Who is Larry Fink? Profile and biography

Laurence Douglas Fink, popularly known as Larry Fink, is the founder, chairman and CEO of BlackRock. He, along with seven partners, founded BlackRock in 1988. BlackRock is the world’s largest publicly traded asset management firm, with $9.42 trillion in assets under management as of June 30, 2023.

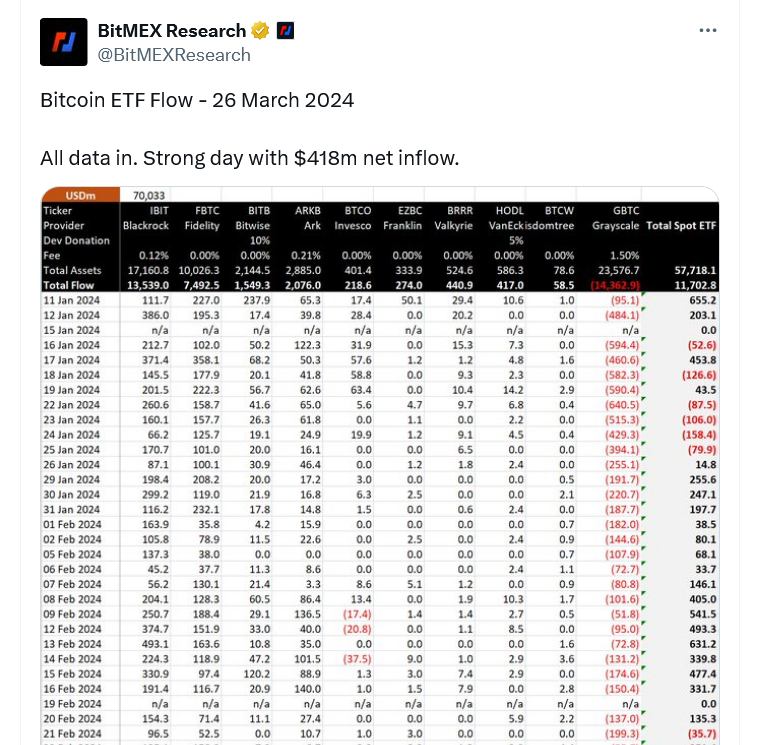

Fink is widely recognized for his influential role and leadership in the growth journey of BlackRock. The company has invested in blockchain companies from time to time, but in 2023, it made headlines globally when it applied for a spot Bitcoin exchange-traded fund (ETF).

The move, under the leadership of Fink, is seen in the cryptocurrency market as a huge step to capitalize on digital assets and increase Bitcoin (BTC) and crypto adoption. Following this, in November 2023, BlackRock filed for a spot Ether (ETH) ETF with the United States Securities and Exchange Commission (SEC).

When asked about his views on the Bitcoin ETF in an interview with Fox Business, Fink said, “We are hearing from clients around the world about the need for crypto.” He mentioned that there has been an increase in demand for cryptocurrencies among BlackRock’s global clientele.

Fink is the recipient of many awards and recognition in his career, spanning almost 50 years. Fortune previously named Fink one of the “World’s Greatest Leaders,” and he appeared in Barron’s list of the “World’s Best CEOs” for 12 consecutive years.

Each year, Fink writes an open letter on the BlackRock website addressing CEOs worldwide, setting the tone for investors, companies and, most recently, environmentalists. His 2019 open letter urged CEOs globally to think beyond their bottom lines and focus on sustainability, emphasizing environmental, social and governance (ESG) goals.

This led Barron’s to recognize him as “the new conscience of Wall Street,” but he also received criticism from Warren Buffet, Sam Zell and others, who said they don’t need Fink to tell them how to run their companies.

Fink’s early days and family life

Born on Nov. 2, 1952, Fink grew up in a Jewish family in Van Nuys, California, where his mother was an English professor and his father owned a shoe store. He earned a Bachelor of Arts in Political Science in 1974 from the University of California, Los Angeles (UCLA) and a Master of Business Administration (MBA) from the University of California, Berkeley in 1976.

Fink married his high-school sweetheart, Lori, in 1974, and the couple has three children. After pursuing his MBA, he started his career in 1976 at a New York-based investment bank, First Boston. He joined as one of the bank’s first mortgage-backed security traders and managed its bonds department. He was instrumental in creating and developing the mortgage-backed security market in the United States.

Fink spent a successful decade at First Boston as a management committee member, managing director and co-head of the taxable fixed-income division. He also started the financial futures and options department and headed the mortgage and real estate products group.

However, in 1986, his department lost $100 million due to his incorrect prediction about interest rates. This led to major losses, market humiliation and his departure from First Boston. Many years later, in 2016, during a speech at UCLA, Fink revealed how the First Boston setback affected him and emphasized the importance of market evolution. He said, “I believed I had figured out the market, but I was wrong — because while I wasn’t watching, the world had changed.”

In 1988, under the corporate umbrella of The Blackstone Group, Fink co-founded BlackRock with seven partners: Robert Kapito, Susan Wagner, Barbara Novick, Ben Golub, Hugh Frater, Ralph Schlosstein and Keith Anderson. BlackRock aimed to provide institutional clients with asset management services based on a risk management perspective.

However, due to differences between Fink and Blackstone, BlackRock split from Blackstone in 1994 and, in 1999, went public. Fink continues to serve as CEO of BlackRock today. He also serves as a member of the boards of trustees of New York University (NYU) and the World Economic Forum, and he is co-chair of the NYU Langone Medical Center board of trustees.

In addition, he serves on the boards of the Museum of Modern Art, the Council on Foreign Relations and the International Rescue Committee. Fink is also on the advisory board of the Tsinghua University School of Economics and Management in Beijing and the executive committee of the Partnership for New York City.

BlackRock leadership

In his role as chairman and CEO of BlackRock, Fink has been characterized by visionary leadership and unprecedented growth, solidifying BlackRock’s status as the world’s largest and most influential investment management company.

Under his leadership, BlackRock successfully diversified its services and investment strategies. The company evolved from its initial focus on fixed income to become a comprehensive provider of a wide range of investment products, including equities, alternatives, ETFs and crypto-backed ETFs pending approval.

Fink has been a proponent of embracing technology in finance. BlackRock has been at the forefront of using data analytics and technology to make informed investment decisions. For example, Aladdin (asset, liability, debt and derivative investment network) is a proprietary software developed by BlackRock for portfolio management.

Aladdin was originally designed at BlackRock as a piece of technology to analyze risk. In time, it has evolved into an embedded enterprise system that supports a wide range of risk-management systems integrated with the investment process.

Under Fink’s direction, supported by a sound technology core, BlackRock made some significant acquisitions:

Fink’s sustainable investing efforts

Larry Fink is recognized for his commitment to sustainable investing and corporate responsibility. In his annual letters to CEOs, he has emphasized the importance of companies incorporating ESG goals into their business strategies. He believes that integrating sustainability into investment decisions is a moral imperative and essential for long-term financial success.

His advocacy for sustainability extends beyond the financial sector. He has been an influential voice in global discussions on climate change and the role of corporations in addressing environmental challenges. Fink’s efforts to promote sustainable practices have positioned BlackRock as a leader in responsible investing.

Fink’s stance on cryptocurrencies

In the past, Fink has highlighted the need for regulatory clarity and expressed concerns about the use of cryptocurrencies for illicit activities. He has also highlighted the potential for market manipulation in the cryptocurrency space. While acknowledging the innovation and interest surrounding cryptocurrencies and blockchain technology, he has maintained a measured perspective on their role in the broader financial landscape.

In 2017, he said, “Bitcoin just shows you how much demand for money laundering there is in the world.” However, he seemingly changed his stance in 2023, with BlackRock filing for spot Bitcoin and Ether ETFs.

In a July 2023 interview with CNBC, when asked about crypto and ETFs, Fink said: “We believe we have a responsibility to democratize investing. Over the last five years, more and more global investors are asking us about the role of crypto, and I do think a lot of crypto is an international asset.” He continued, adding that an “international crypto product” can transcend the problem of dollar devaluation.

Fink’s popularity in financial circles and news

As the head of BlackRock, Fink oversees an immense portfolio of assets, making decisions that reverberate through financial markets worldwide. His ability to navigate economic uncertainties and adapt to changing market conditions has solidified BlackRock’s position as an industry giant.

Fink’s influence extends beyond the boardroom. As a thought leader, he is sought after for his insights on economic and financial matters, contributing to important discussions on the global stage. Major financial news outlets regularly cover his activities and statements.

His vision for the future of finance embraces novel asset classes like crypto ETFs, sustainability and responsible corporate practices, setting a precedent for the investment management industry.

Written by Shailey Singh

… [Trackback]

[…] Here you can find 92802 more Information to that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Find More Info here on that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Read More here on that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Read More on to that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Here you will find 65664 additional Information to that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] There you can find 50370 more Information on that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] There you will find 98782 more Information to that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Read More on that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Here you can find 63324 additional Information to that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Here you can find 19862 more Info to that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Here you will find 32489 more Information to that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Here you can find 7232 additional Info on that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Info to that Topic: x.superex.com/academys/beginner/1967/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/1967/ […]