Bitcoin halving 2024: Everything you need to know

Bitcoin seems to have emerged from the 2022–2023 crypto winter stronger than most, and people are probably wondering, “What happens to Bitcoin in 2024?” To which we reply, “Bitcoin’s halving event.”

This handy guide covers pertinent issues such as the next Bitcoin halving dates, is Bitcoin halving good or bad, will Bitcoin halving increase price, and whether halving leads to a Bitcoin supply reduction.

Introduction to Bitcoin halving

To get to the bottom of this event, it calls for a comprehensive examination of creating Bitcoin (BTC). Since Bitcoin is a decentralized digital currency, anyone can generate Bitcoin through the digital mining process.

It involves using powerful computers to decipher complicated mathematical problems or an encrypted hash via the proof-of-work (PoW) process, which verifies a transaction and adds it to the blockchain. Successful miners receive a pre-established amount of Bitcoin rewards in return.

In essence, the block subsidy reward received by miners is reduced by 50% as a result of the Bitcoin block reward halving event.

Satoshi Nakamoto introduced halving events to keep the Bitcoin inflation rate in check. Reducing the mining rewards reduces the incentive to mine for more, increasing Bitcoin scarcity and raising the stock-to-flow ratio. Furthermore, creating BTC scarcity makes it more precious and aids in retaining and appreciating in value over time, especially if demand continues to rise.

The history of Bitcoin halving

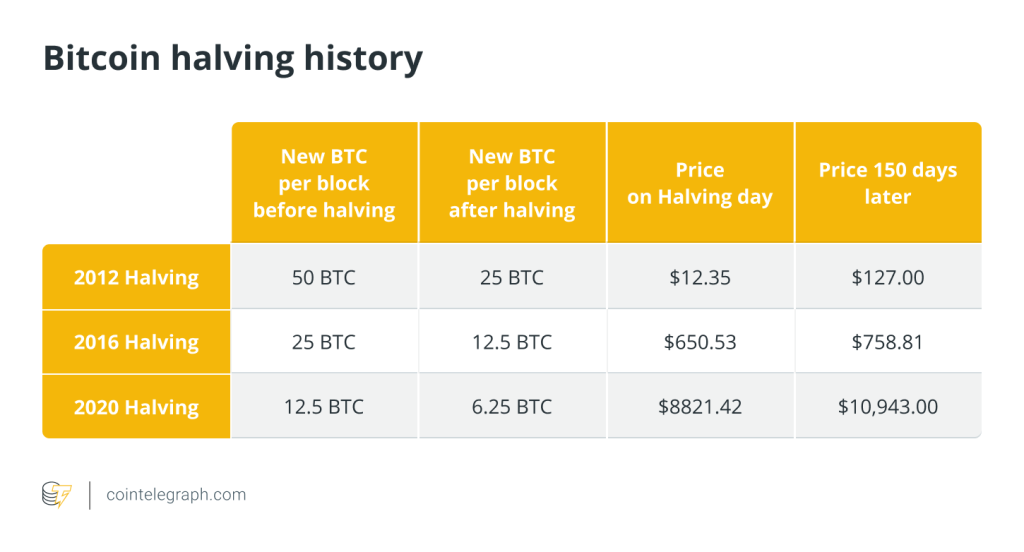

When the Bitcoin network went live in 2009, the mining reward, or Bitcoin mining subsidy, stood at 50 BTC per block. Bitcoin’s pseudonymous creator, Satoshi Nakamoto, hard-baked the miner rewards reduction protocol into the Bitcoin code as part of its monetary policy.

Therefore, the block subsidy halving code will execute automatically on completion of every 210,000 blocks, slashing rewards granted to miners for the next four years.

Since its launch in 2009, there have been three halving events, with the first occurring in 2012, followed by 2016, and the most recent one in 2020. The fourth halving will, therefore, happen in 2024 at a block height of 840,000, with the fifth projected to materialize in 2028.

The Bitcoin halving cycle

It’s nearly impossible to determine an exact date or time when the next halving event will occur because it depends on completing 210,000 blocks. Since confirming or adding a new block to the Bitcoin network takes about 10 minutes, the halving schedule is approximately once every four years.

Technological significance of the Bitcoin halving 2024

Bitcoin’s halving cycle is significant, as it fosters innovation and resilience in its native cryptocurrency, setting it apart from fiat currency.

The Bitcoin halving event of 2024 is significant, as it will have an impact on the rate at which new BTC is introduced into the market. The event will result in a decrease in rewards from 6.25 to 3.125 BTC, potentially prompting miners to enhance their efficiency. In order to maintain profitability, miners must find ways to optimize their operations as the rewards decrease. This can fuel technological advancement in mining hardware, resulting in the creation of mining rigs that are both more energy-efficient and more powerful.

Bitcoin’s capped supply policy ensures no more than 21 million BTC can exist, unlike fiat currencies that are without limit.

Economic significance of the Bitcoin halving 2024

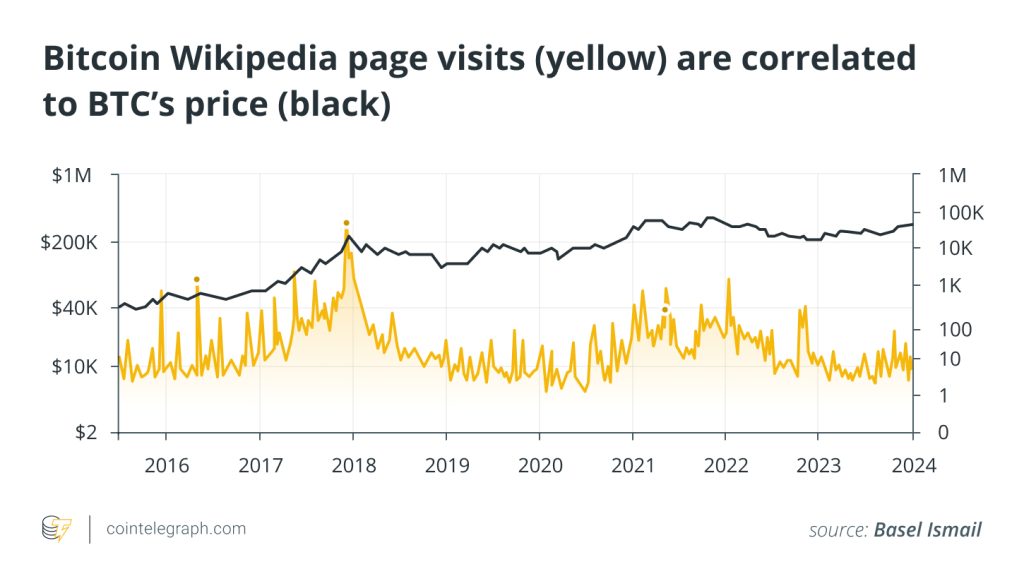

Bitcoin’s halving events have historically precipitated the market scarcity of cryptocurrencies, causing upward pressure on prices, explaining the bull runs witnessed after every halving event.

Based on past occurrences, popular social media expert commentator BitQuant predicted that Bitcoin’s price could reach an all-time high before or after the halving event in 2024. This assertion is hardly surprising, considering all past events preceded all-time price highs for Bitcoin. BitQuant speculates that the price could hit an astronomical $250,000 — nine times its current value.

Bitcoin’s halving timetable in 2024 is crucial after the 2022 crypto winter and the 2023 economic downturn. By slowing BTC creation, it restricts Bitcoin supply over time. Gold-like scarcity applies here. Bitcoin’s deflationary feature attracts investors trying to retain their capital in a world where inflation devalues traditional currencies.

Halving events are predefined, transparent and predictable, unlike central banks’ discretionary judgments in traditional monetary systems. Investors feel secure in this regularity, especially in unpredictable economic times. Bitcoin’s tight monetary policy, enforced by halvings, appeals to people apprehensive of central banks’ actions and policy shifts.

Many gold aficionados perceive Bitcoin as a valuable asset. Gold has always protected against inflation and provided a safe refuge during economic downturns. Bitcoin, in its digital form, has similar traits. Gold investors prefer Bitcoin halvings because they reduce the supply, which is akin to gold mining. The notion of “digital gold” suggests Bitcoin might serve a comparable role in the digital era. Bitcoin halving occurrences are notable for long-term gold investors since both Bitcoin and gold are deflationary.

Impact of the halving cycle on Bitcoin’s price

Since halving reduces the incentive to mine Bitcoin, it creates scarcity and raises the apt question: Will Bitcoin’s halving increase BTC’s price?

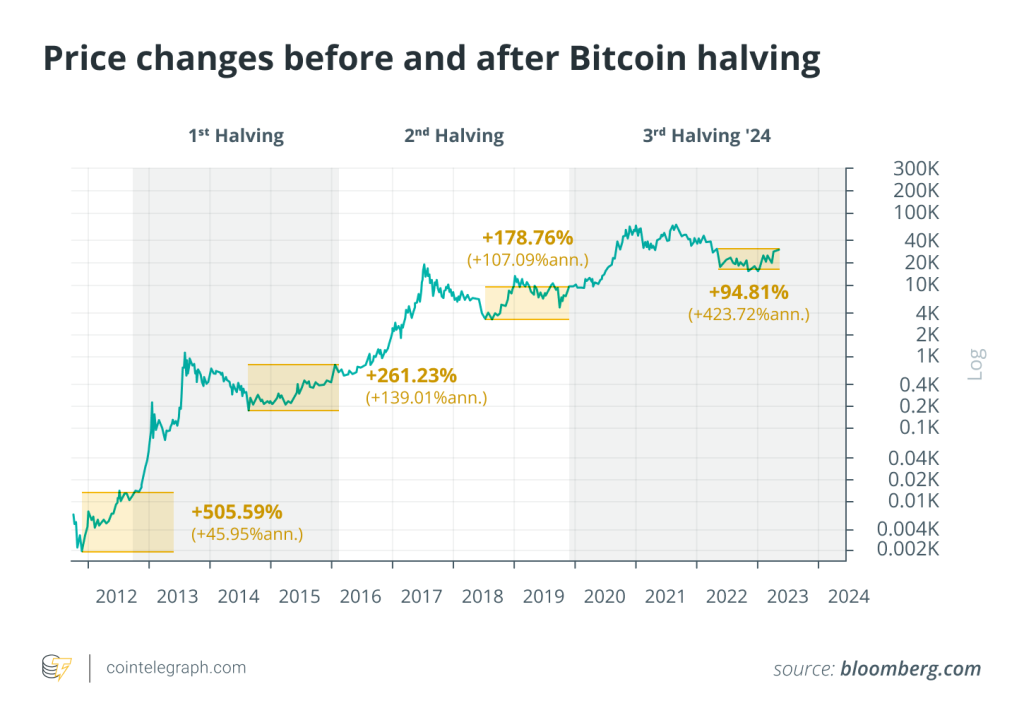

Looking at historical figures from past halving events offers valuable insights, as they’ve all followed a similar pattern. This is mainly due to the decrease in mining rewards and inflation caused by the reduced introduction of new Bitcoin.

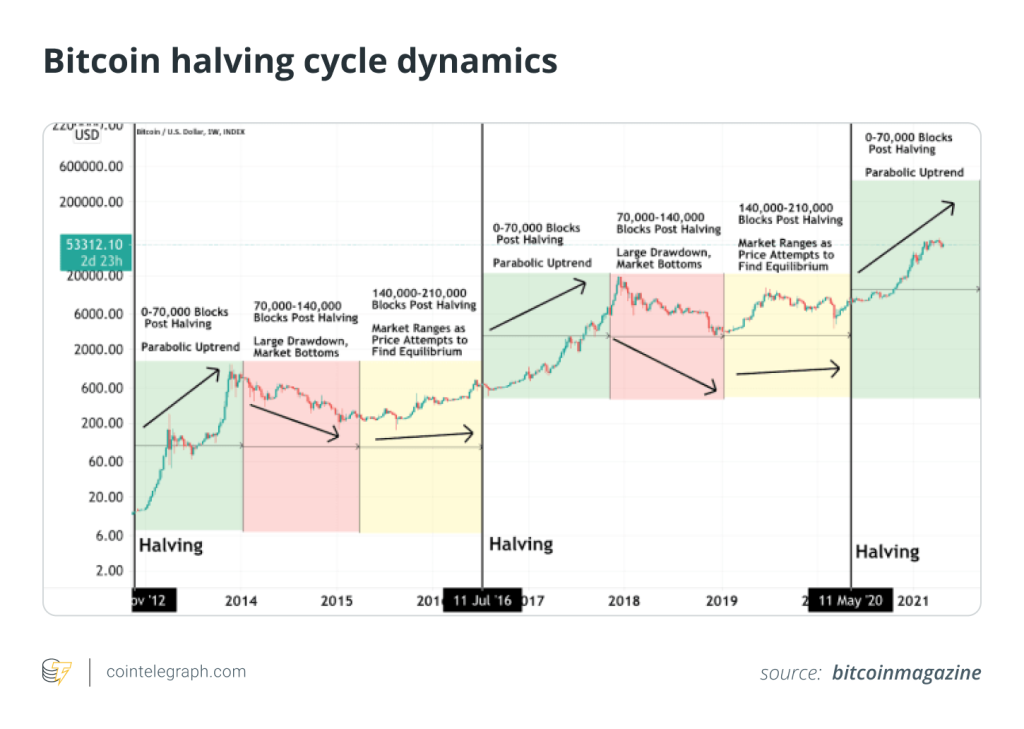

1. Amassing phase

Bitcoin users typically accumulate BTC pre-halving, causing a stagnation or slight uptrend in Bitcoin prices. This phenomenon preceded the first, second, third and current halving events, lasting between 13 and 22 months.

2. Bull run phase

Past halving events triggered bull market phases lasting 10–15 months, with the price rising steadily and attaining all-time highs afterward. Only once (in 2016) did Bitcoin suffer a brief pullback, but it recovered and followed the characteristic bull phase trajectory.

3. Bear run phase

All the previous bull runs ended in a pullback or price correction phase that lasted about 600 days, although the last one only ran for about a year.

Impact of Bitcoin halving on miners

Mining Bitcoin is resource- and energy-intensive. By some estimates, it takes 1,449 kilowatts per hour of electricity to complete a single Bitcoin transaction. That’s the same amount of energy a typical American household will use in 55 days. Halving the rewards for mining Bitcoin will impact miners, as the mining cost remains high, while the rewards dip.

The industry standard for measuring profitability is in dollars per terahash (TH) per second, which refers to the money generated by a mining rig producing a trillion hashes per second. One can utilize mining calculators to find the hash rate and gauge profitability.

While Bitcoin’s price is volatile, mining Bitcoin at its peak in 2017 fetched $3.39 per TH/s, but by mid-2022, it had dropped to $0.104 per TH/s. Halving the rewards will further eat into miners’ profitability, so most miners can only hope to make a profit during a bull run.

Is Bitcoin halving good or bad?

Bitcoin halving has its pros and cons. For instance, halvings affect the issuance rate of new BTC, creating scarcity, which could drive BTC price appreciation. This comes at the cost of short-term Bitcoin price volatility, which is driven by the uncertainty created by the halving event.

On the other hand, the Bitcoin halving reduces profitability, meaning miners will earn half of what they were making to confirm new blocks while spending the same amount on computing and energy costs.

The halving might also negatively impact Bitcoin network security, as fewer miners will be incentivized to continue mining due to reduced profitability. That could theoretically expose the network to a 51% attack, as mining power would consolidate among fewer participants.

Written by Tanuj Surve

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Here you will find 49141 additional Information on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Here you will find 20318 additional Info to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] There you can find 41313 more Information to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Here you will find 88765 additional Information to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] There you will find 36830 more Information to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Here you will find 35974 more Information to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] Read More Info here on that Topic: x.superex.com/academys/beginner/2194/ […]

… [Trackback]

[…] There you can find 75679 more Info on that Topic: x.superex.com/academys/beginner/2194/ […]