What are tokenized real-world assets (RWA), and why do they matter in DeFi

Tokenizing real-world assets enables fractional ownership and makes high-value assets more accessible to a wider variety of investors by facilitating the division of assets into smaller, more affordable units.

Tokenized real-world assets, explained

Real-world assets transformed into digital tokens and stored on a blockchain or other distributed ledger technology are tokenized real-world assets. These include real estate, art, commodities and even intellectual property. Greater liquidity, transparency and accessibility are made possible by this digitization of physical assets, and it is frequently thought of as a way to modernize and democratize conventional financial markets.

Enhanced liquidity is one of the most important benefits of tokenizing real-world assets. Unlike traditional markets with set trading hours, cryptocurrency exchanges allow for 24/7 trading of these tokens, giving traders more freedom. Moreover, investor confidence is increased by the transparency built into blockchain technology, which further lowers the possibility of fraud and ownership conflicts.

Additionally, tokenization lowers the costs associated with asset management, such as paperwork, intermediaries and legal fees, by removing many of the entry barriers prevalent in traditional financial markets. Investor fees may be reduced as a result of this cost reduction.

However, tokenized real-world assets do have drawbacks, including regulatory considerations that differ by jurisdiction. Any tokenization project must adhere to local laws and regulations. Due to the vulnerability of digital assets to fraud and hacking, security is another crucial issue. To preserve these assets, effective custody solutions and security measures are required.

Despite these difficulties, tokenized real-world assets are a promising financial industry innovation that provides more inclusive investing options. Tokenization adoption is still in its early stages, and it might take some time to become widely accepted in traditional finance. Nonetheless, technology can change how we deal with and invest in physical assets.

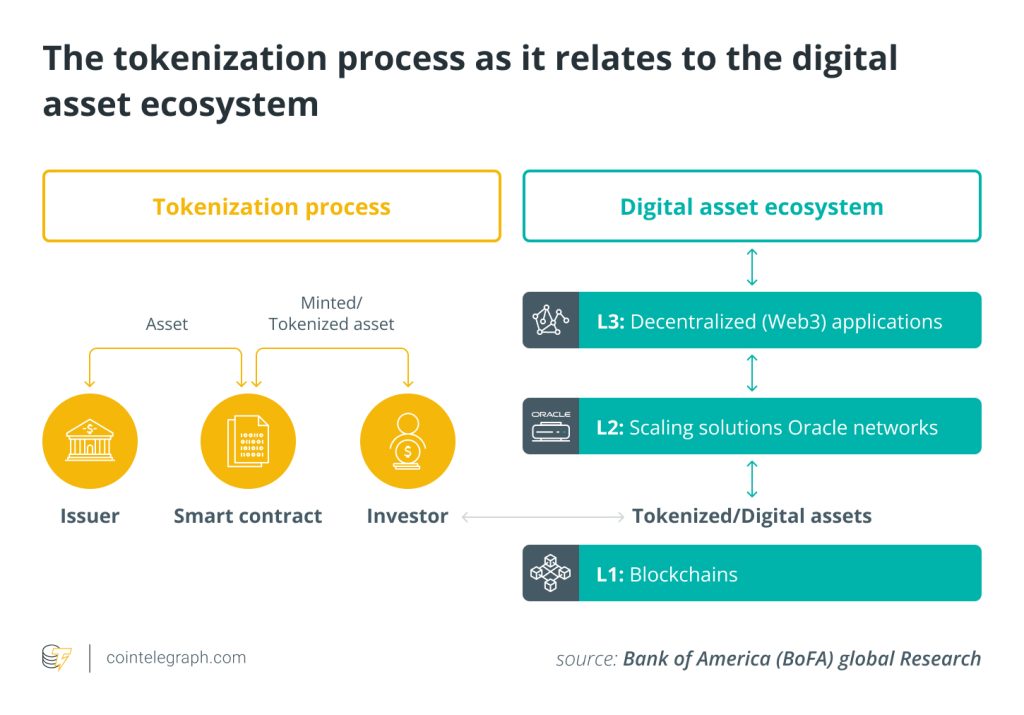

Tokenization process: How blockchain facilitates tokenization of real-world assets

Real-world assets are converted into digital tokens through the tokenization process, which is made possible by blockchain technology so that they may be readily purchased, sold and traded on a blockchain platform. Here is how blockchain makes it easier to tokenize physical assets:

Asset identification and valuation

The first steps in the process are identifying and valuing the real-world asset that will be tokenized. Anything from real estate to fine art, commodities or intellectual property could be considered an asset. The asset’s worth is determined, and a choice is made about dividing it into digital tokens.

Legal and regulatory compliance

Confirming all applicable rules and regulations are followed is critical before moving on. To facilitate tokenization while adhering to applicable rules, legal entities like Special Purpose Vehicles (SPVs) may be developed. An SPV is created for a specific, often single, financial purpose, such as holding and managing assets, reducing risk or facilitating investments.

Creation of smart contracts

Blockchain-based smart contracts are created that specify how the tokens will be created, managed and traded. Automating various processes and guaranteeing that they are carried out in an agreed-upon manner depends on smart contracts.

Blockchain platform selection

The next step is to select a suitable blockchain platform for tokenization. For instance, one may choose Ethereum since it supports smart contracts and has a strong developer community. It’s also possible to use other blockchain platforms with tokenization features.

Token creation

The creation of digital tokens that represent ownership or rights over the physical asset. Typically, each token represents a small portion of the asset’s worth. These tokens are developed using the chosen blockchain and frequently follow well-established token standards, such as ERC-20 for tokens based on Ethereum.

Ownership record

A visible and unchangeable ledger on the blockchain keeps track of who owns which tokens. The blockchain keeps track of all transactions involving these tokens, including purchases, sales and transfers. Ensuring openness aids in preventing theft or ownership conflicts.

Custody solutions

Safeguarding the physical asset that underpins the tokens requires effective custody solutions. These custody solutions may involve physical security measures for tangible assets like real estate or secure storage for digital assets.

Exchange and marketplace

A marketplace or platform is created where these tokenized assets can be purchased, sold and traded. By integrating frequently with cryptocurrency exchanges, these platforms make it straightforward for investors to access and trade the tokens.

Accessibility and liquidity

The tokenization of physical assets boosts their accessibility and liquidity. In contrast to traditional markets with strict trading restrictions and expensive entry barriers, investors can trade these tokens around the clock, making them more accessible.

Benefits of real-world assets tokenization

Real-world asset tokenization offers benefits that reshape the financial landscape. Transforming physical assets like land, artwork and commodities into digital tokens promotes increased liquidity by permitting fractional ownership and round-the-clock trade on blockchain-based platforms.

This increased accessibility democratizes investment opportunities by allowing a broader spectrum of individuals to participate who were previously barred by excessive costs and administrative restrictions.

Transparency instilled by tokenization is yet another appealing advantage. The blockchain creates an immutable ledger that protects against fraud by producing an indelible record of every transaction and ownership record — promoting investor trust.

Real-world asset tokenization, which provides a clear, approachable and effective way to interact with tangible assets in the digital environment, represents a modernization of existing markets.

Why real-world assets matter in DeFi

RWAs hold substantial significance in the decentralized finance (DeFi) sector for many reasons. RWAs play a crucial role in the world of DeFi because they link the digital world of blockchain technology and the physical assets of the real world. DeFi primarily uses digital assets and cryptocurrencies, but real-world assets like stocks, commodities or real estate are crucial for connecting to the established financial system.

DeFi platforms allow users to access, trade and utilize these assets in a decentralized and borderless manner by tokenizing them and representing them on the blockchain. DeFi benefits from real-world assets in various ways too. RWAs open up chances for diversification, lowering risk by enabling DeFi members to invest in assets outside the cryptocurrency sector.

Incorporating assets with well-established values and market behaviors also makes the DeFi ecosystem more stable. Traditional investors may be drawn to DeFi by the yield-generating opportunities these assets can provide, such as lending and borrowing.

Tokenization and smart contracts facilitate simultaneous settlement for tokenized assets by automating clearing, settlement, payment messages, compliance checks, and account transactions in financial institutions. Real-world asset tokenization also improves financial inclusivity by lowering barriers to entry for people who might not have access to conventional financial markets to participate in the financial market.

However, real-world asset integration into DeFi presents regulatory difficulties and necessitates robust mechanisms to secure asset backing and security. Nevertheless, their presence in the DeFi area is a significant step in the direction of the legitimacy and widespread adoption of decentralized finance in the global financial system.

Risks and challenges concerned with tokenization of real-world assets

While intriguing, tokenizing physical assets comes with several serious risks and difficulties. For instance, regulatory obstacles are a major concern. It is difficult to navigate the intricate and changing regulatory environment, which differs significantly between jurisdictions. To avoid legal concerns that could put tokenized asset initiatives at risk, ensuring compliance with securities laws and other pertinent regulations is essential.

Custody of assets is another significant challenge. Protecting the underlying financial or legal assets that support the digital tokens is crucial. To stop theft, fraud or improper handling of the assets, it is critical to opt for reliable and secure custody solutions.

Moreover, it’s important to consider market acceptance and liquidity. Active marketplaces or exchanges are necessary for tokenized assets to sustain liquidity and pricing stability. Investor confidence may be weakened by illiquidity and price volatility caused by low trading volumes or limited adoption.

Additionally, tokenized asset appraisals can be complex. It may be subjective and prone to error to determine the precise worth of a real-world asset and divide it into tradeable tokens. Investor disagreements may result from valuation discrepancies. Furthermore, there are inherent risks with technology. Smart contracts and blockchain networks may be subject to hacking, software faults or other vulnerabilities. These risks may lead to asset loss or manipulation.

Projects involving tokenization should handle privacy and data security concerns because the transparency of blockchain can reveal sensitive data. To minimize potential problems, it is also necessary to clarify the legal enforceability of smart contracts and the dispute resolution processes. Also, crypto market education is important. The lack of a thorough understanding of tokenized assets by investors, companies and regulators may prevent uptake and regulatory acceptability.

Future trends and developments

Real-world assets that have been tokenized are expected to expand and change significantly in the future. We may anticipate a rise in investor confidence and institutional involvement as regulatory frameworks continue to develop and adapt to this new asset class.

A worldwide ecosystem for tokenized assets may be facilitated by more smooth interoperability between various blockchain networks. Furthermore, improvements in blockchain technology and DeFi will probably produce more complex prospects for income generation and novel financial products.

The Internet of Things integration of real-time asset monitoring and improved security measures may help increase public confidence in tokenized assets. Additionally, asset classes like intellectual property and carbon credits may see increased tokenization, broadening the range of investment opportunities in this dynamic landscape.

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2228/ […]

cinemakick

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] There you can find 44801 more Info on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] There you will find 25173 additional Information to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] There you can find 9086 more Info to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Here you will find 42240 additional Information to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Here you will find 34007 additional Info to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] There you can find 60847 additional Info on that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Here you can find 91636 additional Info to that Topic: x.superex.com/academys/beginner/2228/ […]

… [Trackback]

[…] Here you will find 55526 more Information to that Topic: x.superex.com/academys/beginner/2228/ […]