LEARN HOW TO SET TP/SL ON SUPEREX IN 3 MINUTES

Introduction

Futures trading is a convenient way to predict the price of financial assets. When it comes to cryptocurrency trading, SuperEx is one of the largest cryptocurrency futures exchanges under the Web3.0 ecosystem, supporting spot/futures trading of over 1000+ cryptocurrencies.

SuperEx offers us a powerful trading engine, allowing traders and hedgers to predict the futures of many different cryptocurrencies on the platform. It also provides up to 150X leverage trading and a variety of margin trading options to choose from.

Most of the products in SuperEx’s futures trading are perpetual futures contracts, which means the contracts do not have a specified expiration date. However, there are many tools available to help manage your futures contracts, one of which is TP/SL.

In this article, we will discuss how the contracts work and the things you need to know when trading on SuperEx.

What is a Perpetual Contract?

A perpetual contract is an agreement to buy or sell an asset at a predetermined price on a specified future date. This agreed date is known as the contract’s expiration date, the date on which the contract is settled and the asset is delivered.

However, trading cryptocurrencies on exchanges like SuperEx is different from traditional futures contracts. The main difference being: perpetual contracts do not have an expiration date, and so they are termed “perpetual”. They can be held indefinitely and do not expire on a specific date like traditional futures contracts, which require physical or cash delivery.

What is TP/SL?

Take Profit (TP) and Stop Loss (SL) is a risk management strategy used in trading to help investors control risks and maximize profits. These two concepts are Take Profit (TP) and Stop Loss (SL).

Take Profit (TP): Take Profit is a price target set by investors when entering a trade. When the trade reaches or exceeds this price, the trading system will automatically close the position, locking in the expected profit. The purpose of TP is to prevent greed from causing missed profit opportunities and to help investors exit the market securely amidst market fluctuations.

Stop Loss (SL): Stop Loss is a price threshold set by investors when entering a trade. If the trade price reaches or falls below this threshold, the trading system will automatically close the position, limiting potential losses. The purpose of SL is to protect investors from sharp market fluctuations and avoid significant losses.

The use of these two strategies is to help investors make rational decisions in the market, avoid emotion-driven trades, and ensure that investment risks are manageable. By setting take profit and stop loss, investors can automatically execute trades based on predetermined targets and thresholds without continuously monitoring the market.

Hands-on Tutorial: How to Pre-set TP/SL on SuperEx

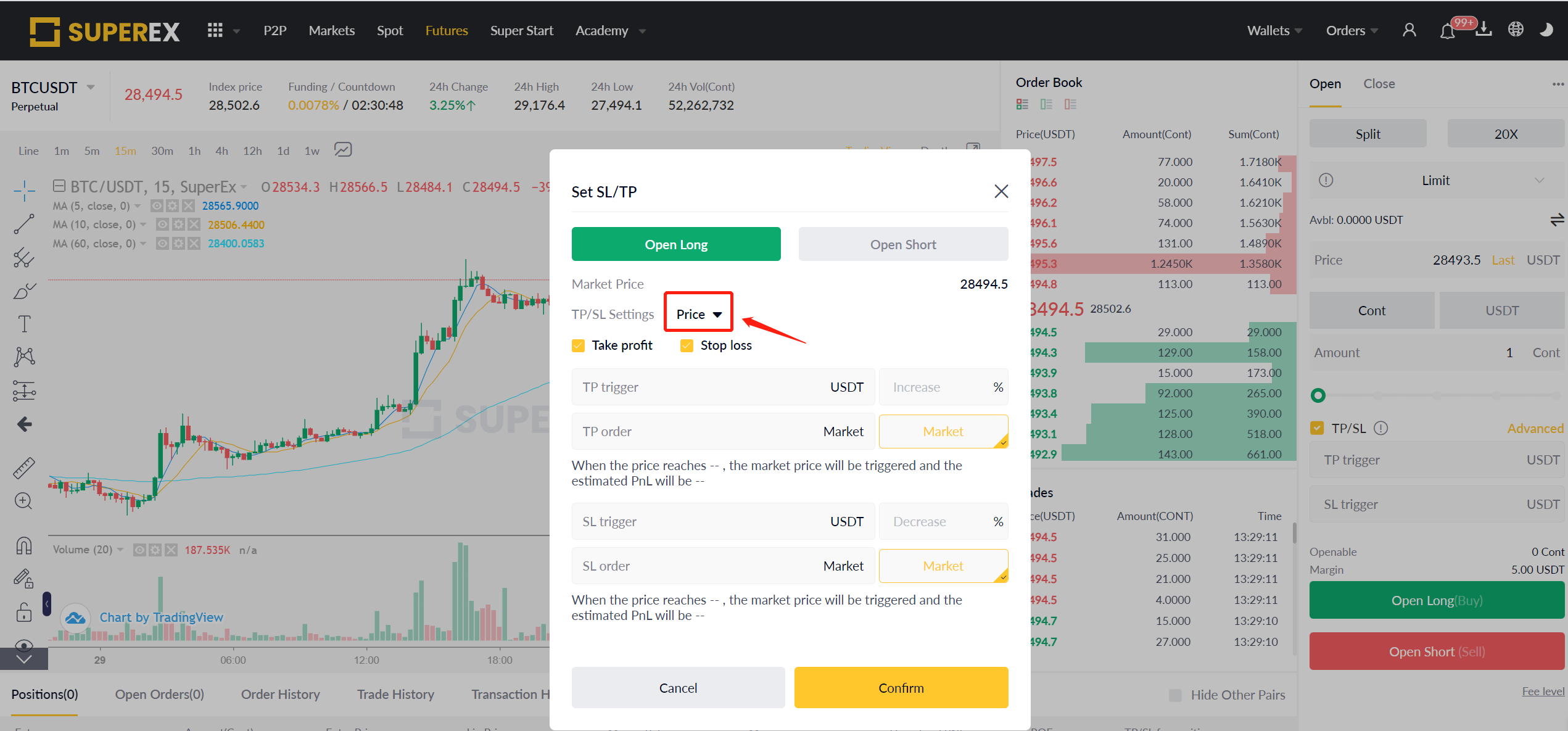

Preset TP/SL, that is, set a take profit and stop loss in advance for the position to be opened. When the user opening a position, you can click to set the take profit and stop loss at the same time. When the order is opened, the system will immediately set the take profit and stop loss order with the trigger price set by the user.

- Before opening a position, check TP/SL to enter the setting page.

- Set the take profit and stop loss

SuperEx supports setting TP/SL in three ways: price, PnL and %PnL to help users manage their positions. After setting the TP/SL, click Advanced to select the suitable way for you according to your needs.

Price:

The user needs to set the trigger price and order price. The order price can be limit/market based. When the market fluctuates to the trigger price, the position will be closed limit/market according to the settings. For limit orders, when the trigger price is reached, the system will open orders according to the limit price, and the transaction rules are consistent with ordinary limit orders.

PnL:

Users need to set a limit for TP/SL, when the profit or loss of a position reaches the set limit, the position will be closed according to the market price.

%PnL:

The user needs to set a earning rate for TP/SL. When the earning rate of the position reaches the set ratio, the position will be closed according to the market price.

By default, it is only necessary to set the TP/SL trigger price. When the market fluctuates to the trigger price, the position will be closed according to the market price.

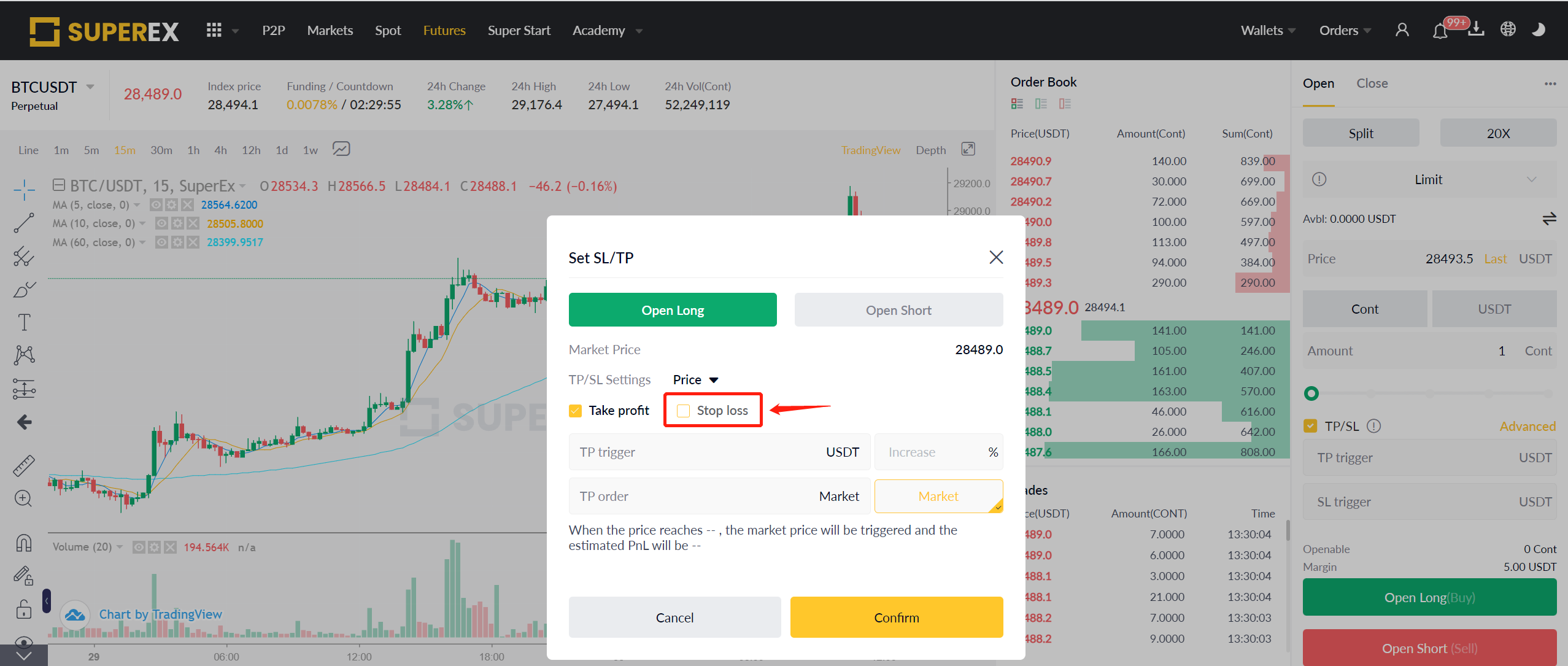

By default, users need to set TP/SL both, users can also select only take profit or stop loss based on their needs. Uncheck (Take profit/Stop Loss) on the advanced page to cancel the corresponding settings.

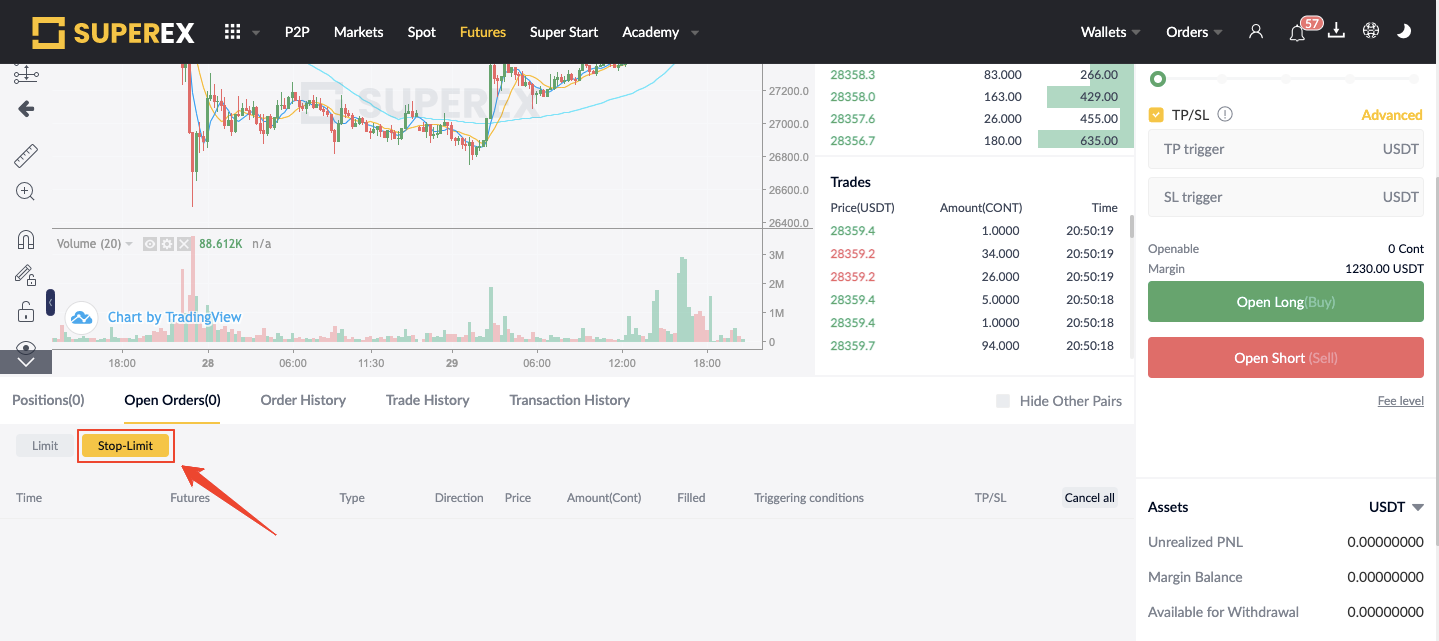

3.Setup Complete

After opening a position, the preset TP/SL will be set synchronously. Users can view or cancel the TP/SL setup on the current TP/SL page.

End

Responses