A beginner’s guide to blockchain and cryptocurrency regulation in Canada

Canada toward cryptocurrency adoption

Counted among the first countries to recognize the potential of digital assets and include them into law way back in 2014, Canada has always adopted a balanced approach toward cryptocurrencies with well-defined rules that have made the country an ideal destination for blockchain-based companies.

The country has established clear rules, regulations and disclosure requirements for entities dealing with cryptocurrencies or that are involved in their issuance. As a result, there are hundreds of crypto businesses in Canada developing decentralized apps (DApps), providing blockchain expertise and services centered around building Web3. Crypto exchanges such as Bitbuy and Newton are just some of the examples of crypto firms that are based in Canada.

The Canadian Securities Administrators (CSA), an influential organization in the country, has established the CSA Regulatory Sandbox to stimulate entrepreneurial development and welcomes companies engaged in a cryptocurrency business to register with them.

Upon attaining membership, such firms can test their products and services in the Canadian market while seeking exemption relief for a limited time duration. They have the advantage of being under CSA’s surveillance and compliance reviews, thus providing a collaborative and community-based approach towards incubating blockchain-focused companies such as cryptocurrency issuers, trading platforms and others innovating in this niche technology space.

Do Canadian banks allow cryptocurrency?

While cryptocurrencies are not considered legal tender in Canada, the country does have an ever-increasing network of Bitcoin (BTC)-friendly ATMs and has generally treated these digital assets without much censure, subject to entities dealing with them meeting all defined federal and state regulations.

The country even conducted a research initiative called Project Jasper to study the feasibility and propose a payment system employing distributed ledger technology (DLT), with the Bank of Canada performing the role of a notary for critical functions such as transferring value and settling payments with limited liquidity requirements.

This project has been a landmark of sorts, being the first time in the world that a central bank came together with private sector participants such as the Bank of Montreal (BMO), Royal Bank of Canada (RBC), National Bank of Canada (BNC), TD Canada Trust, Canadian Imperial Bank of Commerce (CIBC) and HSBC to test the efficiency of DLT for the clearing and settlement of high-value interbank payments.

Moreover, the Bank of Canada has even teamed up with MIT Media Labs’ Digital Currency Initiative (DCI) team to study how advanced technologies could impact the design of central bank digital currencies (CBDCs).

Banks such as the Toronto- Dominion Bank (TD), RBC and CIBC, among others, are some of the many Canadian banks that deal with cryptocurrencies through Interac e-Transfers, a funds transfer service used by banks and financial institutions in the country.

Users are expected to link their bank account with a cryptocurrency exchange to buy digital assets using Canadian dollars or other popular fiat currencies. As a result, crypto exchanges such as Coinsmart, Coinbase and Binance are legal in Canada as long as they follow federal, state and provincial laws. For example, despite being legal in other parts of Canada, Binance doesn’t operate in the state of Ontario as it doesn’t comply with certain provisions of the Ontario Securities Law.

With the increasing popularity and use of cryptocurrencies, Canadian banks have established 2,645 Bitcoin ATMs to facilitate fiat-to-crypto transfers. Most of them are located in the cities of Toronto and Vancouver.

Is cryptocurrency regulated in Canada?

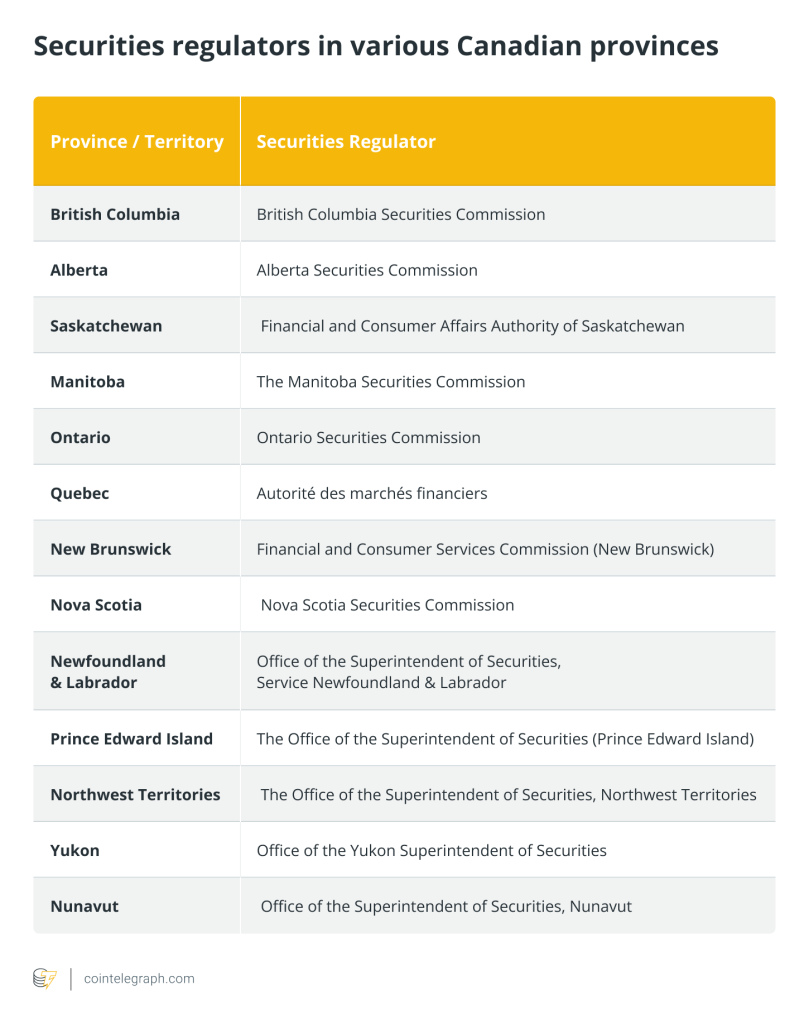

Digital assets such as cryptocurrencies are treated as securities in Canada and hence regulated under the various security laws enacted by securities regulators in the country. These laws are not federal in nature, instead being enacted on a provincial and territorial level, and all of the securities regulators are represented by the CSA.

However, these laws are largely consistent throughout all provinces and territories, with them being applicable for entities involved in the distribution of securities and those using them in a particular jurisdiction.

Thus, platforms such as cryptocurrency exchanges that facilitate the buying and selling of crypto assets or which hold these assets on behalf of the owners are required to be registered with the respective Canadian securities regulator.

Such businesses are subject to continuous disclosure obligations and provide for many investor protection considerations, even if they do not necessarily qualify as investment funds.

Apart from a basic description of their business, such crypto firms are required to reveal all third-party service providers that they are dependent on, disclose risks associated with their crypto assets, define all measures employed by them to prevent theft or fraud and prove compliance with cryptocurrency accounting and auditing standards that are globally accepted today.

Cryptocurrency laws and regulations in Canada are thus a collection of individual rules applicable for securities, with all cryptocurrency offerings (CCOs) subjected to an “Investment Contract Test” to be classified as a security.

If issuers of a CCO fail to comply with any of these laws, they may be subjected to regulatory action including fines and even being permanently debarred from operating in the country. Despite this, virtual assets regulation in Canada is still not well-defined for certain assets like stablecoins and nonfungible tokens (NFTs), with regulators adopting a case-by-case approach for such offerings.

Nevertheless, regulation of crypto assets in Canada has reached a level so mature that crypto investors, entrepreneurs and established crypto firms vouch for it being one of the most crypto-friendly countries in the world today.

Does Canada allow crypto trading?

While popular cryptocurrencies like Bitcoin (BTC) and Ether (ETH) aren’t legal in Canada as currency, the country allows its residents to trade in these digital assets using an approved cryptocurrency exchange in conjunction with a bank account with one of the many banks that offer cryptocurrency services.

Thus, Canadian residents can buy, sell or exchange BTC, ETH and other altcoins, memecoins and stablecoins, with businesses accepting them as payments for the goods and services they offer.

However, the risks associated with cryptocurrency price fluctuations need to be managed by businesses on their own. The same applies to individuals who decide to hold their savings in crypto tokens rather than fiat currencies like the Canadian dollar (CAD).

The Canada Revenue Agency (CRA), the central body that administers tax laws for the Government of Canada and most of its provinces and territories, does not accept cryptocurrency as a form of payment for taxes from individuals or businesses yet.

This implies that Canada has room to further crypto adoption by allowing its citizens and businesses to pay income and sales tax using crypto tokens, just like how the canton of Zug in Switzerland accepts BTC and ETH for tax payments from local companies and individuals.

Still, the country has been making all the right noises about introducing its own CBDC, with the aim of supporting the vibrant digital economy and bringing innovation to the digital payments market.

If and when Canada does introduce its own CBDC, learnings from Project Jasper will undoubtedly help it in bringing to market a secure and legal form of digital currency.

Is crypto taxable in Canada?

Understanding Canada’s cryptocurrency regulation is incomplete without going into the details of how different cryptocurrency transactions are dealt with in terms of tax treatment. Right from the acquisition of a cryptocurrency to how tax is computed during a sale or an exchange, Canadian tax laws subject cryptocurrencies to similar treatment as commodities such as gold or silver.

If a cryptocurrency is purchased using CAD for the purpose of investing, no tax is applicable apart from the acquisition cost being set for the purpose of calculating the income tax during its sale.

On the other hand, if the cryptocurrency is acquired through mining or in lieu of services provided, the transaction is considered a barter and the CRA applies its position on barter transactions to determine what amount needs to be included as income at the time the cryptocurrency is earned.

On selling a cryptocurrency or even using it to pay for goods, the value in excess of the acquisition cost is to be treated as capital gains for individuals and as business income for entities trading in them. Even in scenarios where a particular crypto token is exchanged for another cryptocurrency, the acquisition cost is to be calculated on the resultant crypto holding and the same is to be used when computing the tax liability during the eventual sale.

For businesses that acquire and sell cryptocurrency in the normal course of their business, all applicable federal, provincial or territorial sales taxes are also eligible for input tax credit (ITC), thus avoiding any duplication of sales tax and ensuring crypto businesses have a clear understanding of any income or sales tax implication.

Furthermore, Canada has the distinction of being the first country to approve the regulation of cryptocurrencies with respect to preventing money laundering. This is done by the Proceeds of Crime Money Laundering and Terrorist Financing Act (PCMLTFA) which provides a framework for entities dealing with digital currencies and eventually treats them as money services businesses (MSBs).

This MSB distinction implies that such companies have to ensure the same robust level of suspicious transaction reporting, thorough record keeping of both parties in every transaction and other registration formalities as applicable to MSBs dealing in fiat currencies. Additionally, any entity that qualifies as an MSB must register with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and have a holistic Anti-Money Laundering (AML) compliance plan that is certified by an independent examiner.

To ensure that investor interests are always protected, all cryptocurrency transfers in excess of 10,000 CAD within a 24-hour window need to be maintained and submitted to FINTRAC, along with compulsory 100% Know Your Customer (KYC) verification to be done for all individuals and businesses dealing in cryptocurrencies.

Moreover, learning from how certain crypto firms have bundled due to financial mismanagement, companies dealing with cryptocurrency futures contracts need to ensure that 50% of the market value of the contracts is maintained daily so as to prevent insolvency proceedings in case of a market crash.

The sheer extent of the various provisions and clearly defined rules for cryptocurrencies sets Canada apart, thereby providing a benchmark for other countries to emulate with the aim of accelerating crypto adoption proactively.

Written by Murtuza Merchant.

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Here you can find 61553 additional Information on that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] There you will find 17441 additional Info on that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Here you can find 43879 additional Information to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] There you will find 10529 more Information on that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Here you can find 47210 additional Information on that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] There you will find 3034 more Info on that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2375/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2375/ […]