What is Bitcoin and how does it work?

Bitcoin definition: A number guessing game

The white paper described Bitcoin (BTC) as a “peer-to-peer electronic cash system.” But, where does Bitcoin come from?

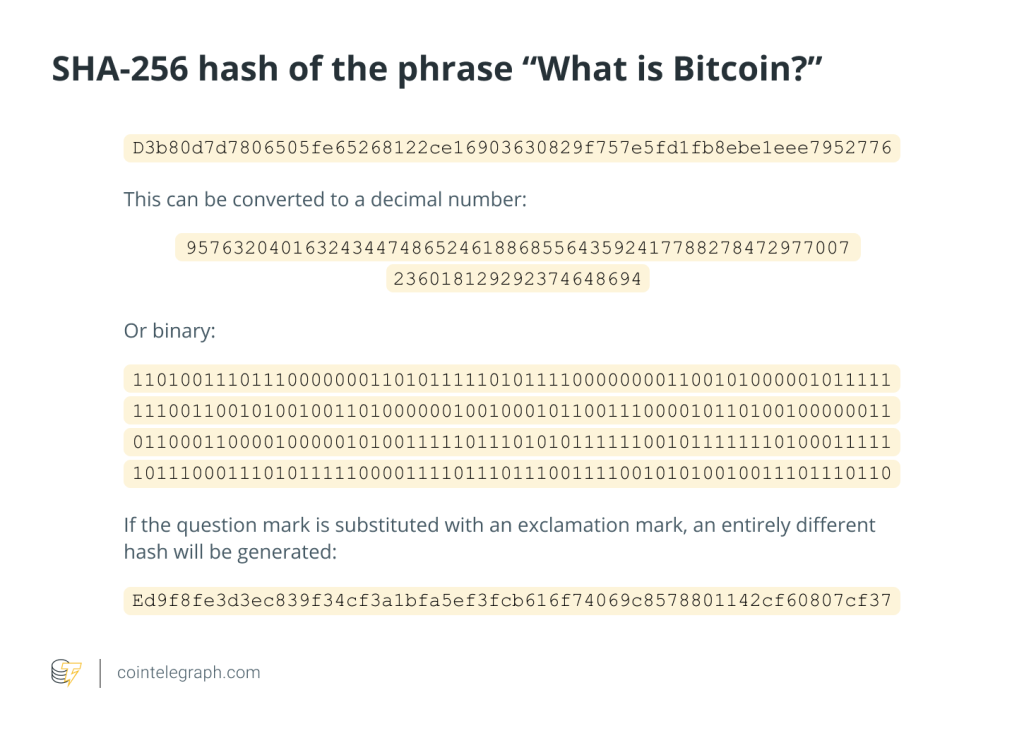

According to the algorithms, new Bitcoin is generated and given to computer users who solve pre-specified mathematical challenges. The mathematical problems refer to a hash, which is a 64-digit hexadecimal number that is less than or equal to the target hash. So, Bitcoin is simply a number, such as 12345.

To illustrate, let's assume Ms. Rose pulls a $1 bill from her wallet with the number G6607081974P. No other bill bears the G6607081974P number, considering the Federal Reserve System (in the United States) operates at a minimum degree of competence.

Since this money has a face value of $1, Ms. Rose can use it to purchase a cup of coffee.

Now, let's say two people agree that bill R7607081974P is actually worth $4,000. The only difference between Bitcoin No.12345 and $1 Bill No. R7607081974P is that the $1 bill has a physical existence and a face value that is worth something. Bitcoin, on the other hand, has no intrinsic value and is simply a number. The number may have a value agreed upon by two persons, but it has no value in and of itself. Hence, Bitcoin is created by a group of individuals playing a number guessing game.

So, what is the point of playing this game in the first place? The game is significant because it is a technique that aids with the verification and security of the Bitcoin network’s transaction history. Anyone who wants to contribute new transactions to the network must first play and win a game, which takes computational power. As a result, an attacker will find it difficult and costly to cause any damage to the network.

What is Bitcoin backed by and how does Bitcoin work?

Unlike traditional currencies, Bitcoin is neither issued by a central bank nor backed by a government. As a result, inflation rates, monetary policy and economic growth indicators that traditionally influence currency value do not apply to Bitcoin.

Bitcoin is based on a blockchain, which is a distributed digital ledger. Blockchain is a linked body of data made up of units called blocks containing information about each transaction, such as the buyer and seller, time and date, total value and a unique identification code for each exchange. Entries are connected in chronological sequence, forming a digital chain of blocks.

When a block is uploaded to the blockchain, it becomes available to anyone looking at it, thereby acting as a public record for cryptocurrency transactions. The blockchain is decentralized, meaning a single entity does not control it. The digital chain of blocks is similar to a Google Doc that anyone can edit. It is not owned by anyone, but anyone with a link can contribute to it. As different individuals make changes to it, your copy is updated as well.

While the idea of everyone being able to edit the blockchain may appear unsafe, it is precisely what makes Bitcoin trustworthy and secure. To be included in the Bitcoin blockchain, a transaction block must be validated by the majority of Bitcoin miners.

The unique codes used to identify users’ wallets and transactions must follow the correct encryption pattern. Since these unique codes are long random numbers, counterfeiting them is extremely difficult. The statistical randomness of the blockchain verification codes required for each transaction dramatically minimizes the likelihood of a fraudulent Bitcoin transaction being made by anyone connected to the network.

Why was Bitcoin created?

During the 19th and 20th centuries, many of the world's most popular currencies were convertible into fixed amounts of gold or other precious metals. However, most countries abandoned the gold standard between the 1920s and the 1970s, partly due to the strains of funding two world wars and global gold production's inability to keep up with economic development.

Moreover, physical valuables such as gold and silver were previously traded for commodities and services. Because physical assets were cumbersome to carry and prone to loss and theft, however, banks retained them for users, producing notes confirming users’ bank holdings.

Users rely on banks to maintain the value of their currency and protect their funds. Between 2008 and 2009, nevertheless, several banks and other financial organizations failed worldwide and governments had to bail them out at taxpayers' expense.

The failure of banks (as guardians of public funds) highlighted how fragile the modern financial system can be and the need to decentralize the financial services to enhance customer experience. As a result, Bitcoin was seen as a response to the Great Financial Crisis and the financial world's reliance on banks as financial transaction intermediates.

Satoshi Nakamoto had the notion of removing banks from financial transactions and replacing them with a peer-to-peer (P2P) payment system that didn't require third-party confirmation, eliminating the need for banks to be facilitating every transaction. The blockchain, a network-based ledger, is how Bitcoin and other cryptocurrencies develop trust. So, when was Bitcoin created?

When the first block, known as the genesis block, was mined on Jan. 3, 2009, the blockchain was officially launched. A week later, the first test transaction took place. Bitcoin blockchain was only available to miners confirming the Bitcoin transactions for the first few months of its existence.

Bitcoin had no real monetary worth at this point. Miners — the machines that solve complex math problems to discover new Bitcoin and verify that existing Bitcoin transactions are valid and accurate — would exchange Bitcoin for fun.

The first economic transaction took more than a year to complete, when a Florida man agreed to have two $25 Papa John's pizzas delivered for 10,000 Bitcoin on May 22, 2010. This day has been celebrated as Bitcoin Pizza Day ever since.

The initial real-world price or value of Bitcoin was set at four BTC per penny due to this transaction. Supply chain management, cross-enterprise resource planning, logistics, energy trading, DAOs or decentralized autonomous organizations and many other applications are currently being explored with Bitcoin.

When was Bitcoin created?

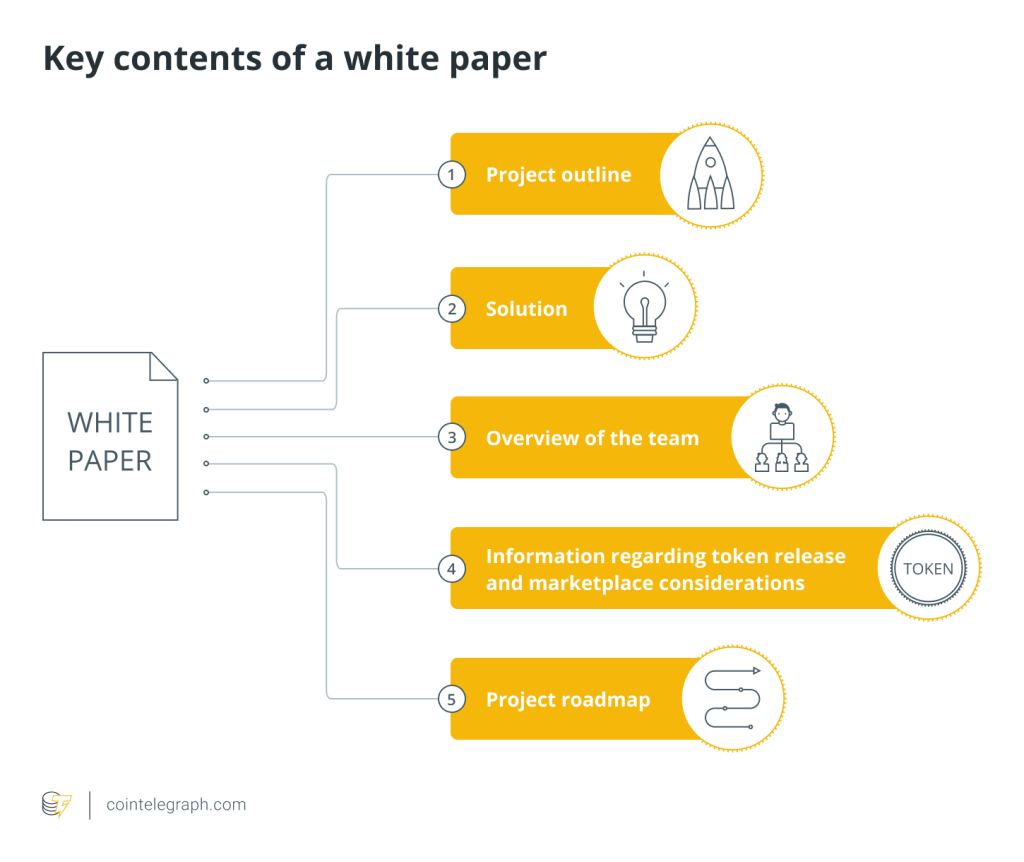

Bitcoin was created in the aftermath of the 2008 financial crisis via a white paper written by a pseudonymous entity or a group of people named Satoshi Nakamoto. The crisis served as a strong motivator for Bitcoin’s development. This guide aims to provide a glimpse of how long has Bitcoin been around, who started Bitcoin and what is Bitcoin used for?

The financial crisis of 2007 and 2008 — often known as the subprime mortgage crisis — was a global event that led to the significant contraction of liquidity in global financial markets (that began in the United States) due to the collapse of the housing market.

As the world was engulfed in a global recession brought on by excessive financial market speculation and banks risking millions of dollars in depositor funds, the white paper laid the groundwork for the first fully functional digital money based on the distributed ledger technology (DLT) called the blockchain. So, what is Bitcoin and how does it work?

The Bitcoin white paper was the first document to lay forth the fundamentals of a cryptographically secure trustless peer-to-peer (P2P) electronic payment system fundamentally designed to be censorship-resistant and transparent, all while reclaiming financial power for individuals.

Bitcoin is digital money, also known as cryptocurrency, that functions independently of any central authority. A cryptocurrency is a digital means of exchange that secures and verifies transactions using encryption. Encryption refers to a method of transforming plain text into a meaningless or random text called ciphertext. The study of secure communication techniques that allow only the sender and intended recipient of a message to read its contents is known as cryptography.

Bitcoin was created as an alternative to existing fiat currencies that could eventually be recognized as a global currency. Today, fiat currencies such as the British pound and the U.S. dollar are the most widely used types of money globally. Fiat currencies are controlled by a national government in terms of supply and creation and are backed by the trust and confidence in that government.

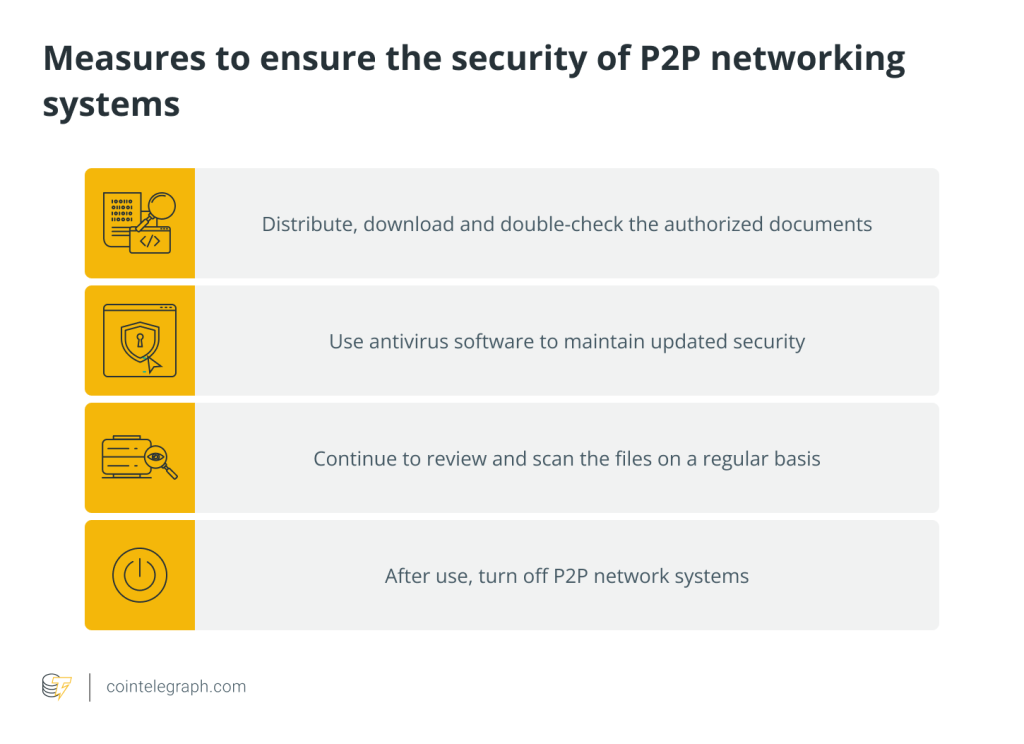

However, Bitcoin utilizes peer-to-peer technology to facilitate transactions between parties who believe that the asset being transferred has intrinsic worth. P2P refers to the direct exchange of an asset, like Bitcoin, between individuals without the interference of a central authority.

What is Bitcoin made of: Public and private keys in Bitcoin

At its most basic, Bitcoin is an autonomous public-key cryptosystem that facilitates the exchange of digital value among peers via a sequence of digitally signed transactions, rather than messages. The basic process flow of a Bitcoin transaction is identical to that of a series of encrypted messages found in a schematic of public-key cryptography and digital signatures.

To safeguard data from unauthorized access or use, public-key cryptography uses a pair of keys to encrypt and decrypt it. A digital signature is an electronic signature that uses a mathematical algorithm to verify the validity and integrity of a digital message. Therefore, Bitcoin is a chain of digital signatures.

Each owner sends Bitcoin to the next by digitally signing a hash of the previous transaction and the next owner's public key, then appending them to the end of the coin. The chain of ownership can be confirmed by the payee by verifying the signatures.

Users must have access to the associated public and private keys to transfer the required amount of Bitcoin. While referring to someone who owns Bitcoin, it really means that they have access to a key pair that includes public and private keys.

A public key refers to an address to which some Bitcoin has previously been transmitted. The accompanying unique private key (a password) allows Bitcoin to be sent elsewhere once sent to the above public key (address).

Bitcoin addresses, also known as public keys, are randomly generated sequences of letters and numbers that act similarly to an email address or a username on a social media site. They are public, as the name implies, so users can safely share them with others. In reality, if users want anyone to send them Bitcoin, they must provide them with their Bitcoin address.

The private key is made up of a different set of letters and numbers produced at random. Private keys should be kept confidential, just as passwords for email or other services. Never give out your private key to someone you don't completely trust not to steal from you.

A Bitcoin address can be compared to a transparent safe. Others can see what’s inside, but only the private key owner can open the safe and gain access to the money.

Transaction inputs and outputs

Although handling coins individually is conceivable, making a separate transaction for each penny in a transfer would be inconvenient. Transactions have many inputs and outputs to allow value to be split and merged.

Usually, there will be either a single input from a prior more significant transaction or numerous inputs combining lesser amounts with at most two outputs: one for the payment and one for returning any change to the sender.

Now, imagine that Romeo wishes to send Juliet 1 BTC. He accomplishes this by signing a message containing transaction-specific information with his private key. The following will be included in this message which must be broadcast to the network:

Inputs: Inputs contain details about the Bitcoin delivered to Romeo’s address previously. Consider the case where Romeo got 0.7 BTC from Alice and 0.7 BTC from Bob. Now, to transmit 1 BTC to Juliet, there may be two inputs: one 0.7 BTC input from Alice and one 0.7 BTC input from Bob.

Amount: The amount Romeo wishes to send is 1 BTC.

Outputs: The initial output is 1.4 BTC to Juliet's public address (0.7 BTC + 0.7 BTC). The second output is 0.4 BTC returned to Romeo as “change.”

Broadcasting and confirmations over the network

Romeo will broadcast his intended transaction to the Bitcoin network via his wallet software in the example above. The inputs (i.e., the address(s) from which Romeo previously obtained the Bitcoin he claims to possess) are verified by a specific group of network members known as “miners.”

Miners also create a block by combining a list of additional transactions broadcast to the network around the same time as Mark’s. Any miner who has completed the proof-of-work, or PoW, can propose a new block to be added to the chain or “connected” to it by referencing the previous block. The network is then informed of the new block.

Other network participants (nodes) will pass it forward if they agree it's a valid block (i.e., the transactions it contains meet all protocol requirements and adequately reference the previous block). When proposing the next block, another miner will eventually build on top of it by referring to it as the previous block. The next miner will have “verified” any transactions that were added to the last block. The number of confirmations for Romeo’s transaction grows as blocks are added to the chain.

What is Bitcoin mining and how does it work?

The process of adding new transactions to the Bitcoin blockchain is known as Bitcoin mining. It’s a difficult job. Bitcoin miners employ a PoW technique, in which computers compete to solve mathematical problems that validate transactions.

In general, miners attempt to generate a 64-digit hexadecimal number, referred to as a hash, that is less than or equal to the target hash. Bitcoin hash rate indicates the estimated number of hashes created by miners attempting to solve the current Bitcoin block or any given block.

The hash rate of Bitcoin is measured in Hashes per Second, or H/s. Miners need a high hash rate, measured in megahashes per second (MH/s), gigahashes per second (GH/s) and terahashes per second (TH/s), to mine successfully.

The Bitcoin code rewards miners with additional Bitcoin to encourage them to keep racing to solve the riddles and maintain the entire system. This is how new blockchain transactions are added to the system.

It’s vital to note that the Bitcoin hash rate has no bearing on the speed at which each block is solved. The Bitcoin mining difficulty value (adjusted upwards or downwards at each block) ensures blocks are solved at a fixed time frame called the block time.

Bitcoin mining is considerably less profitable than it once was, making it even more challenging to recoup increased costs associated with acquiring computational power and running it by using up electricity.

When the system was first introduced in 2009, miners received a stamp every time they got a higher quantity of Bitcoin than they do now. The block reward is halved in half every 210,000 blocks (roughly every four years).

For instance, one block of Bitcoin was worth 50 BTC when it was initially mined in 2009. This was reduced to 25 BTC in 2012. By 2016, it had been cut in half again at 12.5 BTC. The reward was reduced again on May 11, 2020, to 6.25 BTC.

As the number of transactions increases, the amount miners get paid for each stamp decreases. By 2140, it is expected that all Bitcoin will have been released into circulation, leaving miners with little choice but to rely on transaction fees to turn a profit from validating the network.

What is a Bitcoin wallet and how does it work?

A Bitcoin wallet is a digital wallet that may store Bitcoin and other cryptocurrencies such as Ethereum (ETH). A Bitcoin wallet (or any crypto wallet) is a digital wallet that stores the encryption key that grants access to a BTC public address and allows transactions. There are five types of Bitcoin wallets: mobile, web, desktop, hardware, and paper.

Bitcoin wallets not only store your digital currency, but they also protect them with a unique private key that only you and anybody else you provide the code to can access. A crypto wallet allows you to store, send and receive various coins and tokens. Some handle basic transactions, while others include built-in access to blockchain-based decentralized applications, or DApps.

When you create a Bitcoin wallet, you will be given a private key and a public key that is linked to your wallet. When you create a Bitcoin wallet, you will be given a private key and a public key that is linked to your wallet.

A public key is comparable to an email address in that it can be shared with anyone. When your wallet is created, a public key is created which you can share with anyone to accept funds.

The private key is a closely guarded secret. It’s similar to your password in that it shouldn’t be hacked and shouldn’t be shared with anybody. Instead, you spend your money using this private key. If someone obtains access to your private key, there is a good chance that your account will be hacked and you will lose all of your cryptocurrency deposits.

What is a Bitcoin exchange, and how to buy and sell Bitcoin?

A Bitcoin exchange is a digital marketplace where traders may buy and sell BTC using various fiat currencies and altcoins. A Bitcoin currency exchange is an online platform that operates as a middleman between BTC buyers and sellers.

Traders can purchase and sell Bitcoin using either a market order or a limit order, much like on a typical stock exchange. For Bitcoin trading on an exchange, a user must first register with the exchange and then go through a number of identity verification processes. After successful authentication, the user’s account is created and they must put funds into it before they can purchase or sell BTC.

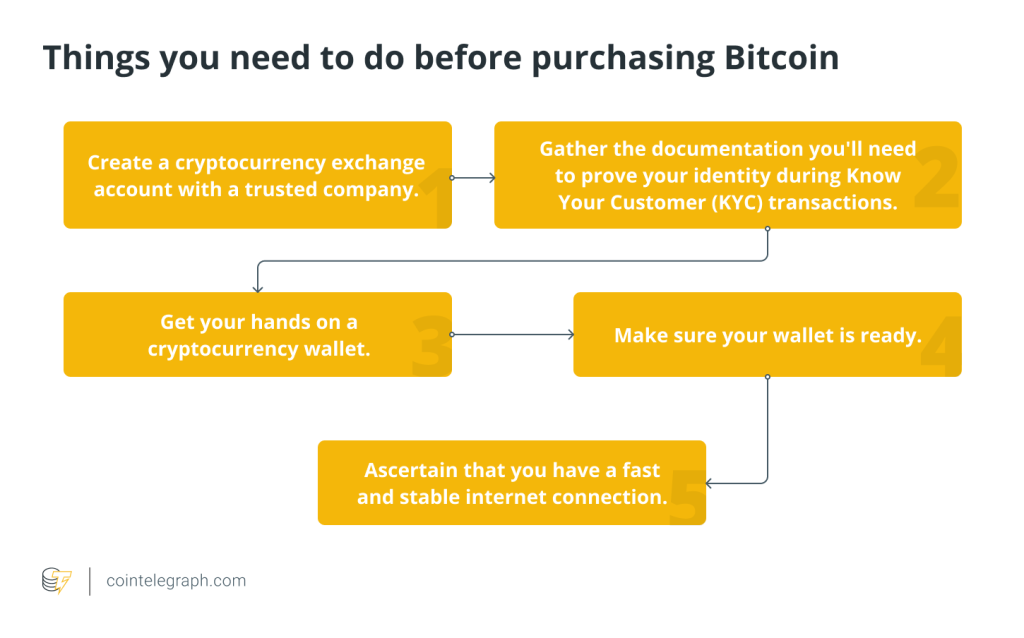

However, there are a few things you need to do before digging deeper into how to invest in Bitcoin. These are some of them:

In order to commit your funds for Bitcoin investment, please follow our guide here. Similarly, for cashing out your BTC holdings, please follow our guide here.

How anonymous is Bitcoin?

Bitcoin is frequently called “anonymous” since it may be sent and received without revealing any personally identifiable information. However, obtaining reasonable anonymity with BTC can be difficult and complete anonymity may be unattainable.

Sending and receiving Bitcoin is similar to writing anonymously. If an author’s pseudonym is ever linked to their identity, everything they've ever written under that name will be linked to them as well.

Your pseudonym is the address to which you receive Bitcoin in Bitcoin. Every transaction that involves the address is recorded in the blockchain at all times. Every transaction will be linked to you if your address is ever matched to your identity. Therefore, Bitcoin is pseudonymous rather than anonymous.

Advantages and disadvantages of Bitcoin

Advantages of Bitcoin

No government controls the Bitcoin network. Each player participating in the Bitcoin network automatically guarantees the protocol’s operation. Bitcoin users have significantly more control over their personal information and financial data than users of fiat currencies and other digital forms of payment such as credit cards, compared with traditional financial infrastructures. They also face fewer risks of identity theft than users of fiat currencies and other digital forms of payment such as credit cards.

When fraudsters gain access to enough information about a person's identity such as their name, current or previous addresses, or date of birth, they commit identity theft. The risk of identity theft while using crypto is low due to cryptographic private keys, which hide a user’s identity behind a publicly viewable Bitcoin wallet address.

Bitcoin’s network hash rate, which is a measure of the aggregate collective computer power involved in validating transactions on the Bitcoin blockchain at any given time, is continuously breaking records.

Thankfully, greater network security has been established as the Bitcoin blockchain becomes more resilient against the possibility of a 51% attack, guaranteeing that the blockchain ledger’s shared truth is protected, but the threat of a 51% attack is always possible. When one or more miners gain control of more than 50% of a network's mining power, computational power, or hash rate, a 51% percent attack occurs. If it succeeds, the miners in charge effectively control the network and some transactions on it.

A 51% attack would allow miners to prevent new transactions from being recorded, prohibit transactions from being validated or completed, change transaction ordering, restrict other miners from mining coins or tokens within the network and reverse transactions to double-spend coins.

A double-spend situation, for example, would allow miners to pay for something with cryptocurrency and then reverse the transaction later. It means miners keep anything they bought, as well as the cryptocurrency used in the transaction, thereby bilking the seller. As a blockchain grows in size, however, it becomes more difficult for rogue miners to attack it. On the other side, smaller networks may be more vulnerable to a block attack.

Disadvantages of Bitcoin

Governments may try to restrict, regulate, or outlaw the use and selling of Bitcoin, as some jurisdictions have previously done. Furthermore, the volatility of Bitcoin is always in the news, which is a crucial reason to avoid accepting Bitcoin as a form of payment for many traders since they are afraid of a price decline. Bitcoin is still being used to pay illegal operations and money laundering, unfortunately. On the other hand, secret agencies around the world are beefing up their cybersecurity and anti-crypto crime capabilities.

The irreversibility of Bitcoin transactions is not always a good thing. In the event of an attack, a botched transaction, or a fraudulent exchange of products, it can quickly become a huge issue.

Anything electronic must be reversible, according to a fundamental principle of modern finance. If Bitcoin is truly the internet applied to money, it should also feature a “back” button. It is only possible to prevent fraud without an undo/back button. However, fraud can be detected and minimized with an undo option upon realizing that something suspicious has happened and correcting it.

On the contrary, in the case of BTC theft, a burglar needs the private key to take a million dollars worth of Bitcoin from a corporation. As BTC balance transfers are irreversible, as there is no way to reclaim it if hackers steal Bitcoin. Also, the Bitcoin wallet’s password is unrecoverable — if a user forgets his password, the money in his wallet will be worthless.

The future of Bitcoin

The next ten years could be crucial for Bitcoin's development. Aside from financial revolutions, there are a few aspects of Bitcoin's environment to which investors should pay particular attention. At the moment, cryptocurrency is torn between becoming a store of value and a transactional medium.

Even though governments worldwide such as Japan have recognized it as a viable means of payment for goods, institutional investors are keen to join in on the action and profit from the volatility in its pricing.

However, issues with scaling and security have stopped both events from becoming a perfect medium of exchange. Also, concerns about security, custody and capital efficiency remain a challenge that needs to be addressed.

Since the industry is new and there is no user-friendly manual, do your own research and read articles such as: What is Cryptocurrency?, What is the Bitcoin blockchain?, How to mine Bitcoin in order to learn more.

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/3056/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/3056/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3056/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3056/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3056/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/3056/ […]

… [Trackback]

[…] Here you can find 82061 additional Information on that Topic: x.superex.com/academys/beginner/3056/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/3056/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3056/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3056/ […]

… [Trackback]

[…] Here you can find 8846 more Information on that Topic: x.superex.com/academys/beginner/3056/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/3056/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/3056/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/3056/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/3056/ […]