Who is Michael Saylor? Profile and biography

Michael Saylor is the chairman, co-founder and former CEO of MicroStrategy, an American company that provides business intelligence, mobile software and cloud-based services. He is one of the most vocal supporters and prolific buyers of Bitcoin (BTC).

Saylor co-founded MicroStrategy with Sanju Bansal and was its CEO from 1989 to 2022. He also served as chairman of the board of directors of MicroStrategy since the early days of co-founding the company. On Aug. 8, 2022, Saylor resigned as CEO but continued serving as MicroStrategy’s executive chairman.

Saylor, while stepping down as CEO, highlighted his focus on Bitcoin and was quoted in the official MicroStrategy press release saying, “As Executive Chairman I will be able to focus more on our Bitcoin acquisition strategy and related Bitcoin advocacy initiatives.”

This article explores Saylor’s entrepreneurial journey, cryptocurrency advocacy and Bitcoin evangelism, his early life, leading MicroStrategy through dot-com turbulence, hodling through crypto market upheavals and more.

Educational and professional background

Saylor was born on Feb. 4, 1965, in Lincoln, Nebraska and spent his childhood living on various United States Air Force bases worldwide, as his father was an Air Force chief master sergeant. In 1983, Saylor enrolled at the Massachusetts Institute of Technology (MIT) on an Air Force Reserve Officer Training Corps scholarship.

He pursued a double major in aeronautics and astronautics and science, technology and society, laying the foundation for his future innovative approach to business. During his time at MIT, he met the co-founder of MicroStrategy, Sanju Bansal.

In 1989, Saylor and Bansal co-founded MicroStrategy, focusing initially on data mining and business intelligence solutions. Under Saylor’s guidance, MicroStrategy rapidly gained prominence in the tech industry, offering data analytics tools that empowered organizations to make informed data-based decisions.

Saylor’s penchant for forward-thinking strategies became apparent during the dot-com bubble in the late 1990s. Despite the tumultuous period, MicroStrategy persevered and solidified its position in business intelligence and data analytics, and in 1992, MicroStrategy won a $10 million contract with McDonald’s to provide analytics for the efficiency of its promotions.

In 1998, he took the company public, and MicroStrategy emerged as a global leader in enterprise analytics and mobility software. Saylor’s commitment to data-driven decision-making was well acclaimed and a defining factor in MicroStrategy’s sustained growth and success.

Saylor’s multifaceted accomplishments

Saylor is popular as an American entrepreneur and business executive. Additionally, he is an investor, founder, inventor and author featured on The New York Times and The Wall Street Journal best seller lists.

In 2012, Saylor authored the bestseller book The Mobile Wave: How Mobile Intelligence Will Change Everything, discussing the impact of mobile, cloud and social networks and the rise of Big Tech companies like Apple, Amazon, Facebook and Google as transnational technology leaders.

Saylor launched his philanthropic initiative called The Saylor Foundation, which he founded in 1999 and eventually renamed Saylor Academy. Saylor.org was introduced in 2008 as The Saylor Foundation’s free education program for over a million students.

Saylor has 40 patents listed to his name. He is credited with creating relational analytics and works in web, distributed and mobile analytics, cloud, mobile identity and the Internet of Things. Saylor founded and created Alarm.com, one of the first home automation and security firms, and Angel.com, one of the first cloud-based interactive voice response service providers, which he later sold to Genesys Telecommunications Laboratories in 2013 for $110 million.

Saylor and Bitcoin evangelism in corporate finance

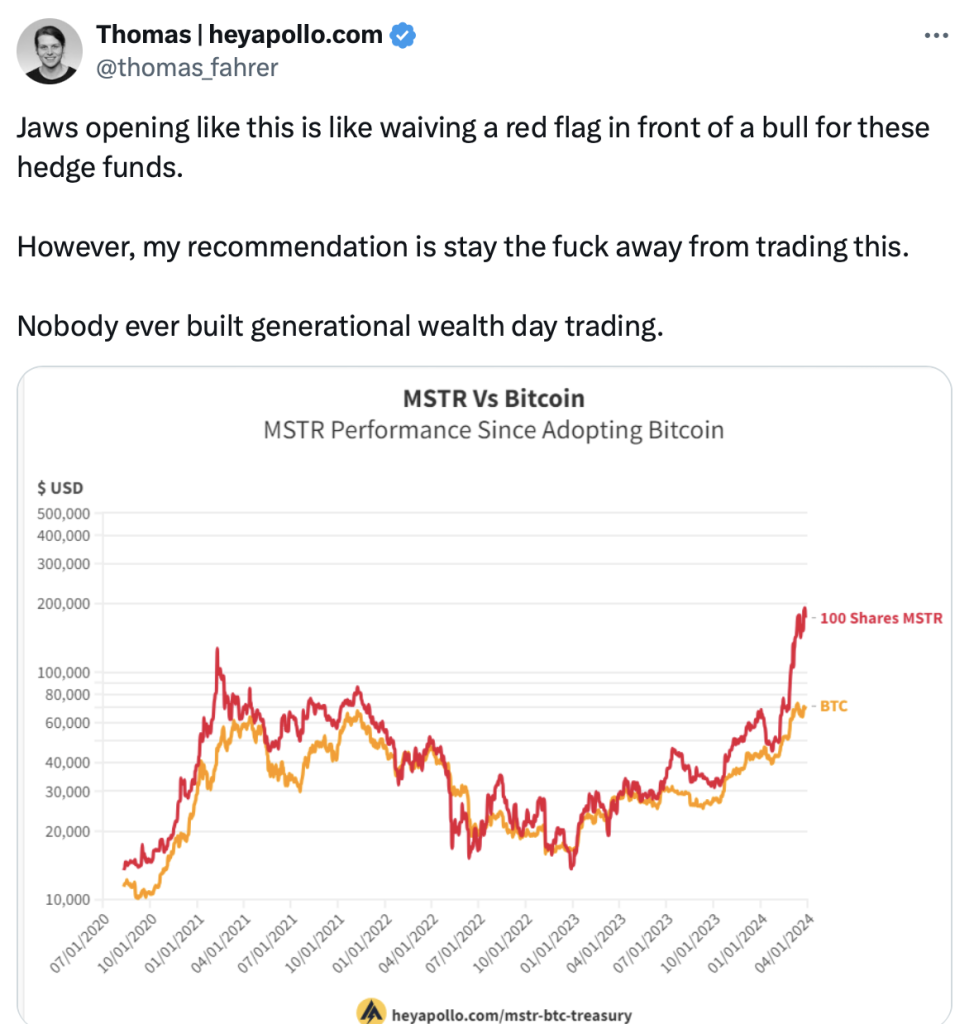

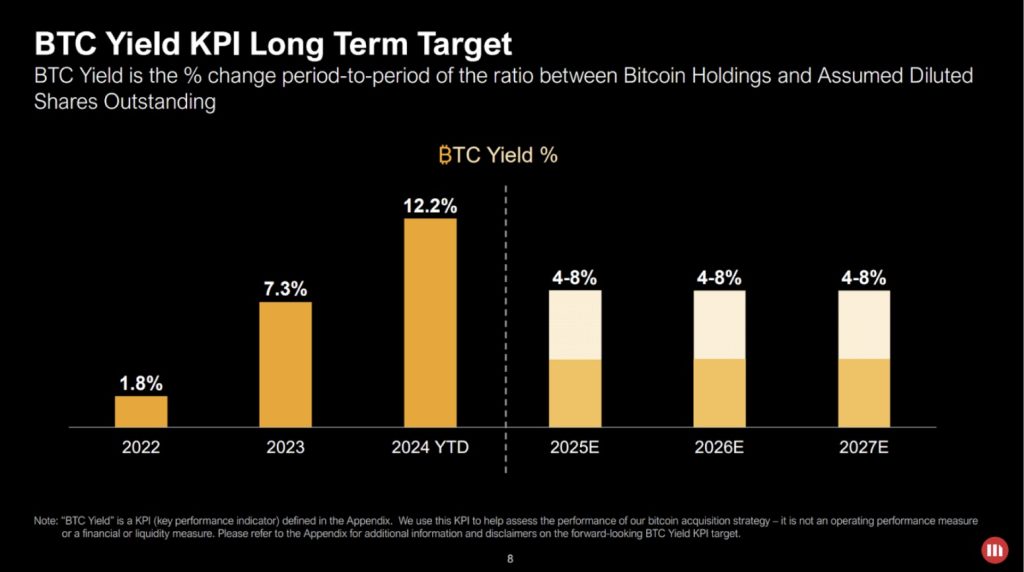

Saylor’s most revolutionary move came in 2020 when MicroStrategy made headlines by announcing a significant investment in Bitcoin worth $250 million in August 2020. This marked a watershed moment in the financial world, as Saylor steered the company into uncharted territory by incorporating the cryptocurrency into its treasury reserves.

MicroStrategy then became the first publicly traded company to buy Bitcoin as part of its capital allocation strategy. In August 2020, MicroStrategy disclosed its Bitcoin holdings in a Securities and Exchange Commission (SEC) filing. In a press release at the time, Saylor said, “Our investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a reliable store of value and an attractive investment asset with more long-term appreciation potential than holding cash.”

Saylor’s firm belief in Bitcoin as a store of value spurred MicroStrategy to acquire substantial holdings of BTC. MicroStrategy has since remained a prolific buyer and has so far sold only once in a 708 BTC sale in December 2022, worth $11 million at the time. MicroStrategy owns 158,400 Bitcoin as of Nov. 1, 2023.

Various reports and social media posts suggest that Saylor possesses a significant stake in Bitcoin, aligning his personal beliefs with his professional endeavors. In October 2020, he disclosed he personally bought 17,732 Bitcoin for $175 million.

MicroStrategy’s Bitcoin holdings have drawn widespread attention, signaling a shift in the way corporations perceive and utilize their treasury assets. In the latter half of 2023, as crypto enthusiasts eagerly await the U.S. SEC’s decision on the first spot Bitcoin exchange-traded funds (ETFs), MicroStrategy’s enduring commitment and robust investment strategy put it in a confident position if one or more of the ETF applications are approved.

Saylor’s personal life, advocacy and future plans

Saylor is not married, and as of August 2023, his net worth is $1.3 billion. Saylor’s advocacy for Bitcoin extends beyond corporate boardrooms. He has emerged as a leading Bitcoin evangelist and a fervent advocate for cryptocurrency adoption.

His engagement in public forums, webinars and social media, notably via his X (formerly Twitter) account, serves as a platform for sharing insights, strategies and updates on Bitcoin, corporate finance, and the evolving landscape of Bitcoin and cryptocurrencies.

Saylor has received several awards and recognition, including the KPMG Washington High-Tech Entrepreneur of the Year award in 1996 and the Ernst & Young Software Entrepreneur of the Year in 1997. Red Herring Magazine listed him as one of its Top 10 Entrepreneurs for 1998. Saylor was also listed as a 1999 “Innovator Under 35” by the MIT Technology Review.

MicroStrategy and Saylor have been subject to investigations by the SEC over civil accounting fraud in 2000 and later objections to the accounting method for Bitcoin in one of its 2021 filings.

The earlier investigation involving Saylor and two other MicroStrategy executives was settled with the SEC for $11 million, with none “admitting or denying the Commission’s allegations.” While Saylor continues to be involved with MicroStrategy, his future plans seem inclined to focus on Bitcoin initiatives.

Written by Shailey Singh

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] There you can find 95850 additional Info on that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Here you can find 40963 additional Info on that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] There you can find 94823 additional Info on that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Read More here to that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] There you will find 80769 more Info to that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Read More Info here to that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Find More Info here to that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Read More Information here to that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Find More here on that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/1939/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/1939/ […]