LEARN T3 MOVING AVERAGE INDEX IN 3 MINUTES ——BLOCKCHAIN 101

SuperEx Academy is the world’s first online academy to offer comprehensive education on crypto-native indicators. It features the most extensive technical indicator tutorials and is the most detailed online learning platform for market technical analysis. Here, you’ll find hundreds of courses on commonly used indicators, along with nearly every known crypto-native indicator tutorial.

Today, we will be studying the T3 Moving Average Index.The T3 Moving Average (T3 MA) is not your typical moving average — it’s a third-generation smoothing technique created by Tim Tillson.

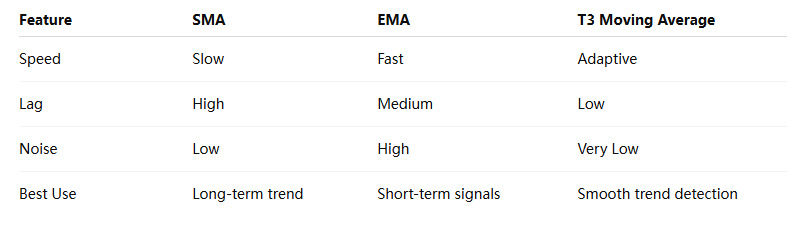

Unlike the Simple Moving Average (SMA) or Exponential Moving Average (EMA), which can be slow or overly sensitive, the T3 MA strikes a perfect balance between responsiveness and smoothness. It’s designed to reduce lag while filtering out noise — meaning you can catch trends earlier without being shaken out by small market fluctuations.

In short: T3 = smoother than EMA, faster than SMA, smarter than both.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

The Core Concept Behind T3

To understand T3, let’s break down what makes it different.

Most traders know:

- SMA = average of past prices

- EMA = gives more weight to recent prices

But both have trade-offs:

- SMA is too slow — you miss early reversals.

- EMA is too sensitive — too many false signals.

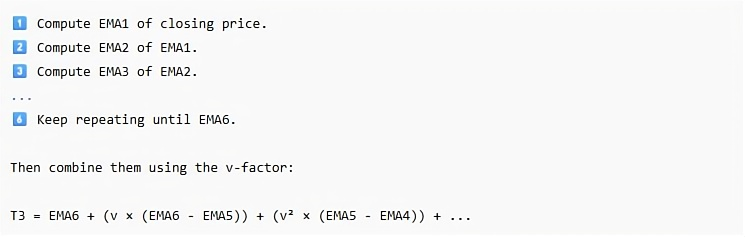

Tim Tillson designed T3 to fix this. It applies multiple layers of exponential smoothing (usually six) and introduces a “volume factor” (v-factor) that controls the curve’s smoothness and reactivity.

Mathematically, it’s based on EMA of EMA of EMA… — repeated six times.The “v-factor” (commonly 0.7) defines how smooth or fast the line reacts.Think of it as a “smart filter” that adapts to price speed.

How the Formula Works

Let’s not get lost in the math — here’s the conceptual flow:

Don’t worry — your trading software or blockchain analytics platform calculates all this automatically. What you need to understand is why it’s powerful: It smooths out random market noise while still reacting quickly to real momentum shifts.

How To Read the T3 Moving Average

Let’s make it simple: T3 behaves like any moving average — but better.

- When price crosses above T3

→ It’s a bullish signal — trend may be turning up. This means buyers are regaining control and the market could begin a new uptrend.

- When price crosses below T3

→ It’s a bearish signal — trend might be reversing downward. This shows selling pressure and potential trend weakness.

- When T3 itself turns upward or downward

→ The slope of T3 is key. Even before a crossover, a change in slope often signals a shift in momentum — like a car slowing before a turn.

- When T3 flattens

→ Market is likely consolidating. Traders often use this period to prepare for a breakout.

How It Differs from EMA and SMA

In crypto or blockchain-based assets, where volatility is extreme, the T3 MA is particularly useful — it keeps you from overreacting to every small move while helping you spot the real directional shift early.

How To Use T3 in Trading

T3 can serve multiple purposes depending on your trading style:

✅ 1. As a trend filter

Use T3 as your main trend-defining line. When price stays above T3, only take long positions; when it’s below, only take short positions.

This helps you avoid countertrend trades in volatile crypto markets.

✅ 2. As a crossover confirmation

Combine T3 with another faster moving average, like EMA(10).

- When EMA(10) crosses above T3, it confirms bullish momentum.

- When EMA(10) crosses below T3, it confirms bearish pressure.

This method filters out false signals common in single-MA strategies.

✅ 3. As a momentum indicator

Look at how steeply the T3 line moves.

- A sharp slope = strong momentum.

- A flattening T3 = waning interest or consolidation.

You can use this to gauge whether to add or reduce your position.

✅ 4. As a support/resistance guide

During strong trends, T3 often acts as a dynamic support or resistance line — price bounces around it before resuming the main direction.Example: In an uptrend, if price dips near T3 and rebounds, that’s a potential buy-the-dip zone.

✅ 5. T3 + Volume Indicators = Smart Confirmation

For even more precision, combine T3 with volume-based indicators like:

- OBV (On-Balance Volume)

- NVI / PVI (Negative / Positive Volume Index)

- Accumulation/Distribution Line

For example:

- If T3 turns up and OBV rises → smart money is likely buying.

- If T3 rises but NVI falls → uptrend may be weak, driven by retail.

This combo gives you a clearer read on who’s driving the market.

Why T3 Works So Well in Crypto Trading

Unlike traditional markets, blockchain assets trade 24/7, with higher volatility and lower liquidity during off-hours. T3’s smoothness helps absorb these irregularities. Here’s why crypto analysts and algo traders love it:

- Low lag means early trend detection in fast-moving tokens.

- Noise reduction avoids panic exits from small pullbacks.

- Scalability — T3 works across all timeframes, from 1-minute charts to weekly trends.

- Algorithmic compatibility — it integrates easily into bots or on-chain analytics dashboards.

In DeFi or perpetual markets, where fake breakouts are frequent, T3 helps identify whether a move has real institutional momentum or just retail noise.

Limitations of the T3 Moving Average

No indicator is perfect — T3 has its caveats:

- Slghtly complex to compute:You’ll rely on trading software (like TradingView, SuperEx, or Coinigy).

- Still a lagging indicator:It reacts faster than EMA but still follows price — not predict it.

- Over-smoothing can hide micro-trends:If your v-factor is too high (like 0.9), it may smooth out too much detail and delay your entries.

- Not suitable for very short scalping:Because of its layered calculation, T3 is best used for medium- to long-term trend analysis.

Summary: Why You Should Care About T3 MA

- It’s smarter than EMA, smoother than SMA, and faster than most hybrid averages.

- It helps you stay in trend longer without being shaken out.

- It filters out noise — crucial for crypto and DeFi assets.

- It’s ideal for trend-following and algorithmic models alike.

In short: T3 is like a turbocharged moving average — fast, smooth, and reliable.

If you trade in a 24/7 volatile market like crypto, this is the tool that can help you see the trend clearly, act earlier, and trade smarter.

Responses