How are metaverse assets taxed?

Can metaverse assets be taxed?

The idea of the metaverse is not new. Early iterations have existed for many years, ranging from the introduction of digital twins and used in manufacturing to investigate real-world problems virtually to early virtual worlds like Second Life, released in 2003.

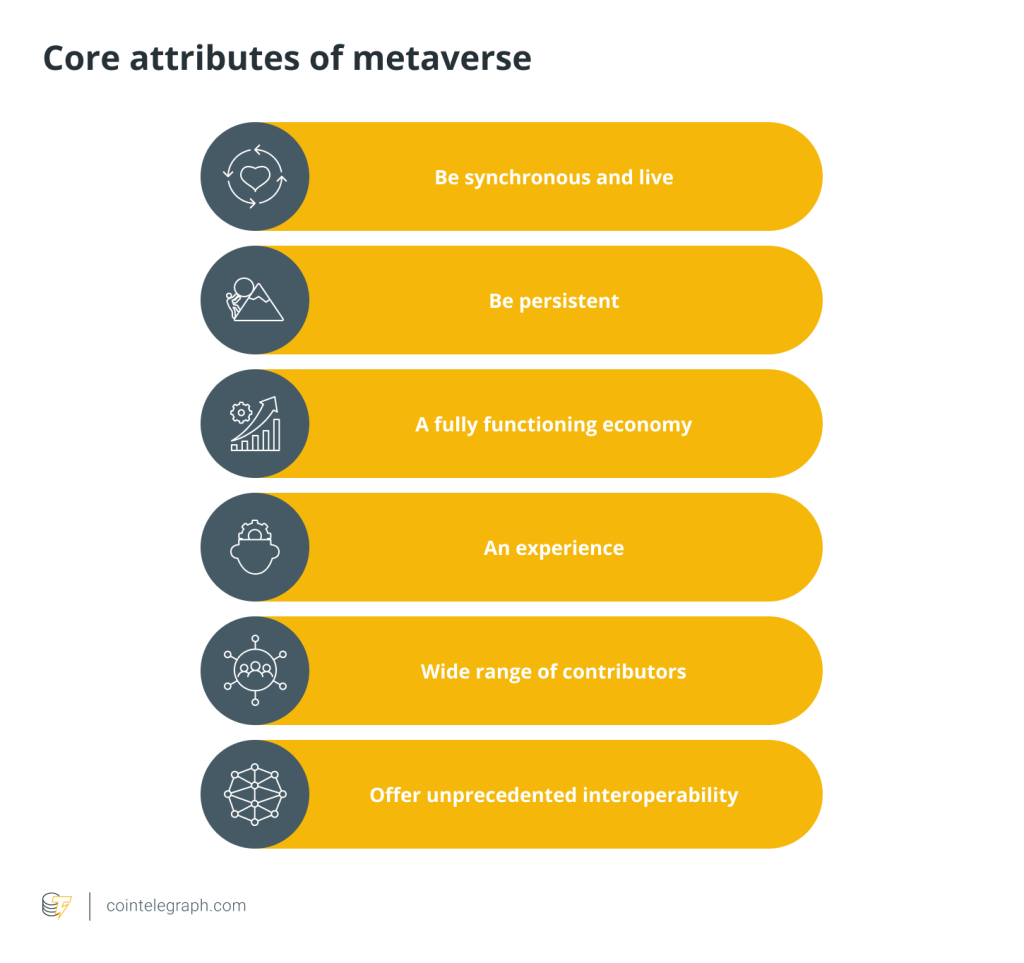

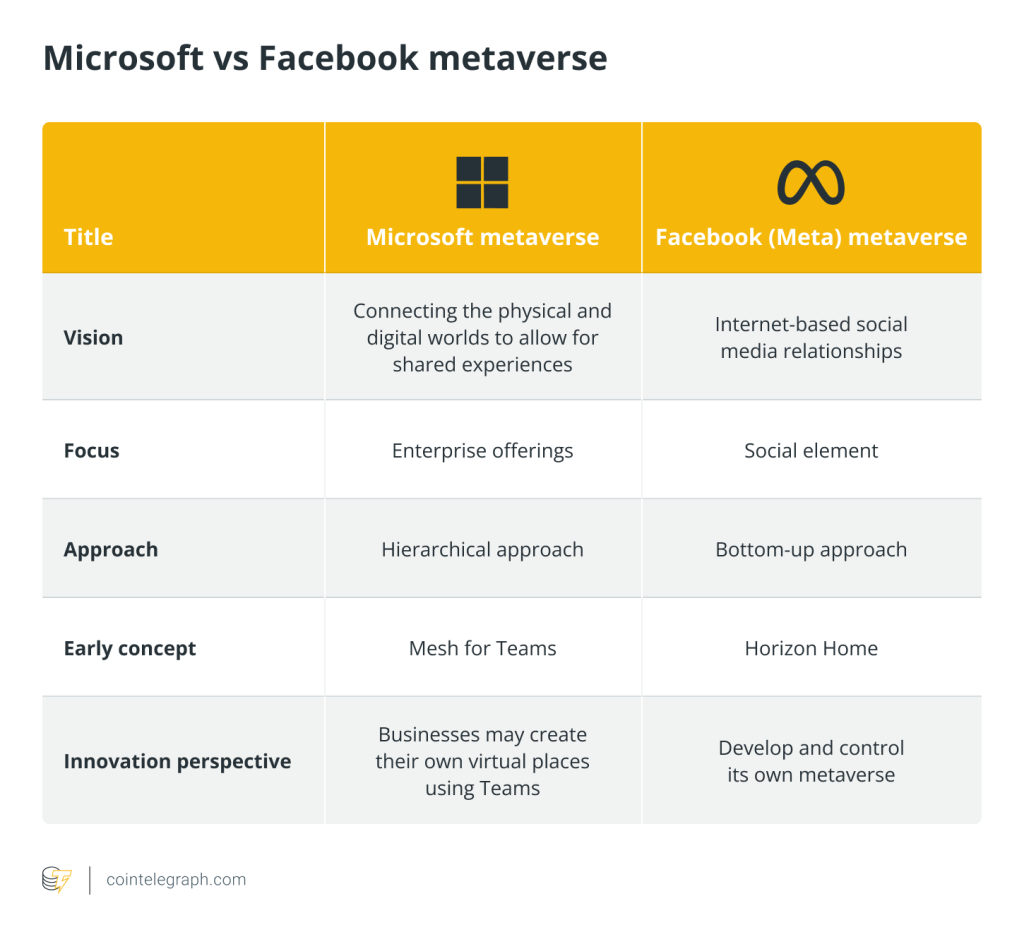

However, the metaverse concept, which consists of flawlessly connected virtual worlds where people can play, live, work and conduct business, may seem science fiction to those unfamiliar with it. Major tech companies like Microsoft and Meta are realigning their plans to work towards a digital future, heralding a new technological era that has already given rise to numerous taxable events.

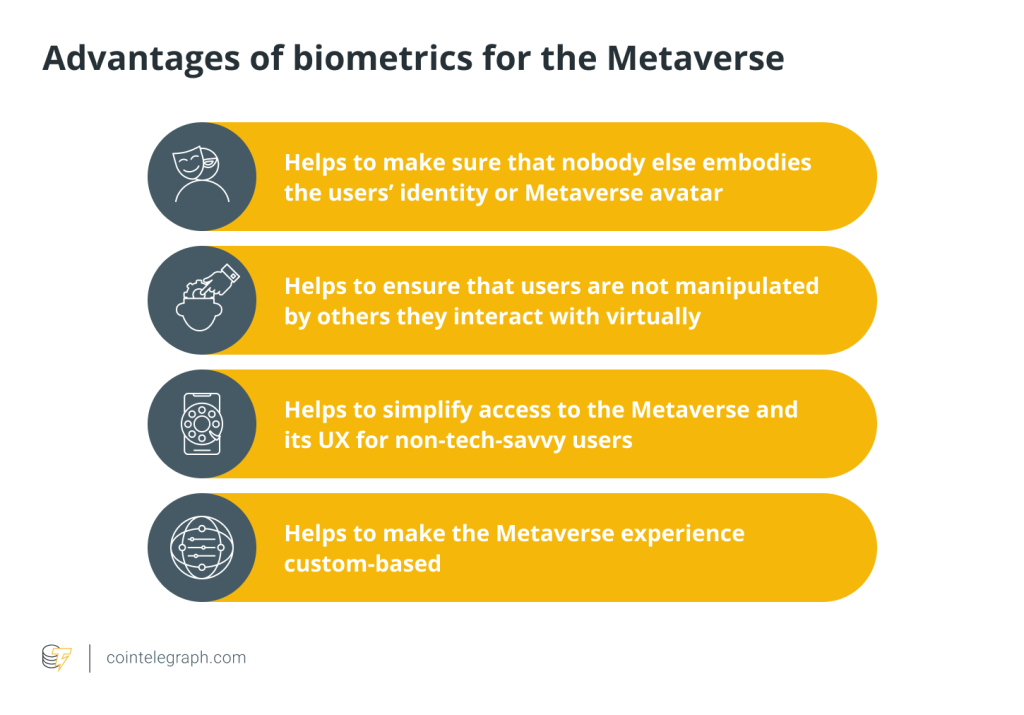

A new version of the internet known as Web3 is also being created by the powerful convergence of blockchain and other cutting-edge technologies that aim to decentralize and disintermediate the current Web2 Internet. Moreover, adopting the metaverse will lead to attending concerts or a doctor’s appointment virtually, implying that the fundamental changeover to Web3 requires understanding the tax repercussions of residing in and conducting business in this innovative and exciting environment.

This article will discuss metaverse income tax implications, such as the tax on virtual real estate and NFT earnings.

Metaverse and taxation: Does the digital world trigger taxable events

In general, the location and citizenship of the associated parties determine how tax regulations are often applied. In the case of cryptocurrencies, metaverse and nonfungible tokens (NFTs), loose reporting requirements lead to tax fraud and tax evasion.

Moreover, there is little agreement on when NFT and cryptocurrency transactions should be taxed due to a lack of common taxation standards and regulatory clarity on these digital assets. For instance, some nations, like the United Kingdom, the United States and Australia, impose capital gains tax with varying degrees of strictness. However, China has outright bans on cryptocurrencies, while India is debating this subject, and Singapore has relatively lax tax laws.

Related: How to buy Bitcoin in Australia?

One example of unresolved questions on taxation in the metaverse is the multi-day tour in October 2021 by pop star Ariana Grande, which was streamed on the Fortnite platform. 78 million fee-paying viewers watched her performances worldwide, earning Grande over $20 million from virtual concerts and retail sales.

However, there is still no universal agreement as to whether the country where Grande performed or the jurisdiction where each audience member resides should be the one with authority to tax such activity.

In addition, an indirect tax (which is passed on to the consumer) raises several other unanswered issues related to metaverse taxation. For instance, should purchasing a plot of NFT real estate in the metaverse using cryptocurrencies be subject to capital gains or value-added-tax (VAT)? Another question that remains unaddressed is whether the metaverse needs its own taxation system.

A consumption tax known as a value-added tax or VAT is imposed on the value contributed throughout each stage of the production of products or services. For the VAT previously paid, each business in the value chain is given a tax credit. However, when users sell or earn a yield on assets that have gained value, they must pay capital gains tax on the profit.

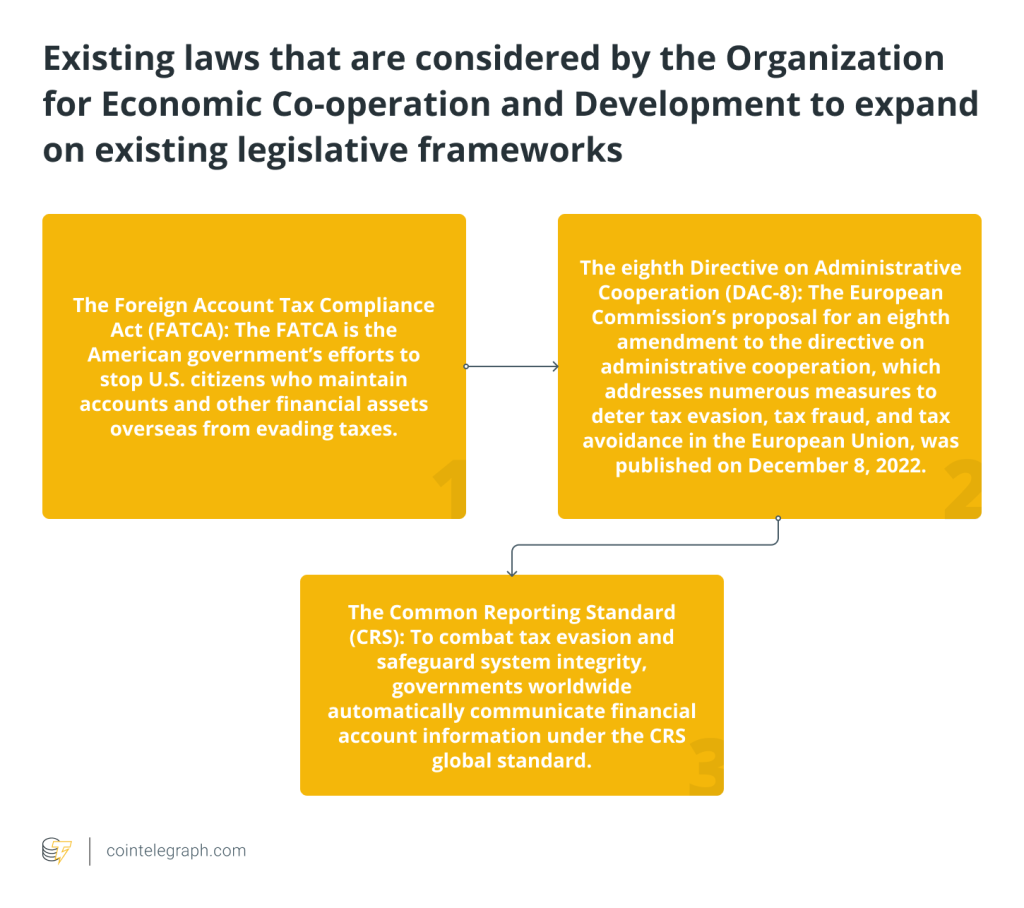

In addition to removing traditional intermediaries, digital assets avoid formal operational tax reporting procedures. To protect the consumer interest, the United States, the United Kingdom and the Organization for Economic Co-operation and Development are working on expanding existing legislative frameworks to include digital intermediaries like custodians, cryptocurrency exchanges, and wallet providers. These laws include:

Do you have to pay taxes on digital assets in the metaverse

The metaverse and Web3 technology could present serious tax issues as the taxability of the digital assets traded virtually still need to be established globally. However, they also have the ability to equip tax professionals with innovative new tools, making it simpler to collect the appropriate taxes at the right times and in a way that is both efficient and economical for all parties.

Moreover, the efforts to impose a tax on metaverse events are already beginning to emerge. For instance, Linden Labs, the parent company of the metaverse platform Second Life has declared that users in the U.S. will be responsible for paying sales taxes on any applicable subscription and digital land taxes.

The taxes imposed on one-time name changes and the acquisition of its native token, $L, will, however, continue to be covered by Linden (with the intention of passing these taxes to consumers in the future).

Tax on rewards earned from play-to-earn games

As noted, no tax authorities have provided specific instructions on how to tax profit earned from play-to-earn (P2E) games. However, given that it is a source of income, many tax offices may regard such rewards as capital gains and will probably subject them to income tax.

P2E gaming rewards, such as earning tokens by playing games, airdrop from a gaming company and staking in-game assets to earn passive income, may be viewed as income. Similarly, purchasing an in-game asset with cryptocurrencies, selling in-game assets and swapping one in-game asset for another are treated as capital gains for taxation purposes.

P2E games are still a gray area in most countries, so always verify your region’s instructions on taxes on play-to-earn games and engage with a local tax expert to categorize your transactions appropriately.

Tax on metaverse land

In the case of the metaverse, taxpayers must declare and pay capital gains tax if they rent or sell digital land. For instance, if someone owns metaverse land, they must pay tax if they sell it at a profit. Additionally, if they rent their virtual land for Ethereum-based income, they need to pay tax on rental metaverse land. Any capital losses can be offset against capital gains, reducing overall tax on metaverse land.

Furthermore, the IRS allows taxpayers to deduct any gas fees or commissions from the sales revenues of digital assets subject to proper documentation of such costs. However, a question arises on whether or not the landlord’s or seller’s jurisdiction should be considered for taxation purposes. Also, how to assess taxes if the platforms themselves buy or rent digital real estate.

Related: What is tokenized real estate? A beginner’s guide to digital real estate ownership

Either the nation where the servers for the digital environment are situated or the region where the seller and landlord physically reside may be considered to impose a tax on metaverse land. Similarly, the platform’s home jurisdiction’s tax rates are applied if they buy or rent digital land.

EU VAT law for digital services and virtual events

The majority of sales and purchases of goods within the EU are subject to VAT for businesses based in the EU. In these situations, VAT is assessed and owed in the EU nation where the final consumer consumes the goods and when services are rendered in each EU nation.

The EU VAT regulation defines “digital services” as those provided through the internet or another electronic network, are fundamentally automated, need little to no human interaction, and are not conceivable without information technology. The term “event” is not defined under the EU VAT regulation.

However, the Court of Justice of the European Union contends that participation in an event is what counts, not access to a particular physical site. Now that it is clear that from a VAT standpoint, metaverse activities can be classified as either events or digital services, let’s examine how taxes are applied to each category in more detail.

If metaverse activities are treated as digital services (e.g., online exhibitions where the organizer does not interact with audiences in real-time), they are taxable in the nation where the customer resides or usually resides and has a permanent address. The consumer is responsible for recording the sale’s VAT.

On the other hand, if digital services are bought for private use, the vendor must identify each customer’s location to apply the appropriate tax rate based on bank information, billing address, etc.

Admission to events, such as virtual conferences with live sessions, is subject to taxation in the nation where the event is held, according to a particular rule in the present EU VAT regulations. Nonetheless, since event organizers face significant legal uncertainty due to virtual events being taxed similarly to physical events, the EU has proposed new rules that, if approved, must be put into effect by the member states by 2025.

According to the new legislation, in the case of business-to-consumer transactions, organizers will charge VAT based on the tax rates of the customer’s jurisdiction, a common practice for all digital services. In contrast, no tax will be levied in the case of business-to-business transactions.

Do NFT earnings get taxed?

In October 2023, the U.S. Internal Revenue Service (IRS) clarified the tax implications of nonfungible tokens by adding NFTs to the digital currency category. This means that NFTs are subject to the same tax rules as other digital assets for federal income tax purposes.

Due to the nonfungible tokens being viewed as inventory and the earnings from NFT sales being treated as income, NFT creators will also be required to pay self-employment tax on profit in addition to individual income tax. In India, earnings on the sale of NFTs are subject to a 30% tax, with the only allowable deductible being the acquisition cost.

However, the tax status of royalty income from NFTs generally is liable to self-employment taxes as it has not received any guidance from the IRS. Furthermore, nonfungible tokens given as donations are not treated as taxable events. Nonetheless, depending on how long the asset was stored, the creator may be subject to taxation (on capital gains) if he auctions the NFT first and then donates the revenues to the charity.

… [Trackback]

[…] There you can find 66727 more Info to that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Here you will find 694 additional Info to that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Here you can find 23062 more Info on that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2497/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2497/ […]