What happens when a country defaults?

A country default refers to a situation when a sovereign state is unable or unwilling to fulfill its financial commitments, notably its debt repayments. When a nation defaults, it means it has not made the necessary loan or bond payments.

Several nations experienced substantial economic difficulties during the 2008 global financial crisis, and the prospect of sovereign defaults emerged as a worrying concern. With the collapse of the housing market and the ensuing subprime mortgage crisis, the crisis had its start in the United States and rapidly expanded to other regions of the world, severely depressing the international economy.

In some circumstances, a default may force a nation to seek assistance from international organizations like the International Monetary Fund (IMF) to help stabilize its economy and pay its debts. The conditions set by these organizations as part of the assistance packages may have an effect on the economic and political systems of the defaulting nation.

Factors leading to a country’s default on its financial obligations

A nation may default for a number of reasons, including economic, political or a combination of both. A default can take many different forms, from a total failure to make any payments to a selective default in which the nation fails to pay some creditors while still making payments to others. Some common factors that lead to a country’s default are explained in the below sections.

High debt burden

A nation’s excessive debt load may become unmanageable, particularly if it is accompanied by slow or stagnant economic growth. Default becomes a genuine possibility when a nation’s debt loads get so high that it can no longer produce enough revenue to pay its debts.

Argentina experienced a significant default in 2001 due to an economic downturn. The nation battled with a fixed exchange rate system that was unsustainable, large levels of debt and a severe recession. It ultimately went into default on its debt, which caused a sharp decline in its economy and a huge depreciation of its currency.

Economic instability

A nation’s finances can be severely strained by economic instability, such as a recession, high inflation or currency depreciation. These circumstances can lower tax receipts, raise borrowing costs, and make debt servicing difficult, increasing the risk of default.

Political instability

A nation’s capacity to satisfy its financial obligations and maintain economic stability might be threatened by political turbulence, social unrest or poor governance. Foreign investment can be discouraged by political unrest, which can also interrupt economic activity and prevent the required reforms from being put into place to address financial issues.

External shocks

Defaults can also be caused by external, uncontrollable reasons such as global economic downturns, significant drops in commodity prices or abrupt changes in investor attitude. These shocks have the potential to erode a nation’s economic foundation and make it challenging to access global financial markets.

Fiscal management

Unsound fiscal policies, such as excessive government spending, insufficient taxation or pervasive corruption, can impair a nation’s financial standing and raise the risk of default. Budget deficits, a rising debt load and insufficient funds to pay off debts are all consequences of a lack of fiscal responsibility.

Lack of access to financing

A nation may find it difficult to repay its debts if it is unable to obtain inexpensive financing or has few other options. This may occur if investors lose faith in the nation’s capacity to make payments, which could result in higher borrowing prices or a total cutoff from financial markets.

Contagion effects

Investors may lose faith in a particular nation as a result of the defaults of other nations or financial institutions. A nation becomes susceptible to contagion and may have trouble paying its debts if it is significantly dependent on external finance or has a high level of debt in foreign currencies.

Economic, social and political consequences of default

Financial obligations not being met can have serious negative economic, social and political effects on a nation, as discussed below.

Loss of investor confidence

The decline in investor confidence is one of the most immediate effects. Investors are informed when a country defaults and the government is unable or unwilling to fulfill its financial obligations. This decline in confidence can cause a substantial capital outflow as investors pull their money out of the country. The nation’s capacity to finance initiatives and foster economic growth is constrained by low levels of foreign direct investment and portfolio investment.

Limited access to credit markets

Access to credit markets is also restricted as a result of default. It becomes more difficult to borrow money abroad or even locally when a government fails. The inability of the government to raise money for necessary projects and services is further hampered by lenders’ reluctance to give loans to a nation with a history of default. It can also be more expensive for the nation to borrow the money it needs due to higher borrowing costs.

A decline in credit rating

The deterioration of the nation’s credit rating is another consequence of default. Default is an obvious indicator of financial trouble, which rating agencies use to determine a country’s creditworthiness. Because lenders expect higher interest rates to make up for the perceived higher risk, borrowing costs rise when a credit rating is lower. The cost of servicing the existing debt rises as a result, further taxing the nation’s finances.

Economic downturn

A default might start an economic downturn or exacerbate existing problems. Business investment, consumer spending and general economic activity can be significantly impacted by the decline in investor confidence, restricted credit availability and higher borrowing costs.

Furthermore, budget restrictions may cause the unemployment rate to increase, government revenue to decrease and important public services to be reduced. An economic decline may trigger a vicious cycle of slower growth, higher debt payments and increasing financial stress.

Social unrest and political turmoil

Defaulting on a loan can make social injustices and financial problems worse, which can spark protests and other forms of unrest. Government-imposed austerity measures, such as budget reductions, fewer public services and more taxes, are frequently the result of a default. These policies may disproportionately hurt underprivileged groups, which could fuel public discontent, social unrest and political instability.

Strained international relations

Relationships with foreign lenders, investors and creditors may be strained if a nation defaults on its financial responsibilities. As a result, there may be a decline in diplomatic ties and diminished credibility in international forums. Future negotiations for advantageous trade deals or efforts to draw in foreign investment may prove challenging for the nation.

Political instability

Public confidence in the government’s ability to handle the nation’s finances can be damaged by default. Political instability, including governmental changes, protests and political polarization, could result from this decline in confidence. Political instability can make it more difficult to implement effective governance and promote economic recovery.

Spillover to global financial markets

A significant economy going bankrupt can cause market instability and have an impact on international financial markets. Because financial institutions are intertwined and international investments are common, a default may result in panic selling, a drop in asset values and interruptions to financial flows. Investor confidence may suffer as a result, and other economies may feel the repercussions as well.

What will happen if the U.S. defaults?

There would probably be serious repercussions for the world economy if the United States were to default on its financial obligations. Interest rates might increase, there might be turbulence in the financial markets, and investor confidence might decline.

Additionally, it can result in a cutback in government services, a recession and harm to the nation’s credit rating. The effect would be felt outside of the U.S., damaging financial stability globally and possibly starting a global recession.

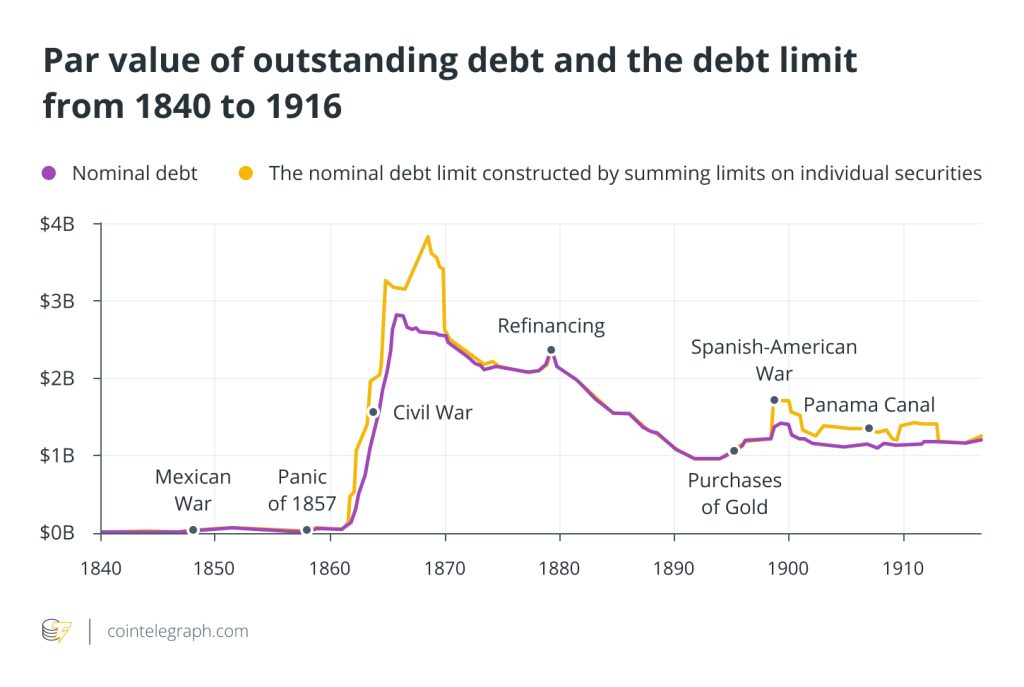

It is important to note that the U.S. has never defaulted on a debt obligation. The U.S. government has always upheld its financial obligations, despite instances of debt restructuring and payment delays. However, there have been a few occasions where the United States has nearly defaulted, such as during the 2011 and 2013 debt ceiling discussions. The term “debt ceiling” refers to the legal cap on the total amount of debt that the United States government can borrow to support its operations.

There were worries that there might be a technical default or a delay in payments in those situations, but eventually, the U.S. government took action to prevent default by giving debt payments top priority and coming to last-minute agreements.

Restructuring and recovery process

When a nation faces a financial default, it frequently starts the process of restructuring its debt and moves toward economic recovery. An overview of the restructuring and recovery process is described as follows:

Debt restructuring negotiations

The defaulting nation negotiates a new repayment plan with its creditors. Discussions about changing the terms of current debt, such as extending maturity dates, lowering interest rates or even lowering the principal amount owed, are part of this process. The objective is to build a more manageable debt load that the nation can sustain over time.

Implementing economic reforms

The defaulting nation frequently carries out a number of economic reforms to regain economic stability. Fiscal consolidation measures to reduce budget deficits, structural changes to increase productivity and competitiveness, and efforts to promote governance and transparency are a few examples of these reforms. The objective is to foster an atmosphere that will encourage economic growth and attract investment.

External assistance

International agencies like the IMF or regional development banks may be approached by a defaulting nation to provide financial help. This support frequently has prerequisites, such as carrying out particular policy measures and hitting financial benchmarks. Such financial assistance attempts to offer liquidity, stabilize the economy of the nation and aid in its recovery.

Rebuilding investor confidence

In order for the defaulting countries to gain access to global financial markets, investor confidence must be rebuilt. Transparent economic practices, successful reform implementation and a clear commitment to paying debts off are all ways to do this. To entice investment and restore trust, the nation may use roadshows, investor engagement and marketing initiatives.

Stimulating economic growth

The defaulting nation prioritizes boosting economic growth by investing in infrastructure, encouraging entrepreneurship, assisting small and medium-sized businesses, and luring foreign direct investment, among other strategies. These initiatives seek to boost productivity, create jobs and produce long-term economic growth.

Strengthening the financial sector

The struggling nation takes action to fortify and increase the resilience of its financial system. This may entail putting regulatory reforms into place, improving banking oversight, capitalizing banks if needed, and fostering financial system stability.

For the economy to recover, a stable and effective financial system is crucial. Capitalization banking is one such recovery method used by a bank to raise capital by selling shares of its stock to investors. Through this method, money is raised for the bank’s operations, commercial growth and compliance with regulations. This capital can be used to cover losses, facilitate lending and keep enough reserves.

Social safety nets and poverty alleviation

To lessen the negative social effects of the default and economic changes, the defaulting country may develop social safety nets and targeted poverty alleviation programs. These precautions are intended to safeguard the population’s most vulnerable groups and offer assistance during the healing process.

Can Bitcoin serve as a protective measure against a country’s default?

Bitcoin (BTC) is viewed as a potential protective measure against a country’s default due to its decentralized structure and freedom from any central authority or government. Bitcoin’s security features, such as cryptography and the transparency offered by blockchain technology, can provide a level of confidence and safety in nations with a history of financial mismanagement or corruption.

Additionally, anybody looking to relocate assets outside of a defaulting country or conduct international trade will find Bitcoin to be a feasible choice due to its global accessibility and affordable transaction fees.

Bitcoin’s price volatility, on the other hand, presents a serious problem because consumers could potentially lose money due to its quick value fluctuations. Moreover, widespread adoption and accessibility of BTC may be hampered by regulatory uncertainty and poor infrastructure in some areas.

In addition, during times of financial difficulty, the liquidity and simplicity of transferring Bitcoin into local currencies can also be challenging. Although Bitcoin has the potential to be a safeguard, its drawbacks and difficulties should be carefully considered before relying on it to prevent country defaults.

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Here you can find 95181 more Information to that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Here you can find 42463 additional Information to that Topic: x.superex.com/academys/beginner/2491/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2491/ […]