DeFi and AI: Synergies and challenges

Artificial intelligence (AI) and decentralized finance (DeFi) are two of the most disruptive technologies of our time, and their convergence will likely unlock unparalleled opportunities in the financial landscape while increasing transparency and decentralization.

The blockchain technology that empowers DeFi and the AI market were valued at a combined $230.10 million in 2021, with a growth expected to exceed $980 million in 2030. Such positive data demonstrates the rapid development of the two integrated technologies, which will bring more security, inclusiveness and self-reliant solutions to individuals globally, especially in the financial spectrum.

This article explores how DeFi will influence AI, the benefits of this convergence, the challenges, the risks, and the future opportunities of this explosive synergy.

What is DeFi?

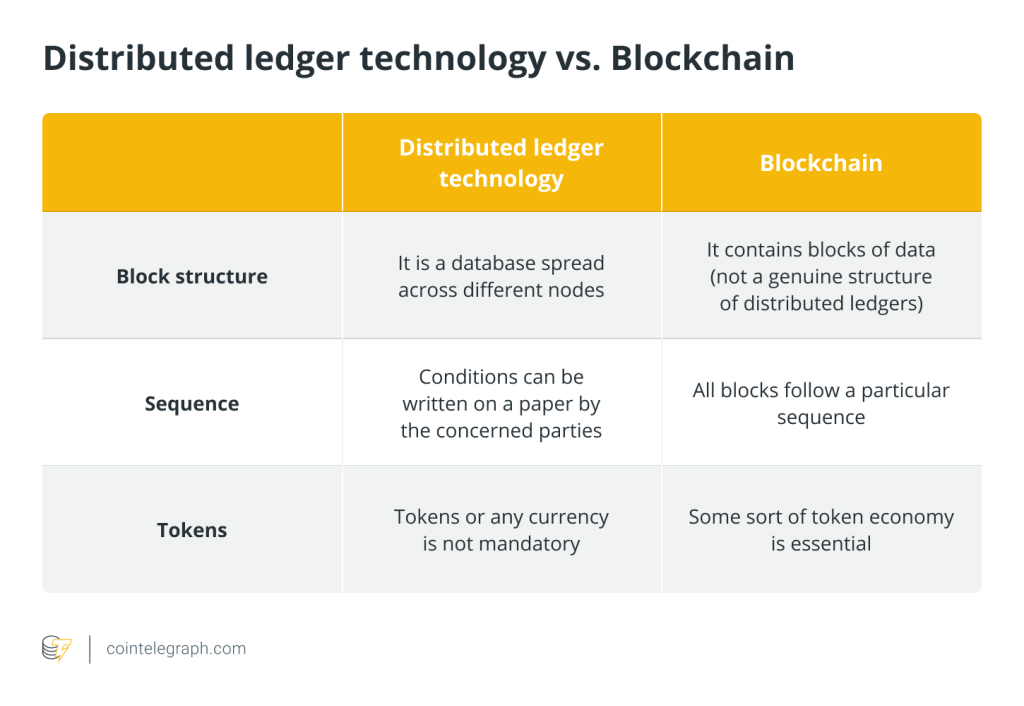

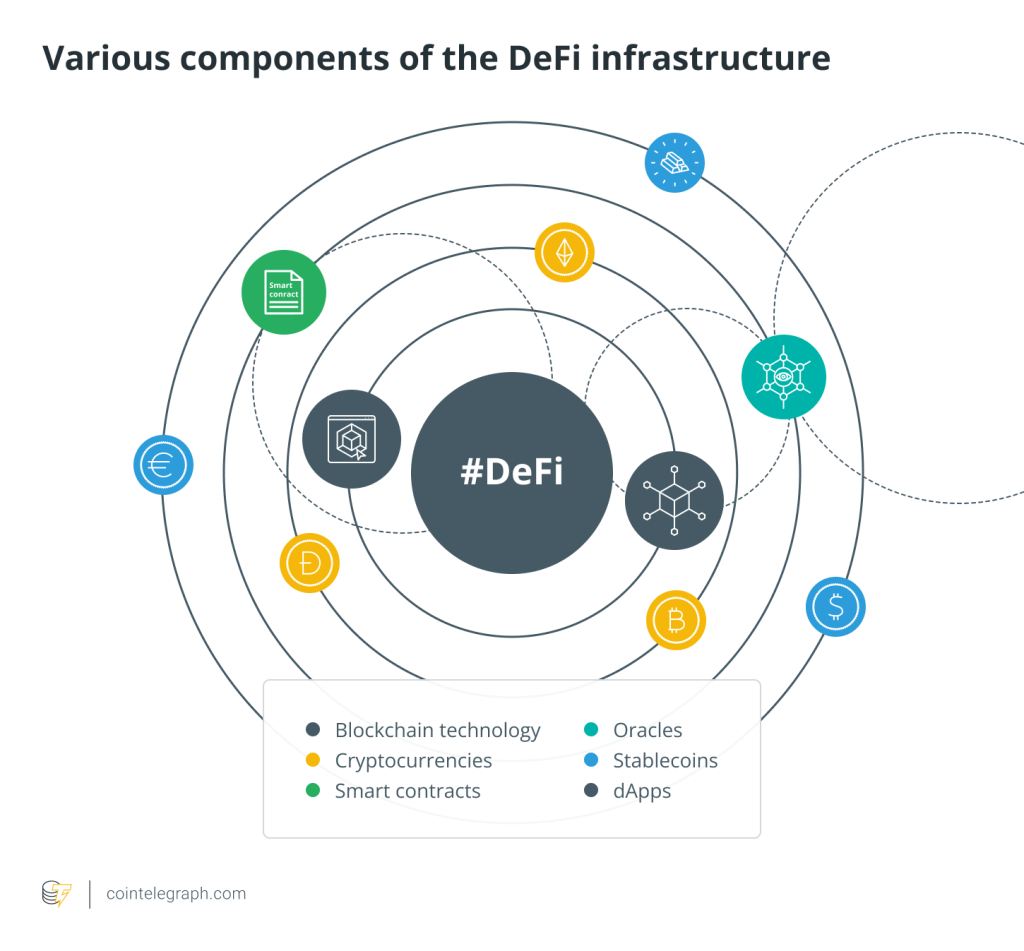

DeFi refers to financial applications and services that are built on blockchain networks, primarily utilizing smart contracts, which are self-executing agreements written in code. DeFi aims to decentralize and democratize traditional financial systems by eliminating intermediaries and providing open, permissionless access to financial services.

In traditional finance, intermediaries, such as banks, exchanges and lending institutions, play a central role in facilitating transactions and managing funds. DeFi, on the other hand, leverages the decentralized nature of blockchain technology to create a trustless and transparent financial ecosystem with secure, transparent and immutable transactions.

DeFi has the potential to bring financial services to the unbanked and underbanked populations worldwide who lack access to traditional banking services. Since DeFi platforms operate on blockchain networks, anyone can access them with a smartphone, opening up efficient financial opportunities for individuals, such as decentralized lending and borrowing, decentralized trading, and yield farming.

What is AI?

Learning from existing data, AI simulates human intelligence and performs human brain-driven tasks, such as decision-making, problem-solving and pattern recognition. It has advanced rapidly in recent years, with the potential to disrupt various fields, including healthcare, finance, transportation, cybersecurity, manufacturing and entertainment.

To be programmed to think and learn like humans and perform human-driven tasks, AI uses specific techniques, including machine learning, neural networks, automated decision-making and the Internet of Things (IoT).

It has the potential to automate repetitive tasks, enhance decision-making, improve efficiency and drive innovation, freeing up time and resources and allowing humans to focus on more creative and complex tasks.

What connects AI and DeFi?

AI’s ability to analyze vast amounts of data efficiently, identify patterns, and make intelligent predictions can empower DeFi solutions to optimize their operations, enhance security measures, and provide personalized services to users.

From automated trading algorithms, cybersecurity, and risk assessment models to fraud detection systems and smart contract auditing, the applications of AI in DeFi can help create new financial products and services that are more accessible, efficient and fair.

AI may offer improvements and opportunities in DeFi, helping traders implement strategies through AI-powered trading bots and predictive analytics to identify market trends and enable optimal trade execution.

AI’s ability to help manage portfolios through personalized recommendations can help investors rebalance and optimize assets efficiently with accuracy and profitability.

What are the opportunities for AI-powered DeFi?

The combination of DeFi and AI offers several exciting opportunities that can transform the decentralized finance ecosystem. Here are some ways AI can be used in DeFi for maximum optimization.

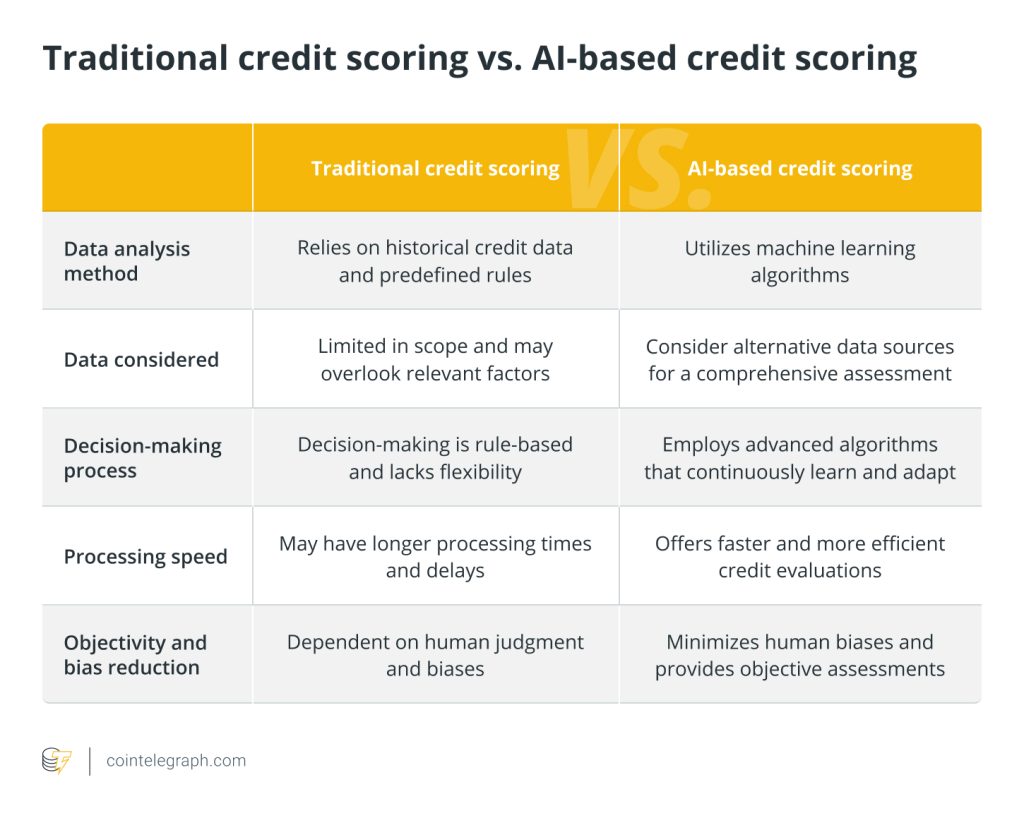

Credit scoring for risk assessment and management

AI can provide DeFi lending platforms with quick credit scoring and risk assessment for better-informed lending decisions. AI can assist in assessing and managing DeFi platforms’ risks — such as price volatility and smart contract vulnerabilities — by analyzing historical data, monitoring market conditions, and providing real-time risk alerts. AI-powered risk models can help DeFi platforms and users make more informed decisions and develop robust risk management strategies.

Fraud detection and security

DeFi platforms can benefit from AI algorithms that can analyze patterns, detect anomalies, strengthen security measures, and identify potential fraudulent activities and cyberattacks within decentralized ecosystems. User protection can be enhanced, and unauthorized access can be prevented by integrating AI-based security measures that can help identify potential threats and vulnerabilities.

Data analysis and decision-making

AI can analyze vast amounts of data to provide valuable insights, identify patterns, and make data-driven decisions on DeFi-generated transaction history, smart contract interactions and user behavior.

For example, AI-powered algorithms can assist in predicting market trends or detecting anomalies. Integrating AI algorithms into DeFi platforms allows personalized investment portfolios and investment strategies to be tailored to each individual’s financial goals and risk tolerance.

Smart contract automation

AI can be used to automate the creation and execution of smart contracts in DeFi. By leveraging machine learning and natural language processing, AI can facilitate the development of self-executing contracts, reducing the need for manual intervention, improving the accuracy of contract terms, streamlining operations, and increasing overall efficiency by leveraging AI algorithms.

Regulatory compliance

AI can assist DeFi platforms in addressing regulatory compliance challenges by automating compliance processes, ensuring transparency and facilitating auditability. AI-powered solutions can help businesses and customers observe Know Your Customer (KYC) requirements, Anti-Money Laundering (AML) regulations and other compliance standards.

DAOs

DeFi and AI can also be leveraged in the context of decentralized autonomous organizations (DAOs), self-governing entities operating on blockchain networks and running on smart contracts, making decisions through voting or consensus mechanisms. Both DeFi and AI can bring significant value to DAOs leading to more efficient, transparent and intelligent decision-making processes.

What are the challenges concerned with AI-powered DeFi?

While the integration of DeFi and AI presents exciting possibilities, it also introduces challenges, such as data quality, privacy, transparency, scalability and regulatory compliance. Considering and overcoming the risks of using AI in DeFi is essential for effectively leveraging the synergies between the two technologies, unlocking their full potential and ensuring their reliable and efficient performance.

These are some of the DeFi and AI challenges that need to be addressed to ensure these technologies’ responsible and secure implementation.

Data quality, privacy and security

There needs to be a balance between the benefits of AI-driven personalization and the necessity to protect user data privacy and security. AI algorithms heavily rely on high-quality and diverse data sets; however, in DeFi, obtaining reliable and comprehensive data can be challenging due to data fragmentation, privacy concerns and the need for standardized data formats. Ensuring data privacy and maintaining data integrity are crucial challenges that must be addressed when integrating AI into DeFi.

Adversarial attacks

AI models used in DeFi platforms can be susceptible to adversarial attacks, where malicious actors can manipulate the models to gain unfair advantages. Adversarial attacks may lead to financial losses, exploitation of vulnerabilities or manipulation of outcomes within DeFi protocols. Implementing robust security measures and conducting regular vulnerability assessments can help mitigate such risks.

Overreliance on AI

Overreliance on AI can lead to complacency, ethical concerns and a lack of human oversight. AI models are not infallible, and they have limitations. Relying solely on AI-driven decision-making without human intervention or critical analysis can result in unpredictable consequences. It is essential to balance AI automation and human evaluation.

Scalability and computational requirements

AI algorithms, especially those based on deep learning, can be computationally intensive and require substantial computational resources. Integrating AI into DeFi platforms may pose scalability challenges, mainly when dealing with large-scale data sets and real-time processing requirements. Ensuring efficient and scalable AI implementations within the DeFi ecosystem is a significant challenge that needs to be addressed for more efficiency.

Regulatory and compliance considerations

While the combination of DeFi and AI offers opportunities in the regulatory and compliance field, it may also represent a challenge since DeFi technology operates in a rapidly evolving regulatory landscape, with AI adding another layer of complexity.

Regulatory frameworks may need to adapt to address the challenges and risks associated with AI-powered DeFi applications. Striking a balance between innovation and regulatory compliance is crucial to foster the growth of this emerging field.

The future of AI in DeFi

The convergence of DeFi and AI could be one of the most disruptive technological applications of our time since it can democratize finance, promote financial inclusion, and produce a more transparent financial system while automating repetitive tasks and building more efficient and secure processes.

As AI in DeFi continues to gain momentum, a key consideration for the future should be to remain realistic in regard to expectations and address some significant challenges, including ethical concerns in the design and deployment of AI-driven DeFi applications.

AI is not a panacea, and as with every technology, it should be implemented in situations where it could make a genuine difference, such as improving risk assessment and management and decision-making processes, resulting in a more satisfactory user experience.

Written by Emi Lacapra

… [Trackback]

[…] Here you can find 82873 more Information on that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Here you can find 80261 additional Information to that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] There you will find 74420 more Information to that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] There you will find 64522 additional Info to that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2274/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2274/ […]