Architectural components of the Ethereum blockchain

The Ethereum blockchain is a decentralized and open-source blockchain platform that supports smart contracts and decentralized applications (DApps). Its architecture is made up of several key components that interact to offer its functionality.

Unlike its predecessor, the Bitcoin blockchain, which primarily facilitates peer-to-peer digital currency transactions, Ethereum extends its capabilities beyond just financial transactions. It can support various types of applications and platforms, including decentralized exchanges (DEXs) and decentralized finance (DeFi) products.

An overview of the Ethereum blockchain and its architectural components

The Ethereum network has a distinct blockchain that operates independently from other blockchains, such as Bitcoin. The protocol has its own cryptocurrency, called Ether (ETH).

As mentioned, the Ethereum network supports the building of DApps, which are a distinct class of applications built upon the Ethereum network. Unlike conventional applications, they function within the framework of a blockchain.

The applications operate autonomously without any central authority’s control or influence. A noteworthy subset of DApps are DeFi protocols, which utilize the capabilities of smart contracts to streamline and automate different forms of financial transactions, including lending, borrowing and trading.

Ether

ETH is the Ethereum blockchain’s native coin. ETH has several uses in the Ethereum ecosystem. One of them is fee payment for activities on the Ethereum blockchain. These types of payments are generally referred to as gas fees. Gas fees are essentially the transaction costs associated with using the Ethereum network. They’re paid in ETH tokens to compensate the network’s validators for participating in the processing and validating of transactions on the network.

Each ETH coin comprises smaller units; the smallest ETH unit is called a wei. One wei is 0.000000001 ETH (10^-9 ETH).

Another ETH denomination is gwei. One gwei is equal to 1 billionth of an ETH. Gwei is a more convenient unit to use when talking about gas fees. For example, if the gas fee is 100 gwei, it costs 0.0000001 ETH to execute a transaction.

Gas fees and transactions

Ethereum gas fees have historically posed a significant challenge for users. In 2020, network fees surged to unprecedented levels, peaking at more than 500 gwei. This translated to basic transactions incurring costs exceeding $50 per transaction. Such exorbitant fees rendered the Ethereum network prohibitive and costly across many applications.

Subsequently, the Ethereum community responded proactively, and in 2021, a notable development emerged with the introduction of the EIP-1559 upgrade by the Ethereum Foundation. The London hard fork upgrade curbed the exorbitant gas fees that had hitherto burdened users. EIP-1559 introduced a base fee, making gas costs less predictable, but decreasing overbidding. Reducing high gas prices and enhancing network reliability enhanced the user experience and made Ethereum more accessible and user-friendly.

Fast forward to the present day, and the average network gas fees stand at a modest 23.91 gwei at the time of writing. This equates to $0.809 for the execution of a direct transaction.

Moreover, when sending ETH from one wallet to another, some information is visible on the blockchain, such as the sender’s ETH address, the recipient’s ETH address, the amount of ETH sent and the gas price paid.

The London upgrade and beyond

The Ethereum network underwent a hard fork called London in 2021 that changed its fee structure, among other alterations. Instead of a first-price auction fee paid to miners with each transaction, as in the past, transactions after the London fork included a base fee, a tip or priority fee, and a max fee.

Base fee: The base fee is the bare minimum amount of ETH that must be paid to process a transaction on the Ethereum network. It is calculated based on the transaction’s complexity and the current network congestion level.

The complexity of a transaction is determined by the number of steps involved in executing the transaction.

The network congestion is determined based on the demand for blockspace at any given time. The more congested the network, the higher the base fee.

Priority fee (tips): The priority fee is a premium that users can pay to expedite their transactions on the Ethereum network. It is in addition to the base fee, which is the minimum amount of ETH that must be paid to process a transaction.

The priority fee is calculated based on the current level of network congestion. The more congested the network, the higher the priority fee will be for processing a transaction quickly.

The priority fee is a way for users to have more control over the speed of their transactions. If a user is willing to pay a higher priority fee, that transaction will be processed sooner.

Max fee: MaxFeePerGas is an optional parameter that users can set when sending a transaction on the Ethereum network. It specifies the maximum amount of ETH the user is willing to pay as network transaction costs. By setting a higher MaxFeePerGas, users can increase the likelihood of their transactions being processed more swiftly. However, it is important to note that using a high MaxFeePerGas is also likely to raise the overall cost of the transaction. Typically, MaxFeePerGas exceeds the sum of the base fee and the priority fee.

The difference between the maximum fee and the sum of the base fee and priority fee is reimbursed to the transaction sender once the transaction is complete.

The fork also introduced the ability for Ethereum blocks to expand and contract based on traffic, with the base fee adjusting accordingly. Furthermore, it enabled the Ethereum network to prevent bad actors from spamming it by charging a gas fee for each computation performed.

Nodes and clients

Nodes

A blockchain node is a device or computer that participates in the blockchain network by maintaining a copy of the blockchain ledger and verifying transactions. A trio of distinct node types exists on the Ethereum blockchain: light, full and archive nodes, depending on the node runner’s goals, computing power and hardware storage availability.

Light nodes help verify network transactions by checking the block headers. However, they do not participate in blockchain consensus processes.

Full nodes, on the other hand, carry network data. They store the blockchain’s vast trove of information, including all transactions and blocks. In addition, full nodes play an integral role in verifying the authenticity of transactions and blocks, which helps keep the network secure and decentralized. When it comes to archive nodes, they store the entire history of the Ethereum blockchain, comprising all previous blocks filled with transactions and data.

Clients

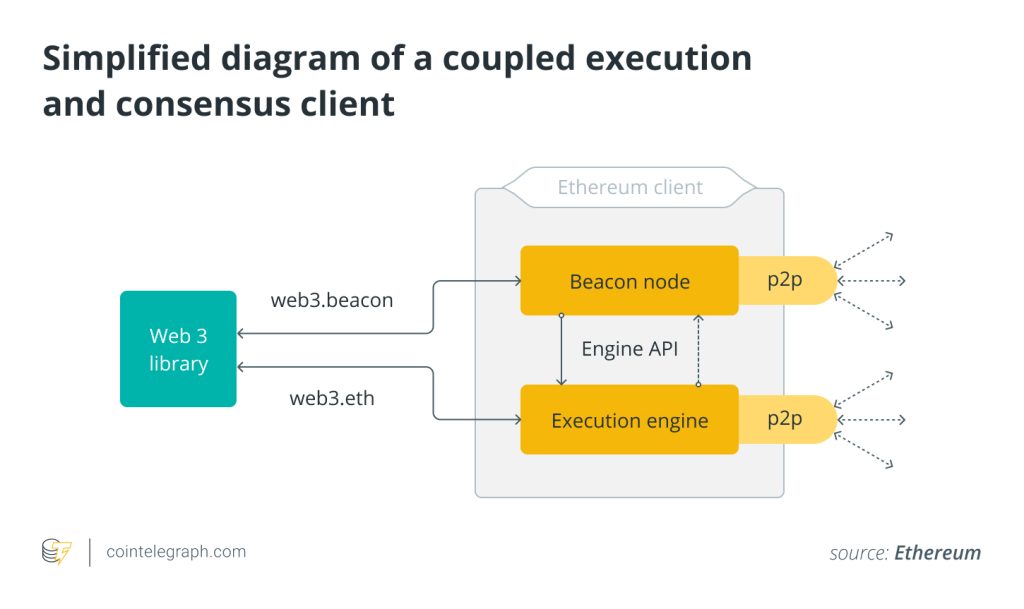

A client within the Ethereum ecosystem serves as a crucial component responsible for validating data according to the protocol’s rules, thus contributing to the overall security of the network. The two clients that a node normally runs are one for execution and the other for consensus.

The execution client, or execution engine, processes new network transactions in the Ethereum Virtual Machine (EVM) and keeps track of the data and state. Additionally, the consensus client, also known as the Beacon Node, employs the proof-of-stake consensus method to guarantee network-wide consensus based on verified information from the execution client.

A “validator” is an optional enhancement to the consensus client, enabling nodes to participate in network security. These clients collaborate to track the Ethereum chain’s newest state and allow user interactions.

Accounts

Accounts on the Ethereum blockchain serve many purposes and come in two primary forms. The first is called an externally-owned account (EOA). This type of account allows anyone to store, receive and send ETH or tokens built on the Ethereum blockchain, such as ERC-20 tokens.

An EOA account is controlled by a private key. This means that whoever possesses the private key can access the account and its assets. EOAs are the most popular type of account on the Ethereum blockchain.

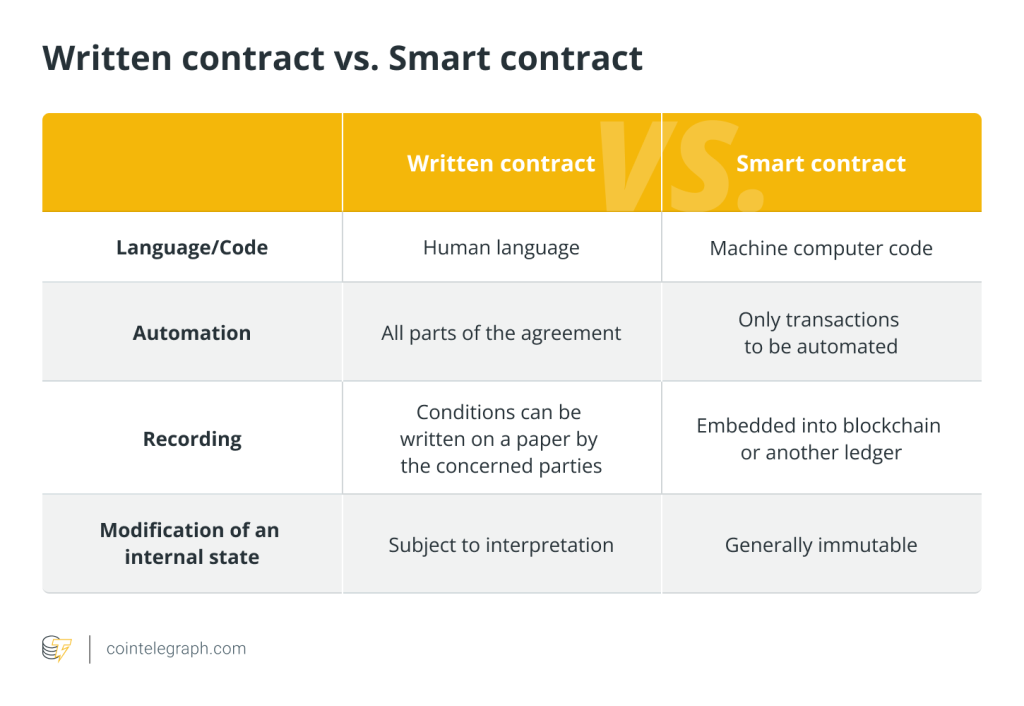

The second type of account on the Ethereum blockchain is a contract account. Ethereum contract accounts are controlled by smart contracts. A smart contract is a codified agreement imprinted on a distributed ledger that initiates automatically when predetermined conditions are met.

For example, a smart contract might be programmed to send a certain amount of ETH to a company as payment on the third of every month, using time as a trigger. In contrast to EOAs, contract accounts cost ETH to set up.

One key distinction between the two types of accounts is that EOA accounts can interact with each other and with smart contracts. Contract accounts can also communicate with other contracts and EOAs but cannot function without smart contracts.

Ethereum Virtual Machine

The Ethereum Virtual Machine is a computation engine that functions as a decentralized computer on the Ethereum blockchain. The EVM serves as the habitat for Ethereum accounts and smart contracts. At any specific block in the blockchain, there exists a singular “canonical” state, and the EVM establishes the regulations governing the computation of a new, valid state as the blockchain progresses from one block to another.

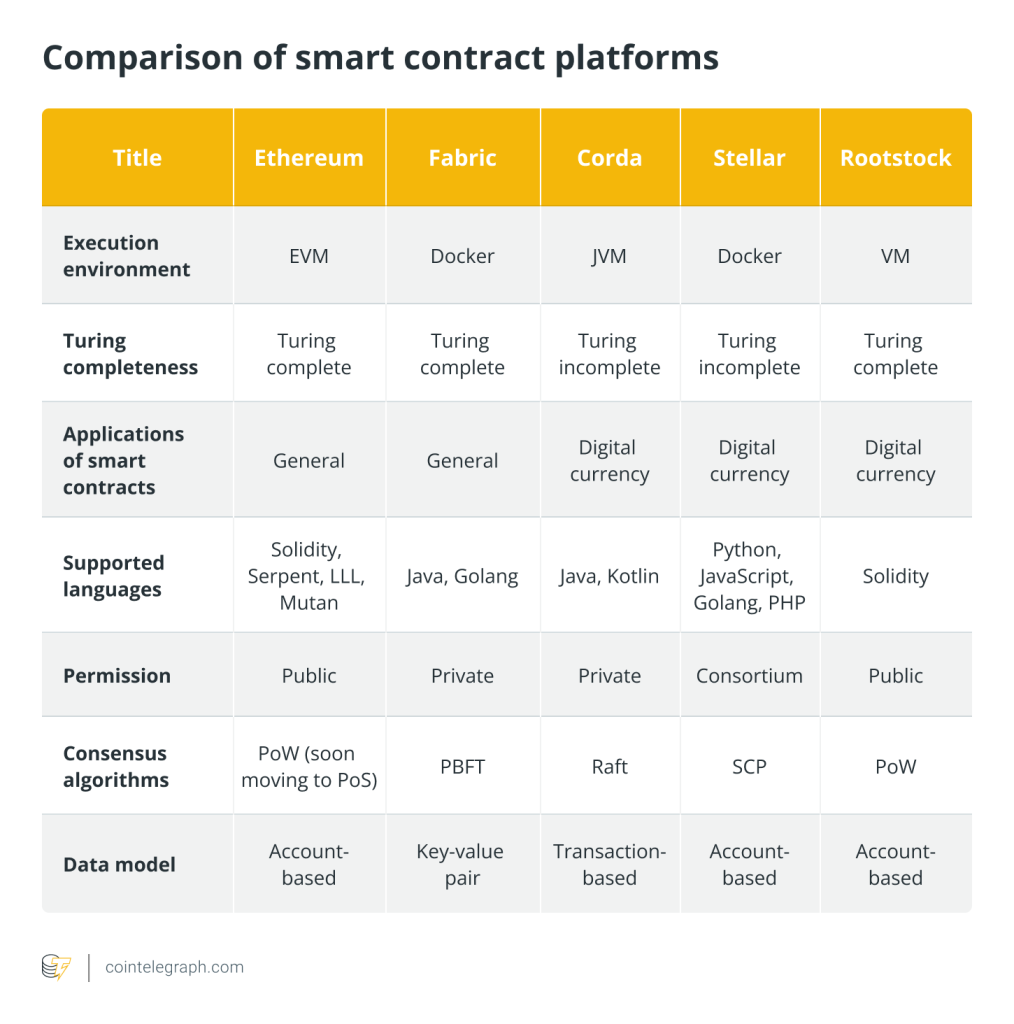

The EVM is Turing-complete, meaning it can run any program if there is enough gas to cover the computation cost. On the Ethereum platform, a wide variety of applications can be created because of its flexibility.

Furthermore, the deterministic execution of smart contracts is guaranteed by the EVM, which means that for a given input and state, the result will always be the same. For the Ethereum network to reach consensus, this characteristic is essential.

Smart contracts

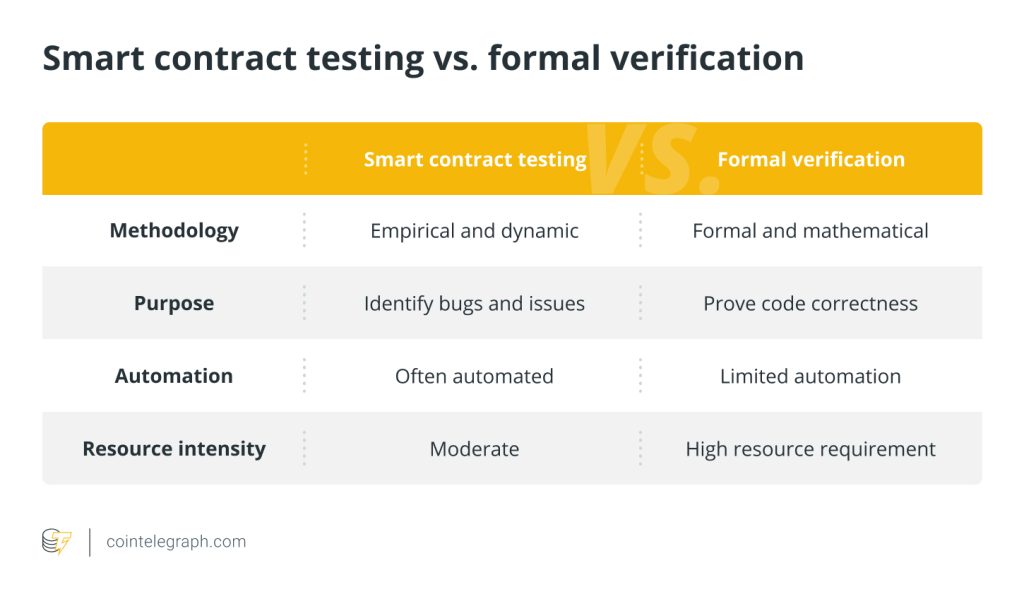

Smart contracts are self-executing agreements embedded on the blockchain, comprising lines of code that activate under specific conditions. They serve a multitude of purposes, and they range from executing transactions to generating digital assets.

Smart contracts are processed on the EVM, and deploying a smart contract on the Ethereum blockchain requires the user to spend ETH as gas fees to interact with the Ethereum blockchain.

Once deployed, smart contracts are immutable and final, and transactions sent to smart contracts are also irreversible. Smart contracts offer a plethora of advantages to the crypto world. They have transformed how transactions and agreements are executed, adding immense value to the blockchain ecosystem by boosting speed, automation, security, trust and transparency.

Ethereum blocks and consensus

Ethereum uses a proof-of-stake (PoS) consensus mechanism in which validators are randomly selected to create blocks and earn rewards. The Beacon Chain introduced proof-of-stake to Ethereum, enhancing security and allowing validators to earn additional ETH in the process.

Participants stake their ETH, locking them up as collateral to participate in the consensus mechanism. The more ETH a participant stakes, the higher their chances of being chosen to forge a block.

The Ethereum consensus system is designed to be more environmentally friendly and secure than the previous proof-of-work (PoW) system. In PoW, miners compete to solve complex mathematical puzzles to create blocks. This requires a significant amount of energy and computing power. PoS, on the other hand, does not require miners to compete. Instead, validators are selected based on the amount of ETH they have staked.

Unlike PoW, PoS offers the advantage of community-driven resistance against a 51% attack. Validators can disregard the attacker’s fork and keep developing the minority chain, encouraging apps, exchanges and pools to do the same. They can also consider destroying the staked assets and expelling the attacker from the network, creating strong economic deterrents against a 51% assault.

The role of the development community in shaping Ethereum’s future

In the context of Ethereum, the term “development community” refers to a broad set of programmers, enthusiasts and developers who work to continuously enhance and maintain the Ethereum blockchain and its surrounding ecosystem.

This community is responsible for writing and reviewing code, suggesting and carrying out network upgrades (hard forks), developing and improving Ethereum standards (such as ERC-20 for tokens), and building DApps and tools that work on the Ethereum platform. The development community is crucial in determining Ethereum’s future by addressing scalability, security and usability issues.

The developer community also aids the development of blockchain interoperability solutions. They actively participate by developing and using technologies like wrapped tokens, enabling one blockchain’s assets to be represented on another and promoting seamless cross-chain compatibility. Additionally, developers create cross-chain bridges to connect several blockchain ecosystems, enabling the transfer of data and assets.

The developer community will likely advance innovation in interoperability in the future as blockchain technology develops further. They will likely refine existing protocols and develop new ones, making it even easier for blockchains like Ethereum to interact with diverse networks, promoting wider adoption and utility across the digital environment and improving the utility of blockchain ecosystems.

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Here you will find 25536 more Information on that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] There you will find 24592 additional Information on that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] There you will find 70642 more Info to that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Here you can find 32621 additional Info to that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Here you will find 64767 additional Information on that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] There you can find 83048 additional Information on that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2644/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2644/ […]