What is a liquidity crisis, and what does it mean for crypto investors?

Liquidity is a term used in the financial world to refer to how easily an asset can be bought or sold. Liquidity crises occur when the markets for various assets freeze up, making it hard for businesses to sell their stocks and bonds. In such a scenario, the demand for liquidity increases dramatically while its supply drops, which usually leads to mass defaults and even bankruptcies.

In the context of a crypto market, platforms don't have enough cash on hand during a liquidity crisis or 1:1 convertible stablecoins to satisfy demand without causing market values to plummet.

What does liquidity mean in cryptocurrency?

In cryptocurrency marketplaces, liquidity refers to the ease with which tokens may be exchanged for other tokens (or government-issued fiat currencies). In essence, it is a measure of how readily your digital assets may be converted into cash.

High-liquidity assets have a high trading volume. Since there is always a large pool of potential buyers and sellers, you can rest assured that you will receive a reasonable offer for your items.

Liquidity can be measured by the bid-ask spread or the difference between the price people are willing to buy it for versus the price people are selling it for.

Why is liquidity so important in crypto?

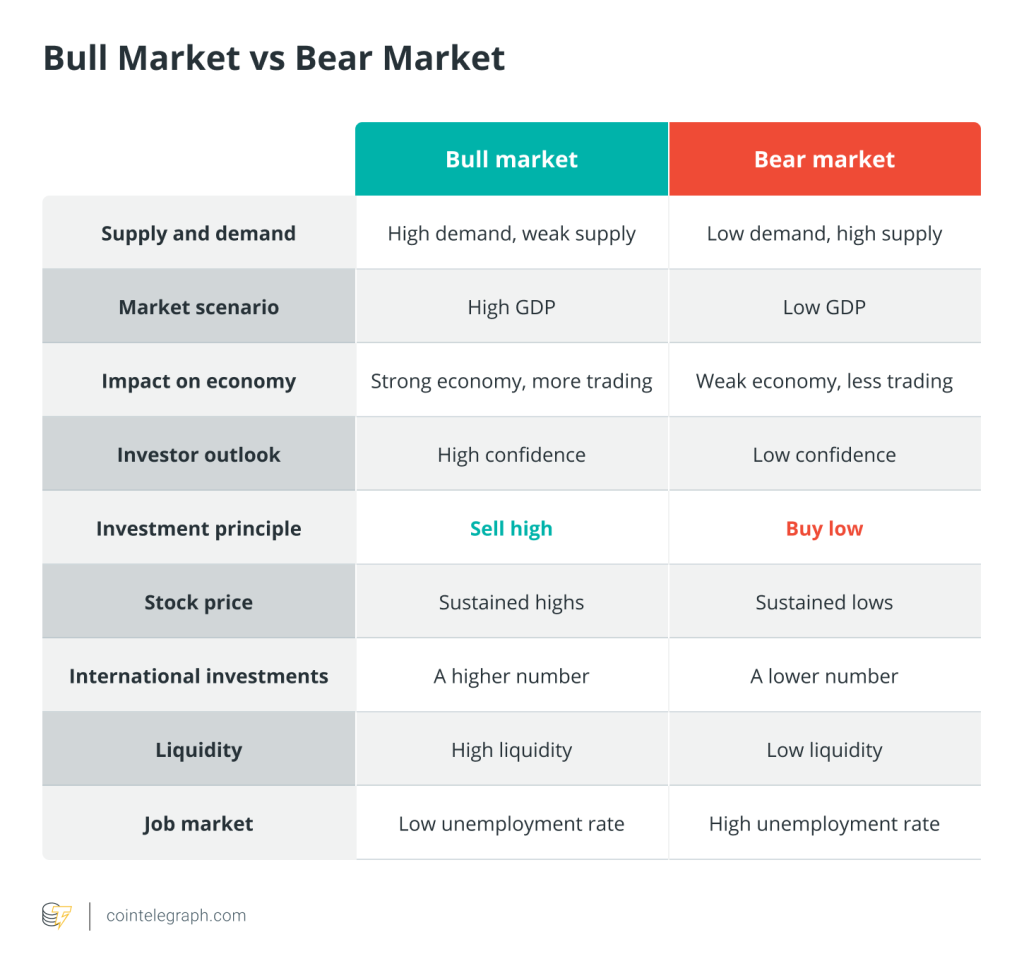

The ability to quickly and easily convert one unit of an asset into another is an important feature of any marketable asset, including cryptocurrencies. Low liquidity levels indicate market instability, which causes Bitcoin (BTC) price increases. In contrast, high liquidity implies a stable market with low price changes.

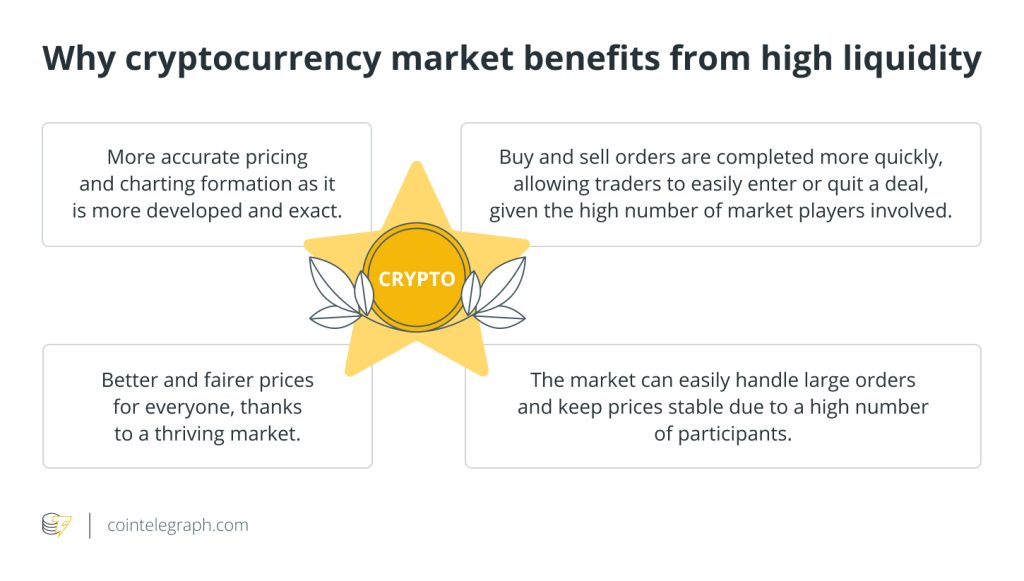

The cryptocurrency market benefits from high liquidity since it allows:

Because of the increase in market players, it is cheaper to acquire or sell cryptocurrencies in a liquid market. The rapid nature of the cryptocurrency markets essentially implies that a transaction may be entered or exited at any time.

What is a crypto liquidity crisis?

Platforms and exchanges need liquidity to run transactions (e.g., buying, selling and transferring). Many investors hold their assets on these exchanges since they offer different interest rates or high yields.

Related: Cryptocurrency investment: The ultimate indicators for crypto trading

A liquidity crisis arises in cryptocurrency when there is a lack of cash or “convertible to cash” assets. If you have cryptocurrency in the exchange, they must be able to finance your transactions, including depositing fiat, purchasing cryptocurrency, trading and withdrawing. However, if there is insufficient money or assets, such as Bitcoin to Tether (USDT) or Ether (ETH) to USDT, to support such transactions, it becomes a serious issue.

So, what happens during a liquidity crisis? In worst-case scenarios, a lack of liquidity signifies a looming bankruptcy. While no sure-fire red flags show a liquidity crunch is coming, investors should prepare for the worst. This could entail sacrificing the money you have on these exchanges as you will be unable to withdraw your assets.

What causes liquidity problems?

To avoid congestion in the market, crypto platforms hold a 1:1 equivalent cash value in proportion to assets. At other times, they may use an algorithmically governed monetary policy to maintain a one-to-one value. This helps move liquidity into the system but makes it hard to withdraw simultaneously. For a complete exit, they still need exchanges or stablecoin bank redemptions.

Liquidity problems arise when liquidity sources are depleted or come to a halt. For example, a bank may “freeze” or cease providing credit lines. Since most businesses rely on these loans to fulfill their obligations, when one company misses a payment, it also causes a domino effect with other businesses.

An example is the Singaporean crypto exchange and lending platform Vauld, which recently suspended operations. Among the reasons cited for the breakdown were the financial troubles at Celsius Network, the collapse of Terra (LUNA) — now renamed Terra Classic (LUNC) — and the default on its loans by Three Arrows Capital.

A liquidity crisis can develop when multiple financial institutions experience a liquidity shortage and start to draw down their self-financed reserves, seek short-term financing from credit markets or sell assets to create cash. Since several sellers attempt to sell at once, the interest rates increase, minimum reserve restrictions become binding, and assets lose value or become unsaleable.

When developers first began developing these crypto platforms, they were designed to generate as much financial gain as possible and with the expectation of exponential growth. However, as growth slows and stops, the larger the platform, the more damaging it is to the crypto ecosystem.

Its effect then spreads, causing the market to drop, which compels people to withdraw and sell their crypto assets or turn to hodling strategies at the same time. So, how do you solve a liquidity crisis? Paying down large amounts of debt can restore users' faith in the financial stability of platforms and make crypto withdrawals possible.

How does a liquidity crisis impact crypto investors?

There are two leading causes of liquidity crises: unexpected economic shocks and the typical ups and downs of business cycles. After the UST-Luna collapse, in which consumers lost significant investments, DeFi entities like Celsius had to freeze withdrawals, causing a drop in the market.

Celsius initially attracted a large number of customers because of its high payouts. After halting all withdrawals, swaps and transfers due to “extreme market circumstances,” investors are concerned about their assets remaining trapped on the platform. Customers may be unable to retrieve much of their assets unless DeFi lenders voluntarily unfreeze them.

How do you increase liquidity in crypto?

The more the crypto community grows in size and popularity, the more liquid its crypto assets become. The tremendous growth in price, volume, social media mentions and Google trends that BTC experienced last year is proof of this.

When popularity rises, an asset will list on more exchanges. This helps more people to know about the asset and the project, and more investors and traders will be drawn to invest in it. But what happens when liquidity is low in crypto?

Market volatility due to low liquidity levels drives price increases in cryptocurrencies. When an asset has low liquidity, it is difficult to buy or sell it fast. A deal usually can't be done, or if done, it won’t have much impact on the price.

How do you know if a token has liquidity?

The most important thing is to research and verify the tokens before investing. Don’t just rely on the word of developers. To do this, find the token’s contract and look for the page with liquidity addition information. If the token is a BSC token, you may use bscscan.com to retrieve the token's contract address. If the information is on the Solana blockchain, you can find it at solscan.io. There is an etherscan.io for tokens on the Ethereum network.

Related: What is Etherscan and How to use it?

Click on the TX hash and scroll down to the area where the liquidity pool tokens have been transferred to the developer's wallet. The developer's LP holdings may be viewed by clicking on the dev wallet. Check the transfer section to ensure the holdings have been moved to the burn address and are zero.

Finding the contract and ensuring a token is liquid can be more complicated than it seems, especially if the person executing it is not a specialist in cryptocurrency. Systems like NeferuCrypto can help provide access to that information. They can notify users via their Telegram channel when liquidity is added or locked, ensuring they are the first to get access to this information.

Purchase a licence for this article. Powered by SharpShark.

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] There you will find 50371 additional Information on that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Here you can find 17503 additional Info on that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Here you can find 39475 more Information on that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] There you will find 40703 additional Info to that Topic: x.superex.com/academys/beginner/3118/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/3118/ […]