An overview of cryptocurrency regulations in South Korea

Cryptocurrency law and the regulation of digital assets more broadly ideally balance safeguards and economic growth. In that light, regulators and policymakers worldwide are seeking a delicate equilibrium between encouraging technological innovation and establishing the necessary rules to prevent potentially illicit behavior by market participants like individuals and corporate entities.

South Korea has become a significant player in adopting blockchain and cryptocurrencies in Asia. Yet the growing popularity of cryptocurrencies has put the industry under increased public scrutiny. The country has taken a proactive approach to digital assets regulation, with several laws and regulations aimed at ensuring the safe and secure operation of the cryptocurrency market in South Korea.

This article outlines the legal and regulatory framework governing cryptocurrencies in South Korea. After exploring whether cryptocurrency in South Korea is legal and what the applicable legal framework comprehends, the article will also uncover cryptocurrency exchange regulations in said jurisdiction and how cryptocurrency is taxed, followed by an outlook on the future of cryptocurrency in South Korea.

Is cryptocurrency legal in South Korea?

Understanding the cryptocurrency regulations in South Korea is crucial for anyone interested in the crypto market and its potential future developments. One of the critical questions on many people’s minds is the legal status of cryptocurrencies in South Korea and who is responsible for regulating them.

In the belief that cryptocurrencies can spur the tech-oriented economy and provide new business opportunities in the global market, the government of South Korea has given cryptocurrencies the green light via a cautious combination of laws and regulations aimed at ensuring the safe and secure operation of the cryptocurrency market.

The legal situation in South Korea might appear complex, but it is important to grasp three fundamental points. First, cryptocurrencies like Bitcoin (BTC) are regulated under precise Anti-Money Laundering (AML) and securities regulations, both of which are enforced by the Financial Securities Commission (FSC).

Secondly, regulations for reporting by crypto service providers, such as centralized and decentralized exchanges, are primarily based on guidelines rather than laws in South Korea. However, these guidelines are fundamental for understanding how cryptocurrency is regulated in the country. Finally, the regulatory framework appears heavily influenced by the government’s policy stance on cryptocurrency assets, which seems to have undergone a paradigm shift over time.

Before starting a deep dive into cryptocurrency laws in South Korea, it is important to note that the Electronic Financial Transactions Act and the Act on Reporting and Use of Specific Financial Information mainly provide the regulatory framework for the use of cryptocurrencies and digital assets.

The Electronic Financial Transactions Act broadly defines cryptocurrencies as “electronic assets.” It outlines the rules for their use, prescribing Know Your Customer checks like real-name verification, AML requirements and cybersecurity measures. The Act on Reporting and Use of Specific Financial Information, in turn, requires financial institutions to report any suspicious financial transactions, including those involving cryptocurrencies.

Laws and regulations are living documents, so before looking more closely at guidelines on South Korean cryptocurrency exchanges, it is important to note that the country has taken a more proactive turn in regulating crypto assets.

Indeed, the executive branch has sought to deregulate the crypto industry; for example, by legalizing security tokens. Security token offerings were previously not allowed, just as South Korea initially banned initial coin offerings (ICOs). However, in light of the country’s digital paradigm shift, the issuance of securities tokens has been enabled, proving that laws can be flexible where regulators and executives are aligned.

South Korea aims to roll out new and comprehensive cryptocurrency legislation in 2023 and to further institutionalize the sector by 2024. To fix the country’s regulatory patchwork on cryptocurrencies, the National Assembly is debating nearly twenty separate crypto-related proposals — from implementing reserve requirements at exchanges to ensuring fair trading — to create better protections for South Korean crypto investors.

The so-called Digital Asset Basic Act (DABA) will be a comprehensive legal framework that will provide regulatory guidelines for the South Korean cryptocurrency sector. The act creates a favorable environment for digital assets as the country seeks to preserve its spot as a regional leader in adopting and regulating cryptocurrencies.

For example, the South Korean state will reportedly create a two-lane regulatory framework for ICOs, defining digital assets as securities and non-securities. The act will also be drafted in line with international norms due to the cross-territorial nature of cryptocurrencies.

Can you buy cryptocurrency in South Korea?

The use of cryptocurrencies has rapidly increased in recent years and South Korea is no exception. One of the questions on many people’s minds is whether or not it is possible to buy cryptocurrency in South Korea.

South Korean cryptocurrency exchanges are subject to several regulations to ensure their safe and secure operation. A few large centralized exchanges dominate the South Korean cryptocurrency market, with enforcement bodies closely monitoring them to ensure they comply with the relevant regulations and guidelines.

An amendment to the Act on the Reporting and Use of Specific Financial Transaction Information introduced licensing requirements for virtual asset service providers (VASPs). According to the regulation, exchanges and other VASPs are subject to this unique licensing system, requiring them to meet specific standards and comply with ongoing reporting requirements to protect consumers and prevent illegal activities, such as money laundering and fraud.

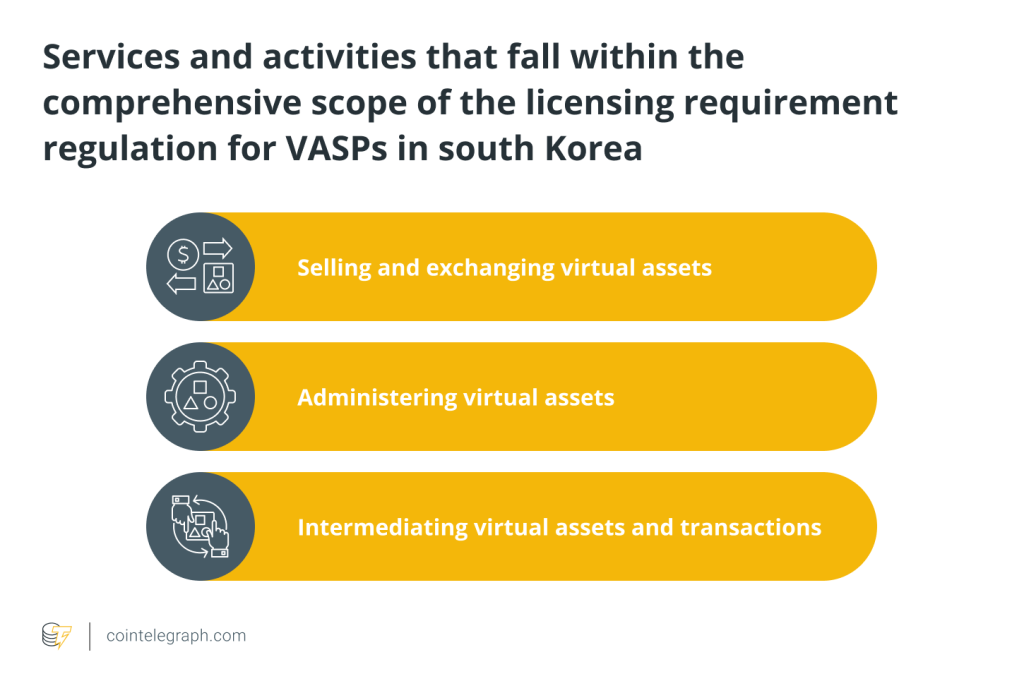

Concerning the scope of said regulation, VASPs are defined as entities that provide services related to virtual assets. The definition of “virtual asset service provider” under the act is vast. The broad scope of implementation has resulted in most entities offering digital asset solutions falling within the scope of regulation, even if they are not considered exchanges.

Indeed, the definition contains virtual asset trading service providers, virtual asset custody and administration service providers and virtual asset digital wallet service providers involved in purchasing, selling, exchanging, safekeeping, administering, or intermediating virtual assets and transactions. Providers offering said services must comply with the regulations as set forth by the FSC.

To comply with the Electronic Financial Transactions Act, VASPs must register with the FSC and comply with strict requirements, including real-name verification of their customers, AML procedures and even cybersecurity measures.

Any service incorporating digital assets could be considered a virtual asset service provider. With the South Korean government enforcing stricter regulations in the virtual asset sector, many of the country’s cryptocurrency exchanges closed due to a lack of licensing from regulatory agencies.

It’s worth noting that, in line with the Travel Rule regulation set by the international watchdog, the Financial Action Task Force, the remaining South Korean exchanges also label cryptocurrency transfers worth more than roughly $820, with transfers higher than that value restricted to user-verified wallets.

In summary, while cryptocurrency and crypto assets providers are implicitly and explicitly regulated in South Korea, there are no explicit prohibitions against cryptocurrencies. South Korean citizens can own cryptocurrencies and trade on licensed exchanges.

In practice, South Korean individuals open an account with a cryptocurrency exchange to buy crypto and verify their identity using their real names, but there is one exception. South Korea did implement a ban on anonymous cryptocurrency trading to prevent illegal activities.

Is crypto taxable in South Korea?

In recent years, the popularity of cryptocurrencies has increased significantly, leading to a growing number of individuals and businesses seeking to understand the tax implications of holding and trading these assets. In South Korea, cryptocurrency taxation is a rapidly evolving area of law.

Cryptocurrencies can be used for various purposes, including as a store of value, payment mechanism, or speculatory buy. South Korea’s tax treatment of cryptocurrencies depends on how cryptocurrencies are used.

For example, once sold, cryptocurrencies held as investments may be subject to capital gains tax. Capital gains tax is a tax on the profit realized from selling a capital asset, such as stocks, bonds, or cryptocurrencies. South Korea’s capital gains tax rate is 20% for individuals and 22% for corporations.

On the other hand, if cryptocurrencies are used as a means of payment for goods or services, they may be subject to value-added tax (VAT). VAT is a tax on the value added to a product or service at each stage of production or distribution. In South Korea, the VAT rate is 10%.

The tax treatment of cryptocurrencies is a complex topic and changes over time as the South Korean government continues to revise its tax policies in response to the changing landscape.

Cryptocurrencies’ underlying blockchain technology is, in principle, anonymous but also traceable due to its transparent character. Both individuals and businesses must always be mindful of the tax implications of holding and trading these assets. South Korean President Yoon Suk-yeol decided to defer taxation on crypto investment gains until the Digital Asset Basic Act is enacted. Under new cryptocurrency taxation rules, South Korea will impose a 20% tax on crypto gains above $2,100 per year.

The future of cryptocurrency in South Korea

Governments want to encourage innovation and market transition but tend to be cautious about the possible misuse of cryptocurrencies for fraud, money laundering and other illicit purposes. South Korea has implemented several regulations to ensure the cryptocurrency market’s safe and secure operation while seeking to provide a supportive environment for innovation and growth.

As a result, the cryptocurrency market in South Korea is highly regulated according to a patchwork of laws and regulations, which the comprehensive DABA framework will likely replace.

Policymakers sought greater regulation for consumer protection and the management of AML risks, particularly concerning exchanges. To this end, the licensing requirements for virtual asset service providers were introduced.

However, the broad scope of implementation has resulted in most entities offering digital asset solutions falling within the scope of regulation, even if they are not considered exchanges. As has happened in other nations like Switzerland, this has led to hesitation among onshore firms, sometimes opting to relocate their businesses to offshore jurisdictions without rules. Therefore, South Korea should arguably implement regulatory reform to enhance the sustained growth and development of the digital asset sector in the country.

Finding a proper balance between providing regulatory certainty and security while having a forward-thinking and adaptive framework is a delicate challenge for regulators. Despite their good intentions, excessive regulation can stifle innovation, while a lack of clear rules can result in confusion and instability. Thus, regulators must navigate this complex landscape carefully to foster a thriving blockchain sector.

Time will tell whether a risk-sensitive regulatory framework in the form of DABA can spur sustained innovation in the sector. The South Korean government has also been asked to make detailed laws on virtual asset providers that prescribe other rules of conduct, ranging from listing, disclosure, business qualifications and advertisement regulation to fiduciary duties.

In light of the broad definition of crypto assets, it will also be interesting to follow whether regulators in South Korea will approve of an appropriate regulatory framework that provides clarity and a clear taxonomy of cryptocurrencies and other digital assets, such as nonfungible tokens.

Author: Alexandra Overgaag

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] There you will find 52715 additional Info on that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] Here you can find 75870 more Info on that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] There you can find 13691 additional Info to that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] There you can find 82356 more Information to that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2300/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2300/ […]