An overview of the cryptocurrency regulations in Switzerland

The accommodative attitude toward cryptocurrencies in Switzerland

As one of the world’s most popular banking and financial centers, Switzerland has been at the forefront of promoting cryptocurrencies for financial payments since 2016. Home to important international organizations such as the Red Cross, World Trade Organization (WTO), the Bank for International Settlements (BIS) and others, the country is emerging as an important center for blockchain and cryptocurrency businesses.

Apart from being a tourist hotspot, the country is home to one of the leading blockchain ecosystems and welcomes entrepreneurs and businesses focused on innovation within cryptographic technology.

With active connections to other international blockchain centers and having adopted several pro-crypto laws, Switzerland is regarded as one of the most crypto-friendly countries by investors and entrepreneurs alike.

With many Swiss cities promoting the use of cryptocurrencies for transacting purposes, Switzerland is grabbing every opportunity to establish itself as a global leader in the cryptocurrency space.

Is crypto regulated in Switzerland?

Unlike many other countries, Switzerland categorizes cryptocurrencies as an asset class rather than a security, treating matters involving the ownership and transfer of virtual currencies in line with other asset classes like property or gold.

The Swiss Federal Tax Administration (SFTA), the country’s leading authority on taxation, has subjected cryptocurrencies to wealth, income and capital gains taxes in a fair and transparent manner, thereby removing any ambiguity concerning the sale or transfer of virtual currencies.

Additionally, classifying cryptocurrencies as an asset class put questions surrounding the treatment of crypto as security in Switzerland to rest. What’s more, cities like Zurich took the lead in setting up the country’s first Bitcoin ATMs way back in 2014, quickly followed by the town of Zug accepting Bitcoin payments for council services in 2016.

The Swiss Federal Railways, Switzerland’s national rail providing authority, enabled the purchase of Bitcoin at more than 1,000 ticketing machines spread across the country since 2016.

Allowing its customers to exchange amounts varying from 20 to 500 Swiss francs for Bitcoin per transaction, it was one of the earliest crypto adoption initiatives in the world. It was also a precursor of the constructive regulations that were soon to be introduced.

The Swiss city of Lugano went one step further and announced its plan to make Bitcoin (BTC), Tether (USDT) and its own LVGA Points token legal tender for transaction purposes. With the ultimate goal of accepting cryptocurrencies as payment for all goods and services in the city, the city formalized its collaboration with stablecoin issuer Tether to provide for the payment of taxes in these cryptocurrencies.

The town of Zug already allows its citizens to use BTC and Ether (ETH) to pay their taxes, permissible up to 100,000 Swiss francs, which will be paid in an equivalent cryptocurrency.

Understanding Swiss rules on crypto asset trading

The country’s financial regulatory authority, the Swiss Financial Market Supervisory Authority (FINMA), governs all matters regarding virtual currency regulation and other digital asset services like decentralized finance (DeFi).

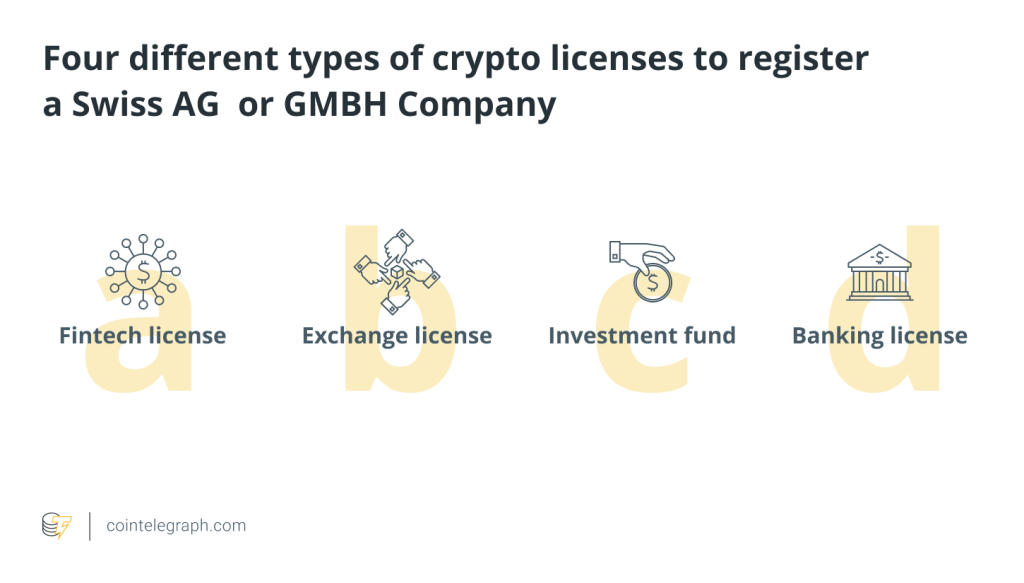

It deemed cryptocurrency exchanges incorporated in the country legal as long as they obtained the necessary license for operation. Depending upon the exact nature of the blockchain project, FINMA issues four different types of crypto licenses in conjunction with a Swiss AG or GMBH Company registered in the country.

Eligible firms can opt for a fintech, exchange, investment fund or banking license and, in turn, are subject to Switzerland’s overarching federal act for combating money laundering and terrorist financing, the Anti-Money Laundering Act (AMLA).

In its 2016 review, the Financial Action Task Force (FATF), an intergovernmental organization that develops policies to thwart money laundering, acknowledged that AMLA is a good framework for preventing illegal financing activities.

FATF’s suggestions for further improvement are expected to come into force on January 1, 2023, and are further proof of Switzerland’s resolve to maintain strict regulatory oversight over all financial institutions, including cryptocurrency exchanges established within Swiss borders.

All of this has improved investor security while maintaining a friendly stance toward companies that want to venture into the blockchain or cryptocurrency space.

As a result of these regulations and favorable Swiss tax laws, many prominent crypto companies, including Ethereum, Solana and Tezos, have made Switzerland their headquarters. Moreover, Switzerland’s overall positive business environment makes it highly beneficial for start-ups to bring about a digital revolution using blockchain technology and has made the country a top destination for crypto entrepreneurs.

Over 1,000 blockchain and cryptocurrency-based businesses have made the country their home, including an increasing number of Swiss-based firms that provide a range of cryptocurrency services as part of the country’s push toward green financing.

The Blockchain Act and the rise of the Swiss Crypto Valley

Switzerland’s crypto regulations have been spurring innovation and fostering the development of an entire ecosystem of blockchain-focused businesses that are building for the future.

With its advanced regulatory model and a detailed framework for STOs based on established laws, the country passed a set of amended Swiss Parliament laws that provide holistic legal regulations for blockchain technology-based businesses in 2020.

Popularly known as the “Blockchain Act,” it was enforced on Aug. 1, 2021 and suitably amended the country’s securities law to provide a legal basis for trading cryptocurrencies, which are considered private assets by definition.

By providing for the segregation of crypto assets and protecting investor interests, the act increases investors’ legal certainty in events such as bankruptcy. Moreover, the Blockchain Act reinforces Switzerland’s technology neutrality principle and aims to improve business conditions for companies using blockchain technology.

It created a new license category for distributed ledger technology (DLT) or blockchain-based trading systems that FINMA supervises. Its core guiding principles are providing clarity on the taxation of crypto assets, safeguarding the integrity of the Swiss financial center and ensuring its stability.

As a result of the legal certainty and innovation-focused regulatory framework, an entire Swiss blockchain ecosystem has emerged in the town of Zug, also dubbed the Swiss Crypto Valley on account of a large number of established crypto firms, developers, service providers and advisers that now call it home.

Projects such as the Ethereum Foundation and the Diem project (formerly known as the Libra project) have cemented Switzerland’s status as Europe’s fastest-growing crypto hub. They are proof of the country’s advancement in regulating fintech and blockchain without stifling growth on account of the risks or vulnerabilities that accompany any new technology.

The country has been actively thwarting the risks associated with cryptocurrency-related activities by adapting many of its national laws and participating in the development of global standards for crypto firms.

Switzerland has taken the lead in countering cybercrime by implementing high-security standards and continuously exploring ways to plug any legal or financial loopholes that criminal entities could exploit.

Can you buy and cash out crypto in Switzerland?

Since cryptocurrencies are considered legal in Switzerland and even deemed legal tender in certain cities, some crypto platforms are available for exchanging popular cryptocurrencies and converting them into Swiss francs.

With international money transfers being used daily in the country, bank transfers using an International Bank Account Number (IBAN) and SWIFT codes are permitted on most cryptocurrency exchanges and businesses operating within Switzerland.

Investors can choose to sell their cryptocurrencies via cryptocurrency exchanges like Coinbase and Wirex, peer-to-peer platforms like Paxful, or even via physical branches of licensed crypto banks such as Sygnum Bank AG and Seba Bank AG.

Additionally, many traditional banks like Bordier & Cie in Switzerland are partnering with digital asset banks like Sygnum to allow their customers to purchase crypto assets.

These Swiss banks accept cryptocurrency and enable individuals and businesses to convert it into fiat like the Swiss franc or stablecoins like USDT. Similarly, along with other cryptocurrency exchanges in Switzerland and platforms like Bitcoin Suisse, they also allow investors to buy cryptocurrencies using fiat and are even introducing staking services from which investors can benefit.

What’s more, with the viewpoint of providing an investable benchmark for the class of cryptocurrencies, FINMA approved the Crypto Market Index Fund as the first crypto fund in September 2021, thereby offering qualified investors the opportunity to invest in the leading cryptocurrencies included in the Crypto Market Index 10, a product administered by the SIX Swiss Exchange.

The country has no special tax laws for cryptocurrencies and subjects them to established tax legislation defined by the SFTA, similar to stocks, bonds and real estate in Switzerland. Whether a crypto investor is classified as a private investor, self-employed trader or a business, the implication of income tax, wealth tax or both varies.

Private investors are not subjected to capital gains tax on profits generated from crypto gains as long as they fulfill five criteria. This includes transaction volumes not exceeding five times the original capital, a holding period exceeding six months, capital gains contributing to less than half of overall taxable income, minimal usage of third-party financing and employing derivatives only as a hedging tool.

For commercial crypto traders, however, losses from crypto trades can be carried forward for the following seven assessment years and capital gains are subjected to progressive income tax rates defined by Swiss laws.

Moreover, an additional 10% of crypto profits needs to be expended toward old-age and survivors’ insurance for such self-employed traders or businesses. Yields from mining, staking or even income generated from tokens received via airdrops are taxed too, but depend on the categorization of the investor and only add incrementally to the net tax outflow.

Written by Murtuza Merchant.

Purchase a licence for this article. Powered by SharpShark.

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Here you can find 24354 additional Info on that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] There you will find 57869 more Information to that Topic: x.superex.com/academys/beginner/2367/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2367/ […]