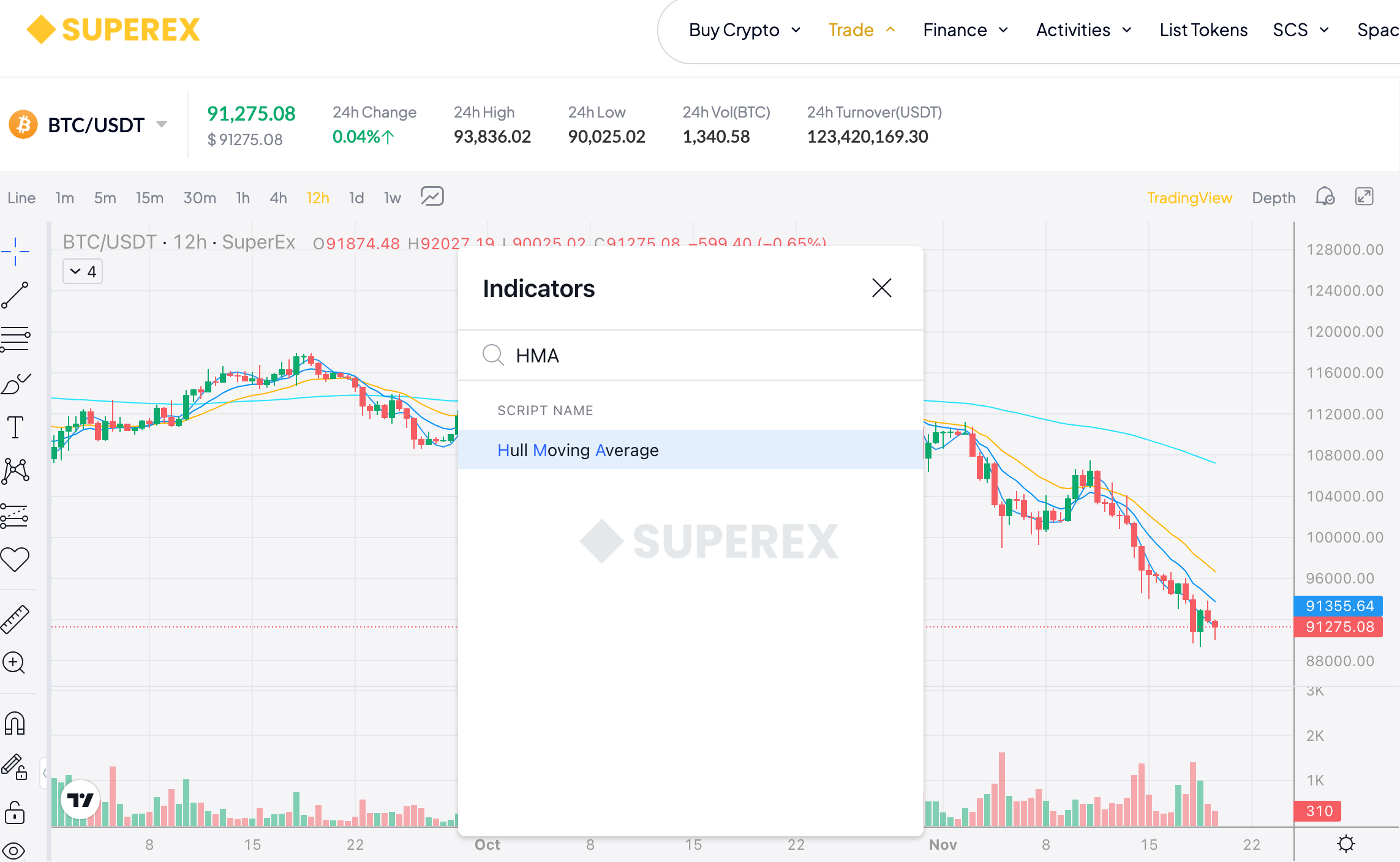

LEARN HULL MOVING AVERAGE (HMA) INDEX IN 3 MINUTES ——BLOCKCHAIN 101

SuperEx Academy is the world’s first online academy to offer comprehensive education on crypto-native indicators. It features the most extensive technical indicator tutorials and is the most detailed online learning platform for market technical analysis. Here, you’ll find hundreds of courses on commonly used indicators, along with nearly every known crypto-native indicator tutorial.

Today, our topic is the HULL MOVING AVERAGE (HMA). Proposed by Alan Hull, it solves three traditional problems simultaneously through a unique calculation method:

-

Eliminates the “lagging” issue of traditional moving averages

-

Reduces false signals during choppy market conditions

-

Makes trend reversals appear much more quickly

Traditional trend tools like SMA (Simple Moving Average) and EMA (Exponential Moving Average) may be classics, but their weaknesses are also extremely obvious:

-

SMA is too slow: when a trend begins, the signal lags behind

-

EMA is too fast: in choppy conditions, false breakouts appear constantly

-

WMA is weighted, but still cannot achieve both “speed + smoothness” at the same time

So traders began looking for a trend tool that is “both fast and noise-filtered.” This exact demand eventually led to the creation of the indicator we’re studying today: HMA (Hull Moving Average) — the Hull Moving Average.

HMA can be fast, smooth, and non-dragging all at once. It is one of the few trend indicators that can truly adapt to the extreme volatility of crypto markets, and is used long-term by many professional quant and trend-following systems.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

What is HMA, and Why Did It Become Popular?

The core goal of HMA is very simple: make a moving average both fast and smooth, while eliminating lag as much as possible.This may sound understated, but for decades, no indicator has achieved it as effectively as HMA.Created by Alan Hull, HMA simultaneously addresses three traditional problems through a special calculation method:

1. Eliminates the “lagging” nature of traditional moving averages

Traditional MAs average historical prices, which always creates lag—especially in the fast-changing crypto market where being half an hour late can mean entering a completely different price environment.

HMA uses Weighted Moving Average (WMA) + acceleration/smoothing techniques to make trend signals far more “real-time.”

2. Reduces false signals in choppy market conditions

It reacts faster than an EMA, yet produces far less noise than an EMA.

3. Makes trend reversals show up quickly

This effect is especially noticeable on BTC, ETH, or mid/low-cap altcoins. Simply put:

HMA ≈ EMA’s reaction speed + SMA’s smoothness

This is why it is viewed by many trend traders as “the most practical moving average for modern market conditions.”

How is HMA Calculated? (Non-Mathematical Explanation)

Although the formula looks complicated, the underlying logic is actually very straightforward. The principle can be broken down into three steps:

1. Use Weighted Moving Average (WMA) to speed up reaction time

Compared to SMA/EMA, WMA gives more weight to recent prices, so it reacts faster.

2. Use a shorter-period WMA to create an acceleration effect

It enhances trend direction through: 2 × short-period WMA − long-period WMA

3. Apply a √n smoothing filter

Why square root?

Because √n is shorter than n, allowing the moving average to stay smooth without losing speed. The result is a line that is both fast and stable — the signature characteristic of HMA.

The Real Advantages of HMA: Why Is It Better Than EMA and SMA for Crypto?

Crypto markets have several unique characteristics:

-

Volatility far higher than stocks or FX

-

24/7 continuous markets

-

Sudden news or tweets can trigger violent reversals

-

False breakouts are extremely common

Therefore, the weaknesses of traditional moving averages get amplified:

| Indicator | Problem |

|---|---|

| SMA | Too slow, lags heavily; unfriendly for crypto conditions |

| EMA | Too fast, creates excessive noise in chop |

| WMA | Still not smooth enough, tends to “shake” |

HMA solves all three problems:

HMA ≈ EMA’s speed + SMA’s smoothness = a far more usable trend indicator

This means:

-

Trend reversals appear earlier

-

False breakouts decrease

-

Local chop won’t shake you out as easily

-

Trend direction becomes clearer

In a fast, complex, noise-heavy environment like crypto, HMA very easily becomes “the best reference line for determining trend direction.”

How to Use HMA Correctly

Knowing the theory isn’t enough — you must know how to use it.Below is the core content: how to use HMA in practice.

1. Observe the Slope = Determine Trend Direction (Most Important)

-

HMA rising → uptrend

-

HMA falling → downtrend

This is the most direct and reliable way to identify trends.

Trend traders love HMA because its slope alone filters out many false signals.

2. Price Breaks Above/Below HMA = Entry Signal

This is the most commonly used trading method:

-

Price breaks above HMA → long entry

-

Price drops below HMA → short entry

Compared with SMA/EMA:

-

More timely signal

-

Fewer fake breakouts

-

More accurate trend reversal detection

Suitable for:BTC/ETH, major coins, and even small-cap rapid breakout plays.

3. HMA Color Shifting (If Your Platform Supports It)

Some charting tools change HMA color based on slope:

-

Green → uptrend

-

Red → downtrend

This provides the fastest visual trend confirmation.Many quant traders use this color shift as their open/close signal.

4. Multi-Timeframe HMA (Professional Strategy)

For more advanced trend confirmation:

-

Fast HMA (e.g., 21)

-

Slow HMA (e.g., 55)

Signals:

-

Fast HMA crosses above slow HMA → strong bullish trend reversal

-

Fast HMA crosses below slow HMA → strong bearish trend reversal

Cleaner than MA/EMA crossovers, with dramatically reduced noise.

HMA Blind Spots: What You Must Know Before Using It

No indicator is perfect — HMA included.

1. Still misleading during extreme consolidation

Although more stable than EMA, HMA can still produce false signals in very tight ranges.

2. Not suitable as a standalone “chase breakout” tool

Faster response means faster false signals if you don’t have risk management.

3. Ends trends quickly — especially during altcoin V-shaped reversals

This is why you should pair HMA with tools like Volume or MACD for confirmation.

Summary — Why Every Crypto Trader Should Master HMA

If you could only choose one moving average to determine trend direction,HMA is the most rational choice.Because it combines:

-

SMA’s smoothness

-

EMA’s reaction speed

-

WMA’s weighted precision

-

√n smoothing’s curved elegance

It is truly a trend indicator “designed for modern markets.”You can think of HMA as a moving average that:“Accelerates when it needs to, and brakes when it should.”

Responses