The digital euro and its impact on the current financial system: An overview

Digital euro explained: Is the digital euro based on blockchain?

The advent of digital crypto assets like Bitcoin (BTC) in 2008 and the underlying distributed ledger technology (DLT) has prompted central banks worldwide to consider digitizing the monetary system and introducing central bank digital currencies (CBDCs). The Bank of England was a forerunner in this trend, examining the possibility of introducing its own CBDC as early as 2014.

The concept has grown in popularity in recent years, with Meta (formerly Facebook) announcing in the summer of 2019 that it would create a digital DLT-based global crypto asset backed by numerous fiat currencies and government bonds.

The cryptocurrency initiative by Meta, which was formerly known as Libra before being rebranded Diem, came under intense criticism from international regulators and central banks due to concerns about the social media giant’s influence over monetary sovereignty.

In response to the growing influence of Big Tech companies in the realm of digital currencies and to safeguard monetary sovereignty, central banks around the world proposed the development of CBDCs.

A digital euro is one such project (based on blockchain) that aims to ensure that European residents have free access to a simple, generally acknowledged, safe and trusted means of payment in the digital era.

Furthermore, DLTs, such as blockchain technology, are frequently thought to constitute the technological foundation for digitizing the monetary system and adopting a CBDC in public discourse. The delivery and payment of assets can be organized on integrated platforms, which is a significant argument in favor of employing DLT.

This article will explore the digital euro project, its impact on the future of Europe and the current financial system.

The idea behind a digital euro

Central banks, like the European Central Bank (ECB) in the eurozone, oversee the production of physical currency issued based on their monetary policies. However, the money in bank accounts isn’t directly issued by the central bank. In case of a bank collapse, there’s a risk of losing funds deposited in these accounts.

Under such circumstances, systems like the Dutch Deposit Guarantee Scheme in the Netherlands come into play to safeguard a portion or all of the deposited funds. This scheme offers protection, easing concerns about potential losses during uncertain financial times, such as a crisis. Nevertheless, in the Netherlands and many other countries, physical currency has diminished in recent years.

In the last 10 years, electronic payments have grown dramatically. That is why the ECB and other central banks have been researching the prospects for cash that only exists in electronic form — like the digital euro — for some time. But what would a digital euro mean?

The digital euro would still be a euro — the official currency of the EU. It would function similarly to banknotes, but it would be a digital currency issued by the Eurosystem, which comprises the ECB and national central banks, and it would be made available to all citizens and businesses. However, a digital euro would not replace cash but operate alongside it. The Eurosystem will continue to ensure that users can get cash anywhere in the eurozone.

Progress of the digital euro

The Eurosystem initiated a two-year investigation in October 2021 to explore digital euro possibilities, examining its distribution and impact on the economy and society. Progress reports were subsequently published, including:

First progress report on the digital euro investigation phase

The report highlighted approved design options and progress in the digital euro project’s inquiry phase endorsed by the ECB’s Governing Council. Investigations included peer-to-peer and third-party validation for payments, privacy enhancements and measures to prevent excessive investment use.

Second progress report on the digital euro investigation phase

The second report outlined extensive engagement with stakeholders, clarifying roles for supervised intermediaries in distributing and managing the digital euro. The design aimed to limit Eurosystem involvement in user data processing while ensuring controlled issuance and settlement.

As per the report, supervised intermediaries would handle user-facing operations, account management, compliance checks, and conversions to and from digital euros. Users would retain the choice of converting bank money or cash to digital euros.

Third progress report on the digital euro investigation phase

The third report detailed that the European Commission planned to propose a digital euro regulation in the second quarter of 2023. The Eurosystem was prepared for necessary design adjustments, aiming for a timely launch upon legal adoption.

It outlined access, holdings, onboarding and distribution aspects for euro area residents, merchants and governments initially, expanding to non-resident citizens and broader European Economic Area consumers later. Holding limits for individuals, zero-holding limits for merchants and governments, and smooth payment mechanisms were also proposed.

Fourth progress report on the digital euro investigation phase

The fourth report outlined the Eurosystem’s principles for a digital euro compensation model, covering ongoing work, prototyping results and market research in Q2 of 2023. It emphasizes free basic services for citizens and fair compensation for intermediaries.

Additionally, the Rulebook Development Group progressed on use cases, user journeys, scheme compatibility, identification and infrastructure requirements for the digital euro. The European Commission’s draft regulation supports a digital euro framework and strengthens the legal status of euro cash, with the ECB ready to offer technical support.

Status of the digital euro in November 2023

The ECB’s Governing Council approved the digital euro project’s transition to the preparation phase on Oct. 18, 2023. Starting on Nov. 1, 2023, this two-year phase aims to finalize rules, select development providers and test the digital euro’s functionalities. It prioritizes meeting Eurosystem requirements and user needs, emphasizing aspects like user experience, privacy, financial inclusion and sustainability.

However, this shift doesn’t equate to a definitive decision on issuing the digital euro. The Governing Council refrains from such determinations until the European Union completes its legislative processes. The ECB remains flexible, ready to adapt the digital euro’s design as needed based on legislative outcomes. Actual decisions regarding issuance will hinge on these legislative conclusions, ensuring alignment between the digital euro’s development and regulatory requisites.

Advantages of a blockchain-based euro

As per the ECB, a digital euro aims to offer the following benefits:

Programmability and automation of money

Smart contracts and peer-to-peer (micro) payments, for example, between machines, can be implemented in euros and do not require the use of volatile or uncontrolled crypto assets. Smart contracts would allow Internet of Things (IoT) devices linked to the DLT, including machinery, automobiles and sensors, to offer services on a pay-per-use basis. In the context of the machine economy, a DLT-based payment system is thus very promising.

DLT is also well-suited to equip millions of IoT devices with a computer chip and, as a result, their digital wallet. Devices would be able to send digital euros straight from wallet to wallet, and they would be able to receive and send money on their own.

Resistance to manipulation

Because transactions are kept on several computers simultaneously, it is impossible to falsify or change transaction data later. This resistance to manipulation has significant benefits, particularly when all parties must have the same degree of knowledge but do not necessarily know and trust each other.

Security

Data is often stored centrally in the present financial system on the servers of a third party, such as a (central) bank. However, while using DLT, transaction data is saved on many computers simultaneously. Because there would be no single point of failure, decentralized data storage would make the system more resistant to hacker attacks.

Efficiency gains

Furthermore, significant efficiency gains could be realized in the case of a peer-to-peer DLT euro system. The payment system might be considerably simplified, eliminating the need for multiple intermediaries such as clearinghouses.

Consequently, the payment system’s expenses would be greatly reduced, and transactions would be processed much faster. Significant efficiency improvements, particularly for cross-border payments, would ensue.

For example, international transfers from Germany to Argentina might take up to 10 days and can cost up to 10% of the total amount sent in fees. Moreover, even between distinct currency zones, the usage of DLT technologies could enable fast settlement at meager transaction costs.

Risks associated with digital euro

The introduction of a digital euro, while promising numerous benefits, also presents certain inherent risks.

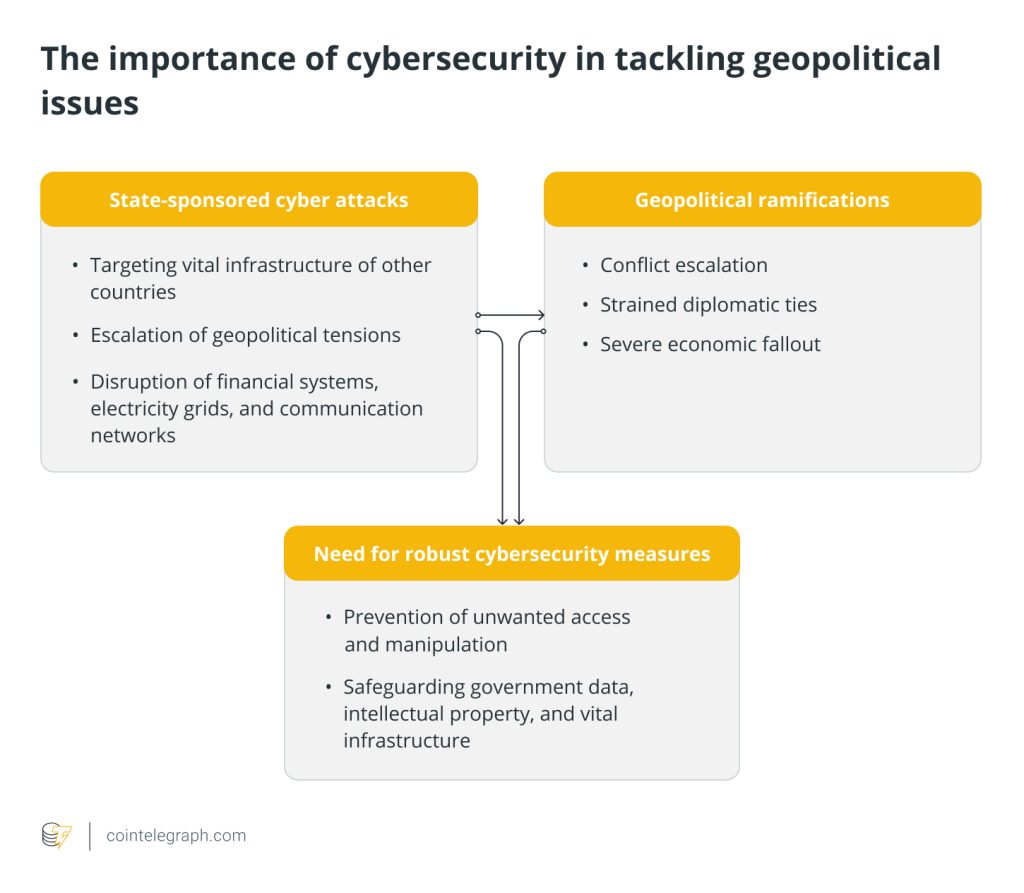

Cybersecurity

Cybersecurity emerges as a primary concern, as the digital realm is susceptible to hacking, data breaches and cyber threats. Safeguarding user information, transactional privacy, and the entire digital infrastructure becomes paramount to prevent potential cyberattacks.

Financial stability and systemic risks

Moreover, there are concerns about financial stability and systemic risks. The digital euro’s widespread adoption might impact traditional banking systems, potentially leading to shifts in deposit behavior and the functioning of monetary policy. Balancing the innovation of a digital currency with the stability of financial systems is crucial to mitigate these risks.

Privacy

Privacy is another significant consideration. The digital euro’s implementation could raise questions about user privacy and surveillance, necessitating robust frameworks to ensure confidentiality while still meeting regulatory requirements.

Operational and technical challenges

Lastly, the possibility of operational and technical challenges cannot be overlooked. Issues regarding scalability, network efficiency and ensuring widespread accessibility need careful consideration to prevent disruptions and ensure smooth functionality of the digital euro ecosystem. Comprehensive risk management strategies and robust regulatory frameworks are essential to address these potential risks effectively.

Will a central bank DLT system be structured like a Bitcoin network?

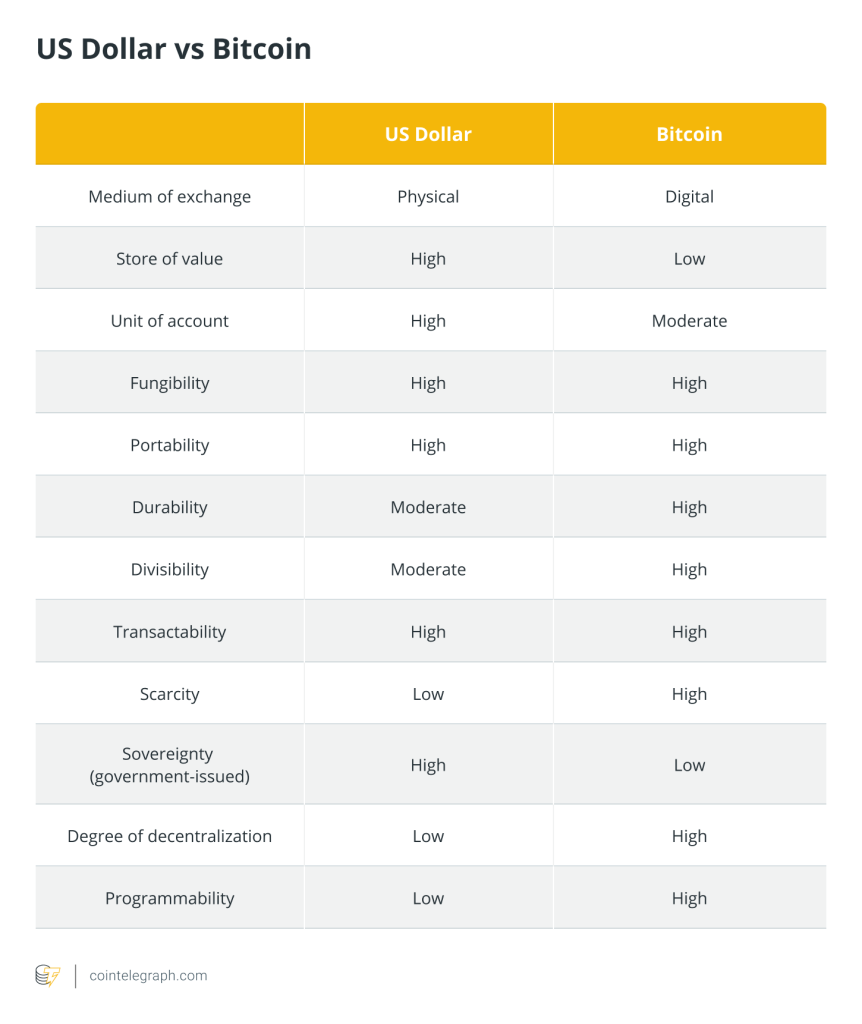

A central bank’s DLT system differs significantly from a decentralized network like Bitcoin. While both leverage DLT, a central bank’s system operates with distinct control mechanisms, emphasizing permissioned access and centralized oversight.

Unlike Bitcoin’s decentralized and anonymous nature, a central bank’s DLT is typically permissioned, ensuring controlled access to authorized entities. It employs governance structures, often restricting participation to authorized users, ensuring compliance and allowing intervention when necessary.

Is there a euro stablecoin?

Several euro-backed stablecoins exist, such as Tether’s EURt, which aims to maintain parity with the euro’s value. These stablecoins are pegged to the euro’s value and are often backed by reserves held in euros. They aim to provide stability and facilitate transactions within the digital ecosystem.

They serve as digital representations of the euro, offering potential benefits in terms of speed, accessibility and interoperability within blockchain networks while attempting to minimize the volatility inherent in other cryptocurrencies.

However, stablecoin depegging events signify the detachment of these digital assets from their intended pegged value, often tied to fiat currencies. These incidents occur due to reasons like insufficient reserves, regulatory pressures or market shifts, creating uncertainties for users and investors.

How would a digital euro impact the current financial system?

Money inventions have challenged and transformed the structure of financial systems throughout history. Innovations have sparked debates about the risks and benefits they offer and the role of central banks in restoring faith in money from time to time.

In this context, a digital euro would attempt to foster digitization while maintaining people’s freedom of choice regarding how they pay, ensuring their payments are competitive and secure. In addition, it will make the current financial system more secure, accessible and simple to use and promote financial inclusion. However, privacy protection would be a top priority, assisting in maintaining payment trust.

The digital euro will lower transaction costs and promote economic digitalization while ensuring that central bank money stays at the heart of the financial system, providing stability. A digital euro might potentially catalyze on a global scale. It might generate much-needed efficiency advantages in cross-border payments by providing interoperability with international digital currencies, including other CBDCs.

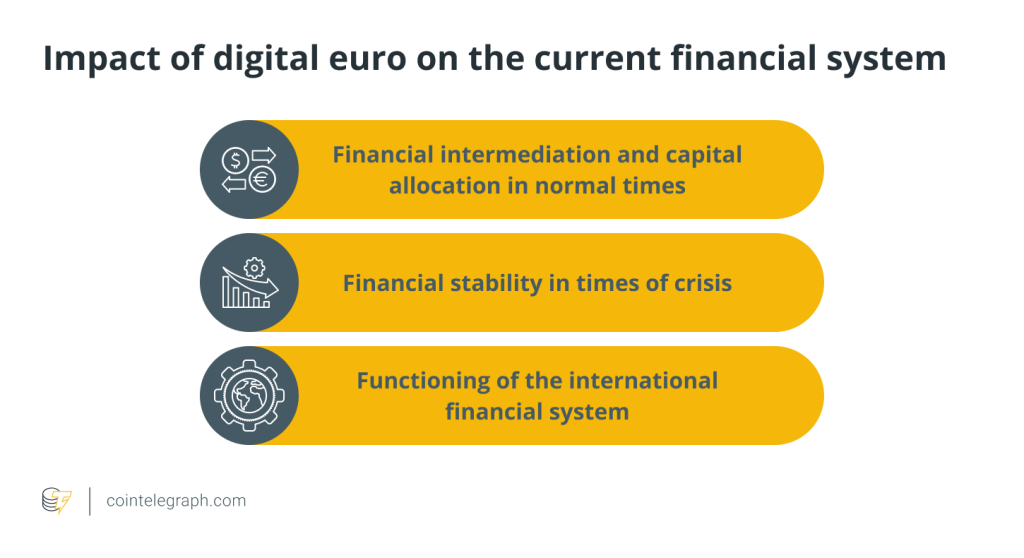

Surprisingly, a digital euro could be too successful. Its main strengths — safety and liquidity — could affect monetary and financial stability on three fronts if not adequately designed:

Effects on financial intermediation and capital allocation in normal times

A digital euro could have several implications for financial intermediation. First, it can draw payment activity from banks while reducing payments-related revenue and consumer information.

Secondly, it may attract deposits, mainly if it was issued without restrictions on individual ownership. The public could transfer vast sums of money from commercial banks to central banks at such enticing terms. The fear is that this will result in less stable and expensive finance, reduced bank profitability and, eventually, less lending, limiting real-economy financing.

Problems during crisis

A digital euro would provide access to a safe liquid asset that could be stored in vast quantities and at no cost, unlike cash and without design limits. Indeed, if not correctly structured, a digital euro in times of crisis might speed up “digital runs” from commercial banks to the central bank. This risk may even be self-fulfilling, causing savers to withdraw money from their bank accounts and exacerbating volatility in normal times.

Impact on the international monetary system

The introduction of a digital euro that is available to non-residents might make the single currency more appealing as a safe means of payment for cross-border retail transactions. In addition, it can reduce inefficiencies in cross-border payment infrastructures and make remittance transfers easier.

However, if a digital euro is not constructed to prevent it from being used as a form of investment, these advantages may come at the expense of amplifying international shocks.

Because a digital euro would be highly liquid, foreign investors would use it disproportionately and rebalance much more forcefully into or away from it in response to shocks, resulting in higher exchange rate volatility and a harsher impact on foreign financial conditions.

The digital euro and the future of Europe

The digital euro will be similar to banknotes, backed by the ECB, which is the strongest guarantee conceivable because the central bank cannot fail. It is a form of sovereign money. It will face competition from cryptocurrencies, which are not money and, above all, private company-created stablecoins.

However, banking intermediation, financial stability and the international financial system are three of the digital euro’s significant issues, with no obvious answer in sight. The same applies to protecting its users’ personal information. It’s also essential to ensure that, unlike cryptocurrencies, the digital euro doesn’t increase greenhouse gas emissions by consuming too much electricity. Therefore, the transition will be challenging, so beginning cautiously or on a trial basis is critical.

The ECB disclosed a two-year preparatory phase for the European CBDC, anticipating a digital euro launch by 2026. This strategic move poses risks in the payment sector while potentially unlocking promising opportunities throughout Europe.

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Here you can find 99226 more Info on that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] There you will find 89541 more Information on that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Here you will find 35995 additional Info to that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] There you will find 88788 additional Information on that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2377/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2377/ […]