Cryptocurrency bill: Countries where cryptocurrency is restricted or illegal

What is the cryptocurrency bill?

The Cryptocurrency and Regulation of Official Digital Currency Bill, more widely known in the cryptocurrency space as the “cryptocurrency bill,” was introduced to the Parliament of India (Lok Sabha) in 2021.

The Lok Sabha announced that the bill sought “to create a facilitative framework for the creation of the official digital currency to be issued by the Reserve Bank of India.” The bulletin further noted that it “also seeks to prohibit all private cryptocurrencies in India.”

Some of the key points from the 2019 draft of the cryptocurrency bill are:

The introduction of the bill caused a scare in the cryptocurrency industry, sparking debates about the Indian government’s move to ban crypto in the country. It also resulted in panic selling of crypto assets on local exchange WazirX.

The resulting outcome was a push for cryptocurrency regulation by the Securities and Exchange Board of India through which local crypto exchanges are regulated. Although the crypto ban did not push through, the government’s move left a lot of crypto enthusiasts conflicted regarding the future of crypto in India. Residual fears remain that concern an outright cryptocurrency ban down the road.

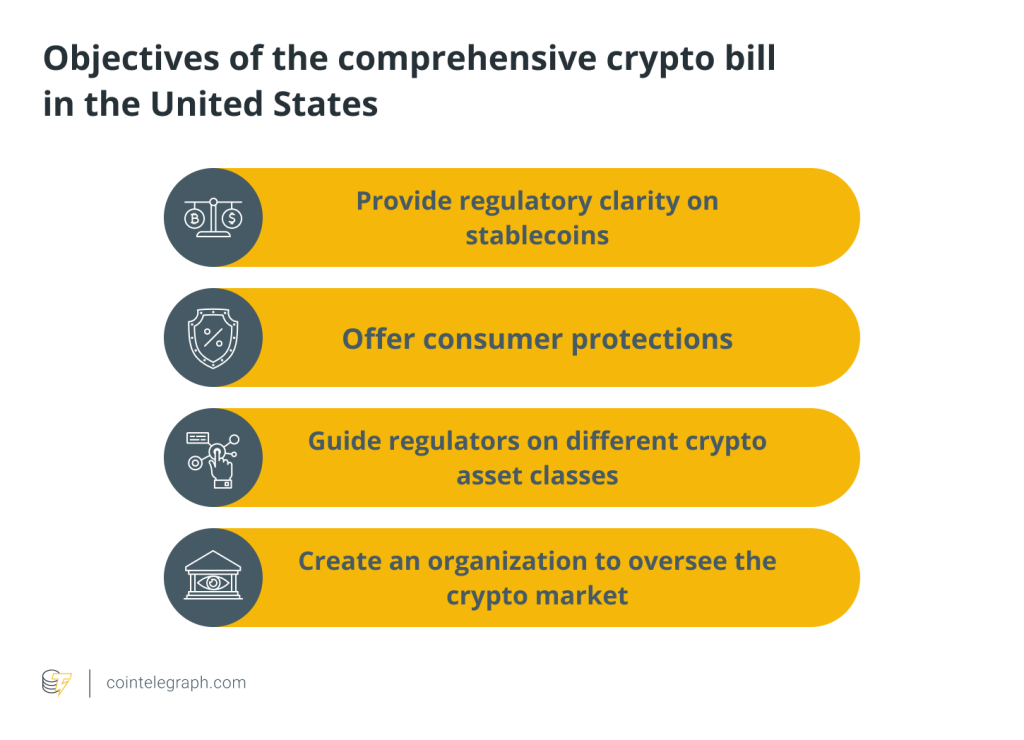

Meanwhile, in the United States, pro-crypto lawmaker Senator Cynthia Lummis of Wyoming recently announced plans to introduce a comprehensive bill to handle digital assets sometime in 2022. Lummis, who also owns Bitcoin (BTC), aims to achieve the following through her proposed bill:

Lummis issued a call on Twitter for U.S. voters to encourage their respective senators to consider and support the bill. The senator wants to see the full normalization of digital assets across the U.S. with the bill being the first step in creating federal rules concerning crypto assets.

Cryptocurrency rules and regulations

Cryptocurrency has evolved from being a largely speculative investment asset into something crucial for a balanced portfolio. Despite cryptocurrency’s increasing adoption worldwide, governments in different countries remain conflicted on how to regulate the controversial asset class. Even in the U.S., one of the countries where cryptocurrency is most popular, a clear regulatory framework for digital assets remains to be set in place.

So, how are cryptocurrencies regulated in countries around the world? There is no singular set of rules and regulations encompassing cryptocurrencies globally. Instead, cryptocurrency is subject to different tax treatments and classifications, depending on each country’s attitude towards the asset class.

Below are some of the most notable developments in cryptocurrency rules and regulations around the globe.

El Salvador

In a bold move that went beyond most countries’ bids to regulate crypto, El Salvador made headlines in September of 2021 as the first country to adopt Bitcoin as a legal tender alongside the U.S. dollar (USD). El Salvador President Nayib Bukele stood by his decision despite skepticism among Salvadorans and the traditional finance sector.

Bukele sees adopting Bitcoin as legal tender as an effective way to bring more of the country’s unbanked population into the formal economy. As it stands, approximately 70% of El Salvador is unbanked – a number Bukele hopes to reduce with the adoption of the digital currency.

While the crypto community has largely celebrated the move, it has also ignited discussions concerning which countries will make crypto legal tender next. Meanwhile, the International Monetary Fund (IMF) remains skeptical of Bitcoin and has gone so far as to urge El Salvador to strip the cryptocurrency of its status as legal currency. IMF executive directors noted Bitcoin’s risks to “financial stability, financial integrity, and consumer protection.”

United States

The U.S. is one of the top countries that invest in cryptocurrency via crypto investors and blockchain firms. However, the country has yet to develop a clear regulatory framework for cryptocurrency.

Cryptocurrency exchanges are required to register with the Financial Crimes Enforcement Network and fall under the scope of the Bank Secrecy Act. Exchanges are also required to comply with Anti-Money Laundering (AML) provisions and obligations to combat the financing of terrorism.

Different commissions also view cryptocurrency as different asset classes, making approaches to crypto fragmented at best. The Securities and Exchange Commission (SEC) views cryptocurrency as a security, while the Commodity Futures Trading Commission calls cryptocurrency, like Bitcoin, a commodity. Meanwhile, the Treasury considers it a form of currency.

As for the Internal Revenue Service (IRS), cryptocurrency is classified as property for federal income tax purposes. This means that under U.S. law, buying and selling crypto is taxable. Failure to report income generated from crypto sales is subject to penalties imposed by the IRS.

Canada

Canada’s regulators have historically been proactive towards cryptocurrency in the country. In February of 2021, it became the first country to approve a Bitcoin ETF. Taxation-wise, cryptocurrency is treated much like other commodities in Canada.

Crypto investment firms, on the other hand, are classified as money service businesses. Hence, they must register with Canada’s Financial Transactions and Reports Analysis Center.

Crypto dealers and trading platforms within the country are required to register with provincial regulators in accordance with the Canadian Securities Administrators and the Investment Industry Regulatory Organization of Canada.

United Kingdom

Cryptocurrency is considered as property in the United Kingdom but not legal tender. Cryptocurrency exchanges are also required to register with the U.K. Financial Conduct Authority and are prohibited from engaging in crypto derivatives trading.

Her Majesty’s Revenue and Customs (HMRC) also has cryptocurrency-specific requirements concerning Anti-Money Laundering and Know Your Customer. Taxability largely depends on who engages in the transactions and what they are for.

The HMRC also has a detailed Cryptoassets Manual to guide people on how to file taxes on cryptocurrency.

Legality of cryptocurrencies

The legality of cryptocurrencies remains extremely varied across different territories. With rules and regulations in a quagmire of political interests and skepticism, the legalization of cryptocurrency is unlikely to achieve a global consensus.

Regulatory implications continue to change in various territories with many governments re-examining their comfort levels surrounding crypto. In most countries, crypto usage remains legal but there are differences in how crypto is used within each economy.

That said, some countries have restricted or banned the use of cryptocurrency altogether, as will be outlined in the next section.

Countries where cryptocurrencies are restricted or illegal

Ecuador

Ecuador banned cryptocurrencies way back in 2014, declaring the use of Bitcoin and other forms of decentralized currencies as illegal. Voting in the National Assembly saw the government amending its monetary laws to allow the use of its own “electronic money.”

The electronic money, issued solely by Ecuador’s central bank, sought to become the country’s national electronic currency. Dinero Electrónico was later rolled out as a mobile payment system that allowed peer-to-peer (P2P) transfers of USD using basic mobile phones.

The program operated from 2014 to 2018 and was discontinued thereafter. Cryptocurrency as a payment tool remains banned in Ecuador, although the Central Bank of Ecuador eased restrictions concerning purchasing and selling cryptocurrencies such as Bitcoin in 2018.

Qatar

Qatar’s central bank issued a warning against financial banks trading cryptocurrencies in 2018. Such institutions were implored not to “deal with Bitcoin, exchange it with another currency, open an account to deal with it, or send or receive any money transfers to buy or sell this currency.” Those caught could be penalized.

Trading cryptocurrencies remains illegal in Qatar, with the country’s government viewing it as something that “is highly volatile and can be used for financial crimes and electronic hacking as well as risk loss of value because there are no guarantors or assets.”

Turkey

When the Turkish lira plummeted in value, many people turned to crypto as a way to hedge against inflation. However, the country issued a regulation banning cryptocurrencies in April of 2021 via its central bank.

The declaration deemed cryptocurrencies and other digital assets illegal to use to pay for goods and services. Turkish President Recep Tayyip Erdoğan declared war on crypto, followed by the arrests of several suspected cryptocurrency fraudsters.

Vietnam

The use, issuance and supply of Bitcoin and other cryptocurrencies as a means of payment are illegal as per the State Bank of Vietnam. Violators can face fines ranging from 150 million VND ($6,592.50 approx) to 200 million VND ($8,790.00 approx).

Although still in the research stage, the country announced in 2021 that it has plans to start regulating cryptocurrencies moving forward.

China

Once home to the world’s largest pool of Bitcoin miners, China has formally banned cryptocurrency transactions since 2019. As per the Chinese government, the crypto ban on crypto was enforced in an effort to reduce greenhouse fuel emissions and energy expenditures associated with crypto mining.

The government has also banned financial institutions from dealing with digital assets and any and all forms of cryptocurrency transactions and mining.

Bangladesh

Under Bangladesh's financial regulations such as the Money Laundering Prevention Act, trading cryptocurrencies is deemed illegal in the country. The Bangladesh Bank likewise forbids trading in foreign currencies, which are also decentralized.

Violators, if caught, can face years in prison under the country’s strict Anti-Money Laundering laws.

Russia

Russia has had a long-standing battle against Bitcoin and other cryptocurrencies, citing crypto as a possible tool for money laundering or financing terrorism. In 2020, cryptocurrencies were finally granted legal status in Russia, but to a very limited extent.

Crypto is still not allowed as a means of payment within the country. In addition, Russia’s central bank is currently proposing further bans on the use and mining of crypto. However, several tech and political executives have been quick to denounce the crypto ban, citing its negative effect on the country’s tech economy.

Russian President Vladimir Putin has also come forward to give crypto enthusiasts a little hope as he acknowledged the advantages of crypto mining early in 2022.

Egypt

Islamic legislature prohibits all forms of cryptocurrency transactions in Egypt. Citing its harmful effects on the country’s economic health and national security, the government has treated crypto much like it does narcotic drugs.

The Egyptian government announced in 2019 that it would revisit laws on crypto in an effort to create new laws that would support the safe use of crypto. No further news has been announced regarding such new laws, however.

Morocco

Morocco’s foreign exchange office considers digital currency transactions an “infringement” on forex regulations. As such, crypto trading was banned in the country in 2017, citing risks associated with a lack of regulations.

Despite this, Morocco remains number one for Bitcoin trading in North Africa.

Nigeria

A cryptocurrency ban was imposed in Nigeria in February 2021. Despite being the largest cryptocurrency market in Africa, the country’s government banned financial institutions and banks from providing crypto services. Bank accounts found using crypto exchanges were also threatened with closure.

The Nigerian Securities and Exchange Commission likewise announced the suspension of all plans for crypto regulation.

Bolivia

The Central Bank of Bolivia ratified its crypto prohibition resolution in 2022. Although cryptocurrencies were officially banned since 2014, the latest resolution specifically targeted “private initiatives related to the use and commercialization of cryptoassets.”

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] There you will find 479 more Info on that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Here you will find 70774 more Information to that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] There you will find 20912 additional Information to that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Here you will find 54935 additional Information on that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] There you can find 10816 more Info on that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2260/ […]

… [Trackback]

[…] Here you will find 14628 additional Info to that Topic: x.superex.com/academys/beginner/2260/ […]