The geopolitics of Bitcoin: Exploring the implications for global power dynamics

The geopolitics of Bitcoin refers to the political, economic and strategic ramifications of Bitcoin’s rise and its impact on global power dynamics. The study of how geography, power and politics interact on a global scale is known as geopolitics.

It looks at how geographic elements like land, resources and boundaries affect politics, international relations and how power is distributed among countries. Geopolitical analysis helps people understand the complexities of international relations and the motivations and behaviors of countries in their quest for dominance and influence on the world.

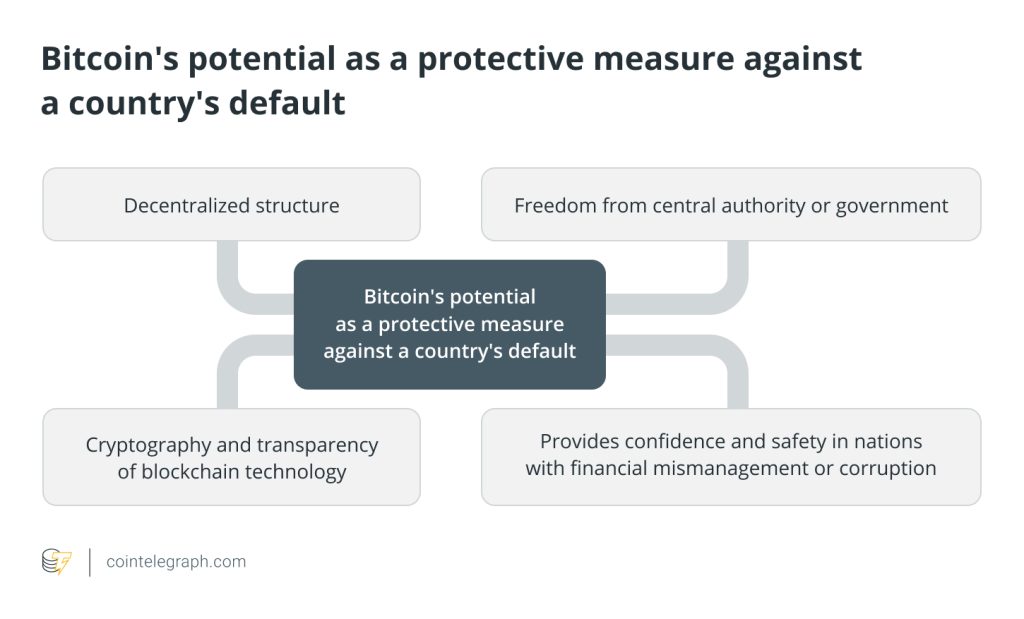

Bitcoin (BTC) raises economic sovereignty concerns linked to national governments’ authority over their currencies. It also affects the dynamics of financial power, possibly transferring influence from established financial hubs to up-and-coming ones that support cryptocurrencies.

Due to the decentralized nature of Bitcoin, regulatory challenges arise that call for diverse approaches worldwide. Bitcoin is linked to geopolitical threats and potential tensions since it can be used for economic warfare or illegal operations while also giving countries a technological edge. Understanding Bitcoin’s geopolitics is essential to understanding how it affects international relations, economic systems and global power dynamics.

The rise of Bitcoin: Disrupting traditional financial systems

The emergence of a peer-to-peer (P2P), decentralized digital currency like Bitcoin has upended established financial structures. Bitcoin runs on the blockchain, a decentralized network that is not governed by banks or governments the way centralized financial systems are. As a result, there is no longer a need for middlemen in financial transactions, enabling global, direct P2P transactions. By giving people access to the global economy, BTC has the ability to empower the unbanked and underbanked masses.

To avoid fraud and guarantee integrity, Bitcoin transactions are recorded on a public ledger that is both transparent and secure. Additionally, Bitcoin offers people more control over their funds by challenging the function of conventional financial intermediaries. Bitcoin offers a different store of value that appeals to those looking for stability thanks to its limited supply and resilience to inflation.

The emergence of cryptocurrencies and blockchain-based applications has been fueled by the ascent of Bitcoin, which has also sparked innovation in financial technology. That said, the disruptive nature of Bitcoin has changed how people think about and interact with money, providing a decentralized and effective alternative to established financial systems.

Geopolitical implications of Bitcoin adoption: Shifting power dynamics

Bitcoin’s global reach has significant geopolitical implications, as it challenges traditional notions of economic control and national borders, as explained below.

Economic sovereignty and control

From a geopolitical standpoint, Bitcoin’s decentralized structure calls into question national governments’ control over monetary systems and economic sovereignty. A country’s capacity to manage and decide on its own economic systems, resources and policies without undue influence or intervention from outside forces is referred to as economic sovereignty.

Governments may see Bitcoin as a possible challenge to their ability to manage and regulate the economy because they are used to doing so. They must figure out how to adjust to this new paradigm and create regulatory frameworks that strike a balance between innovation and control.

Economic power redistribution

The worldwide expansion of Bitcoin also affects the dynamics of financial power. As Bitcoin gains popularity, the long-dominant traditional financial centers might have to compete. For instance, the emergence of cryptocurrency exchanges led to the rise of new financial centers that support cryptocurrencies, which pose a threat to the supremacy of established financial centers like London and New York.

That said, it is possible that new financial power centers will appear, changing the balance of world economic dominance. Geopolitical relationships may reshape as a result of this dynamic, since governments that adopt cryptocurrency may enjoy a tactical edge in some economic sectors and pose a threat to the traditional financial centers’ supremacy.

Regulatory inequality and geopolitical tensions

The regulation of Bitcoin also presents a challenging geopolitical issue. Regulatory inequalities can cause tension between countries because different governments pursue various strategies, such as regulation, acceptance or outright bans. In order to resolve potential problems resulting from contrasting views on the use of Bitcoin and its effects on global financial stability, cooperation and harmonization of rules become crucial.

Geopolitical opportunities and risks

Bitcoin’s global nature also brings with it geopolitical opportunities and risks. On the one hand, it can be seen as a tool for economic warfare, enabling people and organizations to evade sanctions or take part in illegal operations. Governments can be worried about money laundering, funding for terrorism and possible effects on their national security.

However, there is potential for countries to use Bitcoin’s technology and incorporate it into their economic plans, as accepting Bitcoin can boost a country’s competitiveness in the digital economy, encourage investment and promote innovation. Moreover, governments may need to address these concerns and create legal frameworks.

For instance, the Silk Road case, where Bitcoin was used for nefarious activities, brought attention to the risks of unrestrained cryptocurrencies. However, some countries, like El Salvador, perceive an opportunity to expand their economies and encourage financial inclusion by accepting Bitcoin as legal tender.

Financial inclusion and empowerment

Adoption of Bitcoin can empower people in underdeveloped areas by giving them access to a global financial network. For instance, Bitcoin has been utilized by residents of Venezuela, a country with hyperinflation and stringent financial controls, as a way to protect their wealth and gain access to global markets.

By promoting financial inclusion and reducing reliance on conventional banking systems, these actions may change the balance of power in favor of people and communities.

Technological competition and innovation

Countries fight to use Bitcoin’s core technology — blockchain — for purposes other than cryptocurrency. The dynamics of geopolitical power and economic advantages in the digital age may be affected by this fight for technical leadership.

Energy dependence and resource competition

While there are advantages to mining Bitcoin, there are also geopolitical risks involved. Bitcoin mining uses significant processing power, which in turn uses a lot of energy. This has caused mining operations to concentrate in areas with affordable electricity, which frequently leads to a significant dependence on specific energy sources or providers, which has occasionally resulted in competition over resources and geopolitical issues.

For instance, areas with an abundance of fossil fuel resources can attract mining activities, which could exacerbate environmental worries about carbon emissions and climate change. Due to the dependence on energy and the struggle for resources, there may be geopolitical issues, such as possible conflicts over the distribution, control and access to energy.

Related: Bitcoin miners as energy buyers, explained

Economic warfare and sanctions evasion

Bitcoin’s decentralized nature raises concerns about its potential use in evading economic sanctions or conducting economic warfare, influencing geopolitical strategies and impacting relationships between countries.

Influence on international aid and remittances

The use of Bitcoin may have an impact on the flow of remittances and international aid. Bitcoin has the potential to upend established remittance systems and alter the dynamics of global financial flows by offering a more effective and affordable means of cross-border transactions.

Bitcoin and economic sovereignty: Challenges for nation-states

Bitcoin poses problems for states regarding economic sovereignty due to the following factors:

- Decentralization: Because Bitcoin runs on a decentralized network, no government or central organization has full control over Bitcoin transactions and the broader Bitcoin ecosystem.

- Lack of power over monetary policy: To manage their economies, nation-states frequently have the power to conduct monetary policies, such as changing interest rates or creating money. Bitcoin, however, operates on a fixed supply schedule and is not subject to government intervention, making it impossible to dictate monetary policy. The use of monetary policy as a tool for managing the economy by nation-states is constrained due to this lack of control.

- Possibility for capital flight: Bitcoin enables people to send money internationally without the aid of middlemen or conventional financial systems. This may raise worries about capital flight, where people or companies transfer their money outside of the borders of a country, potentially affecting that area’s economic stability and ability to regulate capital flows.

- Regulatory challenges: Nation-states must contend with regulatory obstacles when dealing with Bitcoin. Governments struggle to properly enforce laws and monitor transactions due to Bitcoin’s decentralized and international character. A complicated regulatory environment has resulted from the disparate responses taken by many countries, from embracing Bitcoin to enacting limits or outright bans.

- Money laundering and illicit activities: Because of its anonymity and simplicity in transmitting money, Bitcoin has drawn attention for its potential use in money laundering, terrorism financing and other illegal acts. Governments face the difficult task of combating illegal financial activity without obstructing Bitcoin’s lawful uses.

- Impact on domestic monetary systems: The acceptance and use of Bitcoin can have an impact on a nation-state’s domestic financial systems. There may be a decrease in reliance on traditional financial institutions and fiat currencies as more people and businesses use BTC. This change might make domestic monetary policy less successful and make it harder for the government to maintain control over the country’s monetary system.

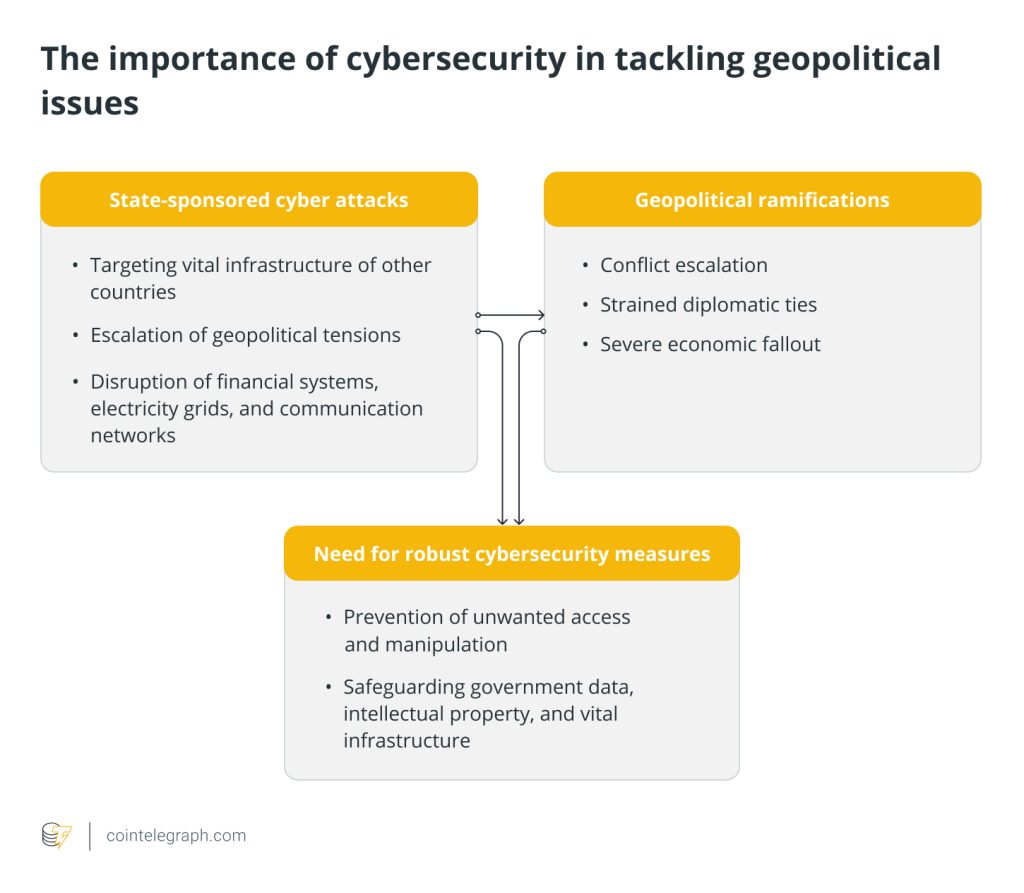

How cybersecurity intersects with geopolitical risks

In today’s interconnected digital environment, cybersecurity is essential for tackling geopolitical issues. State-sponsored cyber attacks are one way that geopolitical tensions between countries might escalate. To gain a tactical edge or disrupt their rivals, governments may target one another's vital infrastructure, such as their financial systems, electricity grids or communication networks.

Such cyberattacks may have important geopolitical ramifications, including conflict escalation, strained diplomatic ties and severe economic fallout. To identify, stop and mitigate these attacks and safeguard a country's most important assets, robust cybersecurity measures must be implemented.

Moreover, cybersecurity is essential for preventing unwanted access to and manipulation of sensitive government data, intellectual property and vital infrastructure. To protect their resources and uphold their sovereignty in the face of potential cyber threats, countries should make significant investments in cybersecurity.

Cyberattacks against vital infrastructure — such as power grids, transportation networks and healthcare networks — can potentially result in geopolitical risks. Essential infrastructure can be disrupted or disabled, which can have far-reaching effects on the economy, the public’s safety and general anarchy. To protect key infrastructure from cyber threats and to uphold the stability and resilience of their countries, governments must prioritize cybersecurity measures.

CBDCs vs. Bitcoin: A clash of monetary ideologies in the geopolitical arena

The rise of Bitcoin and the emergence of central bank digital currencies (CBDCs) have sparked a battle of monetary ideas in the geopolitical sphere. While Bitcoin functions as a decentralized digital currency free from any central authority, CBDCs are a digital version of fiat currency that is issued and regulated by central banks.

Several factors — including monetary policy, financial sovereignty, privacy and the dynamics of global power — are involved in this conflict between CBDCs and Bitcoin, as explained below.

Control and regulation

CBDCs provide central banks with a greater degree of monitoring and control over monetary policy and the financial sector. Governments can use them as a tool to keep an eye on and control transactions, thus enabling policies like negative interest rates and focused economic stimulation.

The traditional centralized control over monetary systems is challenged by Bitcoin, which runs on a decentralized network. Users have more financial autonomy thanks to its peer-to-peer architecture and cryptographic features, which can worry governments about regulation and financial stability.

Financial sovereignty

CBDCs are backed by a central bank in an effort to increase national financial sovereignty. Countries can improve their internal economic resilience, lessen their reliance on foreign currencies and improve their standing in the international financial system.

Bitcoin challenges the idea of sovereignty related to national currencies by providing an alternative to existing fiat currencies. Due to its worldwide reach and borderless transactions, it may undermine current financial systems and have an impact on how countries balance their geopolitical power.

Privacy and surveillance

CBDCs raise privacy and surveillance issues since they make it easier for governments to detect and monitor transactions. While supporters claim that this can help stop illegal activity, detractors point out the possibility of abuse and invasion of personal privacy rights.

Since Bitcoin is pseudonymous and gives some level of privacy, it appeals to people who want to be financially independent. However, the public ledger that underpins Bitcoin transactions is publicly accessible for analysis, and privacy issues persist.

Global power shifts

The conflict between CBDCs and Bitcoin has the power to alter the balance of power on the planet. As large economies’ currencies become more accessible and digital, they may become more dominant as a result of CBDCs. This might put smaller economies and their currencies under pressure.

On the contrary, Bitcoin offers people and countries the opportunity to engage in the global economy without relying on conventional financial intermediaries because it is a decentralized form of money. By empowering areas or people with little access to financial services, it may weaken the influence of existing financial hubs.

The future of Bitcoin

Global power players will face both opportunities and challenges from Bitcoin in the future as the decentralized digital currency continues to disrupt the world’s financial system. Due to its unique features and disruptive qualities, Bitcoin has the ability to upend established power structures and bring about a paradigm shift in how people view and use money.

While it promotes financial inclusion, acts as an inflation hedge and allows for frictionless cross-border transactions, it also threatens established power structures, raises regulatory concerns, endangers financial stability and has an impact on the overall global financial system. The role of Bitcoin in the international financial system and its effects on the geopolitical environment will be shaped by how major international parties respond to these opportunities and risks.

Some countries might take a proactive stance by creating regulatory frameworks that strike a balance between consumer protection and innovation. To improve their financial systems, some countries are already experimenting with CBDCs or working with blockchain technology.

Others might adopt a more circumspect approach, choosing strict rules and possible prohibitions to reduce the alleged risks related to Bitcoin. They might prioritize preserving control over monetary policies and bolstering established financial structures.

However, the rising popularity of Bitcoin has the potential to upend the current financial system and challenge traditional currencies and institutions. This might result in a redistribution of economic influence and power, which would have an impact on international trade dynamics and country-to-country geopolitical ties.

Written by Onkar Singh

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2431/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2431/ […]