An overview of different types of asset classes

How many asset classes are there?

An asset class is a group of investments with similar financial characteristics. As a result, they react similarly to market events. Asset classes are the building blocks of each person’s investment period, with explicit emphasis on spreading the risk.

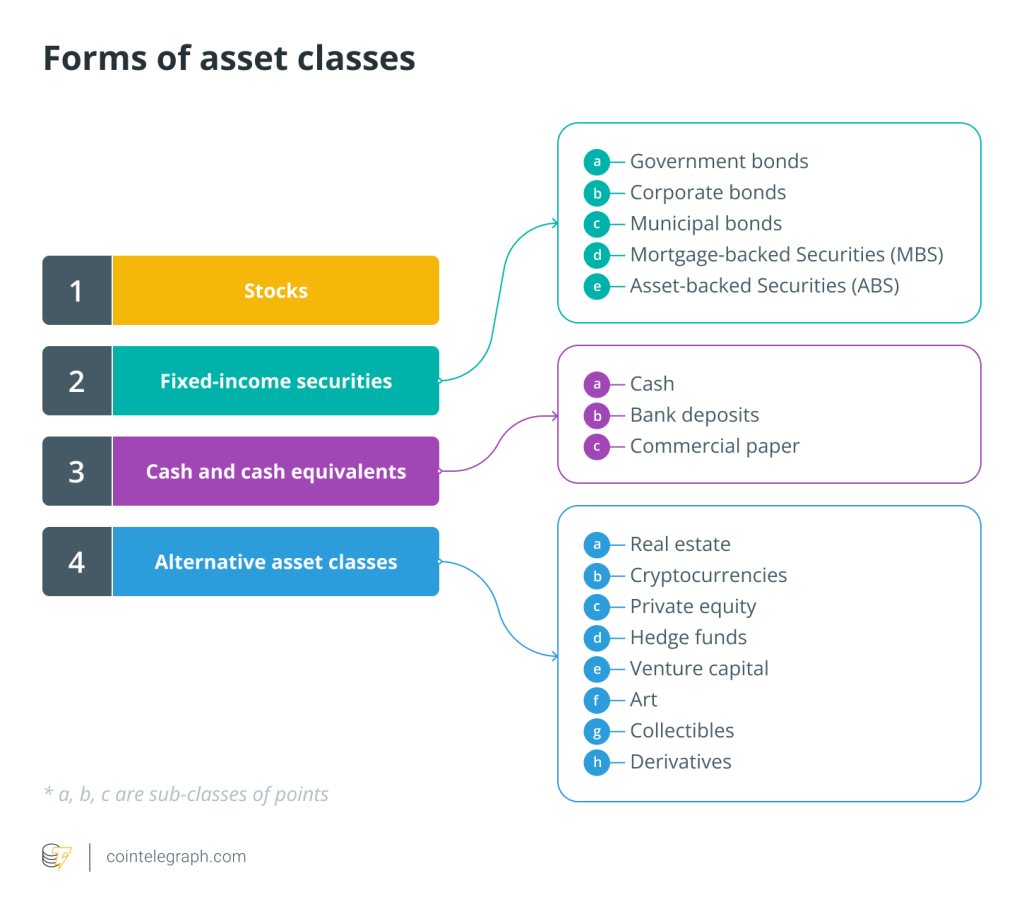

The main asset classes are equities (stocks), fixed income (bonds), cash and equivalents, real estate, commodities, and alternative investments (hedge funds, private equity, venture capital, derivatives, cryptocurrencies, collectibles, and art).

Related: How crypto traders learn lessons from trading different asset classes

Exploring the history of asset classes

The history of asset classes captivatingly reflects human society’s and financial markets’ progression. During ancient times, societies primarily viewed tangible assets, such as gold, silver and land, as crucial asset classes. However, it was not until the increasing necessity for a standard trade medium that the concept of “money” emerged.

Moving to the Middle Ages, sovereign-issued debt made its entrance, laying the foundation for what we now recognize as modern fixed-income assets. Then, in the 17th century, the Dutch East India Company pioneered the introduction of the first publicly traded company shares, cementing equities as an essential asset class.

Throughout the 20th century, the global economy’s complexity expanded, largely due to globalization and technological advancements, fostering the creation of diverse asset classes like derivatives and securitized loans. These trends interconnected financial markets, broadened financial instruments, and triggered changes in regulatory policies and demographic shifts, all contributing to a more complex economic landscape.

The securitization of loans emerged as a key facet of this evolving complexity. This process involves bundling various loans into tradable securities, freeing capital for financial institutions and providing new investment opportunities. While this demonstrates economic sophistication, it also introduces new risks, as seen in the 2008 financial crisis, underscoring the need to manage our increasingly intricate global economy carefully. The 21st century dawned with the emergence of digital asset classes, with cryptocurrencies being the most notable.

Today, this evolution persists. In addition, ongoing technological and financial innovations continue to sculpt the landscape of asset classes, ensuring that the realm of investing remains dynamic and perpetually evolving.

Different asset classes, explained

Stocks

Shares, also called stocks or equities, represent an ownership interest in a company. When you invest in stocks, you buy a share of that company and become a shareholder. The value of shares fluctuates based on various factors, including market conditions, company figures and macro trends in the economy. As a result, stocks carry significant risk, but higher returns can be yielded if the investment is for the long term.

Advantages:

- Growth potential: Historically, stocks have historically provided higher returns than other asset classes over the long term.

- Dividend income: Many stocks, as a part of their value proposition to investors, provide income in the form of dividends.

- Liquidity: Stocks, particularly those listed on major exchanges, are usually highly liquid, meaning they can be bought or sold rapidly with minimal impact on their price.

Disadvantages:

- Volatility: The prices of stocks can exhibit high volatility, meaning they can fluctuate widely within short periods, thus presenting potential risks as well as opportunities for investors.

- Capital loss: If a company underperforms significantly or goes bankrupt, investors risk losing all the capital they have invested in its stocks.

Fixed-income securities

These are investments where the investor theoretically makes a loan to an entity, such as a company or the government. The investor receives periodic interest payments in exchange for investment, making this class relatively safer than other investment forms.

Advantages:

- Steady income: Bonds provide regular interest payments to their holders, thus offering a steady income stream over the period until maturity.

- Capital preservation: We generally consider bonds to be safer than stocks, as they guarantee the return of the principal upon maturity, in addition to regular interest payments throughout the bond’s lifespan.

Disadvantages:

- Interest rate risk: When interest rates increase, bond prices generally decrease, showing an inverse relationship between the two.

- Inflation risk: The fixed income from bonds might not keep up with inflation, potentially eroding purchasing power over time.

Cash and cash equivalents

Cash and cash equivalents are the most liquid form of an asset. They include things like cash, bank deposits, commercial paper, etc. Although you often receive lower returns on this class than the others, you also run the lowest risk. Risk-averse investors want to respond quickly to new investment opportunities and find cash attractive.

Advantages:

- Safety: Cash and equivalents are generally considered the safest asset class due to their high liquidity and low risk of value depreciation.

- Liquidity: Investors can easily convert assets like cash and equivalents into cash, demonstrating their high level of liquidity.

Disadvantages:

- Low returns: While being safe and highly liquid, cash and equivalents generally offer the lowest potential returns compared to other asset classes.

- Inflation risk: Over time, inflation can erode the purchasing power of cash holdings, diminishing their real value in terms of the goods and services they can buy.

Alternative asset classes

In addition to the above asset classes, alternative asset classes include real estate, private equity, hedge funds, venture capital, cryptocurrencies, art, collectibles and derivatives. While alternative asset classes can enhance portfolio diversification and boost returns, they often come with higher risk, lower liquidity and higher investment costs than traditional ones.

Therefore, sophisticated investors with a high-risk tolerance usually consider them for investment purposes. Let’s take a closer look at cryptocurrencies, nonfungible tokens (NFTs) and tokenized assets.

Cryptocurrencies

Besides all mainstream options, cryptocurrencies like Bitcoin (BTC) are increasingly valued investment options. For those looking to invest their wealth in the crypto world, it is essential to know that there are thousands of options, depending on your needs. However, investing in crypto can offer high returns but is also volatile and carries risks.

Emerging asset classes: NFTs and tokenized assets

Step into the forefront of financial innovation, and you’ll encounter a revolution in the form of NFTs and tokenized assets. These digital asset classes are not only reshaping the landscape of investment, but they’re also redefining the very concept of ownership and value.

NFTs, unique digital tokens on the blockchain, allow for the ownership and trading of everything from digital art to virtual real estate, with each NFT having its own distinct value and properties. Meanwhile, tokenized assets represent real-world assets — real estate, art or company shares — digitized on a blockchain, creating new possibilities for buying, selling and trading assets.

These emerging asset classes provide unparalleled liquidity, fractional ownership and global market access, transforming traditional investment norms. However, they also introduce new risks and regulatory challenges, making it crucial for savvy investors to stay abreast of this rapidly evolving space.

Regardless, embracing NFTs and tokenized assets means stepping into a new era of investing, where the digital and physical realms merge to create unprecedented opportunities.

Related: Crypto trading vs. crypto investing: Key differences explained

Importance of asset classes in investing

Asset classes are fundamentally indispensable to investing. As described above, different asset classes have specific risk and return characteristics. In addition, prices tend to react and adjust in response to economic events and market developments. Therefore, investors can reduce risk and optimize total return by spreading investments across various classes.

Understanding the different classes is essential so that returns align with one’s financial goals, investment horizon and risk tolerance.

The impact of economic events on asset classes

Delving into the financial world, one quickly realizes the profound impact of economic events on asset classes. These events, ranging from changes in interest rates and inflation to geopolitical shifts and global pandemics, can drive significant fluctuations in asset values.

For instance, a rise in interest rates generally results in bond prices falling, given their inverse relationship. Conversely, stocks might react differently to the same event depending on company performance and sector strength.

Moreover, investors often gravitate toward safer asset classes, such as cash or government bonds, in times of economic uncertainty or recession. In contrast, periods of economic growth can see a surge in riskier assets like equities or cryptocurrencies.

Therefore, as an astute investor, understanding the dynamics of economic events across asset classes is paramount. This knowledge equips one with the strategic foresight to manage their portfolio effectively, optimizing returns and mitigating risks.

Importance of risk assessment in asset classes

Risk assessment in asset classes is a pivotal element in making informed investment decisions, empowering investors to comprehend and navigate the delicate equilibrium between potential risks and rewards. Various metrics, each offering distinctive insights into different facets of investment risk, serve this purpose.

Among the prominent risk metrics, volatility, beta and standard deviation deserve attention. Volatility quantifies the extent of price fluctuations in an asset, thereby providing a gauge of the price uncertainty investors confront.

Conversely, beta measures an asset’s responsiveness to market swings. Higher beta values indicate heightened volatility relative to the broader market, while lower values indicate reduced volatility. Finally, the standard deviation quantifies the dispersion of values from an average within a data set, thereby serving as an estimation of investment risk.

Return metrics occupy a position of equal significance for investors. Annualized return and compound annual growth rate (CAGR) represent widely utilized measures.

Annualized return offers the average yearly rate of return, accounting for the impact of compounding, thus facilitating comparisons across diverse investments. Conversely, CAGR calculates the mean annual growth rate over a specific timeframe, incorporating reinvested profits. This metric proves especially valuable for evaluating investment growth over time.

Trading metrics, such as trading volumes, bid-ask spreads and market depth, deliver essential insights into market behavior and liquidity. Trading volumes portray the magnitude of shares or contracts traded within a specified period, offering a snapshot of market activity.

Bid-ask spreads reflect the disparity between the highest price buyers are willing to pay (bid) and the lowest price sellers are willing to accept (ask); a narrower spread suggests enhanced liquidity. Finally, market depth refers to the market’s capability to sustain relatively large market orders without significantly impacting security prices.

Safeguarding against investment scams and fraud

Investors must proactively safeguard themselves against investment scams and fraudulent activities that result in significant financial losses. Various types of scams exist, including Ponzi schemes, pyramid schemes, pump-and-dump schemes, advance fee fraud and phishing scams. To protect against such fraudulent schemes, investors must adopt specific protective measures.

Firstly, understanding the investment opportunity is paramount. Investors should thoroughly research and comprehend the investment’s fundamentals, including its underlying business model, revenue sources and growth potential. This knowledge helps identify red flags and inconsistencies indicating a potential scam.

Assessing the credibility of the issuer or investment platform is another vital step. Verifying the credentials, licenses and regulatory compliance of the issuer or platform assures their legitimacy. Investors should also conduct background checks on the individuals or organizations involved, looking for any past instances of fraudulent activities.

Furthermore, evaluating historical performance and track records is crucial. Investors should review the asset’s past performance, including its returns and volatility. Consistency, transparency and a verifiable track record indicate a reliable investment opportunity.

By adopting these protective measures, investors can significantly reduce their vulnerability to scams and fraud, ensuring their hard-earned capital is invested in legitimate, trustworthy ventures.

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] There you will find 85198 more Info to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] There you will find 31724 additional Information to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Here you will find 40526 additional Information to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Here you can find 666 more Information on that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] There you will find 30126 more Info to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/3178/ […]

… [Trackback]

[…] Here you can find 76535 additional Information to that Topic: x.superex.com/academys/beginner/3178/ […]