Markets in Crypto-Assets Regulation (MiCA) explained

Over the past 10 years, there has been a notable increase in the use of digital assets and cryptocurrencies. The explosive growth of blockchain technology use cases and the emergence of new cryptocurrencies have transformed the global financial system.

As cryptocurrencies are subject to scant regulation, there’s a real danger the industry could descend into a lawless frontier-like situation. Establishing crypto assets regulation is vital to protect investors, ensure compliance with financial regulators and minimize catastrophic events like the Terra, Celsius and FTX implosions.

The European Union has made its move, becoming the first major jurisdiction to enact comprehensive, industry-specific rules when its Markets in Crypto-Assets Regulation (MiCA) goes into full effect in 2024.

MiCA, first put forth in September 2020 and approved by the European Parliament in April 2023, aims to usher in a new era of crypto asset regulation, underscoring the growing significance of the industry in the financial sector.

This article explores what MiCA is, its scope, and how it may affect the crypto sector.

What is the Markets in Crypto-Assets Regulation?

The Markets in Crypto-Assets Regulation is a comprehensive regulatory framework for European crypto assets. MiCA is a part of the European Commission’s Digital Finance Strategy, which includes a legislative proposal for a pilot regime to test solutions for the trading and settlement of financial services using distributed ledger technology.

MiCA applies to any crypto assets, including securities and e-money, not currently covered by EU traditional finance regulations. It also extends to all crypto-asset service providers (CASPs) that serve the European crypto industry, regardless of establishment or registration location.

The legal framework seeks to protect investors, prevent crypto asset misuse, offer regulatory clarity, maintain financial stability and protect against market abuse and manipulation. It is hoped the legislation will spur innovation in the face of uncertainties in the crypto-asset sector.

MiCA enables compliance with Anti-Money Laundering and Counter-Terrorist Financing regulations. By facilitating compliance with operational and governance standards, the crypto regulations reduce the risk of crypto assets being used for illegal activities.

Before MiCA, crypto firms operating in the EU had to comply with the various crypto regulations of 27 countries. MiCA eliminates the need for national regulations and introduces a unified EU licensing structure, providing legal clarity for the EU’s crypto space.

Implementation timeline

MiCA was published on June 9, 2023, in the Official Journal of the European Union. The regulation took effect 20 days later. However, the deadline for complying with all its provisions is Dec. 30, 2024, although certain clauses, particularly those related to stablecoins, take effect on June 30, 2024.

Scope of application

According to the MiCA crypto regulation summary, a crypto asset is a digital representation of some value or right that can be transferred and stored electronically using distributed ledger technology or something similar. The act classifies crypto assets into three categories, with different requirements depending on whether they stabilize their value through referencing other assets.

Electronic or e-money tokens (EMTs) are crypto assets that aim to maintain value referencing a single official currency. If an EMT is to serve its intended purpose as electronic money, it must meet stringent regulatory requirements, such as being redeemable at face value into fiat currency.

Asset-referenced tokens are crypto assets that reference any other value or right or a combination thereof, including one or more official currencies, to stabilize their value. This category includes any crypto asset with its value backed by assets, not e-money tokens.

The last category includes all other crypto assets, except e-money or asset-referenced tokens, such as utility tokens. Unlike security-type tokens, regulatory frameworks such as The Markets in Financial Instruments Directive (MiFID II) do not classify them as financial instruments.

While the MiCA fills a regulatory void in crypto assets, it does not impact the regulation of crypto assets already included in other preexisting EU regulations.

MiCA will not apply to all nonfungible tokens (NFTs). It will only apply to NFTs if the NFT shares characteristics with an asset to which MiCA is unquestionably applicable. The legislation will not apply if the NFT is unique.

Similarly, the regulation does not cover the operations of decentralized autonomous organizations and decentralized finance if their operations are truly decentralized. To that extent, MiCA will not apply to decentralized applications.

Regulation of issuers of crypto assets

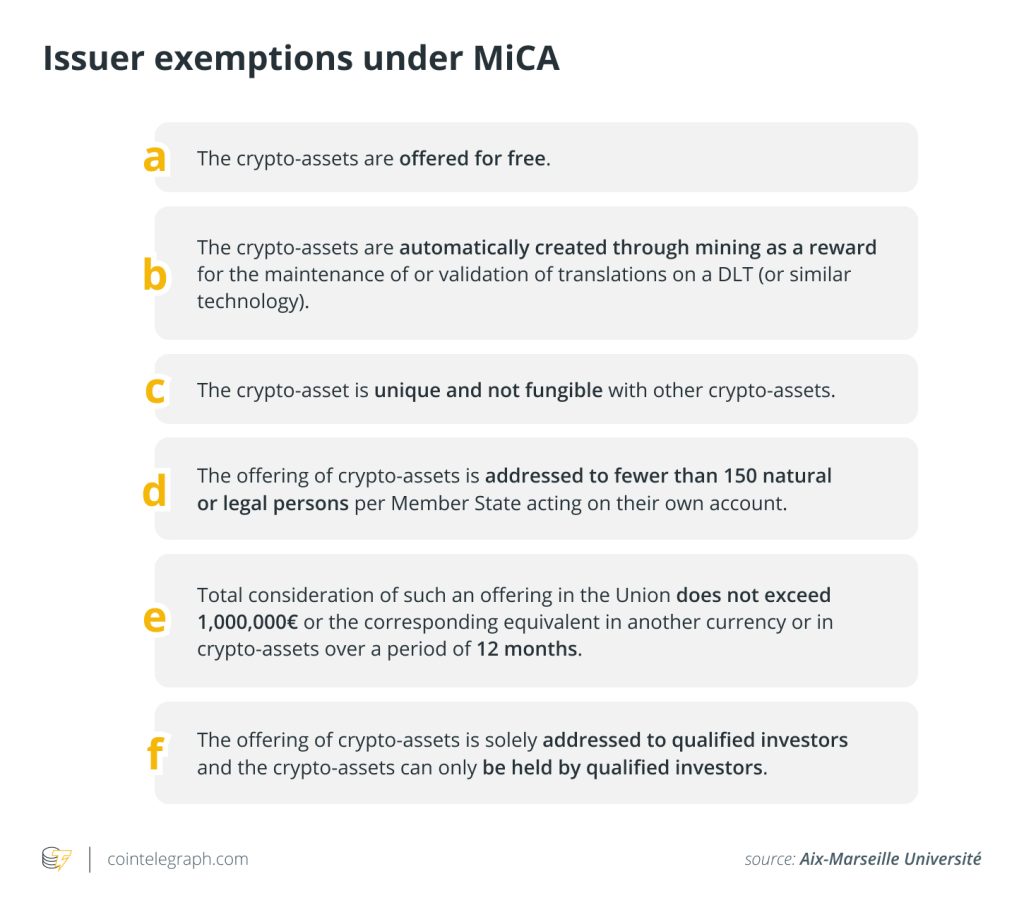

Issuers of crypto assets other than ARTs and EMTs do not need authorization to issue the assets. However, one of MiCA’s primary requirements is that before issuing a token to the general public or listing it on a crypto assets trading platform, issuers of crypto assets must publish white papers, which act as a kind of prospectus for the assets and inform prospective buyers of the crypto assets characteristics.

Additionally, if a crypto-asset was not yet traded on a trading platform at the time of purchase, MiCA provides retail holders the opportunity to withdraw from the agreement within 14 days.

Regulation of issuers of ARTs and EMTs

MiCA imposes more stringent stablecoins regulation on issuers of variants, such as EMTs and ARTs, because of associated concerns about monetary sovereignty and financial stability.

In general, issuers of such assets need prior authorization before publicly offering or listing ARTs or EMTs within the EU, and it can only be done by the issuer themselves unless they grant written consent to another party.

Authorized credit institutions or e-money institutions can only provide or list EMTs after notifying their supervisory body and publishing the necessary white paper.

To obtain authorization, issuers of ARTs must be based in the EU. Unlike other MiCA token types, they must notify the relevant authorities and submit the necessary white paper for approval before publishing it.

Although the term “stablecoin” is not used in the MiCA regulation, ARTs and EMTs are both types of stablecoins that the European Banking Authority (EBA) may consider “significant” based on an established set of criteria. Significant ARTs and EMTs are subject to more stringent regulatory requirements and special provisions.

Regulation of the operation of CASPs

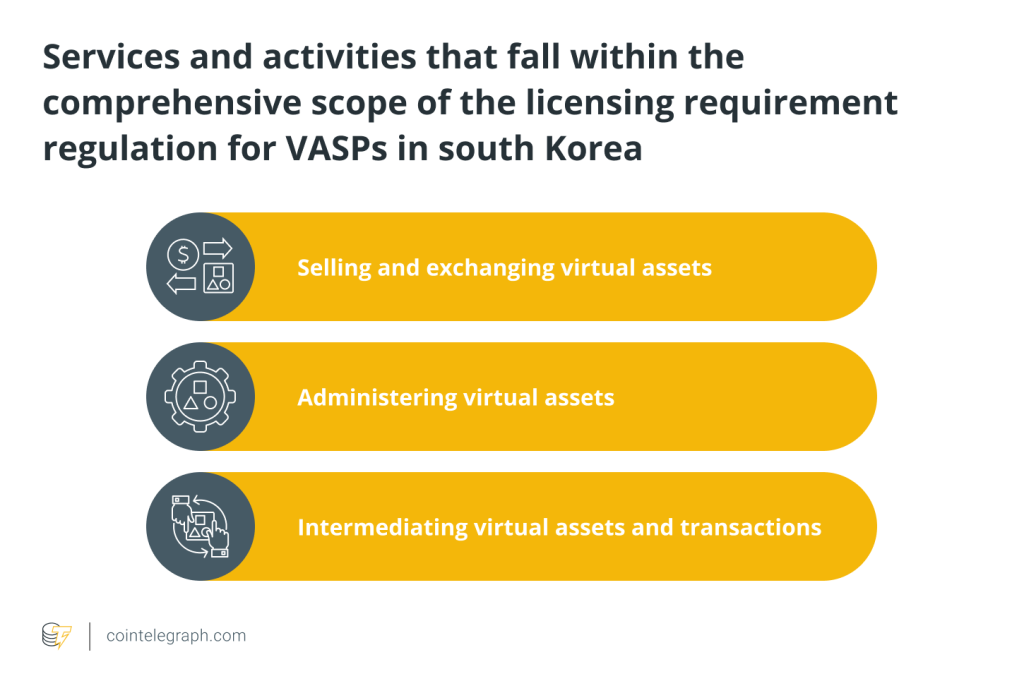

MiCA also creates a framework for crypto asset service providers (CASPs) and services related to crypto assets. CASPs are legal persons or other organizations whose primary activity or business operation is the professional provision of one or more crypto asset services to clients.

According to the regulation, CASPs shall require authorization to provide crypto asset services within the EU legally.

Crypto asset services include custody and administration of crypto assets on behalf of third parties, exchange of crypto assets for fiat currency or other crypto assets, operation of a trading platform for crypto assets, execution of orders for crypto assets on behalf of third parties and placement of crypto assets.

Other services include providing transfer services for crypto assets, advice on crypto assets, reception and transmission of orders for crypto assets and portfolio management on crypto assets.

A legal person or entity must have at least one director located in the EU to be eligible for authorization under MiCA, and this is in addition to having a registered office or location of effective administration in the EU.

MiCA also lays down a wide range of general and service-specific regulations, such as those on governance, capital and transparency, that CASPs must follow.

Authorized CASPs may “passport” that authorization and operate in other EU member states. Since the MiCA lacks a dedicated third-country regime, non-EU service providers outside the EU will be limited to using reverse solicitation to offer their crypto services to EU residents.

By law, CASPs are automatically classified as significant (sCASP) when their average annual number of active users within the EU reaches 15 million. CASPs considered “significant” are subject to increased monitoring and supervision by the respective National Competent Authorities.

MiCA mandates all CASPs to operate honestly, fairly and professionally in their client’s best interests. The regulation law requires CASPs to carry out marketing and informational activities in a fair and non-misleading way. Potential customers must also be fully informed about the crypto assets pricing strategies, risks and climate or environmental effects.

Certain entities with a preexisting regulated status, such as credit institutions and investment firms, can offer specific crypto asset services by notifying the appropriate authorities.

Market integrity and abuse

MiCA establishes a regulatory framework to protect the EU market and prevent abuse. As part of its new regulations, MiCA also makes it illegal to engage in insider trading, unlawfully disclose material non-public information, or engage in any conduct that could reasonably be expected to cause disruption or manipulation of crypto asset markets.

Supervision and enforcement

There will be two main regulatory bodies at the EU level: the European Securities and Markets Authority and the EBA. At the same time, each member state will appoint its own agency to implement the EU law.

In case of a violation, the national bodies can adopt appropriate penalties and other administrative measures, even in cases where member states currently have criminal sanctions.

Written by Tanuj Surve

… [Trackback]

[…] There you will find 85694 more Info to that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Read More on on that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Information on that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Read More to that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Read More Information here on that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Info on that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] There you can find 17007 more Information to that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Here you can find 15372 more Information to that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Find More Information here on that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Find More on on that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Find More Information here to that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Information to that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Find More to that Topic: x.superex.com/academys/beginner/1925/ […]

… [Trackback]

[…] Find More on that Topic: x.superex.com/academys/beginner/1925/ […]