A beginner’s guide to the zkSync ecosystem

The Ethereum blockchain, the massive development of decentralized finance (DeFi) smart contracts and the acceptance of nonfungible tokens (NFTs) have attracted much attention to the network. Despite being very valuable, DeFi and NFTs use significant energy with each transaction. Ethereum uses a proof-of-work (PoW) consensus, which was popular for a while. However, together with the high gas prices, it has emerged as Ethereum’s central issue.

To address the concerns associated with low scalability and high transaction fees, an Ethereum consensus layer was created to salvage the situation. It focused on solutions like zero-knowledge rollups, zkSync and Optimistic Rollups.

ZkSync enables users to exit and enter the Ethereum mainnet in a decentralized pattern while offering lower transaction fees compared to the legacy ecosystem. The advantages of zkProofs were the transmission of speed and low gas fees, which had become two pain points for Ethereum users.

This guide will explain the zk-Rollup technology, the history of zkSync, zkSync vs. other L2 solutions, zkSync token, advantages of zkSync’s technology, decentralized applications (DApps) on zkSync and zkSync bridge.

What is zkSync?

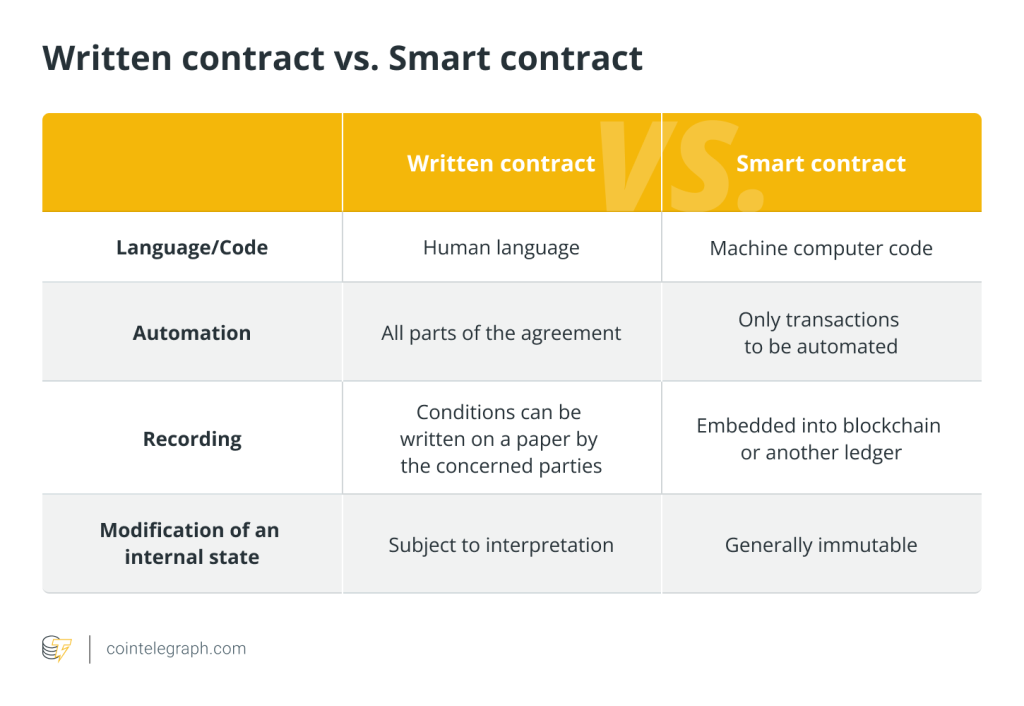

ZkSync is a mainstream scaling technology implementing innovative solutions to Ethereum scaling. Zk refers to zero knowledge, while rollups stands for smart contracts. What smart contracts do is roll up a slew of transactions off the main layer and club them into a single transaction.

Zero-knowledge proofs, or zk-Proofs, have active cryptographic security. For instance, zk-Rollup solutions determine the integrity of a transaction without disclosing the supporting evidence. The following aspects are important for understanding the ecosystem:

zkSync vs. other L2 solutions

Layer-2 chains like Polygon, Optimism, Arbitrum and Immutable X aim to scale Ethereum. Each solution offers remedies for any or a few of the key features like scalability, security, throughput, gas fees and functionality. Not one single solution is all-encompassing. However, rollups are an attempt to enhance all these features.

Layer-2 rollups

As mentioned, zk-Rollup is a layer-2 scalability solution that facilitates faster validation of transactions in Ethereum at a cheaper rate. It simply fuses an array of layer-2 transactions to execute them off-chain at a go and sends them on Ethereum’s blockchain as a single transaction.

Optimistic Rollups improve scalability, as they don’t do any computation by default. After a transaction, they just inform the mainnet of the new state. Optimistic Rollups optimize transactions by reducing congestion of the base lawyer and slashing the gas cost. These rollups publish little information about transactions on-chain and transactions are considered automatically.

Like Optimistic transactions, zk-Rollups also batch up transactions to execute them off-chain. However, there is a difference. Instead of assuming the validity of transactions until proven otherwise, zk-Rollups use validity proofs for instant proof of whether the transactions are valid. The complexity of the technology and its ability to execute arbitrary code makes developing Ethereum Virtual Machine- (EVM)-compatible zk-Rollups challenging.

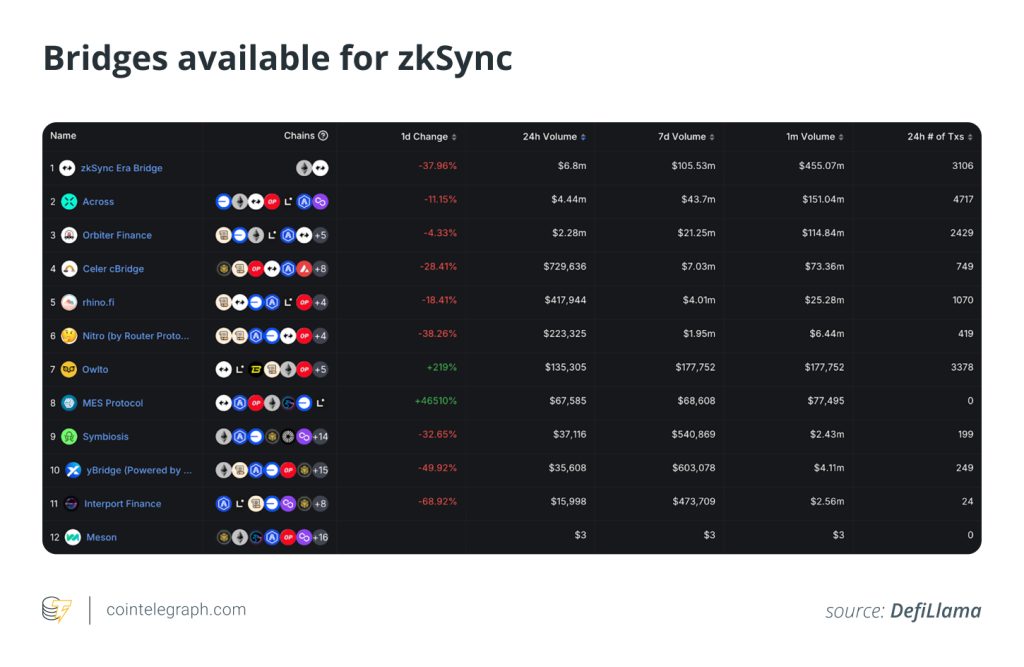

zkSync-compatible bridges

A blockchain bridge is a framework that aligns minting and burning processes to allow constant token supply between two different platforms. Developers find bridges very beneficial because it accounts for faster processing. Some zkSync bridges include:

zkSync Portal: It is a trustless protocol that hooks zero-knowledge proofs to roll out scalable low-cost transactions on Ethereum. The system stores all assets in a single smart contract on the mainchain while performing computation and storing data off-chain.

ZigZag Bridge: ZigZag is an easy-to-use and secure decentralized exchange built on zk-Rollups. ZigZag Bridge is an interface there that helps users easily bridge over funds between networks. You may view transfer history on the bridge as well.

Who is behind zkSync?

Zero-knowledge Rollups were created by Germany-based Matter Labs in 2020 to improve Ethereum scaling. Matter Labs began work on the project in 2019 until they finally released the first version of zkSync called zkSync 1.0 in 2020, as explained below.

zkSync 1.0: The history of zkSync began with zkSync 1.0 in 2020. This Ethereum scaling technology could conduct up to 3000 transactions per second (TPS). However, the need for more throughput as the network grew wider led to a new version: zkSync 2 0.

zkSync 2.0: Recently, Matter Labs launched a zkEVM testnet which means zkSync is the first zk-Rollup to perform Ethereum native smart contracts. zkSync version 2.0 with its alpha version zkEVM infrastructure is a far better improvement than its previous version, zkSync 1.0.

They created zk-Porter to maximize the time and efficiency of Ethereum transactions. zk-Porter is a sharding solution that zkSync intends to increase throughput with. With zkPorter, Ethereum scaling has the potential to move from 3000 TPS up to 20,000 TPS.

zkSync token

ZkSync currently has no native token to its name, but investors should anticipate something from the zero-knowledge proof systems. For instance, one can note from their official page that zkSync would create tokens for investors to stake with and to become zkSync network validators.

The company also implied that zkSync airdrop would be available to be claimed by users and loyal supporters. The airdrop might bear similarities with the optimism airdrop. Users of the zkSync network are hopeful since the news is up on the company’s official tokenomics page.

How does the zkSync ecosystem function?

Zk-Rollups scale Ethereum by rolling up transactions off the Ethereum mainnet (layer 1) but submit transaction data on layer 1. It is better in throughput, security and scalability compared with layer 1, and fees are much cheaper. But, the basic structure of the main Ethereum chain is still maintained since the data is on layer 1.

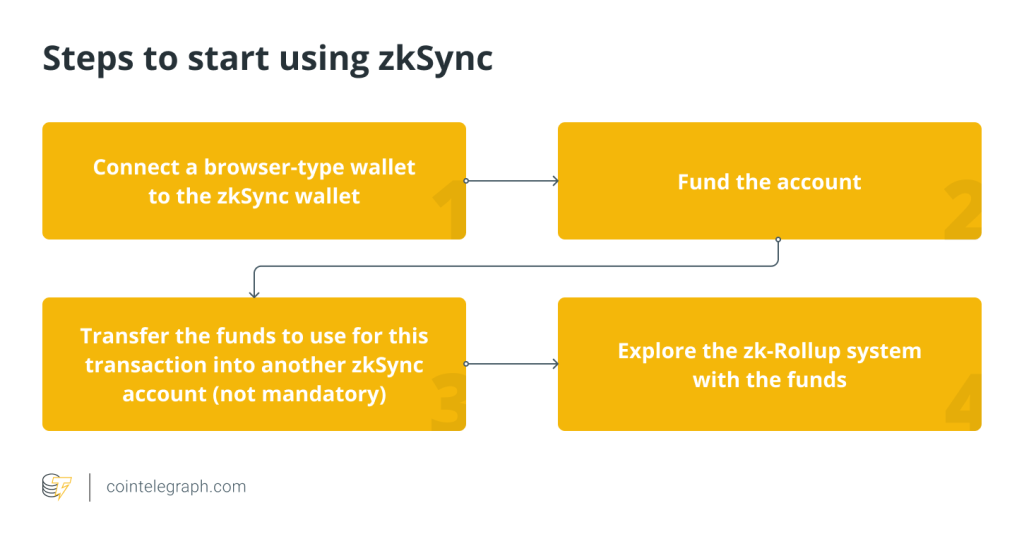

To use zkSync, you need to follow these steps:

Pros and cons of zkSync

Let’s have a glance at the pros and cons of zkSync:

Pros

One of the advantages of zkSync is that the support token payment fee on zkSync is user-friendly and doesn’t require Ethereum payment. You can pay the support token fee in another cryptocurrency. For instance, If you’re transferring a tethered token — also known as stablecoins — on the platform, you may choose to pay the fee with Tether (USDT).

Furthermore, transaction time on zkSync is shorter as well. zkSync system is designed in a way that more transaction volume takes less time to withdraw coins. The approximate amount of time it takes for a withdrawn currency to reach the user’s account is three hours.

Additionally, the transaction fee on zkSync is ridiculously cheap. By estimation, the amount charged for a token transfer is currently about RMB 75 on the Ethereum mainnet, whereas on zkSync transfer, it costs approximately RMB 1.5.

Cons

The consensus mechanism security of zkSync is compromised by consensus networks, such as practical Byzantine fault tolerance (pBFT) and delegated proof-of-stake (DPoS), that are adopted for faster speed. The speed of layer-2 networks is enhanced. However, the protocols used to improve its speed are usually centralized.

Some major wallets and exchanges are not synchronized but support layer-2 networks, which may guide users to wrongly send a transaction intended for an exchange to layer 2. As a result, transactions can be lost irretrievably, especially if that transaction isn’t recognized on the layer-2 networks.

Currently, general support of EVM poses a great risk for zkSync due to its complexities because general EVM is still in its developmental stage. These complexities, together with the challenge of generating proof, are a significant source of pain points during transaction processing.

DApps on zkSync

As reported by Zk_Daily — an educational Twitter account for ZKSync awareness — over 100 projects currently run on zkSync. This reveals that the zkSync ecosystem is expanding and becoming a vast enterprise. zkSync’s investors are manifold, but here are the DApps running with ZKSync:

Curve

One of the first exchanges that popularized the automated market maker (AMM) was Curve. On zkSync, however, Curve’s total value locked (TVL) is far less than its value on other blockchain protocols. But, the good thing is that zkSync is getting widely recognized and more popular, so there’s hope.

ZigZag

The ZigZag decentralized exchange (DEX) is a noncustodial order book running on zkSync. zk-Rollups power the spot trading offered by ZigZag. Thanks to zk-Proof technology, investors can utilize the ZigZag project to swap tokens and perform spot trading straight out of their wallets without additional charges or gas fees. ZigZag has put in place a bridge as well to connect zkSync with Ethereum.

Yearn Finance

Yearn Finance offers various investment strategies to users to generate an ROI on its platform. The platform gained popularity on the Ethereum blockchain before extending to other chains. The yield-compounding platform can be accessed using zkSync through Argent, a wallet provider.

Taker Protocol

Another DApp on zkSync is a platform based on a decentralized autonomous organization (DAO), Taker Protocol, which is majorly a liquidity framework for cryptocurrency tokens, synthetic assets and NFTs. On Taker Protocol, crypto lending and borrowing, NFT lending and even renting are allowed.

Mute.io

Mute.io is entirely grounded in zk-Rollups and ruled by DAO. As an automated market maker exchange, initial DEX offering (IDO) and farming protocol, it conveys transactions at lightning speed while eliminating gas fees that would typically be a challenge. Privacy is improved as well, with the help of zkSync technology.

Should you rely on the zkSync ecosystem?

Indeed, zk-Rollups have positively impacted the Ethereum blockchain. Their evolution from zkSync 1.0 to zkSync 2.0 is indicative of steady growth and improvement. However, what is the future of zkSync proofs? With Ethereum’s long-term significance, a system that proves equal to the task is required to drive the affairs of the decentralized system.

The question is, “Are zero-knowledge-proof systems reliable as a long-term utility?” zkSync has displayed grit since it emerged in 2019. Ethereum transactions can become more efficient, seamless and cheaper with zkSync. Some DApps are on the trustless layer-2 protocol, as mentioned above. Hence, it appears that zk-Rollups have developed more quickly than anticipated. Whatever the case, Ethereum will eventually serve as a data availability layer for these L2 technologies.

… [Trackback]

[…] Here you can find 33672 more Information on that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] There you will find 43424 more Info to that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] There you can find 39882 additional Info to that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] Here you will find 76831 more Info on that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] Here you can find 2034 more Information on that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] Here you can find 53072 additional Information on that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] There you can find 37717 additional Info on that Topic: x.superex.com/academys/beginner/3180/ […]

… [Trackback]

[…] There you will find 3611 more Information to that Topic: x.superex.com/academys/beginner/3180/ […]