LEARN TRIN INDEX IN 3 MINUTES ——BLOCKCHAIN 101

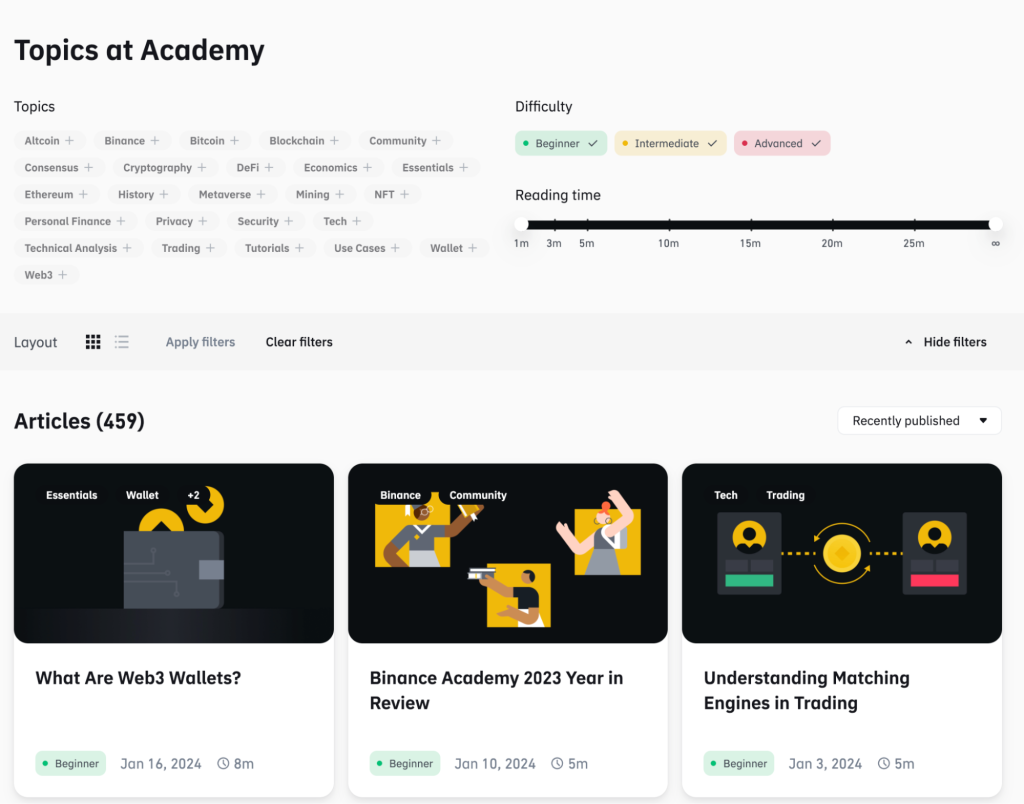

SuperEx Academy is the world’s first online academy to offer comprehensive education on crypto-native indicators. It features the most extensive technical indicator tutorials and is the most detailed online learning platform for market technical analysis. Here, you’ll find hundreds of courses on commonly used indicators, along with nearly every known crypto-native indicator tutorial.

Today’s lesson is TRIN Index (Arms Index), a classic breadth indicator. Even though it was invented decades ago for the stock market, TRIN has unique value for crypto traders as well. Let’s dive in.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

What is TRIN (Arms Index)?

Imagine the market as a tug of war: some stocks (or tokens) are pulling the rope up, while others are dragging it down. The TRIN Index tries to measure which side is stronger, not just by numbers, but by volume as well.

- Full name: TRading INdex (hence TRIN).

- Other name: Arms Index (named after Richard Arms, who created it in 1967).

The key idea: It compares the number of advancing vs. declining assets with their trading volume.

So, it doesn’t just ask: “How many coins went up today?” It also asks: “Did they go up with strong volume, or just weak moves?”That’s why TRIN is often called a “breadth momentum indicator”.

The Formula

The TRIN formula looks a bit scary at first, but once you break it down, it’s simple:

TRIN=(Advancing Issues / Declining Issues) ÷ (Advancing Volume / Declining Volume)

- Advancing Issues = Number of coins/stocks going up.

- Declining Issues = Number of coins/stocks going down.

- Advancing Volume = Total trading volume of the gainers.

- Declining Volume = Total trading volume of the losers.

In words:

- If a lot of assets are rising, but their volume is weak, TRIN will show it.

- If fewer assets are rising, but with huge volume, TRIN will capture that too.

How to Interpret TRIN

Now, let’s talk about what the values mean.

- TRIN < 1.0 → Bullish strength

Advancing volume outweighs declining volume. Buyers are driving the rally with strong participation.Example: TRIN = 0.7 → Broad market buying pressure.

- TRIN > 1.0 → Bearish pressure

Declining volume dominates. Even if some assets are up, the “real money” is behind the losers.Example: TRIN = 1.4 → Market under selling pressure.

- TRIN ≈ 1.0 → Neutral

The tug of war is balanced. No clear dominance from bulls or bears.

- Extreme values:

- TRIN < 0.6 = Overbought (market too hot, could pull back).

- TRIN > 2.0 = Oversold (panic selling, could rebound soon).

Think of it like the market’s heartbeat monitor. A normal beat = around 1. Too fast or too slow = stress.

TRIN in Traditional Markets

Originally, TRIN was widely used in the NYSE. Traders loved it because it could reveal when an apparent rally was actually weak.

For example:

- Dow Jones may rise 200 points, but TRIN = 1.5.

- This means: Only a few big stocks lifted the index, while most stocks fell with high volume.

- Translation: The rally isn’t healthy.

So TRIN became a go-to tool for identifying breadth divergence — when the index says “party time” but the underlying market whispers “not really.”

TRIN in Crypto Markets

Now, let’s move to our world — crypto.

- Crypto is different from stocks:

- Thousands of tokens, not just 500.

- Volume often concentrated in a few big names (BTC, ETH).

- Extreme volatility.

- Does TRIN still work here? Absolutely.

- On Exchanges: You can calculate TRIN using “advancing pairs vs. declining pairs” across the exchange. If most coins are up but TRIN > 1, it means big money is flowing into the losers, not the winners.

- For BTC dominance: If BTC is up but TRIN shows selling pressure, it could mean altcoins are bleeding heavily.

- For Altseason: A TRIN < 1 across the board often aligns with broad altcoin rallies.

- Example:

During a recent altcoin pump, TRIN on SuperEx stayed around 0.65 for two days. That signaled broad participation, confirming the rally wasn’t just BTC dragging the market higher.

Comparing TRIN with Other Indicators

Let’s see how TRIN stacks up against some familiar tools:

- VS RSI (Relative Strength Index)

- RSI measures momentum of one asset.

- TRIN measures breadth of the whole market.

- Use them together: If RSI is bullish but TRIN > 1, beware — market participation is weak.

- VS MACD

- MACD tracks trend strength on a chart.

- TRIN tracks crowd participation underneath.

- MACD might say “trend is up,” TRIN might say “but most assets are left behind.”

- VS VPT (Volume Price Trend)

- VPT is volume-weighted trend for one asset.

- TRIN is volume-weighted balance for the whole market.

In short: TRIN is not about “one coin,” it’s about the ecosystem health.

Limitations of TRIN

Of course, no indicator is perfect. TRIN has its blind spots:

- Short-term noise: In crypto, intraday volume shifts fast. TRIN values can swing wildly.

- Altcoin illiquidity: Many tokens have tiny volumes, which can distort advancing/declining ratios.

- Doesn’t predict direction: TRIN tells you about strength/weakness, but not “where price will go tomorrow.”

- Better for broad markets: Works best on an exchange-wide or index-wide scale, less useful for one token.

So, don’t rely on TRIN alone. Pair it with trend indicators, sentiment, and fundamentals.

Practical Trading Tips with TRIN

Here are some ways traders actually use TRIN:

- Confirm rallies:

- If BTC is up and TRIN < 1, the rally is healthy. If TRIN > 1, be cautious — it might be a fake pump.

- Spot reversals:

- TRIN > 2 for multiple sessions → panic selling → short-term rebound likely.

- TRIN < 0.6 for days → overheated market → watch for a pullback.

- Altseason timing:

- Sustained TRIN < 1 across multiple exchanges → strong participation → altseason vibes confirmed.

Final Thoughts

The TRIN Index may be more than half a century old, but like a wise veteran, it still has valuable lessons for today’s traders.

- In stocks, it revealed the truth behind index rallies.

- In crypto, it tells us if the party has real guests or just a fake DJ.

As SuperEx Academy emphasizes:Indicators are not magic spells, but flashlights. They don’t decide the market for you, but they help you see the hidden corners.

So next time you see BTC pump, don’t just cheer. Open your TRIN dashboard. Ask yourself:“Is the whole market with it, or is it just a few big names carrying the show?”

Responses