What is de-dollarization and what happens if the U.S dollar crashes

A burgeoning de-dollarization movement is starting to gain traction in a world that is heavily dependent on the U.S. dollar. Countries all around the world are looking for methods to lessen their reliance on the dollar because they are tired of the risks and vulnerabilities that come with its hegemony. The established international banking system starts to change as people look into alternatives.

Central banks begin to modify their currency reserves in an effort to increase stability and diversification. They think about holding a variety of currencies, including local ones, and even look into developing brand new global payment systems. Countries start using other currencies besides the dollar to settle trade transactions as trade agreements are renegotiated.

The effects of a United States currency collapse would be felt all around the world. Because of how intertwined the world economy is, changes in the value of the dollar would have an effect on worldwide trade, investments and financial stability. The abrupt decrease in the value of the dollar could result in inflationary pressures that would impact both domestic and international markets.

In reaction, countries quickly adjust. In order to protect themselves against the effects of the dollar meltdown, they mobilize their efforts. Businesses and governments are frantically looking for alternative currencies for investment and trade. As new financial alliances are formed and regional currencies gain prominence, the pursuit of stability becomes of utmost importance.

A new chapter in the history of global finance is being written in the wake of the dollar catastrophe. The need for a more balanced and diverse monetary system around the world has put the U.S. dollar's once-dominant status under pressure. The repercussions are extensive, necessitating creative solutions, collaborative agreements and a recalibrating of the international economic system.

What is de-dollarization

De-dollarization is the process by which countries look for alternate methods of conducting international trade and financial transactions and lessen their reliance on the U.S. dollar as the main global reserve currency. Diversifying currency holdings and encouraging the use of other currencies in cross-border transactions are both involved.

The American dollar has historically dominated the world economy. It is widely used as the primary currency for commodities like oil, a reserve currency kept by central banks and for international trade settlements. De-dollarization, on the other hand, is a reaction to worries about the risks and weaknesses brought on by the dollar's hegemony.

De-dollarizing countries seek to lessen their vulnerability to potential disruptions brought on by changes in the dollar's value, adjustments to American monetary policy or American economic penalties. By diversifying their foreign exchange holdings and looking into other options like regional currencies or virtual currencies, they want to increase the stability and independence of their financial systems.

De-dollarization can take the form of agreements between two countries to swap currencies, the promotion of local currencies in international trade, the development of alternative payment methods and increased international collaboration among trading partners. Due to the complexity of the procedure and the number of players involved, implementation may take some time.

De-dollarization attempts to lessen the dominance of the U.S. dollar and provide countries with more flexibility and resilience in their financial systems, even though it does not necessarily mean the total eradication of the U.S. currency from international commerce.

History of the U.S. dollar’s dominance

The dominance of the U.S. dollar as a major reserve currency dates back to the years following World War II. Here are significant turning points in the dollar’s ascent to prominence:

Bretton Woods System (1944)

The U.S. was a key contributor to the creation of the post-World War II global monetary system at the New Hampshire-based Bretton Woods conference. The summit established the International Monetary Fund to oversee global monetary stability, with the U.S. dollar serving as the anchor currency and backed by gold.

Convertibility to gold (1945-1971)

Under the Bretton Woods system, other countries pegged their currencies to the American dollar, which was convertible to gold at a predetermined rate from 1945 to 1971. This arrangement gave the dollar's status as the reserve currency stability and gave other countries confidence. However, growing economic problems in the U.S., such as inflation and budget deficits, raised questions about the convertibility of the dollar.

Related: Bitcoin and inflation: Everything you need to know

Nixon Shock (1971)

In 1971, U.S. President Richard Nixon halted the ability of the dollar to be converted into gold. This action is referred to as the “Nixon Shock.” As a result, the Bretton Woods system was virtually abolished, and a new age of flexible exchange rates began. The value of the dollar started to be determined by market forces, which exacerbated volatility.

Petrodollar system (1970s)

The petrodollar system, which major oil-producing countries decided to use in the 1970s, was a significant turning point in the history of oil pricing. This agreement increased the demand for dollars significantly because countries required them to buy oil. It increased the dollar’s status as a reserve currency and further cemented the dollar’s position as the main currency for international oil transactions.

1980s to 2000s

Because of the resilience of the American economy and its financial markets, the supremacy of the U.S. dollar increased during the 1980s and 1990s. The dollar evolved into the preferred currency for foreign exchange reserves, international trade and investments. The dominance of the dollar as the main currency for international trade was further strengthened by the globalization of financial markets.

Financial crisis and safe-haven status (2008–present)

The global financial crisis of 2008 brought to light the U.S. dollar’s status as a safe-haven asset in times of apprehension about the future of the economy. Investors flocked to the dollar and U.S. Treasury bonds, confirming the dollar’s position as a currency of last resort. Despite the ensuing issues and debates about the dollar’s dominance, it is still the most frequently used reserve currency in existence today.

Which countries are involved in de-dollarization

Several countries have actively pursued de-dollarization initiatives to lessen their reliance on the U.S. dollar. Here are a few examples.

Russia

Russia has been at the forefront of the de-dollarization movement. It has expanded its gold reserves and decreased its holdings of U.S. Treasury bonds in recent years.

In order to facilitate bilateral commerce outside of the dollar system, Russia has also tried to engage in more national currency trade with its trading partners and has signed currency swap agreements with a number of countries.

China

As the second-largest economy in the world, China has been encouraging the use of its currency, the yuan (or renminbi), in cross-border trade. It has worked to broaden the yuan’s adoption around the world and has signed currency exchange agreements with a number of countries to ease commerce and investment in the currency.

The Belt and Road Initiative, which aims to increase trade and economic cooperation with partner countries by utilizing local currencies, is one of the efforts that China has also started.

Iran

As a result of American sanctions, Iran has been aggressively attempting to lessen its reliance on the dollar. It has looked for alternate ways to carry out foreign trade, such as by using different currencies like the euro.

Iran has also looked into using blockchain technology and cryptocurrencies to go around the established financial system and lessen the effects of sanctions.

El Salvador

El Salvador hopes to increase its financial independence and reduce its dependence on the U.S. dollar by adopting Bitcoin as legal tender. This decision affects the country in a number of ways. El Salvador can diversify its monetary system and lessen its reliance on a single currency thanks to this.

The country may benefit from more flexibility in its foreign commerce and financial dealings as a result of this diversification. Additionally, embracing Bitcoin encourages monetary sovereignty, giving El Salvador more control over its monetary policies and lowering its susceptibility to outside economic forces.

European Union

The European Union has stated ambitions to lessen its reliance on the U.S. dollar and to boost the role of the euro as a global reserve currency. In reaction to U.S. sanctions on countries like Iran and Russia, efforts have been made to advance the euro for energy transactions.

The EU has also looked into developing a separate payment mechanism to enable trade with Iran and get around American sanctions.

Venezuela

Venezuela has started the process of de-dollarization in response to economic hardship and American sanctions. The country has made an effort to conduct business in various currencies, like the euro and Chinese yuan. Additionally, it has launched its own digital currency, the Petro, as a way to get around American sanctions and access foreign funding.

Implications of de-dollarization on the U.S. economy

The effects of de-dollarization on the U.S. economy are complex and could be either beneficial or detrimental. Key factors relating to de-dollarization and its effects on the U.S. are as follows:

Global currency shift and reserve currency status

A global currency shift away from the U.S. dollar as the main reserve currency is referred to as de-dollarization. The demand for U.S. dollars may decline if important countries diversify their currency holdings, thereby undermining the dollar's standing as a reserve currency. This may affect the U.S. economy’s capacity to draw in foreign capital and keep its sway over the global monetary system.

Geopolitical implications and financial independence

Geopolitical factors can have an impact on de-dollarization, as countries work to increase their monetary sovereignty and reduce their vulnerability to U.S. sanctions or other external economic pressures. Changes in international alliances, trade patterns and geopolitical dynamics may result from this, which may have an impact on U.S. geopolitical influence and economic ties.

Exchange rate volatility

As more currencies are used in international transactions, de-dollarization may result in an increase in exchange rate volatility. This volatility may have an impact on the competitiveness of U.S. exports and imports, which could affect the trade balance and overall economic performance of the country.

Central bank policies and foreign exchange reserves

As countries diversify their foreign exchange reserves, central banks may adjust their policies regarding currency management, setting interest rates and using monetary instruments. This may have an influence on the U.S. dollar's worldwide liquidity and the efficacy of U.S. monetary policy.

Alternative currencies and currency pegging

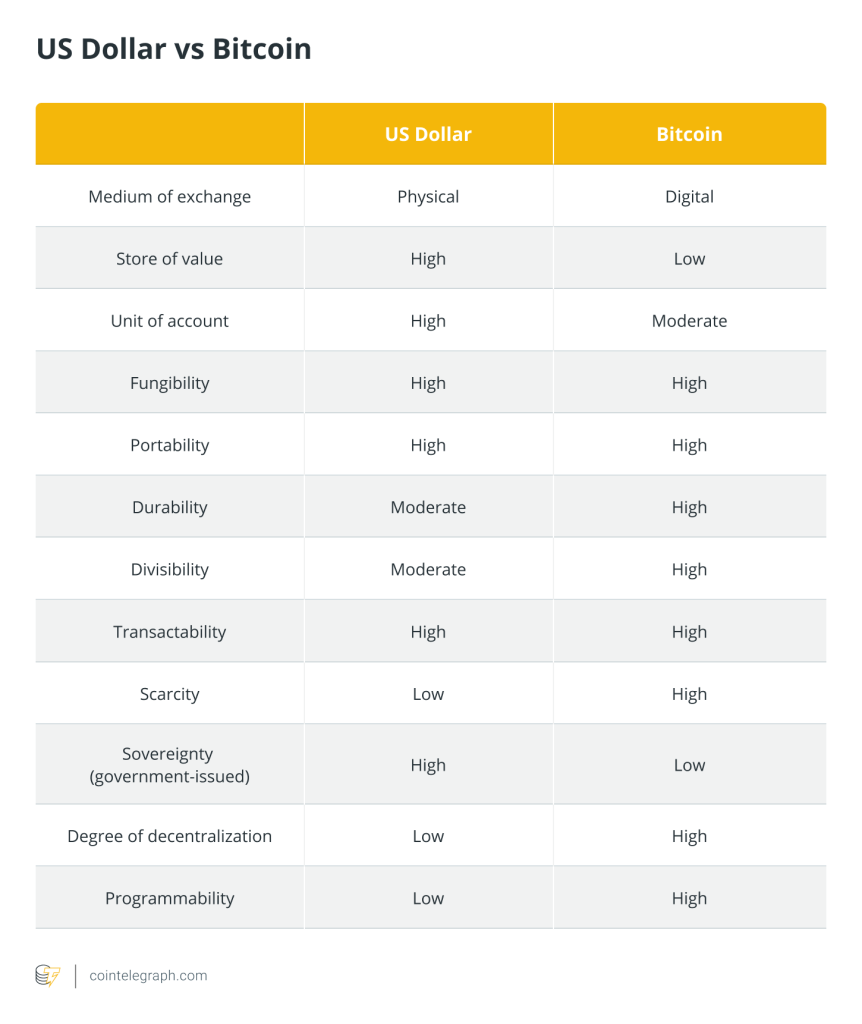

De-dollarization may promote the use of alternative currencies, such as the euro, yuan or virtual currencies, in international trade. This may weaken the U.S. dollar's status as the world's main currency and reduce its impact. Additionally, to lessen their reliance on the U.S. dollar, countries may think about pegging their currencies to alternative benchmarks.

Financial stability and currency wars

The de-dollarization of the world’s currencies raises the possibility of heightened currency competitiveness and “currency wars” between countries fighting for economic superiority. As countries alter exchange rates and put policies in place to safeguard their economies, this could lead to further financial volatility.

It is important to remember that the effects of de-dollarization on the U.S. economy are nuanced and situation-specific. While certain implications, like a decline in the demand for the dollar abroad, may bring difficulties for the U.S., others can offer chances for diversification and financial security.

The overall impact is dependent on a number of variables, including the rate and degree of de-dollarization, the stability of other currencies and how well U.S. economic policies can be adjusted to shifting global dynamics.

Advantages and disadvantages of currency devaluation

Deliberately lowering a currency’s value in relation to other currencies is referred to as currency devaluation. Currency devaluation, as opposed to de-dollarization, strives to change the value of the domestic currency relative to other currencies in order to accomplish particular economic goals.

Devaluation can have both positive and negative effects, but it’s crucial to remember that the precise effects will depend on the economic situation of the country and the degree of the devaluation. The following are some general benefits and drawbacks of currency devaluation:

Benefits of currency devaluation

- Export competitiveness: A depreciated currency can increase a country’s ability to export and grow its competitiveness on world markets.

- Tourism and foreign investment: By making the local currency less expensive in comparison to a foreign currency, devaluation can increase a country’s tourism.

- Debt repayment: A devaluation might ease the burden of debt repayment if a country has a sizable amount of external debt that is denominated in foreign currencies.

Drawbacks of currency devaluation

Devaluation may result in an increase in the cost of imported commodities and raw materials, which is known as imported inflation. This might weaken consumers’ purchasing power and lower their standard of living by increasing inflationary pressures in the country.

- Cost of imports: Depreciation raises the price of imported items, increasing the costs for companies that depend on imported inputs, thus lowering their competitiveness.

- Capital flight and investment uncertainty: Devaluation may lead to capital flight that can exacerbate the domestic economy’s vulnerability and obstruct long-term economic expansion.

- Challenges with debt servicing: If a government has taken out loans in foreign currencies, depreciation may raise the cost of paying back the debt.

- Impact on standard of living: As imported items become more expensive as a result of devaluation, individual purchasing power may decrease and affect the standard of living, particularly for low-income households.

The future of the United States in the event of de-dollarization

In the case of de-dollarization, the future of the United States would depend on a number of variables and how the process plays out. However, a large decline in the use of the U.S. dollar globally might have a number of possible effects on the U.S. economy (as discussed above) and its standing in the global financial system.

The U.S. may face serious economic difficulties and potential geopolitical changes in the case of de-dollarization. As a result of the dollar’s declining dominance as the world’s reserve currency, the U.S. economy may experience rising borrowing costs and inflationary pressures. Additionally, modifications to the global financial system could have an impact on the United States’ position as a superpower, which would change the geopolitical environment.

Written by Jagjit Singh

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] There you can find 59494 additional Information to that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] There you will find 42761 additional Information on that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] Here you will find 95448 more Information to that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] Here you can find 92739 additional Information to that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] There you will find 50452 additional Info on that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] There you can find 28975 additional Info to that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] There you can find 81402 more Info to that Topic: x.superex.com/academys/beginner/2475/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2475/ […]