fundamental blockchain. But what is Algorand used for?

Algorand's technology provides a collection of high-performance layer 1 blockchains that offer security, scalability, privacy and transaction finality. A layer-1 blockchain is a collection of solutions that improve the fundamental protocol to make the system more scalable. The consensus protocol changes, as well as sharding, are the two most prevalent layer-1 options.

Algorand was founded by Silvio Micali, a professor of computer science at the Massachusetts Institute of Technology in 2019. Silvio co-invented many breakthroughs at the heart of modern cryptography, such as verifiable random functions, zero-knowledge proofs and other protocols. Silvio launched Algorand in 2017 with the primary goal of overseeing significant research projects in theory, security and crypto finance.

The Algorand blockchain is managed by the Algorand Foundation and is available to any company or individual that wants to use it. Performance, interoperability and scaling as well as layer-2 smart contracts and private and public models are at the forefront of Algorand's technical innovation development. Additional functionality like payment scalability and off-chain computing can be provided by layer-2 scaling solutions.

Algorand scales to many users and confirms transactions with latency on the order of a minute. Even if some users are malicious and the network is momentarily partitioned, Algorand assures that users will never have contradictory views of confirmed transactions. On the other hand, existing cryptocurrencies allow for temporary forks and require a considerable period to verify transactions with high confidence on the scale of an hour.

In this article, we will discuss Algorand staking, Algorand governance rewards, why you should buy Algorand and the difference between the Ethereum, Cardano and Algorand blockchains.

What is so special about Algorand?

Bitcoin (BTC) presupposes that no single bad actor has control over most of the computational power used to generate blocks. On the other hand, Bitcoin faces several challenges, including the fact that BTC's proof-of-work approach to block generation necessitates a large amount of computation.

Moreover, PoW allows for forks, in which two alternative blockchains with the same length coexist, and neither succeeds the other. As a result, it takes around an hour to confirm a Bitcoin transaction. Additionally, the anonymity (pseudo) provided by BTC payments could be used for money laundering financing criminals or terrorist organizations.

Algorand, like all other public blockchain platforms, is a decentralized network. On the other hand, Algorand aims to solve the “blockchain trilemma,” addressing the three major issues that the ecosystem now faces: scalability, speed, and security.

How does Algorand solve the blockchain trilemma?

Through a variety of improvements, including the unique pure-proof-of-stake (PPoS) approach (Algorand’s proof-of-stake protocol) used to reach decentralized consensus, the Algorand blockchain outperforms preceding blockchain protocols. PPoS is designed to avoid the issue of the “rich growing richer.” In essence, whereas PoS pays miners with the highest stake, PPoS selects miners at random, regardless of their investment in the system.

Byzantine agreement protocol

When PPoS is paired with a Byzantine agreement (BA) protocol, the mechanism determines how people can join in the decentralized network, disincentivizes fraudulent activity and produces a single source of truth that can be verified.

The Byzantine agreement mechanism scales to many users and allows Algorand to reach a consensus on a new block with low latency and no forks. The use of verifiable random functions (VRFs) to randomly choose users in a private and non-interactive manner is a fundamental method that makes BA suitable for Algorand. VRF is a public-key pseudorandom function that generates proof that its outputs are accurate.

The agreed-upon block is then confirmed and transmitted via the network using various digital signatures from the proper verifiers. Because only one block can have the required threshold of committee votes on Algorand, two blocks can never be added to the chain at the same time. This means that in a properly decentralized network, all transactions are completed within seconds, assuring speed.

Two-tiered blockchain architecture

Algorand uses a two-tiered blockchain design to maintain speed while running complicated applications. The layer 1 tier allows for creating Algorand Standard Assets (ASA). ASA represents new or existing tokens on the blockchain, atomic swaps and simple Algorand smart contracts.

The layer-2 tier is for more complicated smart contracts and decentralized apps that run off-chain. This method enables the Algorand blockchain to handle transactions at a rate comparable to that of large payment networks.

Staking for security

Anyone who wishes to help secure the Algorand network can use an account that owns ALGO, Algorand’s cryptocurrency, i.e., the blockchain's native token, to declare their interest. The possibility of being chosen is determined by the quantity of ALGO a user has in comparison to other users on the network who expressed an interest in participating.

However, Algorand encounters three obstacles. Firstly, Algorand must protect itself from Sybil assaults, in which an attacker generates a large number of pseudonyms to influence the Byzantine agreement protocol.

Secondly, BA must incorporate millions of users, significantly scaling to what current Byzantine agreement protocols can handle. Finally, Algorand must be resistant to denial-of-service assaults, allowing it to continue functioning even if an attacker disconnects certain users. So, how does Algorand address these issues?

Algorand applies various techniques to solve the above issues, as explained in the sections below:

Weighted users

The protocol can handle dishonest users as long as honest users who follow the protocol's recommendations account for more than two-thirds of the system's total stake.

Consensus by committee

BA achieves scalability by assigning each step of its protocol to a committee, a small group of representatives chosen at random from the total number of users based on their weights. As a result, Algorand can assure that a sufficient number of committee members are truthful.

Participant replacement

Once a committee member submits a message in BA, an enemy can target that member. BA counteracts this threat by only allowing committee members to speak once. As a result, once a committee member reveals his or her name to an adversary, he or she is no longer important to BA.

BA achieves this quality by avoiding any private state (other than the user's private key), allowing all users to participate equally, and electing new committee members for each step of the Byzantine agreement protocol.

Cryptographic sortition

BA picks committee members confidentially and non-interactively to prevent an enemy from targeting them. This means that each user in the system can decide whether or not they want to be on the committee on their own.

If the user is chosen, the function produces a short string that proves the user's membership in the committee to other users, which the user can include in his network messages. For example, an adversary does not know which user to target until that user starts participating in BA since membership selection is non-interactive.

The steps during the cryptographic sortition process are listed as follows:

How does Algorand work?

There are two types of nodes in the Algorand network: participation and relay nodes. The relay nodes act as network hubs, maintaining the link between Algorand and the rest of the system's nodes. Participation nodes give computing power to validate transactions, and they are the nodes that get the most significant rewards.

The relay nodes are used by the participation nodes to connect and keep track of the ledger. Anyone can run a relay or a participation node in Algorand, but while participation nodes are paid for their efforts, relay nodes cannot “mine” ALGO. Instead, the Algorand Foundation has established a reward system for relay nodes that will expire in two to five years. To connect to the Algorand network, they need virtualization software called Algorand Virtual Machine (AVM).

The AVM is software that operates on both relay and participation nodes on the Algorand network. The stack engine of the AVM is responsible for evaluating the smart contracts on the Algorand network. In addition, the AVM assesses all of the logic contained in smart contracts before deciding whether or not to execute them.

Smart contracts are handled by Algorand in two layers: on-chain and off-chain. On layer 1, the system enables smart contracts to function “on-chain,” similar to Ethereum blockchain. This means that each smart contract adds traffic to the network, and having too many of them can cause the network to slow down.

To circumvent this, Algorand also provides layer 2 smart contracts, which are executed “off-chain.” The smart contract does not add traffic to the network; instead, it runs outside the network and is recorded in the blockchain ledger.

How to mine Algorand?

At present, it is not possible to mine Algorand using computer hardware. However, because Algorand is based on the pure proof-of-stake consensus method, it is possible to receive ALGO rewards simply by staking Algorand in a crypto or Algorand wallet. So is Algorand a coin or token?

Algorand is an altcoin that offers various value-added services due to smart-contract capability. The new feature expands the platform's applications, including decentralized finance (DeFi) and non-fungible token (NFT) enterprises.

At present, these growth drivers support Algorand's bull thesis. ALGO-USD will stand out among the altcoins as having the most potential as more investors diversify their holdings with crypto assets.

How do you buy Algorand?

You can buy ALGO from crypto exchanges like Coinbase or Binance. To buy ALGO from Coinbase, follow the steps below:

-

Create a Coinbase account if you don't already own one. Get your account verified and add a payment method.

-

Start a trade by selecting “Agorand” from the list of assets.

-

Input the fiat amount (automatically convertible to Algorand amount) to buy ALGO coins.

-

Before finalizing your purchase, preview it once again.

If you want to buy ALGO on Binance, you may buy ALGO by exchanging it on the Binance exchange. With ALGO, you'll need to use a token in a trading pair like BNB or BUSD. Additionally, you can also buy ALGO using a debit card, credit card or PayPal by following the steps below:

-

Create a cryptocurrency wallet.

-

You can buy BTC quickly with your debit card, credit card or PayPal account once your crypto wallet account is live following personal identity verification.

-

Select a trustworthy cryptocurrency exchange platform that accepts Algorand and send your newly purchased Bitcoin to the exchange platform.

-

The final step is to convert your newly obtained BTC to ALGO.

How do you stake Algorand?

Algorand can be staked immediately using the mobile wallet app, which is available on both Android and iOS devices. Deposit ALGO directly into the wallet to stake the coin. Over time, the wallet will automatically accrue ALGO.

Furthermore, on October 1, 2020, Algorand launched its community governance initiative, which offers ALGO holders the opportunity to make decisions about the future of Algorand. People can get involved in governance by pledging their ALGO for the duration of the 90-day voting period and then voting on the ideas. In addition, participants can receive their governance prizes when the 90-day voting session has ended.

What are ALGO auctions?

ALGO was first made available on Binance through IEO. Because the pioneers believed that the market should determine the asset's worth, tokens were distributed through a Dutch auction.

A Dutch auction is a public offering auction structure in which the offering price is determined after all bids have been received to establish the maximum price at which the entire offering can be sold. Investors submit a bid for the amount they are willing to acquire in terms of quantity and price in this form of auction.

The Algorand Foundation's main function is to distribute ALGO tokens. For all the participants in the Dutch auction, the fund also has a refund policy. The first auction took place on June 19, 2019, and for $2.40 each, 25 million tokens were sold.

Is Algorand a good investment?

Algorand has already proven to be a robust platform with extensive developer support, cutting-edge technology and real-world applications. In addition, it is pioneering new standards in the digital asset ecosystem by solving the blockchain trilemma, accelerating worldwide adoption at retail and institutional levels.

However, from an investment perspective, you should gauge ALGO's market movement consistently before committing your funds. Moreover, the network's potential gives investors seeking growth-oriented cryptocurrency networks a compelling reason to acquire ALGO, its digital token.

Algorand vs. Ethereum: Is Algorand an Ethereum killer?

There isn't a definite answer if Agorand is an Ethereum killer. However, Algorand is faster than Ethereum, and does not charge gas fees. The minimal transaction fee on Algorand is 0.001 ALGO coins, and it is determined solely by the transaction size.

The ASA is comparable to the ERC-20 token in that both allow for the creation of smart contracts. On the other hand, ERC-20 smart contracts always send traffic to Ethereum's network and thus boost gas expenses whereas ASA smart contracts can be executed off-chain and lower transaction fees.

Furthermore, bridges between ASA and ERC-20 allow Algorand applications to communicate with Ethereum applications. As a result, currencies like Tether (USDT) can be transferred at 1000 transactions per second to ALGO.

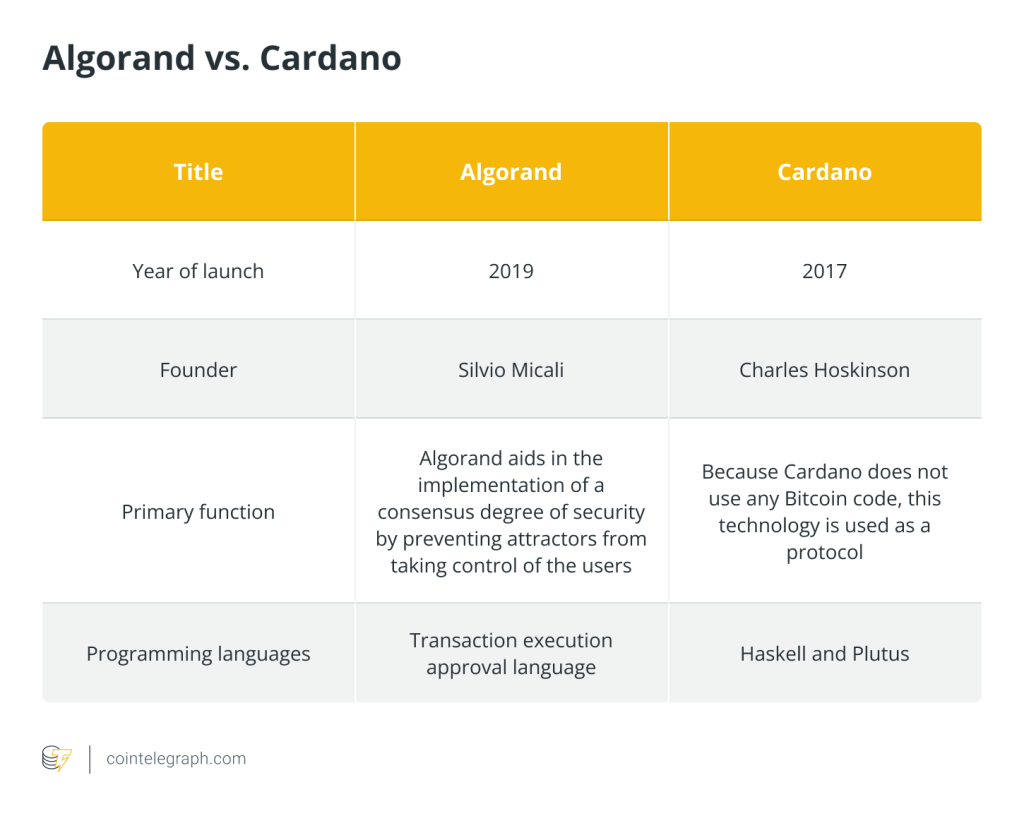

Algorand vs. Cardano

The critical difference between Algorand and Cardano is that Algorand was created to use other technologies with pure-proof-of-stake, which addresses security, scalability and speed-related concerns. In contrast, Cardano was created to solve scalability issues.

The summary of key differences between Algorand and Cardano is listed in the table below:

The road ahead

On its website, Algorand describes itself as “the future of finance.” It's no wonder that Algorand has become such a hot name, with a core team focused on creating the greatest technology possible in the DeFi and NFT space as well as some of the most coveted partnership lists out there.

Algorand, led by one of the world's finest living cryptographers, seems to be the most definite contender to lead the smart contract race in the world of Ethereum, Cardano, Polkadot and various other blockchains. If you want to know more about Polkadot, please read our guide here.

The future of Algorand blockchain depends upon the amount of effort that the team will put forward to make it distinctive from competitors and its ability to solve current blockchain challenges.

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Here you will find 61437 additional Info on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] There you can find 38166 additional Information to that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] There you will find 92357 more Information on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Here you can find 35800 additional Information on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Here you will find 27915 additional Information on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Here you will find 11973 more Information on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] There you will find 7394 additional Info on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3260/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3260/ […]