Centralized vs. decentralized crypto exchanges

What is a centralized crypto exchange?

There are various types of cryptocurrency exchanges, but the most popular among regular users are centralized exchanges. This is because they are the main avenue for buying cryptocurrencies, especially for first-time crypto investors. What exactly is a centralized crypto exchange?

A centralized cryptocurrency exchange is a digital currency trading platform that is controlled by a central entity that acts as an intermediary between cryptocurrency buyers and sellers.

How does a centralized crypto exchange work? A centralized exchange (CEX) stores digital assets on behalf of clients and facilitates crypto trading mechanics while determining the trading terms and conditions.

Key features of a centralized crypto exchange

Centralized exchanges share some unique features, one of which is that they hold the private keys to their clients’ wallets, a critical component of cryptocurrency transfers.

They also usually require platform users to undergo a Know Your Customer (KYC) process, usually to comply with regulatory requirements that have been put in place to verify user identities and help curb illicit activities, such as money laundering and terrorist financing.

The steps involve completing identity information, submitting identity verification documents and waiting for the verification of the KYC documents. Typically, users are granted permission to fund their accounts and commence trading once these steps are fulfilled.

That being said, centralized exchanges rely heavily on order book matching technology to facilitate cryptocurrency trading. The order book systems help to identify matches between buyer and seller orders to facilitate trades. Many centralized exchanges also utilize the services of market makers to provide liquidity for listed cryptocurrencies to ensure competitive spreads.

Centralized exchange examples include Binance, Coinbase and Kraken.

Advantages of centralized crypto exchanges

Centralized exchanges offer a range of benefits to their users, one of which is their user-friendly interface. These platforms are usually designed with simplicity in mind, allowing both novice and advanced users to navigate, deposit and withdraw their funds effortlessly.

Moreover, established centralized exchanges usually support a wider range of cryptocurrencies for trading than decentralized ones. Their extensive array of options is a boon for users who seek to diversify their investment portfolios.

Another benefit is that when it comes to liquidity, they have higher amounts compared to decentralized exchanges (DEXs). Liquidity refers to the ease with which a user can purchase or sell an asset without significantly impacting its prevailing market value and is a crucial factor for traders who wish to carry out fast transactions at low volatility. Regular market forces dictate that the more liquid an asset is, the easier it is for it to be exchanged without impinging on its value.

The main reason why centralized exchanges have higher liquidity is their access to a more extensive pool of buyers and sellers. In addition, access to regulated market makers contributes to higher liquidity. Moreover, some CEXs support the trading of asset derivatives, such as collateralized debt obligation, options and futures, and the additional product offerings tend to have higher liquidity.

Another major pro is that a huge number of centralized crypto exchanges are owned by regulated entities and are, therefore, subject to rigorous regulatory oversight. This is a vital element that appeals to institutional investors that require a degree of regulatory conformity to deal with cryptocurrencies. This factor also appeals to professional traders and investors.

Disadvantages of centralized crypto exchanges

Centralized exchanges are not without significant drawbacks. One major disadvantage of using these platforms is that users have no control over their crypto wallet keys. This means that they lack direct access to their assets, and this can lead to significant losses, for example, in the event an unregulated exchange abruptly shuts down.

The other drawback is security issues. Over the years, centralized exchanges have been the targets of high-profile hacks that have resulted in the loss of hundreds of millions of dollars worth of cryptocurrencies.

Many of the hack schemes have targeted central authorities that are deemed to be a likely point of failure. Their centralized control also makes them susceptible to rug pulls, causing investors to lose money.

Another drawback is that many centralized exchanges are controlled by regulated entities that are, in turn, subject to the oversight of regulatory authorities. The regulatory authorities usually have the power to impose stringent restrictions, such as new licensing requirements and compliance regulations on the platforms, and this can sometimes limit their ability to support some tokens or serve users in certain jurisdictions.

Centralized exchanges also have a downside when it comes to service delivery. Since they are designed for maximum profitability, this aspect can sometimes lead to conflicts of interest between the exchange owners and users. Some centralized exchanges may resort to unethical practices, such as market data manipulation, to increase their profits at the expense of their users, which can result in a negative user experience.

What is a decentralized crypto exchange?

A decentralized cryptocurrency exchange is an exchange that is built atop a decentralized, noncustodial blockchain system that primarily supports direct peer-to-peer transactions.

Key features of a decentralized crypto exchange

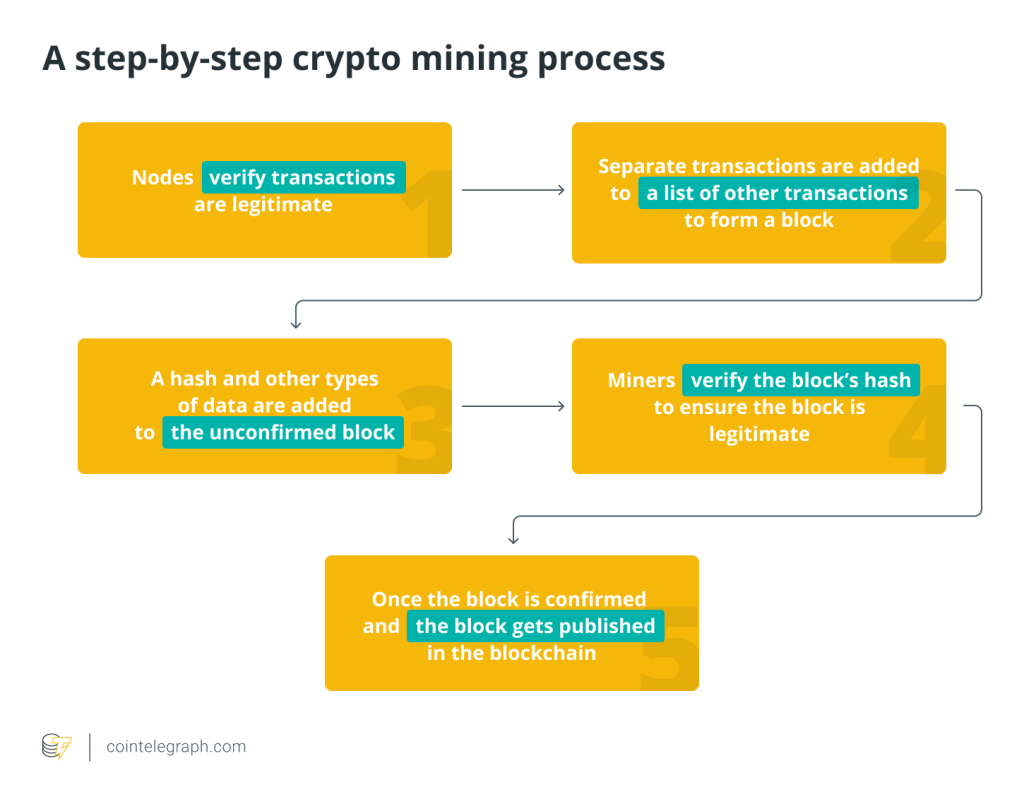

How does a decentralized crypto exchange work? These types of exchanges are designed to support peer-to-peer trading between cryptocurrency users, with the processes being controlled by self-executing blockchain-based applications known as smart contracts.

This approach eliminates the need for intermediaries. Furthermore, decentralized exchanges do not require users to complete a KYC process. This enables them to trade anonymously.

How do DEXs work when it comes to private keys? Decentralized exchanges enable users to maintain autonomy over their private keys, and therefore, they are solely responsible for the security of their funds.

Decentralized exchange examples include PancakeSwap, Uniswap, dYdX and Bisq.

Advantages of decentralized crypto exchanges

DEXs provide a range of benefits to users, and one of them is that, unlike centralized exchanges, they have a strong resilience to censorship as they do not have KYC requirements. As such, they are preferred by users looking to trade anonymously.

The lack of KYC requirements also allows them to cater to unbanked users who are unable to access traditional banking services, especially those without proper documentation.

Decentralized finance (DeFi) platforms, which are particularly designed to provide blockchain-based financial services, allow users to lend and borrow funds through a peer-to-peer system. Lending pools controlled by smart contracts enable users to lend out their funds and earn interest. DeFi users can also earn passive income through DeFi staking.

DeFi staking entails locking cryptocurrency assets in a DeFi network to validate transactions on proof-of-stake (PoS) systems. Users who stake their assets earn staking rewards. Another advantage of decentralized exchanges is that they have lower transaction fees when compared to centralized exchanges.

Because decentralized exchanges enable direct transactions between buyers and sellers and operate without an intermediary, they have lower transaction fees compared to centralized exchanges.

Disadvantages of decentralized crypto exchange

Decentralized exchanges have several disadvantages, and one of them is that they often suffer from lower liquidity levels when compared to centralized exchanges due to their typically smaller user base and trading volumes. This dearth can sometimes cause significant asset price deviations from the prevailing market rates, resulting in unfavorable trading outcomes for buyers and sellers.

The other disadvantage, when compared to centralized exchanges, is that they are more technical in nature and require a degree of familiarity with blockchain technology to use them. Users, for example, have to use compatible wallets to trade on the platforms and have to manage their private keys.

Another technical aspect is that users have to purchase native platform tokens to pay for gas fees. To acquire native tokens, users usually have to purchase specific cryptocurrencies, in most cases from CEXs, that can then be used to buy native tokens on decentralized platforms.

These steps, which can be challenging at times, may result in asset losses due to errors, particularly for novice traders and investors. That said, drawbacks arising from a lack of regulation also negatively impact decentralized exchanges. Decentralized exchanges function through a decentralized model and are thus exempt from the same regulatory limits that are imposed on centralized exchanges. The latter are mandated to adhere to an array of regulatory obligations, such as Anti-Money Laundering (AML) and KYC protocols to curtail illicit activities.

The absence of such stringent compliance standards makes them more vulnerable to illegal activities, such as money laundering. As such, regulated companies that are looking to invest in cryptocurrencies are keen to steer away from them.

Another DEX disadvantage is that these types of platforms often lack customer support services. This problem can pose significant challenges for users who need assistance.

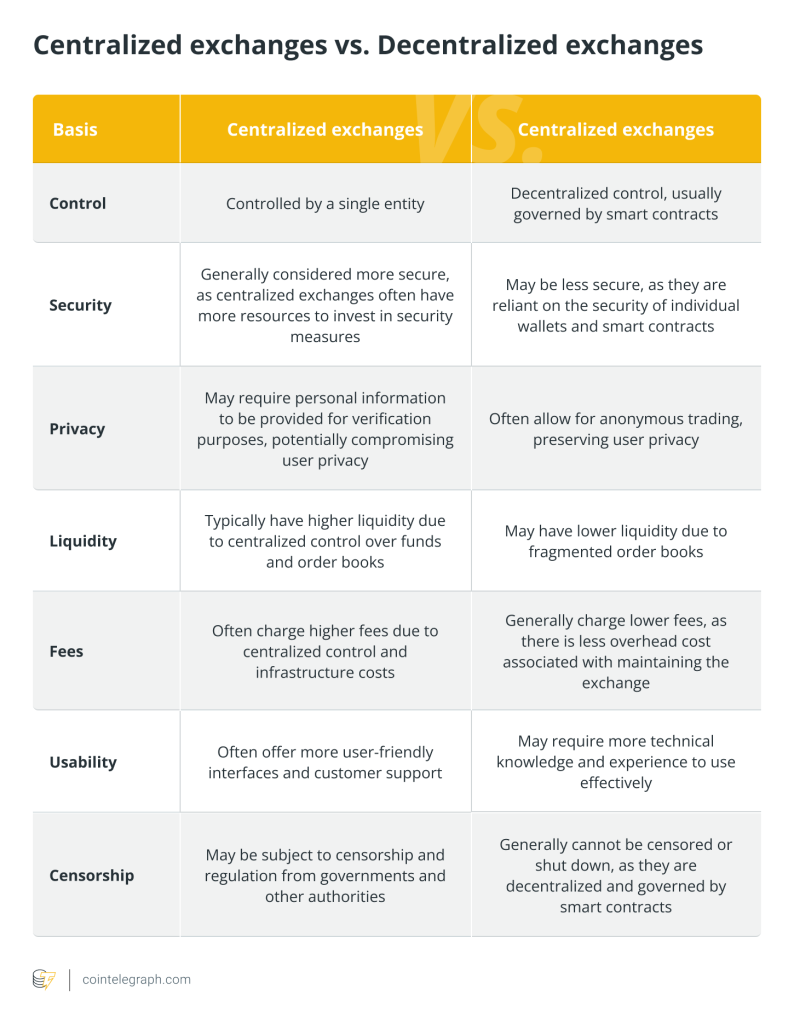

Centralized vs. Decentralized exchanges

Centralized exchanges have been more popular and have been around for longer than decentralized exchanges. However, decentralized exchanges have gained popularity in recent years due to their advantages in terms of privacy, security, and control over funds.

Here are some general differences between the two types of crypto exchanges: However, this might not be necessarily true for all centralized and decentralized exchanges.

The future of crypto exchanges

The future of cryptocurrency exchanges holds immense potential and is poised to undergo significant advancements driven by the increasing mainstream adoption of cryptocurrencies and the continuous evolution of the cryptocurrency landscape.

Governments and regulatory agencies worldwide are also starting to take steps to establish regulations governing cryptocurrencies and exchanges, and this will undoubtedly influence how crypto exchanges work. The regulatory measures are likely to boost investor confidence, facilitate integration with traditional financial institutions, and create a conducive market environment that enhances platform security and transparency.

Technological advancements will also play a pivotal role in shaping the future of crypto exchanges moving forward by enhancing their usability and efficiency. These advancements are expected to refine the overall user experience, streamline transaction processes, and improve the operational effectiveness of exchanges.

That said, crypto exchanges are likely to continue facing persistent challenges that have plagued the industry, which include adverse regulations, market manipulation and security concerns. Efforts to combat these challenges will be crucial for the sustainable growth and long-term success of crypto exchanges.

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] There you can find 5601 more Info on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Here you can find 74053 more Information on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Here you can find 47519 more Info to that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2565/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2565/ […]