A beginner’s guide on how to short Bitcoin and other cryptocurrencies

What is shorting cryptocurrency, and how does it work?

Short-selling is typically associated with the stock market. However, investors can also short Bitcoin (BTC) and other cryptocurrencies, especially given the volatile nature of most crypto assets. Volatility provides an opportunity for investors to take home large gains with short-selling.

Shorting, or short-selling, generally refers to an investment practice that involves borrowing securities and selling them in the hopes that the price will continue to drop. When one shorts cryptocurrency, they anticipate a decline in its value and essentially bet it will continue to decline, and can thus be bought at an even lower price later on.

Betting on an asset’s decline may be counterintuitive to the concept of making a profit when the value increases, but shorting allows for the potential of profit even when prices go down. However, there is also a large potential for loss, and it’s important to understand the risks before getting into shorting.

There are a few ways to go about shorting cryptocurrency, and it’s helpful for investors to learn about shorting or short-selling Bitcoin and other cryptocurrencies, especially when they think certain crypto assets will crash. Shorting may also be useful for hedging against potential losses in one’s cryptocurrency portfolio.

In traditional markets, investors borrow shares from their broker at a certain price when they want to short a stock. The investor then sells these borrowed shares on the open market, hoping the price will drop. Once it does, the investor can buy back the shares at the lower price and return them to the broker, pocketing the difference in price as profit. In shorting cryptocurrency, the process is slightly different but follows a similar concept. Instead of borrowing actual units of a cryptocurrency from a broker, investors often use derivatives like futures contracts or contracts for difference (CFDs) to short crypto.

These derivatives allow investors to speculate on the price movements of a particular cryptocurrency without actually owning it, and can be used similarly to when shorting stocks. However, shorting is a more advanced trading strategy that requires a bit of experience. An investor must have a solid understanding of market trends, price movements and risk management before getting into short-selling.

Is shorting cryptocurrencies safe?

Shorting cryptocurrency involves a high degree of risk. It involves leveraged trading as well as futures trading and options trading, which are all quite sophisticated and complex as far as trading strategies are concerned.

Whereas long trades involve the speculation that an asset’s price will rise, shorting necessitates taking on debt. If an investor is not cautious, they might have difficulty repaying debts related to their investments.

And if the market trend changes in a way that works against them, the exchange managing their investment may cash out their position to get their money back, leaving the individual with less than what they started with.

Additionally, the crypto market is highly volatile and rapidly changing, making it difficult to predict price movements accurately. This means that there is a high potential for loss when shorting crypto, and investors should be wary of getting in over their heads and potentially losing a significant amount of money.

For this reason, some crypto exchanges like Binance make crypto traders take a test before engaging in derivatives trading. This is to ensure they understand the complicated financial products they’re using. Granted, they can find answers to these tests online, which means anyone can get into short trading if they really want to. However, such extra measures may deter inexperienced investors from jumping into short trading without a proper understanding of the risks involved.

Choosing a trusted and reputable exchange or broker when shorting crypto is also important, as the market is filled with scams and fraudulent activities. It’s best to do thorough research on any platform before using it for shorting or other trading purposes. Overall, investors should approach shorting cryptocurrency with caution and be sure to educate themselves on the risks and strategies involved before attempting to short.

How to short Bitcoin and other cryptocurrencies

There are multiple methods of shorting crypto, such as buying options or futures contracts, using a CFD or trading on margin. Let’s explore each method in further detail.

Using futures or options

Buying futures or options contracts allows investors to buy or sell a certain asset by a specific date, set at a specific price. Futures require pre-agreed transactions to take place on a set date, while options give the investor the choice to go through with the transaction or not.

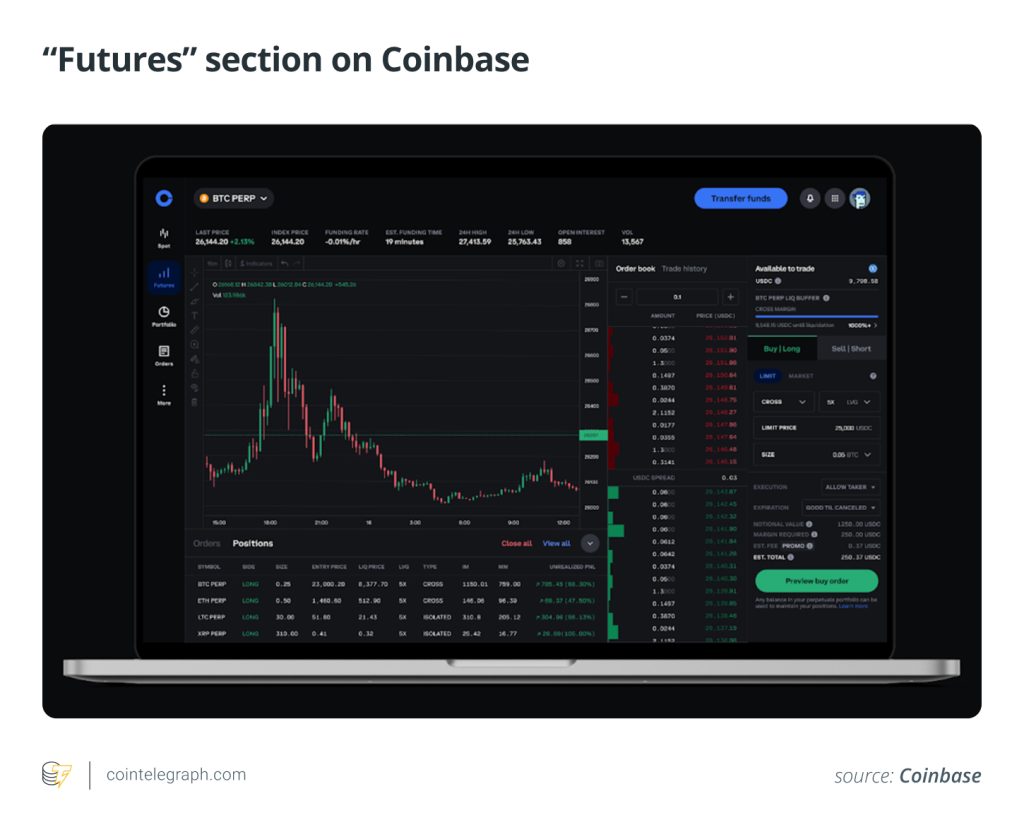

As mentioned earlier, using futures or options necessitates a good grasp of crypto derivatives, market trends and risk management strategies. Much like other assets, cryptocurrencies also have a futures market.

Bitcoin futures, for example, allow an investor to buy or sell BTC at a future date. As such, if one sells a futures contract, they can lock in a price and hope to buy back the asset at a lower price in the future, thus profiting from its decrease in value. It’s worth noting that this shorting strategy might not pay off if the value of Bitcoin rises, but an investor stands to gain a lot if the market turns. With recent exchanges allowing investors to bet against crypto assets through short-selling, it has become much easier to profit from a bearish market.

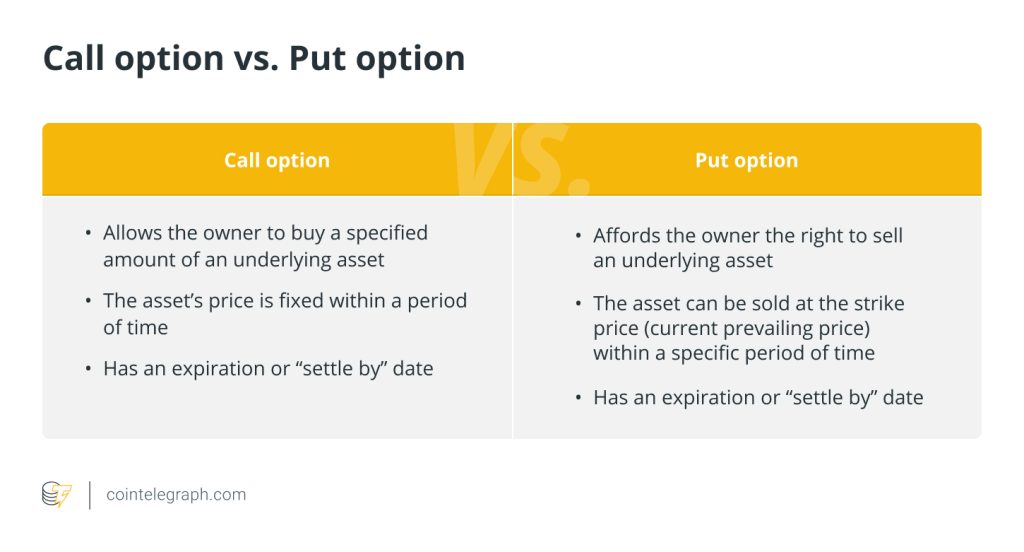

Options, on the other hand, also allow traders to short crypto. Binary options (call and put options) refer to the right to buy or sell a certain asset in the future at a set price. A put option particularly provides the holder the advantage of being able to sell their currency at its current prevailing price, even if the value falls in the future.

If one trades binary options instead of futures, they can limit their losses by holding onto their put options. This way, their maximum loss is limited to the price they paid for the options.

Using CFDs

A contract for difference, or CFD, is a contract that pays out the difference in the value of an asset from the time the contract is opened to when it is closed. CFDs are often used for short-term trading and allow investors to speculate on whether an asset will increase or decrease in value without actually owning it.

Similar to futures and options, shorting crypto with CFDs allows investors to potentially profit from a decrease in value. However, it is important to note that CFDs often have high fees and the potential for large losses if the market turns against the investor’s favor.

If the price of an asset goes down, the investor makes money. If not, he or she loses money. With a CFD, investors don’t need to hold or store cryptocurrency, as it is instead settled in fiat. Also, as compared to futures that have predetermined settlement dates, CFDs have a more flexible settlement tenure.

CFDs also offer leverage, allowing investors to control a larger position with a small amount of money. A 2:1 leverage ratio, for instance, will allow an investor to short $100 worth of Bitcoin while only investing $50.

CFDs are currently unregulated and thus are illegal in the United States for use in regulated markets. However, since crypto is largely an unregulated market, crypto traders can still use them.

Margin trading

Another way to short crypto is through margin trading, which can often be done through a margin trading platform such as a crypto broker or exchange. Investors effectively borrow money from a broker to use in making a trade, thereby allowing them to control a larger position.

If an investor has $200 in their account, for instance, but is purchasing $1200 in Bitcoin, then the remaining $1000 is on margin or borrowed from an exchange or broker. For shorting, the investor borrows an asset from the broker in order to trade larger amounts and enjoy bigger returns.

Margin traders usually purchase crypto with their borrowed money, sell the crypto once it appreciates in value, and then pocket the difference and pay back the loan with interest.

Prediction markets

Prediction markets are another way to short Bitcoin and other cryptocurrencies, and it’s done by placing bets on the outcome of events. An investor could predict that Ether (ETH) will decline by a certain percentage, for example. Should anyone take them up on their bet, they stand to profit if their prediction comes true.

Prediction markets like Gnosis, Argur and Polymarket allow investors to short crypto even without holding any assets, allowing those that do not want to invest capital in buying cryptocurrencies to still participate in the market.

However, shorting crypto via prediction markets is considered a high-risk strategy, as it involves predicting future events, and the potential for losses is unlimited. It also requires some understanding and research of market trends, as well as a keen understanding of how prediction markets work.

What are the rewards and risks of shorting crypto?

For those using margin, this could result in larger profits since they are effectively trading with borrowed funds. And for those using prediction markets, their potential profits are unlimited as long as their prediction is correct.

In addition, shorting crypto can also help to hedge against potential losses in a portfolio and provide some balance to an investment strategy. Not to be discounted, however, are the rewards that can be reaped by shorting cryptocurrencies. If an investor is able to successfully predict the direction of a cryptocurrency’s price movement, they can make major gains and potentially secure greater returns than if they had invested in the asset directly.

On the contrary, the risks of shorting crypto are fairly plain. If an investor is betting that a crypto’s value is going to plunge and it climbs instead, they could lose everything. How much one stands to lose largely depends on the instruments or methods used to open a short position, as well as how much money they have invested.

If an investor uses a margin to buy $5,000 in Bitcoin, for example, and its value drops by 50% in two days, this makes their investment only worth $2,500. In addition, they owe the exchange or broker back the money they borrowed plus interest, which can result in major losses.

Not to be forgotten is the potential risk of missing out on profits if a cryptocurrency’s value starts to rise after selling. While prediction markets can provide some shielding against future losses, they are complex and require in-depth knowledge or research to use correctly.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Here you will find 54523 additional Info on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Here you will find 5338 more Info on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Here you can find 18331 additional Information to that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] There you will find 51340 more Information on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/3116/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/3116/ […]