LEARN KLINGER VOLUME OSCILLATOR (KVO) IN 3 MINUTES — BLOCKCHAIN 101

SuperEx Academy is the world’s first online academy to offer comprehensive education on crypto-native indicators. It features the most extensive technical indicator tutorials and is the most detailed online learning platform for market technical analysis. Here, you’ll find hundreds of courses on commonly used indicators, as well as nearly every known crypto-native indicator tutorial.

In trading markets, price movements are often just the “surface,” while the real strength lies behind the volume. You can think of the price as waves on the water, and the volume as the wind driving those waves. Watching the waves alone may let you guess the rise or fall, but without checking the wind’s strength, it’s hard to predict whether the waves will continue.

The Klinger Volume Oscillator (KVO) is an indicator designed to combine this hidden force—volume—with price movements. It can tell you:

-

Whether the current rise is backed by real strength or just hype.

-

Whether a decline reflects genuine selling pressure or is just market fear.

-

Whether big players are quietly accumulating or withdrawing.

In volatile crypto markets, where emotions are easily amplified, the value of KVO is even clearer. When the “wind” changes direction, the market can turn immediately.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Origin of the Klinger Volume Oscillator

KVO was developed by Stephen Klinger in 1994. His idea is straightforward: a market trend is only valid if supported by money flow (volume flow).

-

If the price rises without volume, it’s like “water without roots”—likely to reverse anytime.

-

If the price falls but volume shrinks, it usually reflects panic, not a true collapse of the trend.

Klinger designed a calculation that combines volume, price direction, and money flow cycles into a single oscillator, helping traders quickly distinguish the authenticity of trends and momentum.

Klinger Volume Oscillator Formula

The calculation of KVO is complex, but the logic can be broken down into three steps:

-

Determine price trend direction

Compare the current day’s “typical price” (High+Low+Close÷3)(High + Low + Close ÷ 3) with the previous day’s to determine whether money flow is positive or negative. -

Incorporate volume

Combine volume with trend direction to calculate the so-called “Volume Force.” -

Short-term and long-term smoothing

Apply two EMAs of different periods (typically 34 and 55) to the Volume Force and subtract one from the other to get the oscillator curve.

The result is a curve oscillating around zero:

-

> 0 indicates stronger bullish power

-

< 0 indicates stronger bearish power

-

Crossovers often signal trend reversals

How to Interpret KVO

The value of KVO lies not in the formula, but in its ability to answer three core questions:

-

Trend Confirmation

If the price rises while KVO remains above zero and continues to climb, the bullish trend is supported by money flow and is more reliable.

Conversely, if the price rises but KVO does not follow—or declines—it’s likely a false breakout. -

Early Warning

As a volume-price combined indicator, KVO often signals before the price does.-

In a downtrend, if KVO turns from negative to positive first, it suggests the bearish pressure is fading and a rebound may be brewing.

-

In an uptrend, if KVO starts to decline first, it signals weakening buying momentum, and the rally could peak soon.

-

-

Divergence Signals

Like MACD, KVO divergences are highly informative:-

Price makes a new high, but KVO doesn’t → the rise lacks volume support

-

Price makes a new low, but KVO doesn’t → selling pressure is exhausted

In crypto markets, divergence is especially important, as big players often act before the price reflects their moves.

-

Practical Uses of KVO

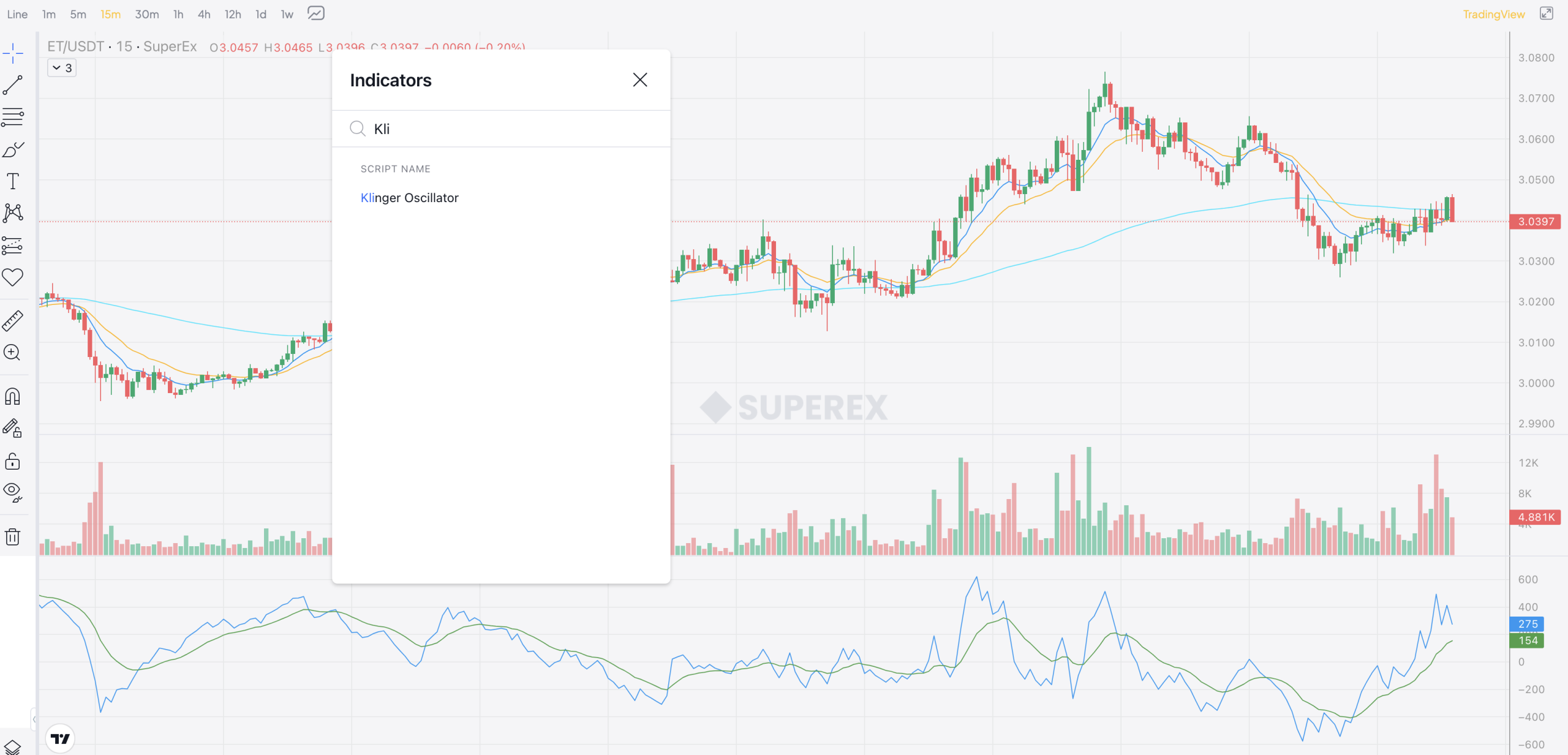

1. Combine with Trend Indicators

Using KVO alone may generate false signals due to short-term fluctuations. Many traders combine it with trend indicators like EMA or Bollinger Bands.

-

KVO crosses above zero + EMA upward → momentum and trend align, a more reliable buy signal, often the start of a new rally.

-

KVO crosses below zero + EMA downward → money is exiting, trend aligns with selling pressure, market risk is high, consider reducing or exiting positions.

Many traders treat KVO as a “confirmation tool”: if a chart shows a breakout but KVO doesn’t support it, it’s better to skip rather than chase blindly.

2. Position Management

KVO is also useful for deciding when to scale in or out of positions. In crypto, the challenge isn’t entering the market, but knowing when to add or reduce positions.

-

In an uptrend, if KVO keeps rising, money inflow is strong → gradually add positions.

-

If the price keeps rising but KVO starts falling → the uptrend is losing momentum → consider taking profits.

Example:

You bought BTC at $100,000. When it rises to $110,000, KVO is above zero and climbing → good time to add positions. If the price reaches $118,000 but KVO declines → strong sell/exit signal.

3. Combine with Crypto Market Trends

Some crypto sectors (DeFi, NFT, meme coins) are driven by sentiment and can experience rapid surges. KVO helps filter out noise.

-

A coin surges, but KVO doesn’t rise → no sustained capital inflow, high-risk short-term hype.

-

A coin is steady in price, but KVO rises → hidden accumulation, early positioning could yield profits.

For example, some meme coins in early 2025 doubled in price quickly, but KVO barely moved → only early entrants profited; latecomers likely lost.

4. Consider Market Cycle and Context

KVO should be interpreted within market cycles:

-

Early bull market: each KVO cross above zero signals capital re-entry.

-

Late bull market: even if the price hits a new high, KVO divergence signals a potential top.

-

Bear market: KVO is better used to catch rebounds than confirm long-term trends.

This prevents misusing the indicator across different market environments.

Summary

The practical value of KVO is that it is not just a buy/sell signal, but a tool to interpret capital behavior, manage positions, and distinguish hype from real trends.

In highly speculative crypto markets, KVO acts like a “sentiment filter”, helping you avoid emotionally driven risks and capture opportunities backed by real money flow.

Responses