LEARN CHANDE MOMENTUM OSCILLATOR IN 3 MINUTES – BLOCKCHAIN 101

Introduction

In the tumultuous world of financial markets, traders constantly seek accurate tools to reveal the momentum of assets, overbought and oversold conditions, and potential trend changes. The Chande Momentum Oscillator (CMO), a momentum indicator created by technical analysis expert Tushar Chande, proudly takes the stage.

How does this remarkable indicator stand out in market fluctuations and become a powerful assistant for investors to discern market dynamics? In this lesson, we will delve into the Chande Momentum Oscillator (CMO) indicator in detail.

Chande’s Momentum Oscillator is a great technical tool for identifying overbought and oversold market conditions. Developed in 1994 by renowned technical analysis expert Tushar Chande, it is a momentum indicator designed to help traders identify overbought and oversold conditions of assets, as well as measure the momentum of price movements.

The Mathematical Beauty of Chande Momentum Oscillator

To deeply understand the secrets of CMO, we first need to explore the mathematical concepts behind it. The calculation of CMO is based on the relative difference between two key indicators, transformed into an oscillator form through a series of smoothing processes. Specifically, the calculation of ROC (Rate of Change) involves the closing prices of the current and past n periods, while the Exponential Moving Average (EMA) provides a smoothing effect for the CMO values, enhancing their interpretability and operability.

Moments of Overbought and Oversold in the Market

The wonder of CMO lies in its oscillation between positive and negative values, providing traders with a clear window to observe the market’s overbought and oversold states. When the CMO value is positive, the market might be in an overbought state, while a negative value suggests a potential oversold market. This visual contrast allows traders to quickly assess market conditions, enabling them to formulate more flexible trading strategies.

Calculation Method of Chande Momentum Oscillator

1.Calculation of Rate of Change (ROC):

ROC = (Close – Close_n) / Close_n × 100

Where Close is the closing price of the current period, and Close_n is the closing price n periods ago.

2.Smoothing Process:

The Exponential Moving Average (EMA) is used to smooth the ROC, resulting in the value of the Chande Momentum Oscillator.

CMO = EMA(ROC) – EMA(-ROC)

Practical Use of Chande Momentum Oscillator

Chande’s Momentum Oscillator employs two extreme values, -100 and 100.

- A value of -100 indicates an extremely oversold condition of the currency pair;

- A value of 100 indicates an extremely overbought condition;

- When the value is above the 0.00 level, the CMO trend is considered bullish;

- When the value is below the 0.00 level, it is considered bearish;

- When CMO crosses above the 50 value (upper end of the blue line), it is considered overbought;

- When it crosses below the -50 value (lower end of the blue line), it is considered oversold.

- As mentioned earlier, use CMO in conjunction with trend-following indicators and trade in the direction of the basic trend. Avoid counter-trading the oversold/overbought signals of the CMO indicator.

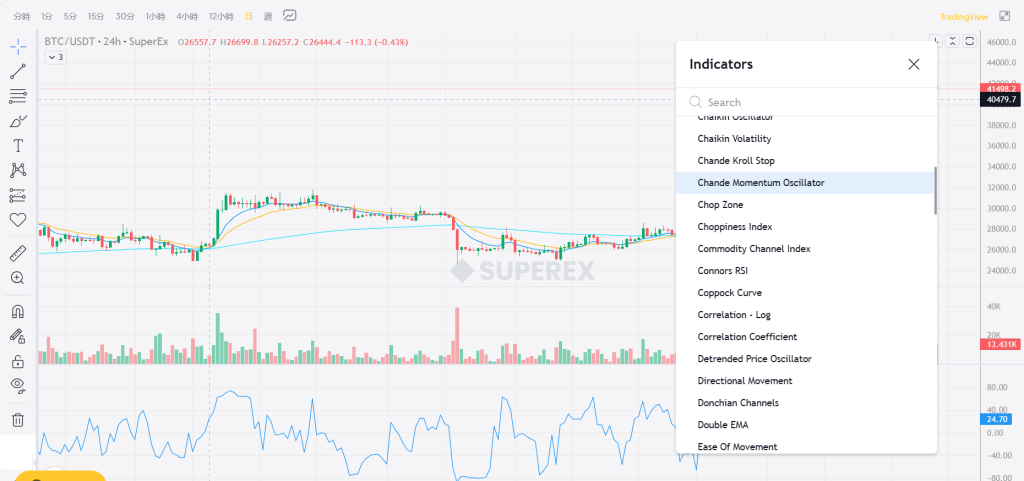

SuperEx: Market Leader’s Application of CMO

As one of the leading digital currency trading platforms, SuperEx demonstrates its depth in technical analysis through the application of CMO. We fully recognize the importance of accurately capturing trends and balancing overbought and oversold conditions in the market. As a momentum oscillator, CMO provides us with a unique tool to better interpret the market.

Therefore, SuperEx provides a complete CMO chart and has completed the initial setup, allowing all users to directly use the CMO indicator in the market.

Note:

- Overbought and Oversold Signals: CMO can be used to identify overbought and oversold conditions, but it should be used with caution, as markets can remain in overbought or oversold states for extended periods.

- Trend Confirmation: CMO has some ability to identify trend changes, but it is best used in conjunction with other trend confirmation tools to improve accuracy.

- Signal Line Settings: Some traders may adjust the signal line periods of the CMO to suit different market conditions. Different settings can affect the generation and accuracy of signals.

Conclusion:

The Chande Momentum Oscillator is a useful tool for measuring asset momentum and identifying overbought and oversold conditions. As a momentum oscillator, it provides traders with a way to understand market sentiment and potential trend changes. When using CMO, traders should handle overbought and oversold signals cautiously and combine it with other indicators and trend confirmation tools to develop a more comprehensive trading strategy.

Responses