An overview of the cryptocurrency regulations in New Zealand

One of the key factors influencing crypto asset regulation in New Zealand is its status as a technology-neutral jurisdiction. This means that any service or technology that requires adherence to regulations can be governed by a law that is not specific to cryptocurrency.

The New Zealand Financial Markets Authority (FMA) is responsible for regulating all financial activities in the country, including cryptocurrencies. While the country maintains a relatively neutral stance toward digital currencies, it has implemented several measures to ensure that all aspects of these technologies and services are appropriately regulated.

For instance, New Zealand considers cryptocurrency a form of property and is thus subject to income tax. This means that if at any point, a cryptocurrency holder disposes of their holdings at a profit, they will be required to pay taxes on that profit. Disposals include selling or trading cryptocurrency, as well as using it to make a purchase.

Is cryptocurrency regulated in New Zealand?

Because most legislations in New Zealand are technology-neutral, no legislation is specifically dedicated to the regulation of cryptocurrencies in the country. However, tax and contract laws apply. The Inland Revenue Department (IRD) declared that cryptocurrencies were to be treated as property beginning in 2018.

According to the IRD, crypto assets were to be taxed based on defined income tax rates — similar to how cryptocurrency is taxed in other countries. This means that anyone who buys and sells cryptocurrencies will be taxed based on the difference between their purchase price and current market value at the time of sale or exchange.

The Financial Markets Conduct Act 2013 (FMCA) is the primary legislation applicable to financial products, including cryptocurrency. Generally, the FMCA dictates that financial product issuers have to comply with fair dealing obligations and governance, disclosure and operational obligations.

The FMCA’s provisions on fair dealing are concerned explicitly with conduct deemed false, deceptive, misleading or otherwise unsubstantiated. As such, non-compliance will result in civic and/or criminal liability. That said, the FMCA only applies to digital currency if it meets the following criteria:

- The digital currency is offered in New Zealand.

- It is made under an offer that is regulated.

- It falls under one of FMCA’s categories of financial products (or is considered a designated financial product per the FMA).

Is buying cryptocurrency legal in New Zealand?

Yes, buying cryptocurrency is legal in New Zealand. In fact, cryptocurrency is largely accepted in the financial sector owing to the country’s technology-neutral legislation. However, it is worth noting that cryptocurrencies are still not considered legal tender in New Zealand. The FMA regulates the following cryptocurrency-related organizations and treats them as financial services:

- Cryptocurrency brokers and exchanges

- Cryptocurrency wallet providers

- Blockchain-based businesses with initial coin offerings (ICOs)

- Blockchain projects offering investment opportunities.

Provided that the above-mentioned organizations obtain the appropriate licenses from the FMA, they may operate under New Zealand’s laws, specifically the Anti-Money Laundering (AML) and Countering Financing of Terrorism Act 2013, the Financial Markets Conduct Act 2013, the Financial Advisors Act (for ICOs) and the Financial Service Providers Act 2008.

The Department of Internal Affairs oversees AML obligations. ICOs, in particular, are treated with caution in New Zealand — they are analyzed on a case-by-case basis to ensure that the appropriate regulatory framework is applied. Each ICO’s token will then be classified as a managed investment product, derivative, equity or debt security.

New Zealand and cryptocurrency

New Zealand’s laws of general applications cover crypto assets and crypto asset service providers. These include the following laws:

The Financial Markets Conduct Act (2013)

As mentioned, the FMCA is primarily concerned with financial products, including cryptocurrencies that fall within its predefined categories:

- Debt security: A financial product where the holder has a redeemable share.

- Equity security: A financial product that allows the holder to benefit from the profits of an entity, but also bear responsibility for its losses.

- Derivative: A financial product whose value is derived from the price or value of another asset, index or rate.

- Managed investment product: A financial product that allows the holder to pool their money with those of other investors.

The Anti-money Laundering and Countering Financing of Terrorism Act 2009

The Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) Act 2009 establishes the requirements for compliance with AML/CFT obligations for reporting entities.

Three AML/CFT supervisors in New Zealand are defined under the Act:

- FMA for wealth businesses

- Reserve Bank of New Zealand for banks and non-bank deposit takers

- Department of Internal Affairs (DIA) for other businesses.

The DIA has supervisory responsibility for New Zealand-based virtual asset service providers, including cryptocurrency exchanges, brokerages and token issuers.

The Income Tax Act 2007 and Goods and Services Tax Act 1985

The Income Tax Act 2007 and Goods and Services Tax Act 1985 are the foundation of New Zealand’s tax system, both administered by the Inland Revenue Department. The Acts were recently revised to further explain how crypto assets will be taxed.

The Fair Trading Act 1986 (FT Act) and Consumer Guarantees Act 1993

The Fair Trading Act 1986 (FT Act) and Consumer Guarantees Act 1993 protect consumers in general and are administered by the Commerce Commission. These Acts may apply to crypto assets, depending on whether or not they are considered financial products (in which case coverage overlaps with the FMC Act).

Does New Zealand have a tax on cryptocurrency?

New Zealand doesn’t have a capital gains tax regime per se. Instead, income from cryptocurrency is lumped together with other sources of income and taxed much like regular income. However, cryptocurrency disposed of at a loss may reduce one’s taxable income for the year.

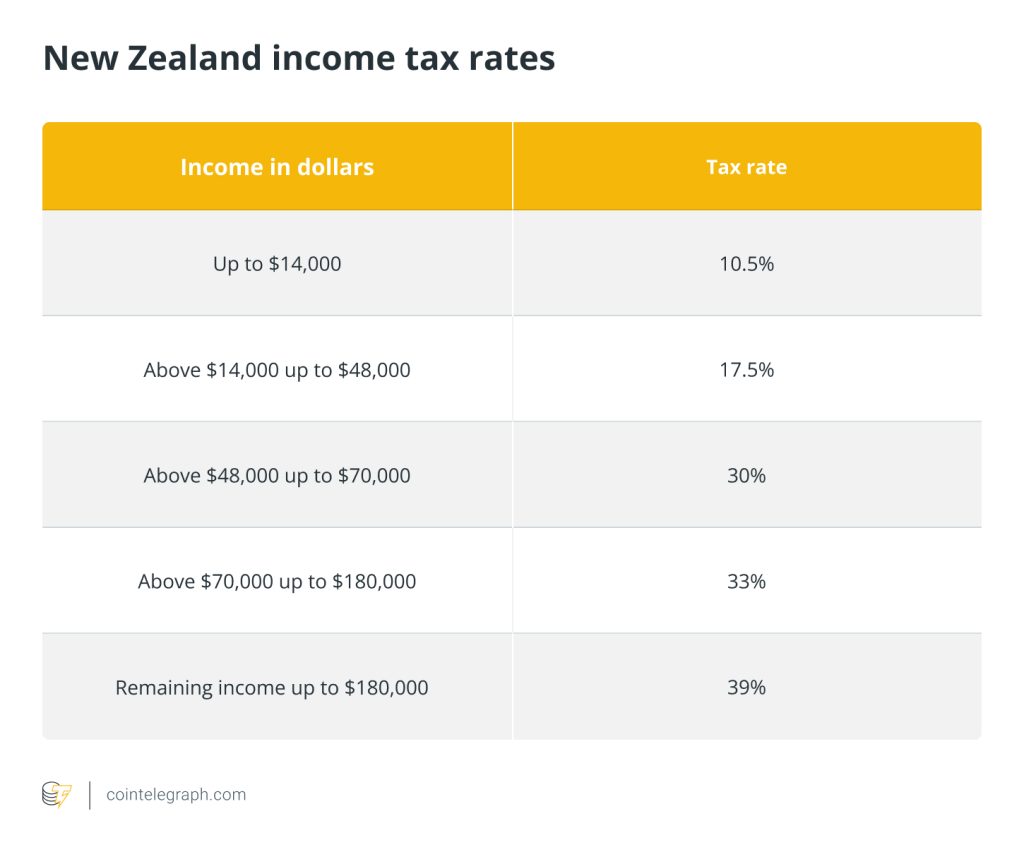

The IRD subjects cryptocurrency income to normal income tax rates, regardless of whether the income came from disposals, gains or earned cryptocurrency. Depending on one’s annual income, one may have to pay anywhere between a 10.5%–39% tax rate on cryptocurrency.

Overall, New Zealand’s tax system is progressive, meaning that there is no flat tax for one’s income in its entirety. Rather, progressively higher taxes will have to be paid on different portions of one’s income. For example, if a person’s taxable income is $25,000, the first $14,000 will be taxed at a lower rate of 10.5%. The rest of the amount will then be taxed at a higher rate of 17.5%. Here’s a table for reference:

As such, any activity involving cryptocurrency, as long as it also involves a profit or loss of fiat money, will need to be reported on one’s tax return. The value of one’s crypto assets should be calculated in New Zealand dollars (NZD) and declared according to gains or losses per transaction.

Crypto assets held as investments and crypto assets used in business will only be taxable at the time of disposal. To ensure accurate reporting with the IRD, cryptocurrency holders and investors should keep records of the following:

- The dates of their transactions

- The type of transactions (buy or sell)

- Details related to staking or lending income

- The types of cryptocurrency held

- The total number of units they have

- The value of crypto assets at the time of the transaction, in NZD

- All records from exchanges and banks

- Cryptocurrency wallet addresses.

How to buy cryptocurrencies in New Zealand

There are several cryptocurrency service providers in New Zealand, such as BitPrime, Coined, Kiwi Coin and Swyftx. The step-by-step procedures for purchasing cryptocurrency may differ slightly among providers, but the general process is as follows:

1. Research and select an online exchange or trading platform

Investors’ preferences, trading goals and risk tolerance are all factors that should be considered before selecting an exchange or trading platform. Checking an exchange’s authenticity and security protocols are crucial, as these will ensure that one’s digital currency is stored safely. User reviews are also a good indicator of an exchange’s legitimacy and quality of service.

Those looking to purchase cryptocurrency will also need to acquire a cryptocurrency wallet to store their cryptocurrency. Most cryptocurrency exchanges offer the option to create wallets after creating an account.

2. Sign up for an account and verify identity

The process of registering an account with a cryptocurrency exchange typically involves providing basic identifying information and setting up two-factor authentication. New users are also usually required to verify their email addresses and identity. In most cases, exchanges require proof of identification, such as a passport, and proof of residence.

3. Select a payment method and make a deposit

Users can fund their accounts by selecting from a variety of methods, including bank transfer, PayPal, POLi or credit and debit cards. Some exchanges also offer instant NZD deposits and zero fees.

4. Choose a cryptocurrency from the “Buy” section and start trading

Navigate to the buy or trade cryptocurrency section of a website or app and select the desired cryptocurrency for purchase. Then, confirm the purchase and start trading.

Is cryptocurrency mining legal in New Zealand?

Although miners are not regulated in New Zealand, certain criminal offenses come with accessing computer systems for dishonest purposes. If a miner chooses to use another person’s computer system to mine digital currencies without permission, they would be committing an offense under New Zealand law.

According to the Crimes Act 1961, many criminal offenses apply when it comes to digital currencies. These include theft, obtaining property or causing loss by deception, and crimes involving computers.

The act would also cover circumstances wherein malicious ICO issuers scam investors by raising money for a project and issuing digital currency with no intention to honor contracts or by hacking the private keys of an investor and stealing their digital currency.

That being said, income made from mining cryptocurrencies in New Zealand is subject to income tax. Notably, miners may claim tax deductions based on the costs incurred from mining. These include electricity, internet and hardware costs.

Written by Marcel Deer

… [Trackback]

[…] There you can find 32483 additional Info to that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Here you can find 13277 additional Info to that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Here you can find 11169 additional Info to that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2369/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2369/ […]