LEARN BITCOIN FEAR AND GREED INDEX IN 3 MINUTES – BLOCKCHAIN 101

Summary

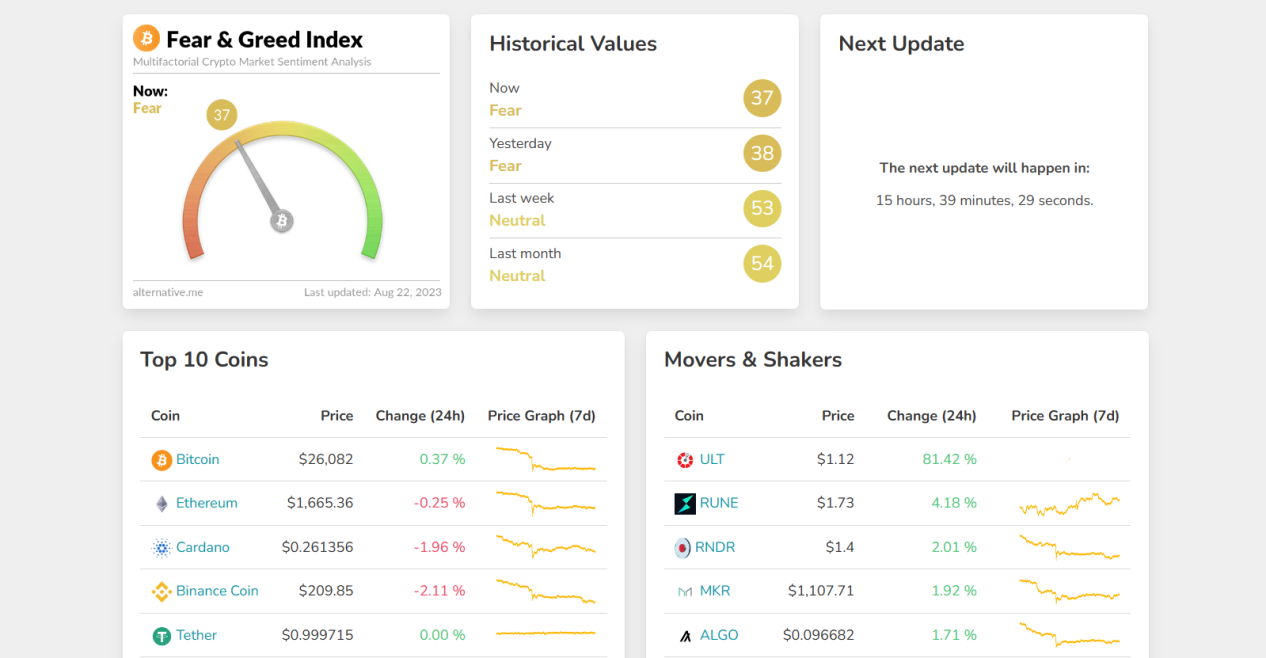

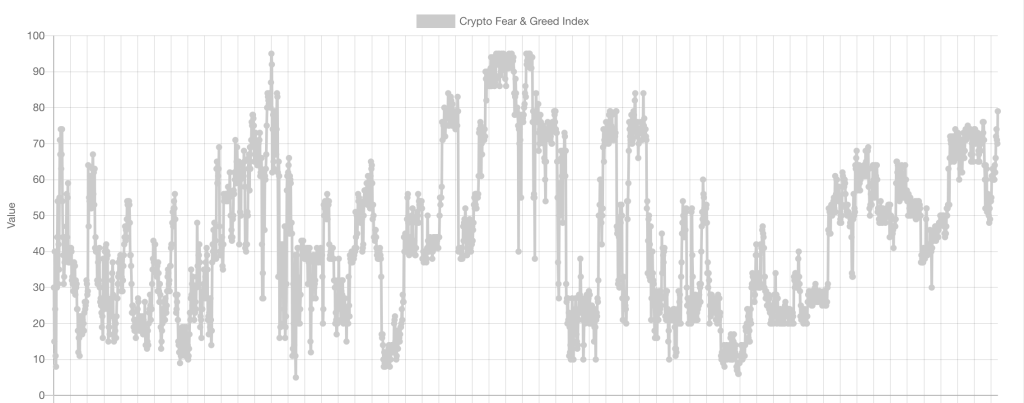

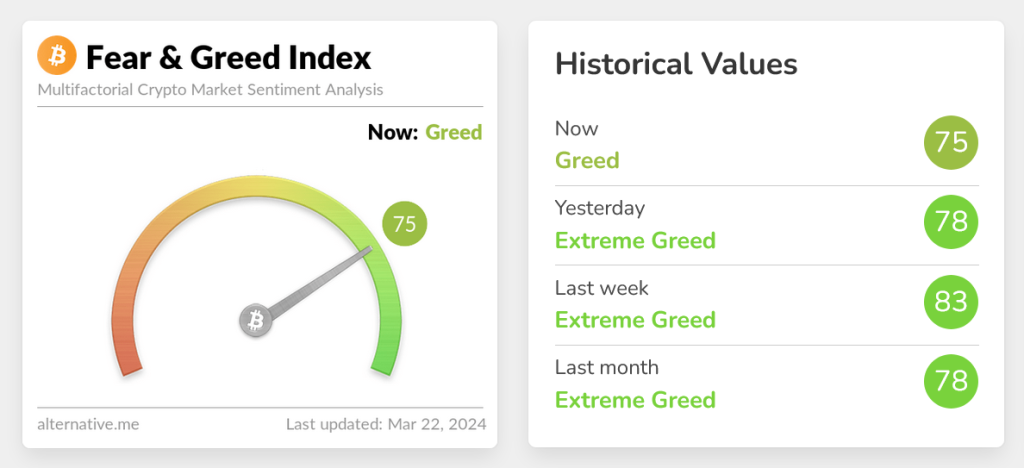

The Bitcoin Fear and Greed Index is a metric designed to measure the sentiment in the Bitcoin market. Its aim is to assist traders and investors in understanding the emotional state of market participants towards Bitcoin. The index calculates this sentiment by analyzing various market data and social media information, which is then translated into a score or index, reflecting different aspects of market sentiment.

Introduction

Lately, with significant price fluctuations in the trading market, investors’ sentiments are affected, and such emotions often get mirrored in the coin’s price. To quantify the impact of such sentiments on the market, the “Bitcoin Panic Index” was introduced.

Phrases like “extreme market panic” or “high market greed index” are frequently heard, all derived from the Fear and Greed Index.

The Panic Index analyzes people’s emotions from different sources and data daily to form a simple index. It can be checked at [alternative.me/crypto/].

Sources of the Bitcoin Fear and Greed Index Data:

- Volatility (25%):This evaluates the current volatility and major drops in Bitcoin, compared to its average over the past 30 and 90 days. A notable surge in volatility signals a fearful market.

- Market Momentum/Volume (25%):This measures market momentum (inflow and outflow of funds) and trading volume, also compared with its average over the past 30 and 90 days. When there’s a large volume of money entering the market, a slight uptrend can be deduced, indicating greed.

- Social Media Buzz (15%):Currently, sentiment analysis from the social news website Reddit is not included, but Twitter analysis is ongoing. We gather and calculate hashtags for various coins (currently only Bitcoin), checking their rate and volume of interactions over a certain period. Abnormally high interactions indicate rising public interest and correlate with greedy behavior in the cryptocurrency market.

- Market Surveys (15%):In collaboration with the survey website http://strawpoll.com, a sizable public polling platform, we conduct weekly cryptocurrency market surveys. Typically, each survey sees participation from 2,000 to 3,000 individuals, providing a sentiment dataset from a group of cryptocurrency investors.

- Bitcoin Dominance (10%):Market capitalization dominance refers to a coin’s market cap as a proportion of the total cryptocurrency market cap. Particularly for Bitcoin, its rise in market cap dominance is often a result of panic investments in altcoins (coins other than Bitcoin), as Bitcoin becomes the safe-haven option in the crypto world.

- Google Search Trends (10%):We reference trends related to various Bitcoin-associated keywords on Google, especially changes in search volume for specific keywords.

Based on these factors, the Bitcoin Fear and Greed Index score fluctuates between 0 to 100, where 0 indicates extreme fear and 100 signifies extreme greed. Traders and investors can utilize this index to grasp the market’s emotional state and consider market sentiment when making investment decisions. However, caution is advised, as market sentiment doesn’t always precisely reflect the market’s future trajectory, and the index itself can be influenced by various factors.

How to Leverage the Fear and Greed Index?

Fear and greed are two primary emotions in human psychology that can influence investor behavior, and the Bitcoin market is no exception. Hence, being aware of market sentiment is vital in deciding when to enter or exit the market.

On the surface, investors generally adhere to the theory of the index, meaning excessive fear tends to depress the Bitcoin price, while excessive greed pushes it up.

Assuming extreme fear amplifies the selling pressure on Bitcoin, pushing prices down, this provides a buying opportunity for investors. On the flip side, extreme greed boosts the demand for Bitcoin, elevating its price and presenting an excellent selling opportunity.

How to Determine Greed or Fear?

The appropriate level of the Bitcoin Fear and Greed Index varies based on market conditions and investor sentiment. However, here are some general guidelines for interpreting the index:

- Too High (Extreme Greed):When the Bitcoin Fear and Greed Index approaches or exceeds levels of 80 to 90 and above, it’s typically seen as the market being overly greedy. This could indicate that the market is overheating, investor sentiment is overly optimistic, and there might be a potential price bubble.

- Too Low (Extreme Fear):When the index is near or below levels of 20 to 10, it’s generally seen as extremely fearful market sentiment. This might indicate the market is overly pessimistic, potentially leading to selling pressure and a price drop.

It’s worth noting that these thresholds are just for reference, and interpretations of market sentiment can vary among individuals. Moreover, the Bitcoin market is highly volatile, and sentiment can change rapidly within a short time frame. Therefore, investors shouldn’t solely rely on the Fear and Greed Index for decisions but should combine it with other technical and fundamental analysis factors, as well as their investment strategies, to assess the market.

Most importantly, regardless of the index, investors should always adopt a cautious approach, set up a sound risk management strategy, and continuously update their knowledge to better understand and navigate the volatility of the Bitcoin market.

Responses