ICOs vs. STOs vs. IPOs in crypto: Key differences explained

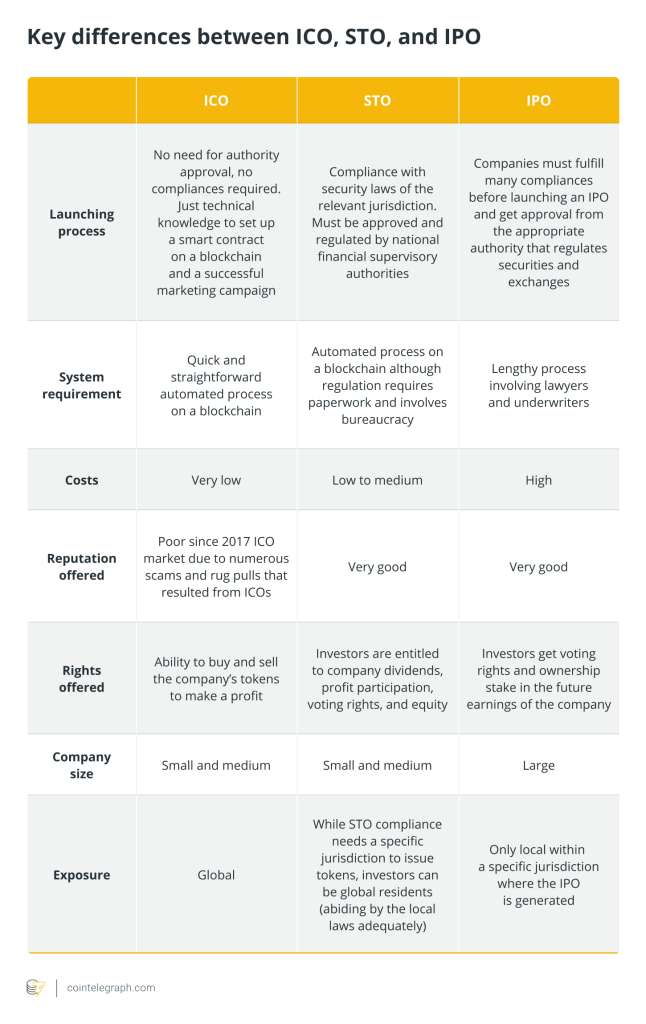

Initial coin offerings (ICOs), security token offerings (STOs), and initial public offerings (IPOs) are all types of fundraising that modern enterprises use to raise capital.

Whether a company chooses to sell blockchain-based digital assets through ICOs or STOs, or shares in traditional stock markets with an IPO, raising capital embodies one of the main objectives of startups, as it will likely determine the success or the failure of a project. Therefore, a business must take the necessary steps to secure adequate investments to help the company thrive.

If you simply would like to know more about the different types of fundraising or you’re founding a startup and expect a deeper dive into the matter, you’re in the right place.

We’ll look at the critical differences between the crypto offerings, the STO meaning in the current cryptocurrency context, the ICO crypto development and what favors, for example, an ICO vs. STO.

Introduction to fundraising

The fundraising concept was first introduced in the early 1900s and was mainly associated with money raised for charitable causes. Organizations used face-to-face fundraising, events and public relations (PR) campaigns as the main techniques to raise funds.

The first most successful campaign was organized by the well-known YMCA — Young Men's Christian Association, a non-profit organization that aims to help disadvantaged youth. The two fundraisers Frank Pierce and Charles Ward could collect an astounding $4 million for the New York City YMCA alone. They set a trend of creative fundraising campaigns through a sound advertising strategy and face-to-face methods, which determined the future of capital acquisition.

The advent of online social media campaigns and internet-induced accessible global communication has given a new perspective to funding and capital raising. The cryptocurrency space has opened other ways to raise capital in crowdfunding projects that use blockchain technology to function.

The first token sale was held in 2013 when the peer-to-peer (P2P) Mastercoin project raised the equivalent of around $500,000 dollars in newly-minted Mastercoins against the payment of Bitcoin. That was officially the first ICO, and the success of this fundraising campaign encouraged other projects to use the Bitcoin blockchain for P2P crowdfunding purposes.

In 2014, the Ethereum token sale raised 3,700 BTC in the first 12 hours, equal to approximately $2.3 million at the time. The funds raised were used to develop Ethereum into an operational blockchain independent from Bitcoin.

ICOs token sales skyrocketed in 2017 when lots of money started to circulate in the cryptocurrency market. However, we’ll discuss them in detail later in this article, as we first look at the instruments employed to raise money: cryptocurrency tokens and smart contracts.

What is a cryptocurrency token?

A crypto token is a virtual token or a cryptocurrency that resides on a blockchain. It represents a tradeable asset or a utility used for investment objectives such as in ICOs or economic purposes to exchange currencies like Bitcoin.

A crypto token suits ICOs and STOs because it is used by blockchain businesses to raise capital.

Tokens have a wide range of functions, from enabling decentralized exchanges to selling rare items as NFTs in blockchain-based marketplaces.

What is a smart contract?

Smart contracts are programs that contain digital agreements stored on a blockchain. They can be considered self-executing contracts that fulfill the terms of an agreement written into lines of code between a buyer and a seller or a contract creator and the recipient. They typically do not require an intermediary while providing traceable, transparent and irreversible transactions.

Smart contracts are the channel, the program that makes ICOs and STOs possible.

What is an initial coin offering?

An ICO in crypto is one of the most popular and efficient fundraising methods for blockchain startups.

The company that chooses an ICO will first publish a white paper, which is a document that highlights the purpose of the project and gives investors technical information about its concept. A white paper is essentially a roadmap for how the company plans to grow and succeed.

The business will then issue tokens — like coupons — to pay for future services. Instead of buying traditional equities like the ownership shares of a company, participants buy tokens to help the business raise capital. However, unlike IPOs, investors are not entitled to hold a stake in the company and participate in internal management decisions.

On the other hand, investors will be able to use the acquired cryptocurrency to contribute to the project’s ecosystem. They can buy or sell it to make profits without having to go through the arduous and regulation-intensive process of a traditional IPO. Due to the simple process, ICOs can be set up and submitted straightforwardly and are particularly suitable for small and medium-sized businesses.

This unregulated environment is at the root of the bad reputation that ICOs have built over the years. Between 2017 and 2018, over 2000 unique token sales raised above $10 billion. Such conditions favored the rise of exit scams and questionable business practices, contributing to criticism and negative attention over the cryptocurrency space and increased regulatory scrutiny.

Ethereum is the blockchain where most of the initial coin offerings take place. Its open smart contract protocol allows developers to easily create new blockchain-based derivative tokens and produce flexible built-in functions like automatic calculations of the funds received. In the Ethereum ecosystem, tokens are identified as ERC-20 tokens.

NEO is another successful ICO blockchain platform created in China in the aftermath of Ethereum’s popularity. Neo ICO smart contract feature is sometimes preferred to Ethereum since its design provides more scalability with as many as 10,000 transactions per second.

Additionally, the platform uses the more common programming languages of Java and C#, making it much easier for in-house specialists to launch a project on the Neo platform.

What is a security token offering?

In the wake of what happened with ICOs’ unregulated environment, STOs were created to provide higher protection and a more transparent fundraising vehicle to investors.

Security tokens are similar to traditional securities and are essentially the digital representation of ownership of assets and economic rights. They provide the same rights to profit participation, dividends and voting in important management decisions. Often, they give holders entitlement to a form of equity or ownership of a specific asset like real estate, trusts, LLC (limited liability company, a U.S.-specific type of private limited company), fine art and so forth.

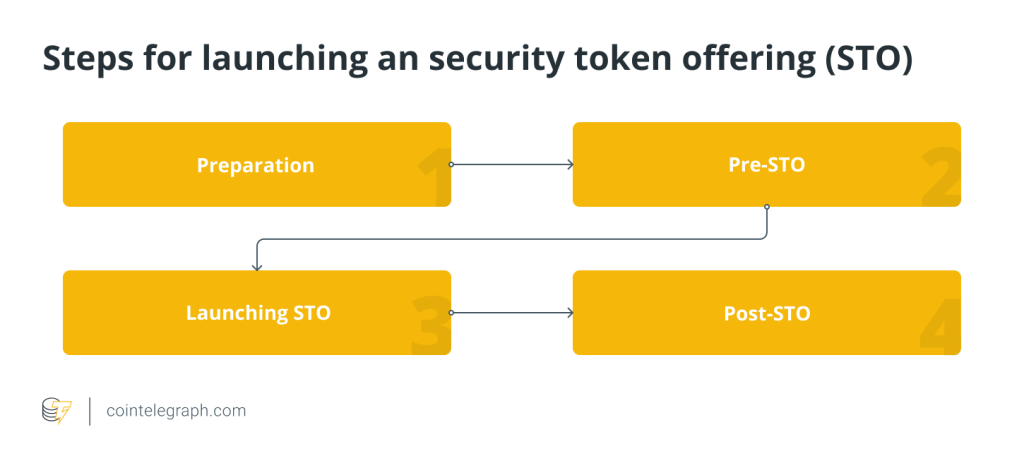

STOs’ purpose and concept are also described in a white paper, but require compliance with the security laws of the jurisdiction where they are issued and must be approved by national financial supervisory authorities.

The first company that launched an STO was the U.S.-based Praetorian Group, which registered the platform in March 2018 with the U.S. Security and Exchange Commission. The platform is listed as a crypto real-estate investment platform.

Although STOs have existed for a few years, the domain is still relatively young with only a tiny number of STOs fulfilled worldwide. For instance, Germany, Luxembourg and Estonia appeared to have the proper legal framework to approve them as a legitimate source of fundraising.

Submitting an STO and getting it approved is a speedy and cost-efficient process, as it can be automated with blockchain-based smart contracts on which the tokens are transacted. Blockchain protocols allow expensive intermediaries to be eliminated and time-consuming underwriting to be shortened.

This relatively new efficient fundraising method could be a game-changer in financial markets. Moreover, the low costs required to conduct an STO make it appetible to small and medium-sized companies.

STOs combine blockchain technology with the requirements of regulated securities markets to facilitate asset liquidity and finance accessibility. The blockchain environment promotes the securities regulatory objectives of disclosure, market integrity, fairness, innovation and efficiency through automation and smart contracts. In essence, investors buy regulated financial security in tokenized form as an investment contract similar to those of more conventional financial instruments.

They are issued on a regulated stock exchange similar to the traditional stock exchange and are usually referred to as a tokenized IPO (initial public offering).

They are viewed as the “everyman’s IPO,” considering everyone can invest in the ecosystem in a safe way because the relevant authority that regulates securities and exchanges like the U.S. Securities and Exchange Commission must have approved of the company that is fundraising through the STO.

Ethereum is the leading blockchain platform used for the issuance of STOs. Stellar and Polymath are also security token issuers as they provide a technically sound smart contract platform.

What is an initial public offering?

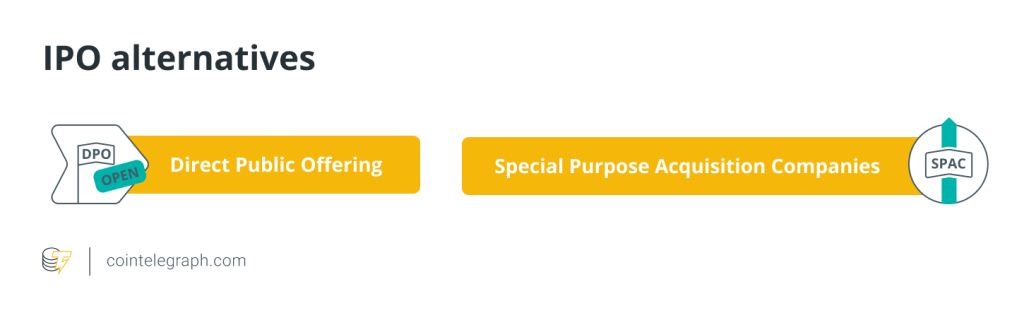

A traditional IPO occurs when a private-owned company sells its shares to institutional or retail investors. By listing them on stock exchanges like the New York Stock Exchange (NYSE), the company makes the shares available for purchase by the general public.

In the crypto space, the company sells digital assets of its business to the general public. Like with regular IPOs, the crypto company that decides to raise funds with an initial public offering will have to undergo severe public scrutiny and meet the wiry requirements of the authorities that oversee public companies. This process is required for the company to go from private to public.

Like for ICOs and STOs, IPOs are first defined in a white paper. They will then have to be supported by underwriters or investment banks that act as a broker between the issuing firm and the general public to assist the company in selling its initial set of coins. Underwriters and investment banks help determine the asset’s price, promote it to potential investors and submit the necessary documents to meet the legal requirements before launching the IPO.

Launching an IPO is a long and challenging process, hence crypto companies prefer to raise capital through ICOs or STOs. However, launching an IPO is a crucial moment for the growth of a significant company that sees its prestige and public interest raised as a result.

After the IPO, the company’s crypto assets trade on a crypto exchange. The Dutch East India Company was the first firm to offer crypto assets of its business to the public, and it is regarded as the first IPO in the crypto world.

Coinbase is the first cryptocurrency exchange platform that launched an initial public offering in the traditional stock market. In April 2021, it was listed on the Nasdaq Stock exchange. The IPO might have directly influenced the company’s value, with 56 million users registered in 2021, up from 43 million only a few months before going public.

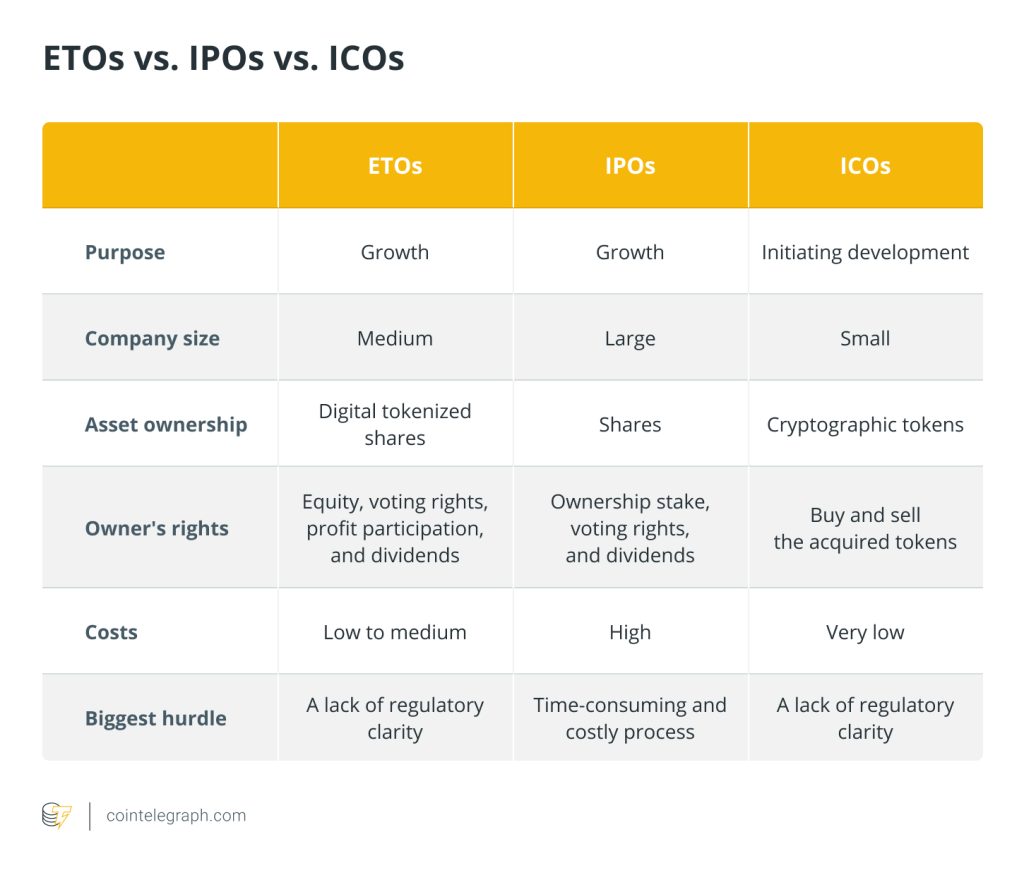

What is the difference between ICO and STO?

The main difference stands in the essence of the digital asset offered. In an ICO, digital assets are classified as utilities and can have an infinite issuance. Over the years, they have proven to be very speculative assets because their value arises from the perceived benefit buyers expect them to provide instead of actual worth.

ICOs have often been associated with pump and dump schemes, representing a big red flag to the regulator’s eye. On the other hand, security token offerings represent real securities like bonds or stocks and are tied to a more stable company.

In terms of legislation, there is also a significant difference. STOs fall under the securities legislation like traditional IPOs, while ICOs are placed under utilities, which denote a shadier and less transparent system. Consequently, STOs provide startups with additional security as tokens must be registered and inspected by the local security and exchange commission.

With STOs, every transaction is overseen by the relevant authority and although transactions and investment processes are longer, investors feel more protected and less inclined to fall prey to scams.

What is the difference between IPO and ICO?

Well-established companies raise funds using IPOs, whereas new young startups use ICOs for fundraising.

One of the main differences is what the investor receives in exchange for the funding. In the case of an IPO, the investor is entitled to equity (ownership of assets that may have debts or other liabilities attached to them) and voting power in the company.

In the case of an ICO, the investor does not hold company equity nor the right to vote in important internal decisions. The value of a coin is usually determined by the rights represented by the token and the progress of any underlying project.

ICOs occur at the launch of the blockchain-based company. In contrast, a private company decides to launch an IPO into a later stage once it has become a more robust business and already has a longstanding working product or service.

Regulation is another significant distinction between an ICO and an IPO. While an ICO is mainly self-regulated by automated and digital smart contracts, an IPO has to go through strict procedures, due diligence and compliances before being approved by the relevant local regulatory body.

The main benefit of an ICO over the IPO method is the eradication of intermediaries that typically make processes lengthy, inefficient and more costly.

Why choose an STO over an IPO?

While an STO and an IPO have the same objective of raising capital in return for security, they are distinct in the processes and the instruments used.

Blockchain technology offers the main benefit to STOs. With automated processes and the removal of intermediaries, STOs provide a more cost-effective and straightforward method of fundraising. On the other hand, IPOs require hiring intermediaries who must be remunerated, ultimately influencing the offering’s success or failure.

STOs quality also allows smaller and medium-sized companies to raise capital, which was unimaginable before the inception of crypto offerings. Furthermore, traditional trade markets are generally only open during working hours since they rely on human maintenance. On the other hand, blockchain and crypto markets are open 24 hours a day, seven days a week, resulting in higher liquidity and increased trade volume.

Both IPOs and STOs allow investors to obtain equity in a company along with dividends, liquidation and voting rights. However, the financial instruments that enable ownership of such things are different. In an IPO, the investor buys stocks representing the assets, while in an STO, the investor buys digital tokens.

Blockchain technology automated processes allow STOs to save considerably on the offering costs with a reduction of up to 40% mainly on intermediaries’ fees and flotation costs associated with IPOs.

Finally, the area coverage is different between an IPO and an STO. An STO is superior in terms of flexibility to an IPO since it gives corporations more certainty of fraud protection. The former is not bound to a single country, has a lower entry hurdle and provides investors with more transparent access to fundraising. Instead, IPOs typically operate only within the region where they are issued, and only local investors can participate in the process.

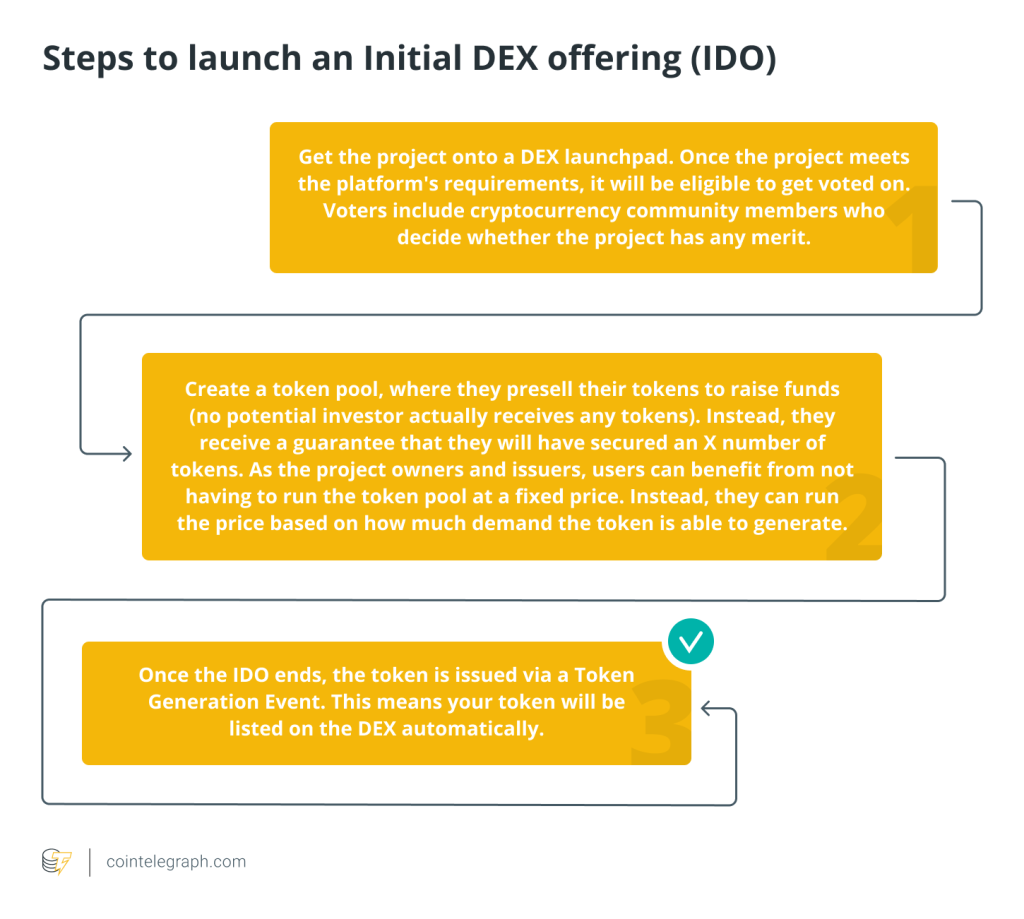

Launchpads in crypto

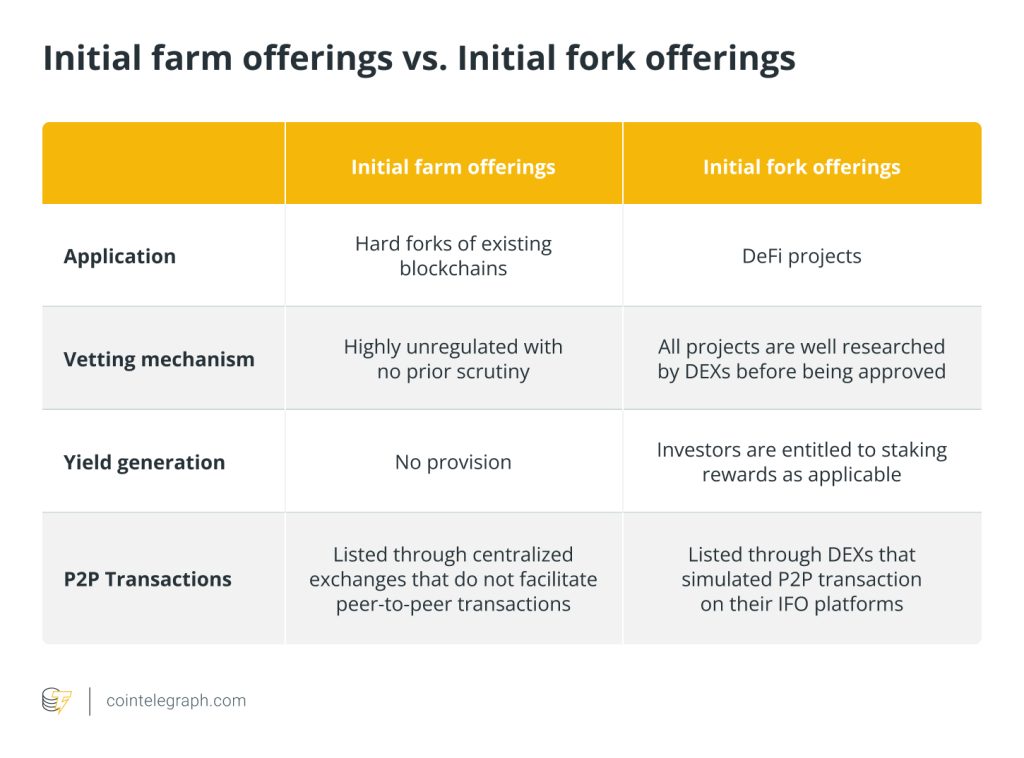

Crypto launchpads have transformed the way token sales are conducted, making it easier and safer for investors to access offerings. Although ICOs processes are more manageable and efficient than traditional public offerings, accessibility is still hard for the everyday retail investor.

The enormous volume of ICOs and information available makes the market confusing and unreliable to deal with. Also, crypto investments are often more profitable if the investor gets in early. Still, it’s almost impossible to individually assess which crypto project is worthwhile in allocating some funds before its launch. This was until the launchpad model was created.

Launchpads are crypto platforms that use specific vetting schemes to help filter out scams and rug pulls and allow investors to identify early-stage promising crypto projects, decide whether they are worth investing in and participate in the token presale process.

Crypto launchpads can provide highly successful token issuance events when they are well-organized and built with teams and investors in mind. Many projects are usually oversubscribed, and token sales can sell out in minutes or sometimes seconds. This demonstrates a definite demand for this market by the investors.

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Here you can find 39995 additional Information to that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Here you can find 34147 more Information on that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Here you can find 1820 additional Information on that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] There you can find 38829 additional Information on that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] There you can find 23473 more Information to that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] There you will find 85777 additional Info to that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Here you will find 4183 additional Info to that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] There you can find 80393 additional Info to that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] There you will find 59857 more Information to that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] There you will find 97636 more Info on that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] There you will find 46676 more Info to that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] There you can find 20186 more Info on that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2742/ […]

… [Trackback]

[…] There you can find 79859 more Information on that Topic: x.superex.com/academys/beginner/2742/ […]