Initial Game Offering: A beginner's guide on launching an IGO

What is GameFi?

An initial game offering (IGO) is a crowdfunding approach for video games. IGOs lower the barrier to entry for participating retail investors and grants them the opportunity to secure in-game assets and tokens before they are made available to the public.

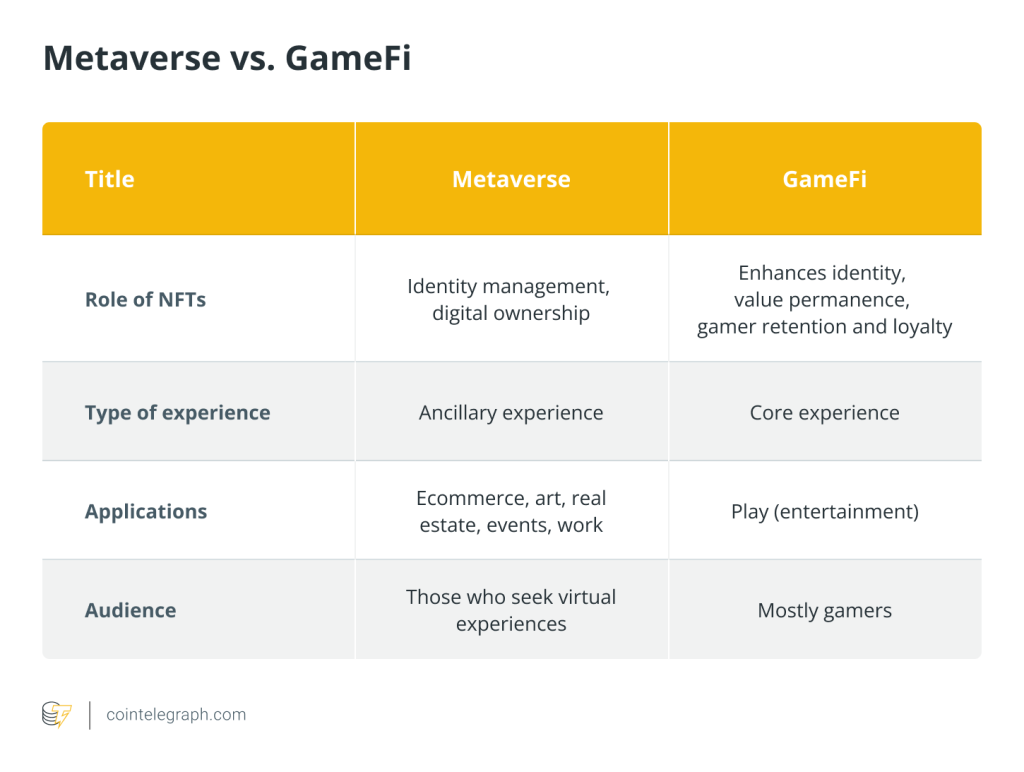

GameFi combines gaming with elements of decentralized finance (DeFi). The term encompasses both the projects and the play-to-earn games that make up the crypto gaming ecosystem. GameFi projects create a virtual environment where players earn in-game tokens by fulfilling certain tasks in blockchain-based games.

The games' native tokens are full-fledged cryptocurrencies in their own right. They’re not just in-game currency that holds no value in the real marketplace. Players earn these cryptocurrency tokens by completing in-game quests, among other tasks. The tokens can then be traded on a centralized exchange or a decentralized crypto exchange (DEX).

DeFi is built into the core of all GameFi projects. Blockchain gaming projects often incorporate DeFi components into the gameplay, itself. Features like token swapping, yield farming, staking, and mining are commonplace in the GameFi ecosystem. A portion of the overall token supply for the games is often set aside in a treasury to serve this exact purpose.

What is an IGO?

As mentioned, an IGO is an approach used by blockchain game teams to crowdfund an early-stage game. In return, early investors may receive lucrative in-game assets and tokens at a considerable discount before the public sale.

IGOs differ from initial coin offerings (ICOs) in that they focus primarily on the gaming industry. By offering their gaming projects through an IGO, developers can request funding from their audience directly. The growing interest in this type of launchpad has encouraged tremendous growth in the blockchain gaming space.

Crypto gaming projects have experienced a rapid rise in revenue. Some established blockchain games have received multimillion-dollar valuations. Developers love the low barrier to entry and the financial benefits conferred, and continue to up the ante on the quality of blockchain gaming projects they release.

Each game outdoes the last, improving gameplay and functionality with every iteration. According to research by DappRadar, blockchain games currently account for 52% of all decentralized app activity.

In 2021, blockchain-based games received $4 billion in cumulative funding. The research also revealed that crypto gaming projects received $1.1 billion in funding in January 2022. Top-tier GameFi projects like Axie Infinity (AXS), Aavegotchi (GHST), and CryptoBlades (SKILL) boast thousands of active users per day.

Based on this data, blockchain games being increasingly announced and launched via IGOs is not surprising. The premise behind an IGO is simple. Investors and potential players are allowed to buy into blockchain gaming projects before the game’s official release.

Although an IGO is typically purposed for early-stage funding, certain IGOs are reserved for games that are already under development. Others feature only the initial concept of a game, which is a long way from project completion.

A major benefit conferred to IGOs is that the project is open to all investors. A gaming startup no longer has to convince venture capitalists or approach a small group of high net worth individuals for funding. Instead, the project can appeal directly to its target audience through an IGO. If successful, they can secure the financial support that will see the project to completion.

How does an IGO work?

IGOs are similar to ICOs in that they are both vehicles for raising capital for new projects. IGO participants buy-in and receive early access to game assets and in-game benefits for supporting the game’s early stage of development. The participants may also receive the tokens designed for the game ahead of its public release.

Assets offered during an IGO range from characters to skins, weapons, accessories and mystery boxes. These assets often live on the blockchain as NFTs. Some of the assets offered via IGOs are required to access or play the game.

IGOs in NFTs

As with any other video game, players can earn in-game tokens, and receive power-ups and special items. With blockchain games, gamers are rewarded for their investment in the gameplay with tokens that can be traded directly on a cryptocurrency exchange. Nonfungible tokens (NFTs) provide established and up-and-coming blockchain gaming projects with considerable financial value.

NFTs help keep track of in-game assets. Digital items like weapons and skins are saved as NFTs, with their information permanently printed on the blockchain. GameFi NFTs give players real ownership of in-game items. Every asset won, bought or generated in-game is registered on the blockchain as an NFT.

Storing them as NFTs prevents the assets from being modified by an outside party. These assets are valuable to the game, and like any other NFT, may be bought or exchanged on an external marketplace.

Both the GameFi project’s in-game tokens and its NFTs can be traded on a DEX. Players can then swap their in-game currency and assets for established cryptocurrencies like Ethereum (ETH) or Bitcoin (BTC).

GameFi tokens can also be swapped for stablecoins. Alternatively, a player may choose to trade a token for fiat currency. Either way, the money earned in-game is now theirs to trade, and is not simply an asset tied to the video game.

Tokens have always played a part in video games that feature in-game marketplaces. What GameFi changes is the ease with which these assets can be legally and quickly converted into cash.

Players earn these tokens in-game and use them to purchase new assets like weapons, outfits or potions within the game. GameFi project tokens can be sold outside the game at a moment’s notice.

What is an IGO launchpad?

Launchpads allow creative fundraising projects and investors to interact. An IGO launchpad is a platform that hosts a number of early-stage blockchain gaming projects. Investors purchase the token native to the IGO launchpad and use it to fund contributions to the chosen IGOs.

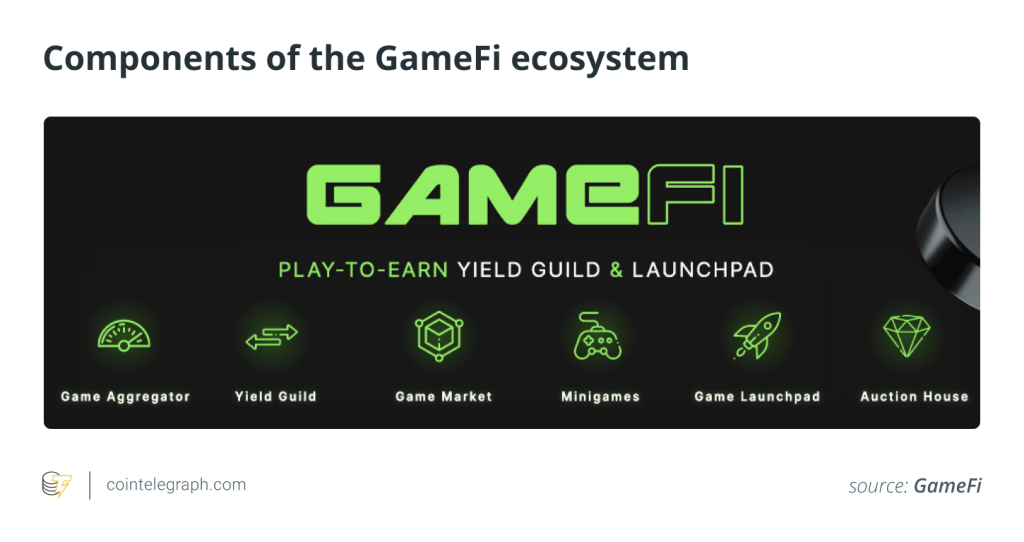

Depending on the launchpad platform, participants either have to lock their tokens in a pool or stake them to invest in the project. Participants then receive either in-game tokens or NFTs required to play the game. Popular IGO launchpads include GameFi, Seedify Fund, TrustPad and BinanceNFT.

How to participate in IGO launchpads

Every IGO launchpad has its respective process. The typical process involves first connecting a wallet to the launchpad. Afterward, the investor must select a tier that reflects the value of the investment and identify an IGO in which to invest.

The specific details on how to execute these steps depend on the launchpad. Some launchpads focus on games. Others offer blockchain games alongside other projects. An IGO launchpad can be hosted on any blockchain, such as Ethereuem, Cardano (ADA), or BNB Chain (BNB). Each launchpad has its own criteria when accepting new projects and different processes for accepting potential investors.

Popular crypto gaming launchpads

Below is a list of popular gaming launchpads in the crypto space.

Binance NFT

Binance NFT is a marketplace for crypto enthusiasts to create and trade NFTs. IGOs on Binance NFT grant access to exclusive in-game assets. Binance NFT uses a subscription system to give all users an equal opportunity to participate in its IGOs.

NFTs are allocated via public and verifiable algorithmic selection, thus ensuring fairness for all users. The details of each blockchain game project are displayed within the IGO. Investors can learn more about a project and familiarize themselves with the team as well.

Seedify Fund

Seedify is a household name when it comes to IGOs. The decentralized launchpad is governed by a decentralized autonomous organization (DAO). Crypto gaming projects can promote their game to the Seedify community for evaluation. Projects with positive evaluations can secure seed funding in this manner.

Between 250 and 100,000 Seedify (SFUND) tokens are required to participate in Seedify IGOs. Seedify has nine tiers. Tier 1 is a lottery tier. Guaranteed allocation into every IGO on the launchpad starts from Tier 2.

Unlike lotteries, guaranteed allocation ensures that investors have access to a portion of the launchpad's total projects at all times. This allocation is distributed proportionately based on the investor's tier or level of investment.

GameFi

GameFi has four investment tiers. Only one tier has guaranteed allocation to its IGOs. GameFi gives one lottery ticket for every 20 GAFI tokens, which is the minimum required to participate.

Since three of the four tiers are lottery entries, the chance of being guaranteed a spot increases with each tier. For example, the “Elite” tier (at 100 GAFI tokens) comes with five entries into the lottery. GameFi’s whitelist has a limited number of spots. This number is announced in advance to all investors who hope to participate in an IGO.

Trust Pad

Also known as one of the safest multichain launchpads, Trust Pad is more of an IDO launchpad. While beneficial to the crypto gaming ecosystem, Trust Pad does not focus solely on gaming, and instead uses DeFi instruments to allow organizations to raise funds from early stage investors.

Trust Pad has nine tiers, which are a combination of lotteries, guaranteed allocations and weighted entries. Weighted entries are lottery entries with more tickets or a higher percentage of entries than previous tiers. To participate, investors need a minimum of 3,000 Trust Pad (TPAD) tokens.

Enjinstarter

Enjinstarter is an IGO launchpad that focuses on expanding the crypto gaming ecosystem within Enjinstarter’s network. Enjinstarter has a unique approach: The ecosystem reserves 75% of IGO tokens for guaranteed allocations, which is split into three tiers.

To participate in the guaranteed allocation, a holding of between 25,000 to 500,000 Enjinstarter (EJS) tokens is required, and 25% of Enjinstarter’s remaining tokens are then made available in the community pool.

This approach allows anyone with a small holding of at least 1,250 EJS tokens to participate in an IGO. Enjinstarter operates on a first-come, first-serve basis and presents a low barrier to entry for new IGO participants.

IGO launchpad development

Individuals may develop IGO launchpads to create their fundraising platforms for crypto games. While IGO platforms are better established, trying to have a game whitelisted can be a time-consuming process.

Developing a unique IGO launchpad is the most cost-effective approach for game developers to control which blockchain games they want to fundraise for.

A game developer may use this approach to build their own IGO platform, one that’s similar to Binance NFT, TrustSwap or EnjinStarter. The goal of IGO launchpad development is to build an open platform where blockchain games may be added to the whitelist to raise funds.

IDO vs IGO: What’s the difference?

Initial DEX offerings (IDOs) are a common fundraising method in the crypto gaming ecosystem. IDOs are used to publicize upcoming blockchain projects, just like IGOs. The difference between an IDO versus an IGO lies in their scope.

Any project launched on a DEX can be classified as an IDO. With an IGO, however, the investment is directed specifically to developing a blockchain game. Compared to the ICO, IDOs are easier to execute.

Tokens announced through an IDO are instantly listed on the DEX from which they were launched. The projects also secure immediate token liquidity. However, IDOs lack a robust and thorough review process. Consequently, compared to both ICOs and IGOs, IDOs have a higher rate of fraudulent and low-quality projects.

The road ahead

IGOs in blockchain are a meaningful way for crypto gaming projects to raise funds. An IGO may also create enough buzz to secure an audience before a game’s release.

IGOs are a relatively new offering. While many blockchain gaming projects have been able to successfully fund their projects via an IGO, some developers have failed to meet their obligations. These developers never deploy the completed game and leave investors at a loss.

There is still significant investor risk for participating in an IGO, especially for investors funding conceptual early-stage gaming projects. When it comes to investing in IGO projects, research and due diligence are key to avoiding some of the most common pitfalls and scams.

Regardless, the IGO space continues to grow. More quality projects are launching via IGOs than before, and IGOs are steadily becoming a mainstay in both blockchain gaming and the crypto industry at large.

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2523/ […]

… [Trackback]

[…] There you can find 38615 more Info to that Topic: x.superex.com/academys/beginner/2523/ […]

… [Trackback]

[…] There you can find 82592 more Info on that Topic: x.superex.com/academys/beginner/2523/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2523/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2523/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2523/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2523/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2523/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2523/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2523/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2523/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2523/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2523/ […]