An overview of the cryptocurrency regulations in Asia

Between July 2020 and June 2021, cryptocurrency in Asia experienced rapid and enormous growth, with transactions soaring 706% in Central and South Asia, and a value of $572.5 billion, equal to 14% of the global transactions’ value.

The region has always been avant-garde in technology, and the trend has been confirmed by the prompt adoption of cryptocurrency and blockchain. With nearly half of the global crypto trades occurring in Asia, regulators inevitably had to start paying attention, primarily due to the increasing number of companies offering crypto-related services.

This article will run through the legal status of the industry in Asian countries and the different government regulations and standards as well as their implications for cryptocurrency and its holders.

Which countries have regulated or banned crypto in Asia?

Currently, crypto laws and regulations are inconsistent in Asian countries. The regulatory framework is fragmented and varied across the board.

Some countries like China have banned cryptocurrency mining amid concerns over energy consumption. Along with Bangladesh, China has also issued strict bans on cryptocurrency trading and other crypto-related activities.

North Korea has used cryptocurrencies to evade sanctions from the West and fund its nuclear missile program. However, their regulatory framework for retail and institutional investors is very unclear to the rest of the world.

Bhutan has partnered with Ripple (XRP) to develop their central bank digital currency (CBDC), while Myanmar’s shadow government has recognized stablecoin Tether (USDT) as legal tender.

Crypto regulations in Singapore and Thailand appear milder than in other countries. Still, the crackdown on the crypto economy is felt particularly in matters pertaining to Anti-Money Laundering (AML), Counter-Financing Terrorism (CFT) and licensing, which have become more stringent in recent months.

In the Philippines, cash remittances represent more than 9% of the total gross domestic product, and cryptocurrencies have become a cheap way to send money in and out of the country, especially for the unbanked population who need only an internet connection and a smartphone to execute transactions.

In Indonesia, legally specified cryptocurrencies are recognized as trading commodities, not as a means of payment, and banks are forbidden to encourage the use of cryptocurrency as a form of payment. Cryptocurrencies have to comply with risk assessment, AML and CFT requirements.

The country has recently experienced a rise of 280% in crypto investors, from 1.5 million to 4.2 million, and a daily trading volume of roughly $117.4 million, and has issued a “fatwa” to its Muslim population against cryptocurrency use.

Some well-established cryptocurrency businesses are based in Asia. Investment platform Crypto.com and stablecoin service provider Tether are settled in Hong Kong, while Singapore is experiencing an unprecedented upsurge of companies involved in crypto.

The overall perception is that most Asian countries recognize the benefits of cryptocurrency adoption, including low transaction costs, particularly for remittances, and the introduction of blockchain technology into their public services, like in Cambodia.

They are, however, concerned about the implications of cryptocurrency in terms of money laundering and terrorism financing, and demand more rigid rules to protect customers from speculative trading activities and businesses from risky financial investments.

The quick rise of cryptocurrencies has taken many countries by surprise. Some have only recently undertaken a regulatory approach towards cryptocurrencies, while others have not yet introduced clear legislation.

Japan

Japan is one of the most crypto-friendly countries in Asia. Its government regulators recognize Bitcoin and other cryptocurrencies as a type of money and legal property.

How is cryptocurrency regulated in Japan? The industry is regulated by the Financial Services Agency (FSA), which manages transactions in the country’s currency, the yen. The Japanese Payment Services Act provides a regulatory framework for payment services and regards crypto assets as payment methods. Owning and investing in cryptocurrencies enjoys no restrictions.

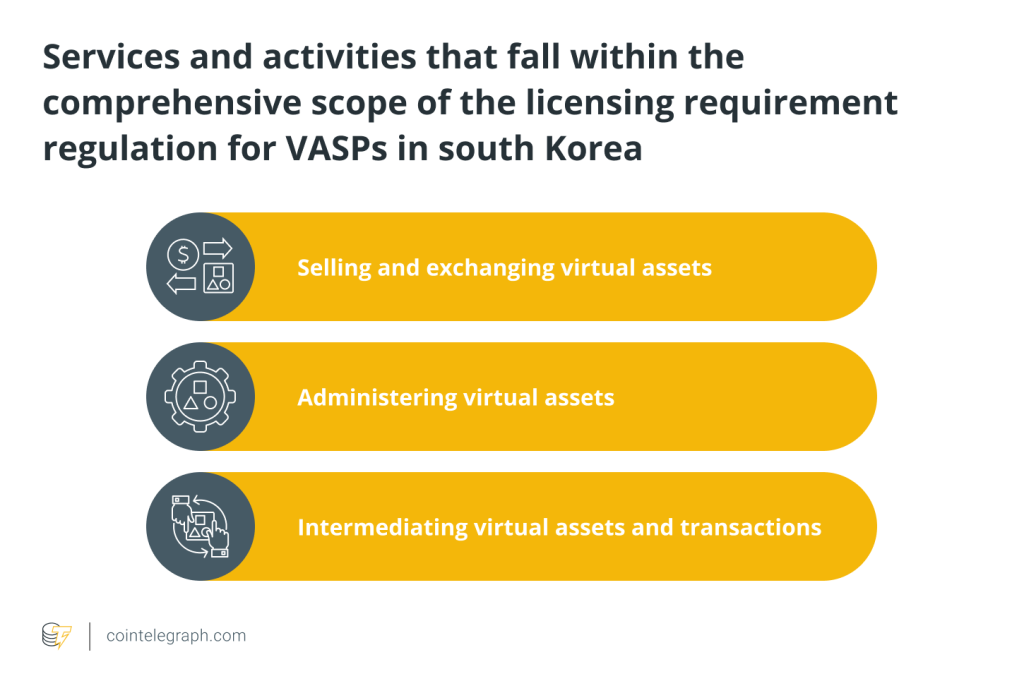

The Payment Services Act also defines crypto exchange providers as businesses that carry out the following:

-

The sale, purchase and exchange of crypto assets;

-

the intermediating, brokering or acting as an agent for the trading of crypto assets;

-

the management of customers’ money in connection with the activities mentioned above; and

-

the management of crypto assets on behalf of another person.

Like many other countries, Japan regulates cryptocurrency under AML and CFT measures. Exchange providers are subject to cryptocurrency scrutiny by the authorities as outlined in the Guidelines for Anti-Money Laundering and Combating the Financing of Terrorism, enforced as of February 2021.

India

The government of India has considerably changed its standpoint on cryptocurrency regulation over the years. In 2016, the country imposed a complete ban on all crypto-related activities, from mining to buying, selling and holding assets.

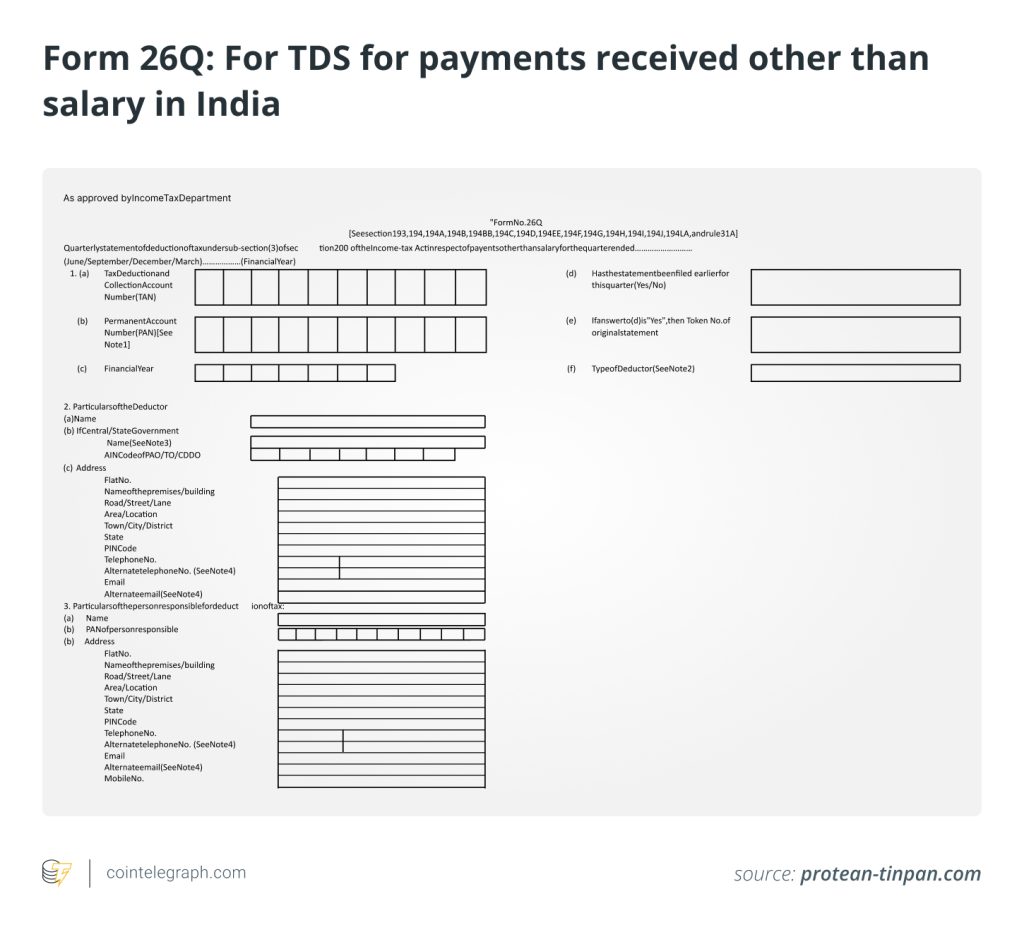

More recently, it has considered regulating the industry in an upcoming Cryptocurrency and Regulation of Official Digital Currency Bill, which outlines a clear distinction between cryptocurrencies and the types of crypto-related activities allowed.

Generally speaking, the country's approach will be to protect both retail and institutional investors from fraudulent activities and speculative operations. Under specific guidelines, exchange platforms will be allowed to work as crypto providers for customers' sales, purchases and storage services.

The government is also reconsidering the tax implications on cryptocurrency and exploring ways to generate revenue from crypto, and the new bill should provide more clarity on the matter.

The new regulation was expected to be approved during the 2021 winter session of parliament. However, closer scrutiny and the likely implementation of a CBDC have delayed its introduction.

Singapore

Cryptocurrency trading and possession of digital assets are legal in Singapore. The country has long been one of the world’s leading countries to encourage blockchain development and the innovative application of cryptocurrencies in beneficial use cases.

However, the Monetary Authority of Singapore (MAS) has recently cracked down on retail cryptocurrency advertisements for companies that offer crypto-related services to protect investors from a risky allocation of their money and the assets’ volatility. The measure included outlawing crypto ATMs, considered advertisements to the public.

How does Singapore regulate crypto? Strict AML and CFT regulations were handled by the MAS in Jan. 2020 and further restricted in 2021. They are outlined in the Guidelines to Notice PSN02 to stop the illegal transfer of crypto funds through Singapore, and it is applied to digital payment token (DPT) service providers. In 2021, the scope was extended to the provision of custodial wallet services for DPTs.

Licensing requirements for Virtual Assets Service Providers (VASPs) in Singapore are delineated in the Payment Services Act 2019. Companies who want to get involved in the crypto business need to apply with the MAS, and only when licensed, can they operate their business. They must have their primary location in Singapore and be compliant with AML/CFT requirements.

Thailand

The rapid growth of cryptocurrency businesses and trading has signaled the need for Thai authorities to regulate the industry to mitigate financial risks for investors and companies, including assets’ volatility, cyber theft, personal data leakage and money laundering.

Regulators want to prevent businesses from enabling the use of crypto as a means of payment for goods and companies, as outlined by the Bank of Thailand, the Securities and Exchange Commission and Ministry of Finance in a joint press release.

They believe the widespread adoption of crypto assets could threaten the country’s economic and financial stability. Thailand’s central bank announced will trial a central bank digital currency (CBDC) in 2022 to mitigate further the threat of crypto to the country’s financial system.

Due to the rapid growth of digital assets’ adoption in the country, Thailand has imposed a 15% capital gains tax on profits from cryptocurrency trading as a way to gain some revenue from the industry.

The tax is applicable by the Royal Decree and the Amendment of the Revenue Code and will be enforced starting from the 2022 financial year. At present, there’s no clear tax regulation that regards corporate entities.

Malaysia

Cryptocurrency is legal and regulated in Malaysia by the Security Commission (SC) under the Capital Markets and Services Order 2019. It is considered a security and is therefore subject to Malaysia's securities laws. Cryptocurrencies and tokens are not regarded as legal tender or payment instruments by the Bank Negara Malaysia, Malaysia’s central bank.

On October 28, 2020, the SC published new guidelines on digital assets for crypto providers who want to raise funds through token offerings, but also for entities that want to run an Initial Exchange Offering (IEO) platform and those who intend to provide storing and custody services of digital assets.

All companies that want to raise funds with token offerings must use approved and regulated crypto assets exchanges that facilitate initial exchange offerings (IEOs). Such exchanges are required to conduct due diligence on the issuer, who must be a Malaysian corporation with its primary business operations in Malaysia and comply with AML and CFT laws.

Two prominent names in the cryptocurrency exchange space, Binance and eToro, are not allowed to operate in Malaysia because they don’t comply with its security laws.

At present, Malaysia does not have a tax framework for crypto businesses, and no capital gains tax is enforced to sell investments or capital assets.

However, companies with digital assets as their primary business activity may be liable for income tax, while crypto exchanges are subject to corporate income tax.

China

How is cryptocurrency regulated in China? The country applies the strictest regulation in terms of cryptocurrency. It’s a blanket ban on all crypto-related activities, and all companies are banned from providing cryptocurrency services, from mining to trading and issuing cryptocurrency.

Such activities are considered illegal financial activities by the People’s Bank of China and government bodies. In September 2021, the country announced further strict measures to combat cryptocurrency adoption in China, including further scrutiny of the companies supervising the regulations.

China is not new to banning crypto-related activities. The first ban dates back to 2013 when the country banned banks from running crypto transactions. In 2017, the ban that initially crashed cryptocurrency value was an explicit prohibition of initial coin offerings (ICOs) and a tough crackdown on crypto exchange businesses. In the aftermath, the country had adopted a milder approach for a few years but recently resorted to a straight ban again.

Why is bitcoin illegal in China? China used to host over 50% of Bitcoin mining hashing power, and mining facilities represented good revenue for the local economies. The drastic ban on mining in June 2021 with the official reason to reduce carbon emissions had a dramatic effect on the mining industry initially.

It caused a massive exodus of miners from China to more crypto-friendly countries where electricity is cheap. Chinese giant merchant Alibaba announced it would ban all sales of cryptocurrency mining rigs. However, the country has recently revealed plans to create a CBDC. They understand the need for a digital currency, but decentralization is not on the table.

Hong Kong

The government of Hong Kong has pursued a relaxed attitude towards cryptocurrency for years because they are virtual commodities and not legal tender, money, or payment methods. As such, they do not fall under the Hong Kong Monetary Authority supervision.

Is cryptocurrency, however, regulated in Hong Kong? Moving forward, the country will be looking at more stringent regulations that restrict retail crypto trading and investing, making licensing mandatory for crypto-related trading businesses and limiting the activity to only professional traders and investors.

The Securities and Futures Commission (SFC) of Hong Kong has so far granted licenses to any entity that offers crypto trading, provided they fall under the definition of “security” or “futures contracts.”

In 2020 and again in 2021, Hong Kong’s Financial Services and Treasury Bureau announced plans to introduce a new licensing regime that will require all crypto exchanges to be licensed by the SFC and in compliance with AML and CFT regulations.

The restriction on retail investors’ access to cryptocurrency is expected to bring turmoil to the Hong Kong crypto economy while underdelivering on the pledge to protect customers, who might end up using foreign service providers and potentially, more exposed to scams.

Vietnam

Vietnam is undergoing a large-scale transition into digital and electronic payments, increasingly favoring cash-less methods and encouraging apps, QR codes and e-wallets.

Within this framework, cryptocurrencies appear as an attractive payment method, especially considering that one million Vietnamese are reported to be using cryptocurrencies, and the figure is only expected to move up considerably within the next few years.

With such an increase in popularity, there has been an inevitable rise in the number of criminal activities like hacks and cyber scams; hence, the need to regulate the industry with more legal implications for those who operate within crypto-related businesses.

How is cryptocurrency regulated in Vietnam? Generally speaking, Vietnam does not recognize Bitcoin and other similar cryptocurrencies as legal means of payment and actually wants to ban their use. The State Bank of Vietnam also banned cryptocurrency issuance and supply, and law-breakers face fines of up to $8,700 and imprisonment.

However, owning cryptocurrencies as an investment is tolerated for the time being. It’s only their use as a means of payment that is prohibited. The grey regulatory framework has not protected investors, especially retail investors, exposed to a high risk of fraudulent activities.

In 2020, Vietnam’s Ministry of Finance appointed a research group to begin an in-depth study of cryptocurrencies to reform the industry from a legal perspective.

Overall, the group will study the cryptocurrency industry and provide recommended guidelines that allow governing bodies to suspend or revoke licenses, regulate business practices and report suspicious activities such as money laundering, hacking, anonymous financing and other illegal activities. Additional revenue for the country will come from the taxation of cryptocurrency trading.

Pakistan

According to the Federation of Pakistan Chambers of Commerce and Industry President Nasir Hayat Magoon, cryptocurrencies constitute investors’ assets for as much as $20 billion, urging the country to provide a regulatory framework within the next few months.

Like other countries, Pakistan has adopted different approaches to cryptocurrency over the years. A statement from the central bank of Pakistan in 2018 had demanded that banks and payment providers refrain from engaging in any crypto-related activity.

Is cryptocurrency regulated in Pakistan, and how? In November 2020, the Pakistan Securities and Exchange Commission published a document that contained guidance on a potential regulatory foundation outlined in collaboration with the Financial Action Task Force. The overall approach of Pakistan towards cryptocurrency and blockchain has since been open to the benefits of the technology and its innovative offering without the need for strict regulations.

Recently, a new ban on cryptocurrency has been discussed by the State Bank of Pakistan and the Federal Government in the aftermath of the China ban to tackle investors’ risk of using crypto exchanges like Binance who do not comply with the country’s AML regulations. The world’s largest crypto exchange was also linked to a multi-million-dollar crypto scam in the region.

As the crypto industry thrives across the region, we can expect other Asian countries to regulate the market soon.

… [Trackback]

[…] Here you can find 98707 more Information on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Here you will find 72973 more Info to that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Here you can find 47204 additional Information on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Here you can find 86713 additional Info on that Topic: x.superex.com/academys/beginner/2385/ […]

… [Trackback]

[…] Here you will find 87410 additional Information on that Topic: x.superex.com/academys/beginner/2385/ […]