LEARN FORCE VOLUME INDEX (PVI) INDEX IN 3 MINUTES ——BLOCKCHAIN 101

Most traders look at price and Some traders add volume.But very few ask the real question:Is the market actually committing capital, or just moving on fumes?

That’s exactly what Force Volume Index (FVI) is designed to answer.

In crypto—where price moves can be driven by narratives, leverage, bots, and temporary liquidity—understanding how much force is behind a move matters far more than the move itself.

This is where FVI becomes powerful.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

What Is Force Volume Index (FVI)?

Force Volume Index is a momentum-based indicator that combines:

-

Price direction

-

Price magnitude

-

Trading volume

into a single measure of directional force.

Instead of asking “Did price go up or down?”,FVI asks:How aggressively did volume push price in that direction?

At a conceptual level, FVI treats volume as energy and price movement as result.

-

Rising price + expanding volume → strong bullish force

-

Falling price + expanding volume → strong bearish force

-

Rising price + shrinking volume → weak conviction

-

Flat price + large volume → hidden accumulation or distribution

This is why FVI is often described as a pressure gauge, not a trend line. It doesn’t just show motion—it shows effort.

Why FVI Is Especially Relevant for Crypto

Traditional markets are relatively stable in structure.

Crypto markets are not.

Crypto has:

-

Fragmented liquidity

-

High leverage participation

-

Narrative-driven rotations

-

Sudden inflows and outflows of capital

As a result, price alone is an unreliable signal.

You’ll often see:

-

Sharp price spikes with minimal follow-through

-

Breakouts that fail within hours

-

Strong-looking candles backed by thin volume

FVI helps distinguish between:

-

Structural moves (capital-backed)

-

Emotional moves (headline-backed)

-

Mechanical moves (liquidation-driven)

When FVI rises with price, it signals:

-

Traders are committing size

-

Orders are being executed with urgency

-

The move has participation breadth

When price moves but FVI does not, it often means:

-

Liquidity is shallow

-

Moves are driven by a few aggressive players

-

Reversal risk increases sharply

In crypto, participation matters more than precision—and FVI measures participation pressure.

How to Read FVI: Beyond the Basics

1. Rising FVI: Expansion Phase

When FVI trends upward:

-

Volume is reinforcing price direction

-

Momentum is accelerating

-

Market confidence is increasing

This phase often appears:

-

At early trend initiation

-

During breakout continuation

-

When narratives gain broad adoption

In practical terms, rising FVI means: The market isn’t just agreeing with the move — it’s pushing it. This is where trend-following strategies perform best.

2. Price Up, FVI Flat or Down: Hidden Weakness

This is one of the most important FVI signals.

When price continues higher but FVI stalls:

-

Buyers are less aggressive

-

New capital inflow slows

-

Late participants are chasing, not leading

In crypto, this often happens:

-

Near local tops

-

During post-hype phases

-

When leverage replaces spot demand

This divergence doesn’t mean “sell immediately,”but it raises risk awareness dramatically.

3. Sharp FVI Drops: Forced Events

Sudden negative spikes in FVI usually indicate:

-

Liquidation cascades

-

Panic selling

-

Stop-loss clustering

These moves look violent, but paradoxically:

-

They often mark short-term exhaustion

-

They may precede rebounds or consolidation

FVI helps you see whether selling pressure is accelerating or burning out.

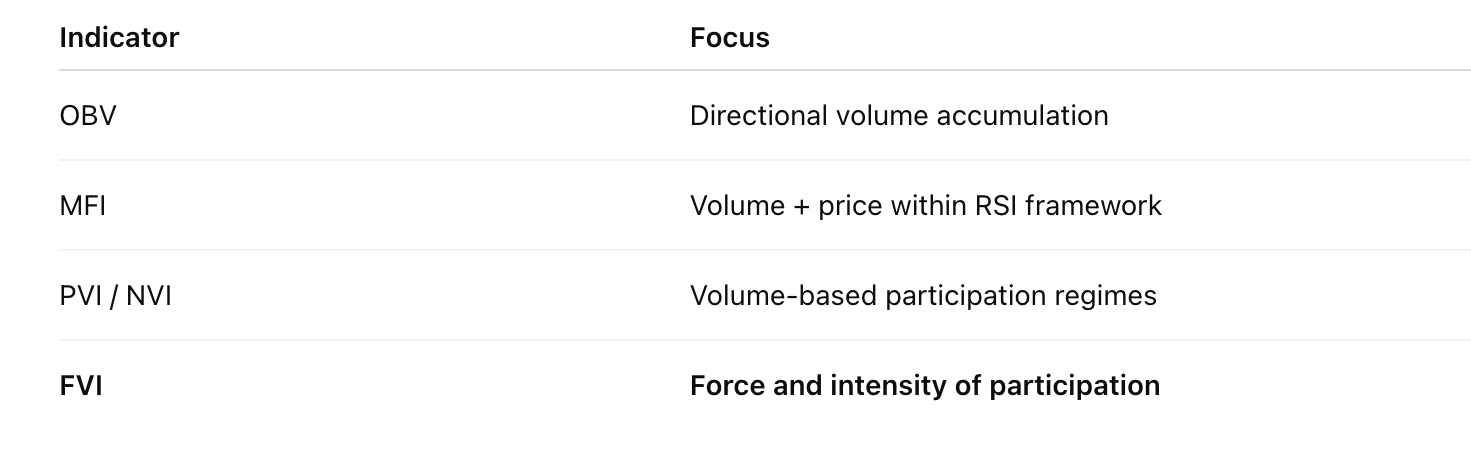

FVI vs Traditional Volume Indicators

FVI is often confused with indicators like:

-

OBV (On-Balance Volume)

-

MFI (Money Flow Index)

-

PVI / NVI

The key difference:

FVI doesn’t smooth participation—it weights it by aggression.

This makes it especially useful in:

-

High-volatility assets

-

Low-liquidity pairs

-

Meme coins and narrative-driven tokens

What FVI Is NOT

To avoid misuse, clarity matters.

❌ FVI does NOT predict future prices

❌ FVI does NOT identify exact tops or bottoms

❌ FVI does NOT replace trend analysis

Instead, FVI answers a different question: Is the market pushing with conviction, or just drifting?

Used correctly, FVI improves:

-

Entry timing

-

Risk assessment

-

Trade confidence filtering

It’s not a signal generator—it’s a context enhancer.

How Traders Actually Use FVI

In real trading environments, FVI is often used to:

-

Confirm breakouts

-

Validate trend continuation

-

Detect weakening momentum early

-

Avoid fake moves during low participation

Advanced traders often combine FVI with:

-

Support / resistance

-

Volatility regimes

-

Market structure analysis

FVI works best when treated as a confirmation layer, not a standalone system.

FVI in One Sentence

If price tells you where the market is moving, and volume tells you how many people are involved, then Force Volume Index tells you how hard the market is pushing.

And in crypto, that force is often the difference between a real trend and a temporary illusion.

Responses