Fundamental vs. technical analysis: Key differences

What is fundamental analysis in crypto?

Fundamental analysis is a technique used to assess an asset’s intrinsic worth, such as a stock, bond or cryptocurrency, by looking at a variety of qualitative, quantitative and economic factors. The goal is to determine whether the asset is overvalued, undervalued or appropriately priced in the market by evaluating the underlying health and performance of the asset.

Fundamental analysis is the process of examining a company’s financial statements, earnings, dividends, market share and general financial health in the context of stocks. Economic data and issuer creditworthiness are taken into account while evaluating bonds. Fundamental analysis assists investors in making choices based on the real value of an asset in relation to its market price.

Due to the digital and decentralized structure of crypto assets, fundamental analysis of cryptocurrencies takes into account a unique set of factors, including:

White paper assessment

White papers describing the technology, application cases and the roadmap of cryptocurrency initiatives are frequently published. Fundamental analysts evaluate the technology’s inventiveness, scalability and practical use using white papers.

Team and development evaluation

The project’s leaders and the development team’s competencies and experience are essential. Investors evaluate the team’s experience, knowledge and capacity to accomplish the project’s goal.

Tokenomics analysis

Fundamental analysts examine a cryptocurrency’s tokenomics, including its total supply, circulation and utility within the project’s ecosystem. They evaluate elements that may affect the token’s long-term value, such as scarcity and the token’s role in transactions and governance.

Partnerships and collaborations assessment

Blockchain consortiums, other projects and partnerships with well-known businesses are all closely examined by analysts. They evaluate the importance of these partnerships in terms of the project’s reputation, commercial potential and adoption rate.

Social and community sentiment monitoring

Fundamental analysts keep an eye on community activity on forums, social media and development communities. They measure sentiment to comprehend the amount of enthusiasm and support for the project, which can affect the demand for it in the market.

Regulatory environment understanding

The regulatory environment in relevant jurisdictions where cryptocurrencies operate is monitored by analysts to evaluate how potential regulatory developments or changes might affect the project’s compliance, adoption rate and overall value.

Security assessment

Fundamental analysts investigate the blockchain network’s security aspects, paying particular attention to consensus mechanisms and resistance to potential attacks. They evaluate the network’s reliability and trustworthiness — two factors important for investor confidence.

Benefits of fundamental analysis

The fundamental analysis of the crypto market provides priceless insights that form the basis of well-informed investment choices. Fundamental analysis offers a thorough knowledge of a project’s potential and sustainability by probing the underlying elements that affect a cryptocurrency’s value. But is fundamental analysis worth it?

One of its key advantages is its capacity to evaluate the project’s technological innovations, scalability and practical applications. Investors might feel confident in the project’s ability to be executed if they are aware of the personnel behind it, their background and their vision.

Fundamental analysis also carefully examines tokenomics, including supply, demand and usefulness, offering essential information on the viability of a cryptocurrency project. Additionally, it makes it possible to assess alliances, market demand and legal compliance, providing a comprehensive view of the project’s ecosystem.

Investors may discover cryptocurrencies with solid fundamentals that are likely to endure market volatility and thrive over the long run by using the information provided by these insights to make informed decisions.

What is technical analysis in crypto?

In the context of cryptocurrency trading, technical analysis involves assessing previous price data and market statistics to project future price changes. Technical analysis makes predictions about market behavior using patterns, trends and statistical indicators, in contrast to fundamental analysis, which concentrates on an asset’s underlying value.

The following are the main elements of technical analysis in the crypto market:

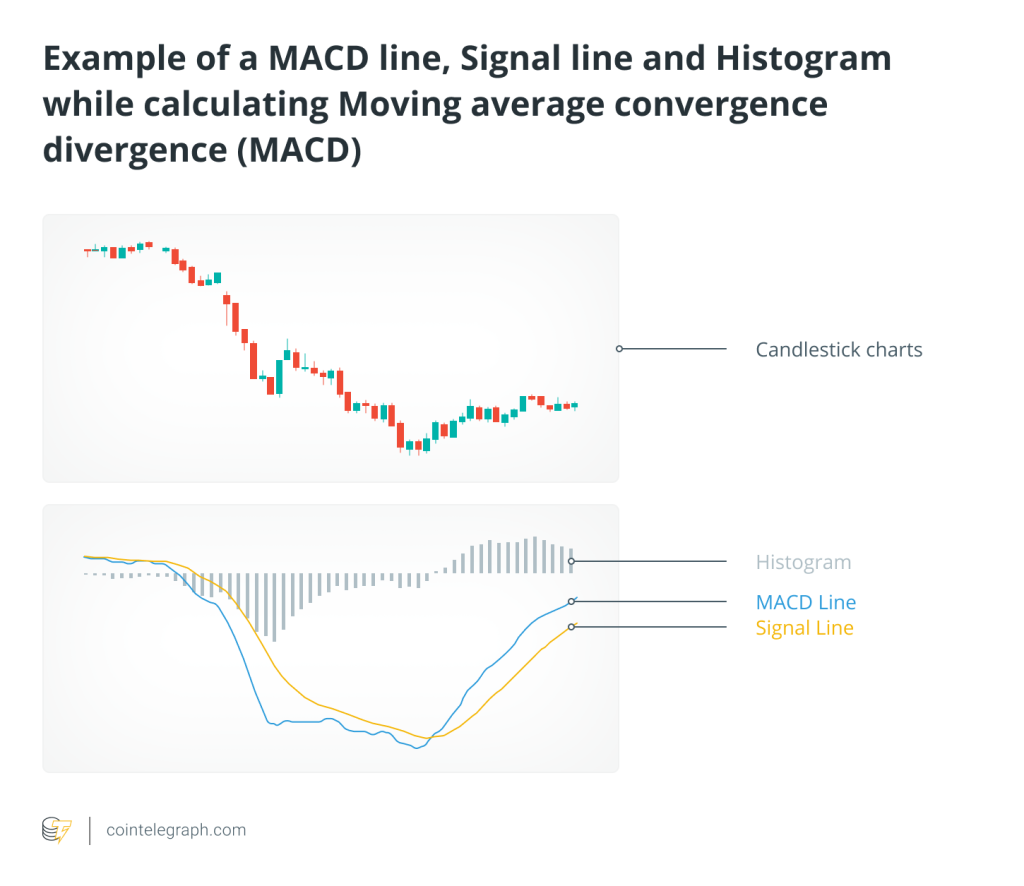

Candlestick patterns and chart analysis

To spot trends and probable reversals, technical analysts look at candlestick patterns on price charts. Doji, head and shoulders and double tops and bottoms patterns, among others, offer perceptions of market sentiment and the potential price direction of a cryptocurrency under consideration.

Support and resistance levels

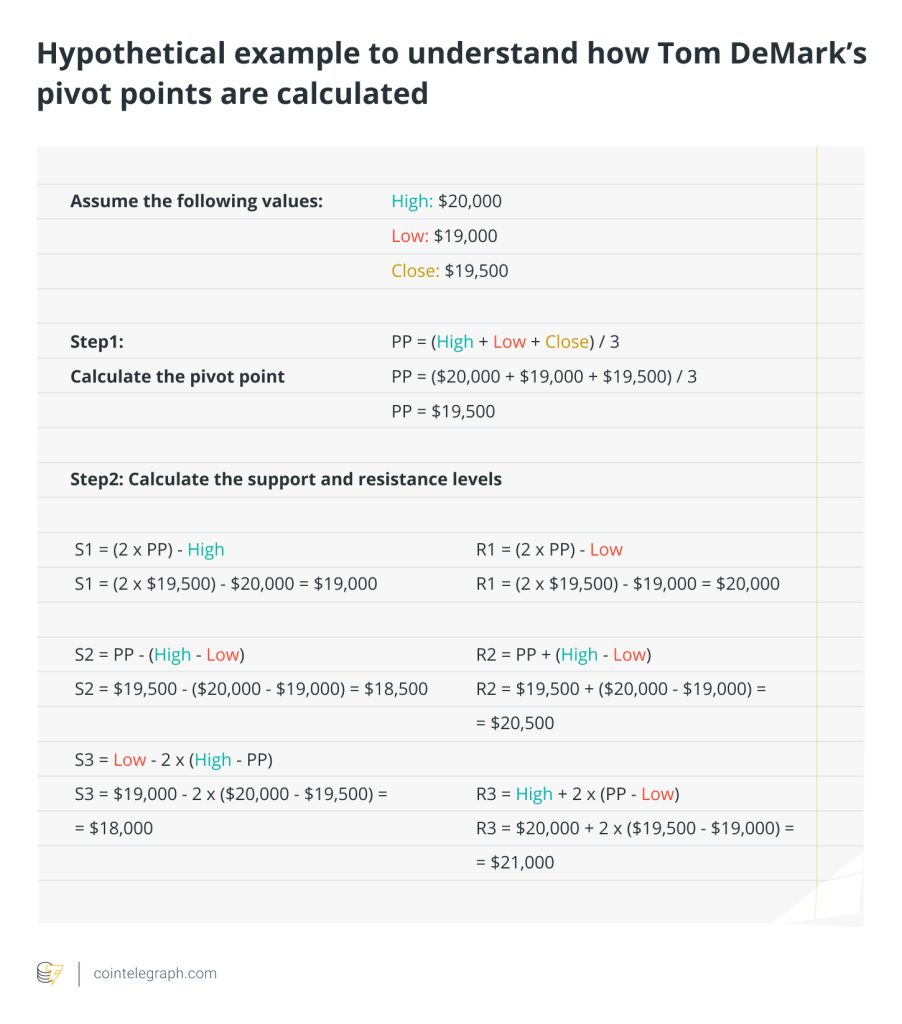

Resistance levels signify a price point that an asset has traditionally had trouble rising above. In contrast, support levels signify a price point at which the asset has historically had difficulty falling below. Technical analysts use these levels to forecast future price moves.

Indicators

Moving averages, the relative strength index (RSI), the moving average convergence divergence (MACD), and Bollinger Bands are some indicators used by technical analysts to determine trend strength, overbought or oversold circumstances, and potential turning points.

Volume analysis

It is vital to analyze trade activity together with price changes. The volume shows how active the market is. Sudden price changes accompanied by large volumes are frequently regarded as being more meaningful than those followed by low volume because they imply a stronger market sentiment.

Trendlines

A price chart’s trendlines can be used to determine the trend’s direction. Breakouts can indicate potential buying or selling opportunities or bounces at these trendlines.

Elliott Wave Theory

The Elliott Wave Theory, which contends that market price movements follow recognizable wave patterns, is used by certain traders. Analysts use this concept to forecast future market changes based on previous wave patterns.

Fibonacci retracement

Fibonacci retracement levels are horizontal lines that represent possible support and resistance levels based on the Fibonacci sequence. Traders use these levels to pinpoint possible price reversal points following a large market movement.

It is important to note that cryptocurrency traders frequently use technical analysis with other trading tools to help them decide when to enter and exit positions, set stop-loss orders and control risk in the highly volatile cryptocurrency market.

Benefits of technical analysis

Technical analysis offers technical traders the tools to successfully traverse the complicated world of digital assets. Its main advantage is its capacity to examine past pricing data and market trends, providing insightful information about probable price fluctuations in the future. Technical analysis aids traders in making informed entry and exit decisions by spotting patterns, support and resistance levels, and employing indicators like moving averages and RSI.

It offers a structured approach to comprehending the psychology and attitude of the market, helping traders to foresee price changes and reduce risks. Technical analysis also enables traders to create explicit risk management methods and place stop-loss orders. Technical analysis acts as a practical guide in the quick-moving and turbulent crypto market, allowing traders to make well-informed, fact-based trading decisions.

Challenges faced by fundamental and technical analysts in the crypto space

Fundamental and technical analysts in the crypto space encounter unique challenges that set digital asset analysis apart from traditional markets. Fundamental analysts struggle with the crypto industry’s lack of consistent financial reporting.

Many crypto initiatives, unlike established businesses, lack comprehensive financial data, making it challenging to determine their genuine worth. Furthermore, regulatory uncertainties and the quickly changing technological landscape pose challenges for fundamental analysts.

The tremendous volatility present in cryptocurrency markets presents a challenge for technical analysts. Digital assets are prone to sharp price fluctuations driven by news stories and market sentiment, frequently resulting in unpredictable pricing patterns.

Traditional chart patterns are distorted by technical analysis, which is further complicated by the prevalence of market manipulation and poor liquidity in some coins. Additionally, the 24/7 nature of crypto trading puts pressure on analysts by requiring real-time research and decision-making capabilities.

Despite these difficulties, skilled analysts successfully negotiate these intricacies by combining fundamental and technical analysis with a thorough comprehension of market dynamics to create informed predictions in the ever-changing crypto ecosystem.

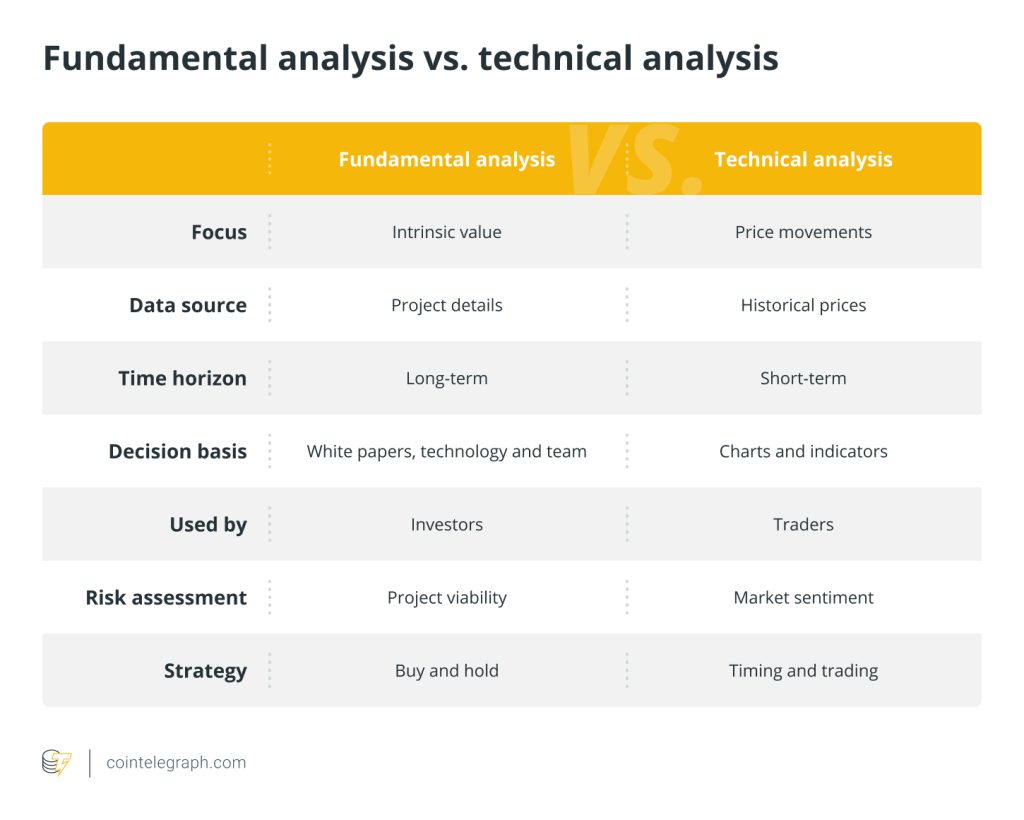

Fundamental vs. technical analysis

The goal of fundamental analysis, similar to researching a company’s fundamentals on the stock market, is to comprehend the essence of the digital asset. On the other hand, technical analysis isolates trends, patterns and potential entry and exit points using market statistics and historical price data.

It’s the skill of deciphering graphs and indicators analogous to reading market movements. Technical research translates an asset’s language, while fundamental analysis searches for a digital asset’s intrinsic worth. Savvy investors frequently combine the two to create a comprehensive, data-driven strategy.

Here’s a summary of the differences between fundamental and technical analysis:

Which is better: Fundamental or technical analysis?

The relative merits of fundamental analysis versus technical analysis in the cryptocurrency market are a contentious topic of discussion. Technical analysis focuses on short-term price changes and market sentiment, whereas fundamental analysis offers insights into a project’s intrinsic value and long-term potential. But is fundamental analysis worth it?

The worthiness of fundamental analysis hinges on the investor’s chosen approach. So, can both fundamental and technical analyses be combined? Most traders often combine both methods to obtain a comprehensive view of the crypto market.

Technical analysis aids in strategic entrance and departure points, while fundamental analysis offers a strong framework for determining the project’s viability. Combining these approaches and utilizing the strengths of each can result in well-informed choices and a balanced trading or investment strategy.

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] There you can find 38254 additional Info on that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Here you can find 13151 more Information to that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Find More on to that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Here you will find 5031 more Info to that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] There you can find 29361 additional Info to that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Here you will find 89147 additional Information on that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] There you can find 82855 additional Information to that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] There you can find 14916 additional Info on that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/2190/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/2190/ […]