Dogecoin vs. Shiba Inu: What’s the difference?

With their innovative approaches to online trading, investing and transactional processes, cryptocurrencies have brought transformations to the financial industry. Although the digital currency market has produced a fair share of eccentric players, Dogecoin and Shiba Inu have managed to effectively capture the public’s attention and maintain high market capitalization.

This article will delve into the details of these meme-inspired cryptocurrencies, examine their history, similarities and distinctions, and assist potential holders in determining the most suitable investment option.

What is Dogecoin?

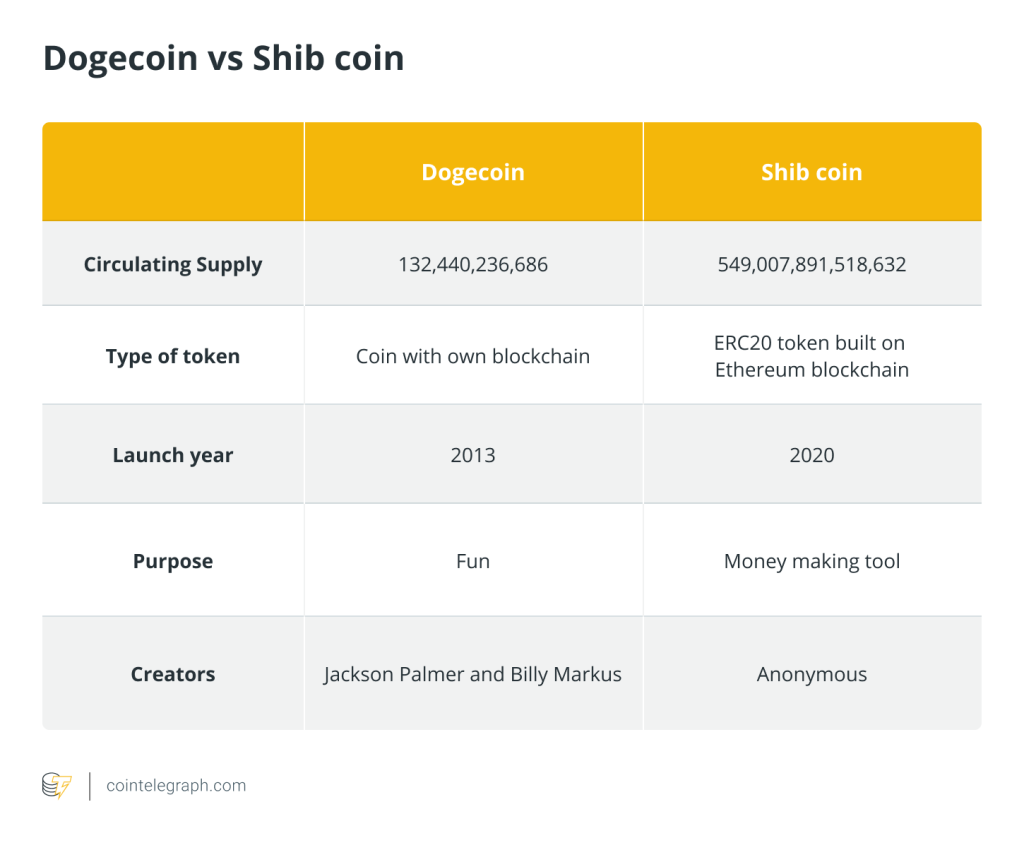

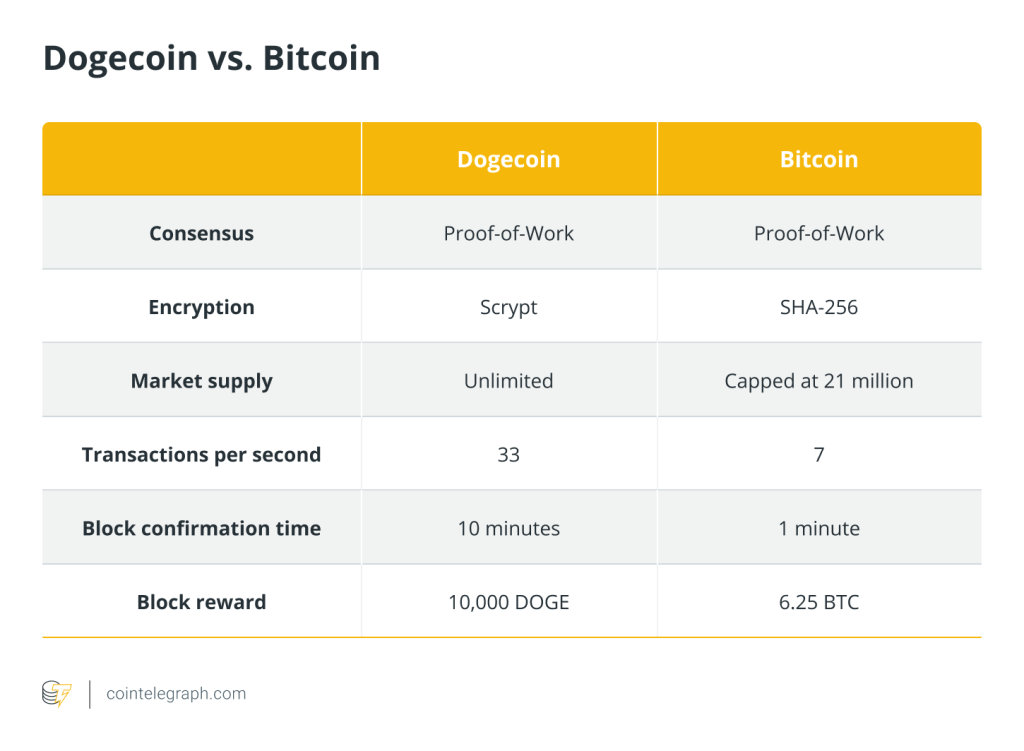

Dogecoin (DOGE), a cryptocurrency that emerged in late 2013, appeared from the whimsical fusion of internet culture and the booming popularity of Bitcoin (BTC). Conceived by software engineers Billy Markus and Jackson Palmer, Dogecoin intentionally adopted the “doge” meme featuring a Shiba Inu dog as its symbol. It introduced its blockchain using the Scrypt hashing algorithm, making the token more accessible for individual miners and fostering a more inclusive and decentralized network.

Initially created as a satirical commentary on the cryptocurrency craze and doge memes, it quickly evolved into a legitimate digital currency with a unique identity while providing a fun alternative to other technical cryptocurrencies.

Dogecoin’s community is one of its standout features. It boasts a passionate and engaged following, known for its charitable efforts, tipping culture and social media campaigns. Tesla CEO Elon Musk’s tweets have further fueled Dogecoin’s popularity.

The altcoin features an unlimited supply, with 5 billion new DOGE minted annually, categorizing it as an inflationary cryptocurrency. This design was a deliberate departure from the scarcity model of Bitcoin, aligning with Dogecoin’s founders’ vision of creating a playful and approachable cryptocurrency.

While Dogecoin boasts a dedicated community of Shiba Inu enthusiasts, its limited updates since 2015 have prompted certain users to seek out more technologically advanced alternatives. Nonetheless, Dogecoin’s substantial market capitalization remains a notable indicator of the memecoin’s enduring significance and influence in the broader financial landscape.

What is Shiba Inu?

Shiba Inu (SHIB), an Ethereum-based cryptocurrency, emerged in 2020 as a unique memecoin and alternative to Dogecoin. The project was initiated by an anonymous founder known as “Ryoshi,” with the aim of creating a decentralized ecosystem governed by its community. SHIB was designed to capitalize on the growing popularity of memecoins and the success of Dogecoin.

Shiba Inu’s iconography revolves around the Shiba Inu dog breed, drawing inspiration from Dogecoin’s meme culture roots. Despite its origins as a memecoin, Shiba Inu has garnered significant attention in the cryptocurrency space, reflecting the influence of internet culture on digital assets.

The token operates on the Ethereum blockchain, utilizing its infrastructure and technology, while its development and technological foundation mechanisms have been detailed in the Shiba Inu white paper and roadmap. Although it primarily employs Ethereum’s proof-of-stake (PoS) consensus mechanism, SHIB also incorporates components of proof-of-authority (PoA) in its ecosystem.

By utilizing Ethereum’s infrastructure and originally combining PoS and PoA, Shiba Inu demonstrates its technological versatility inside the Ethereum ecosystem, enhancing scalability and decentralization while leveraging Ethereum’s technology.

Similarities between Dogecoin and Shiba Inu

Dogecoin and Shiba Inu, two cryptocurrencies with origins deeply intertwined with internet culture and meme-inspired branding, share several striking similarities. Both digital assets draw their inspiration from the Shiba Inu dog and incorporate the breed’s imagery and cultural references, infusing their branding and communities with a playful spirit.

Both Dogecoin and Shiba Inu have cultivated passionate and devoted communities. Enthusiastic supporters actively champion these cryptocurrencies, engaging in social media campaigns, tipping and meme creation to promote and support their respective projects. These vibrant communities have played a pivotal role in their ongoing popularity and adoption.

Influential figures and social media platforms wield substantial influence over the appeal and value of both Dogecoin and Shiba Inu. Notably, Musk’s tweets have significantly impacted the market dynamics of both coins, sparking surges in interest and investment. The power of viral trends and online discourse has propelled these cryptocurrencies into the spotlight.

Dogecoin and Shiba Inu have both enjoyed positions near the top of the market capitalization rankings. While Dogecoin’s market cap has reached approximately $8.2 billion, Shiba Inu has secured a market cap of roughly $3.9 billion (as of Oct. 19, 2023), holding a less prominent standing, reflecting disparities in market perception and adoption. Nevertheless, both cryptocurrencies showcase their substantial influence and prominence in the broader cryptocurrency landscape.

Differences between Dogecoin and Shiba Inu

One key difference between Dogecoin and Shiba Inu lies in their supply capitalization strategies. Dogecoin, originally designed with a 100-billion hard supply cap, removed this cap to discourage hoarding and speculation, becoming unlimited and less scarce, with 5 billion coins issued annually.

In contrast, Shiba Inu initially featured a supply cap but later removed it, prompting concerns about scarcity and its consequent impact on value. SHIB has a limited supply, with a standing total of 1 quadrillion tokens.

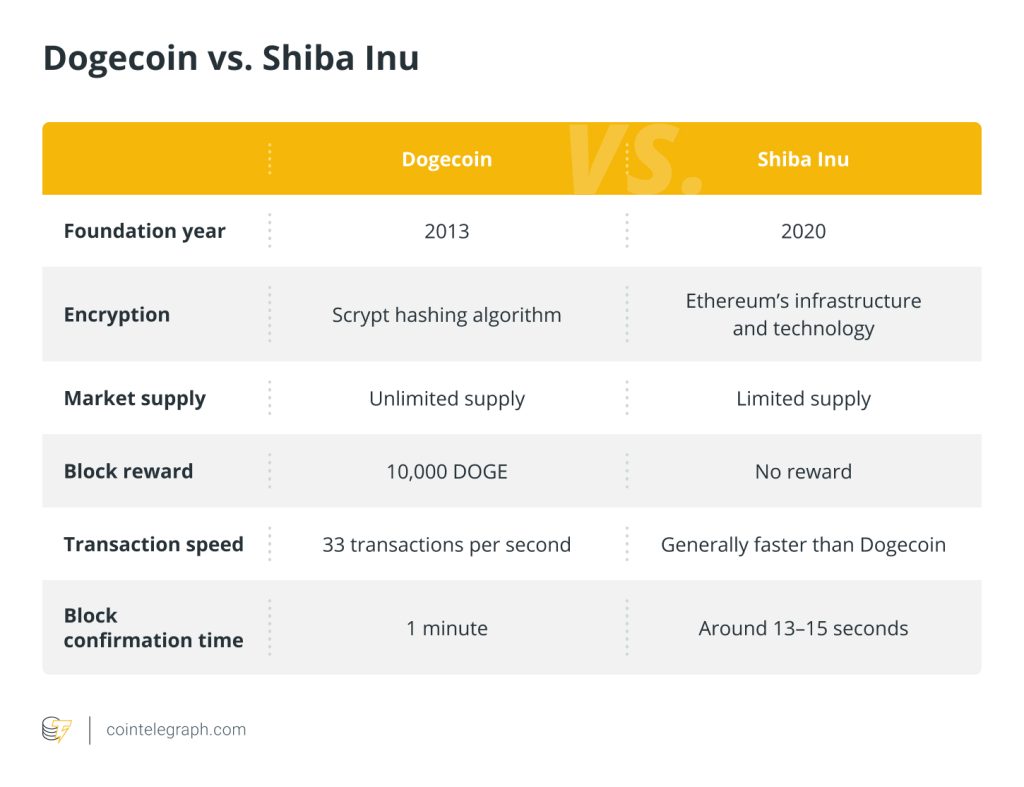

Regarding technical distinctions, Dogecoin employs the Scrypt hashing algorithm and plans to transition to a PoS consensus mechanism for community staking. In contrast, Shiba Inu leverages Ethereum’s infrastructure, combining PoS and PoA techniques to enhance scalability and decentralization.

Additionally, in Dogecoin, there’s a permanent block reward of 10,000 DOGE per block, which is given to miners or validators for securing and validating transactions. However, Shiba Inu, though it once had a block reward system, has moved away from this traditional model, and its current supply dynamics no longer adhere to the conventional block reward mechanism.

In terms of block confirmation time and transactions per second, Dogecoin and Shiba Inu exhibit notable differences. Dogecoin boasts a block confirmation time of approximately one minute, accommodating roughly 33 transactions per second.

On the other hand, Shiba Inu, operating on the Ethereum network, offers faster transactions with a confirmation time of around 13–15 seconds, albeit subject to variations based on network congestion. This means that, while Dogecoin has a slightly longer block confirmation time, Shiba Inu generally provides quicker transaction speeds.

DOGE vs SHIB: Price history and market cap

Comparing the price histories of Dogecoin and Shiba Inu reveals a rollercoaster ride in the world of the cryptocurrency market. The original memecoin, Dogecoin, rose from a mere 10th of a cent to an astounding all-time high of $0.7376 in May 2021. Wild fluctuations have characterized its trajectory, frequently fueled by social media hype and public opinion.

Shiba Inu, on the other hand, reached its initial all-time high in October 2021 and soared to $0.00008845. It currently has a market capitalization of $4.4 billion. This rapid growth exemplified the coin’s remarkable volatility, largely fueled by the fervor of social media enthusiasts.

When it comes to price stability, Dogecoin typically trades below the $1 mark, making it a less risky investment option than Bitcoin. Despite its ups and downs, as of Oct. 19, 2023, Dogecoin holds a market capitalization of $8.2 billion, remaining stable in the top list of cryptocurrencies by market cap.

Shiba Inu’s market dynamics have shown price fluctuations, marked by notable swings, with a market cap of about $3.9 billion as of Oct. 19, 2023. However, it’s crucial to consider that Shiba Inu initially featured a supply cap but later removed it, sparking discussions about scarcity and its potential impact on the coin’s value.

Due to their price fluctuations, both tokens have garnered media attention, demonstrating the volatile nature of the cryptocurrency market and the influence of social media on cryptocurrency valuations.

Dogecoin vs. Shiba Inu: Which one is right for you?

Deciding between Dogecoin and Shiba Inu ultimately depends on investment goals and risk tolerance. Here are some factors to keep in mind:

- Risk tolerance: Dogecoin, with its established position and larger market capitalization, may be viewed as a relatively less risky option. Shiba Inu, while potentially offering higher returns, is associated with greater volatility.

- Community engagement: Appreciating active and passionate communities, both Dogecoin and Shiba Inu boast enthusiastic supporters. Consider aligning with a community that resonates with your values.

- Investor profile: Dogecoin can be viewed as a more reliable, long-term investment, but Shiba Inu might be appealing to individuals looking for quick trading possibilities.

- Technology preference: A preference for specific blockchain technologies or ecosystems — e.g., Ethereum for Shiba Inu — could influence the choice.

Dogecoin and Shiba Inu, born from humor and memes, have evolved into intriguing players in the cryptocurrency landscape. Both possess unique characteristics, and the choice between them should align with investment objectives and risk tolerance. As with any investment, it’s essential to conduct thorough research and consider the financial situation before delving into the world of cryptocurrencies.

… [Trackback]

[…] Here you can find 38714 more Information on that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] There you will find 54287 more Info to that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2198/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2198/ […]