Bitcoin Inscriptions Explained

Key takeaways

Bitcoin inscriptions are issued and operated based on on-chain information and indexing standards.

Bitcoin's Taproot upgrade provided technical support for the birth of inscriptions.

Popular Bitcoin inscription protocols include Ordinals, Atomicals, Pipe, and Runes.

The emergence of Bitcoin inscriptions has brought many benefits, but the resulting junk transactions that clog the network have sparked controversy.

What are Bitcoin inscriptions?

Inscriptions refer to a type of virtual asset. By recording specific formatted information on BTC (or other blockchains) and converting it through specific indexing protocols, the information recorded on the blockchain transforms into virtual assets, known as inscriptions. These virtual assets can be either homogeneous (like BRC20 assets) or non-fungible (such as NFTs, like Bitcoin Frogs). In contrast to Ethereum, where asset issuance and operation are based on smart contracts, Bitcoin inscriptions are issued and operated based on on-chain information and indexing standards.

Why have Bitcoin inscriptions emerged and surged this year? Since its inception, Bitcoin has primarily served as a public ledger recording transaction information on the network. However, after completing the Taproot upgrade in November 2021, the public ledger offers more efficient data storage, reducing the cost of uploading text and multimedia content. This upgrade has laid the technical foundation for the birth of inscriptions.

A brief history of the Bitcoin inscription ecosystem

At the end of 2022, Casey Rodarmor, a core contributor to Bitcoin, established the Ordinals protocol, introducing the concepts of ordinals and inscriptions. This marked the inception of the first NFT on the Bitcoin network. As an NFT protocol, Ordinals empowers users to create the Bitcoin version of NFTs, or "digital artifacts" on Bitcoin. These NFTs support JPEG images, PDFs, videos, and audio formats.

On March 8, 2023, an anonymous developer, @domodata, launched BRC-20 based on Ordinals, setting off a speculative boom in meme tokens within the Bitcoin ecosystem. Subsequently, in September, another anonymous developer introduced the Atomicals Protocol. However, Casey remains skeptical about BRC-20 tokens, arguing that they have brought "junk" inscriptions. Therefore, on September 26, less than a week after Atomicals' release, Casey introduced Rune, a Bitcoin-based homogenized token protocol. Like Atomicals, Runes is based on UTXO technology, representing a significant improvement over BRC-20. According to Casey, a robust homogenized token protocol could drive substantial transaction fees, attract more developers, and expand the user base for Bitcoin.

Since its release, BRC-20 transactions have dominated a significant portion of the Ordinals protocol. Additionally, community developer Beny launched tools such as the BRC-20 proxy tool LooksOrdinal (non-tokenized), the OrdFi-oriented BRC-20 improved version Tap Protocol, and an enhanced version of Runes known as Pipe.

How do Bitcoin inscription protocols work?

Inscription content is entirely on-chain, stored in taproot script-path spend scripts. Taproot scripts have few restrictions on their content and receive the witness discount, ensuring economical content storage. The Taproot upgrade is a crucial technical condition for creating Ordinals. As the latest stage of Bitcoin scaling after segregated witness (segwit), Taproot includes three technical concepts – P2SH, MAST, and Schnorr. These technologies make complex transactions, such as multisignature and time-locked transactions, look like ordinary Bitcoin transactions. Essentially, Ordinal Inscription utilizes a tapscript that is never executed to build a simple accounting layer on the Bitcoin network to aggregate and record assets and data.

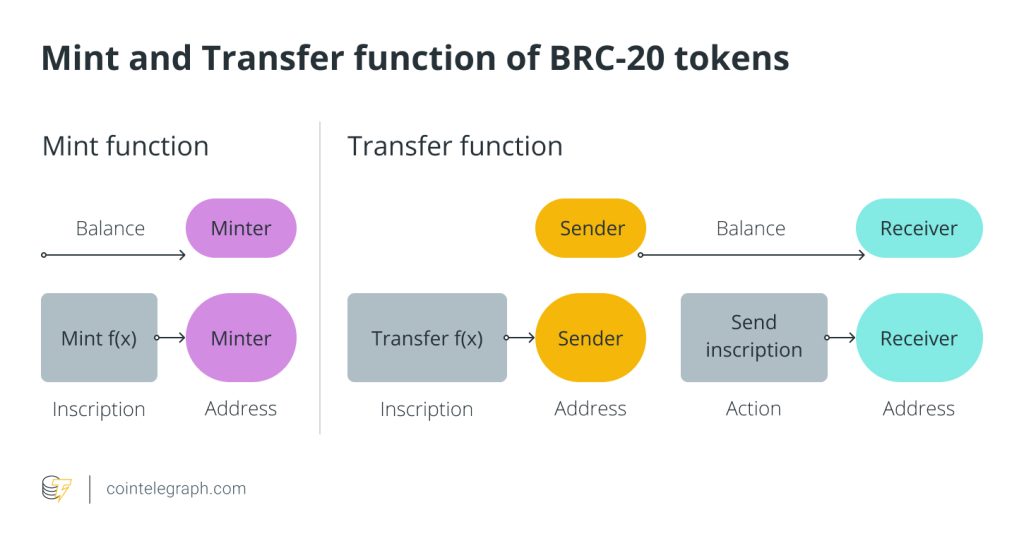

Ordinals & BRC 20: Ordinals leverages Bitcoin's most basic functionalities, and its NFT transfers are entirely processed by the Bitcoin network, making it align well with the principles of the BTC purist community. On the other hand, although the BRC-20 protocol is based on Ordinals, its transfers are not executed on the BTC main chain. Instead, they must undergo a two-step BTC transaction process (i.e., first aggregated in the sorter and then transferred). This additional complexity has resulted in numerous junk transactions, making BRC-20 less embraced by the BTC community and sparking controversy since its inception.

Atomicals Protocol: The Atomicals Protocol is another derivative protocol that inscribes data on UTXO for tokenization. In contrast to Ordinals, initially tailored for NFTs, Atomicals fundamentally rethinks how to issue tokens on BTC in a decentralized, tamper-resistant, and fair manner. Atomicals employs sat, the smallest unit of Bitcoin, as the basic "atom," with each sat's UTXO representing the token, i.e., 1 token = 1 sat. To verify an Atomicals transaction, one simply needs to query the UTXO of the corresponding sat on Bitcoin. Unlike BRC-20, ARC-20 transactions largely reduce the dependence on third-party sorters, markedly enhancing decentralization across the entire system.

Rune & Pipe: Influenced by ARC-20, Rune is designed to inscribe token data directly into UTXO's script, including token ID, output, and quantity. Similar to ARC-20, Rune lets the BTC mainnet process its token transfers. However, by writing token quantity into the script data, Rune achieves a higher precision than ARC-20.

How will Bitcoin inscriptions impact Bitcoin?

The rising popularity of inscriptions has created a significant impact and stirred controversy on Bitcoin. Ordinals, by storing data entirely on-chain instead of through external solutions like IPFS or AWS, achieves a genuine form of decentralization. However, this approach occupies the valuable storage space for regular Bitcoin transactions, "polluting" the Bitcoin financial transaction system.

Moreover, the advent of inscriptions has triggered heightened activity in Bitcoin transactions, leading to a notable rise in miner fees. This, in turn, increases the network's security budget. Glassnode data shows that inscriptions have been a net gain for Bitcoin since early 2023, accounting for a quarter of miner fee revenue, and users are evidently willing to pay a premium. According to data from Intotheblock, Bitcoin's adoption rate has soared to a yearly high of 67.62%, suggesting a substantial growth of new participants. The influx of users willing to pay high transfer fees is primarily attributed to the asset appreciation associated with inscriptions. As transaction volumes escalate, inscriptions have started to clog the Bitcoin network. On November 8, the average BTC transaction fee reached $7.168, marking a six-month high.

The bottom line

In the short term, the speculation on inscription tokens has boosted the prosperity of the Bitcoin ecosystem, making BTC transactions more active and increasing miner fees significantly. This has provided a temporary alleviation of concerns about a mass exodus of miners triggered by reduced rewards. Additionally, the emergence of new Bitcoin protocols has attracted a wave of speculators, potentially driving Bitcoin toward further growth. That being said, many Bitcoin inscriptions lack practical value, exhibiting a high degree of speculative nature. The network is experiencing congestion as a result of junk transactions, fueling skepticism within the community.

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Here you will find 29215 additional Information to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Find More here to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Here you will find 94135 additional Info to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] There you will find 94618 more Info to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] There you will find 72913 more Information on that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Here you can find 89543 more Information on that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] There you can find 4097 additional Info to that Topic: x.superex.com/academys/beginner/1999/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/1999/ […]