LEARN ILLQUID SUPPLY INDEX IN 3 MINUTES ——BLOCKCHAIN 101

Today is yet another session focused on teaching crypto-native technical indicators. SuperEx Academy is the world’s first online academy fully dedicated to crypto-native indicators. It boasts the most comprehensive set of technical analysis courses and is the most detailed online education base globally for crypto market indicators. Here, you can find courses on hundreds of commonly used technical tools, as well as tutorials for almost every crypto-native metric.

Today’s course topic is “ILLQUID SUPPLY.”The first time you hear the term Illiquid Supply Index, you might find it overly technical or even a bit abstract. Don’t worry—today we’ll help you understand this core crypto indicator in just 3 minutes: what it is, why it matters, and how to use it to decode the market.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

What Is the Illiquid Supply Index?

Simply put, Illiquid Supply refers to Bitcoin or other crypto assets that have been locked up for a long period and are unlikely to be traded or sold anytime soon. These coins are typically held in wallets belonging to long-term investors and show extremely low transaction frequency—thus considered “illiquid.”

The Illiquid Supply Index is a metric used to measure the “liquidity” or “lock-up ratio” of crypto assets. It tracks which addresses are long-term holders and identifies how much of the supply is effectively not circulating in the market.

In other words, lower liquidity means fewer coins are available for trading, making prices more susceptible to volatility when demand increases.

Why Is Illiquid Supply So Important?

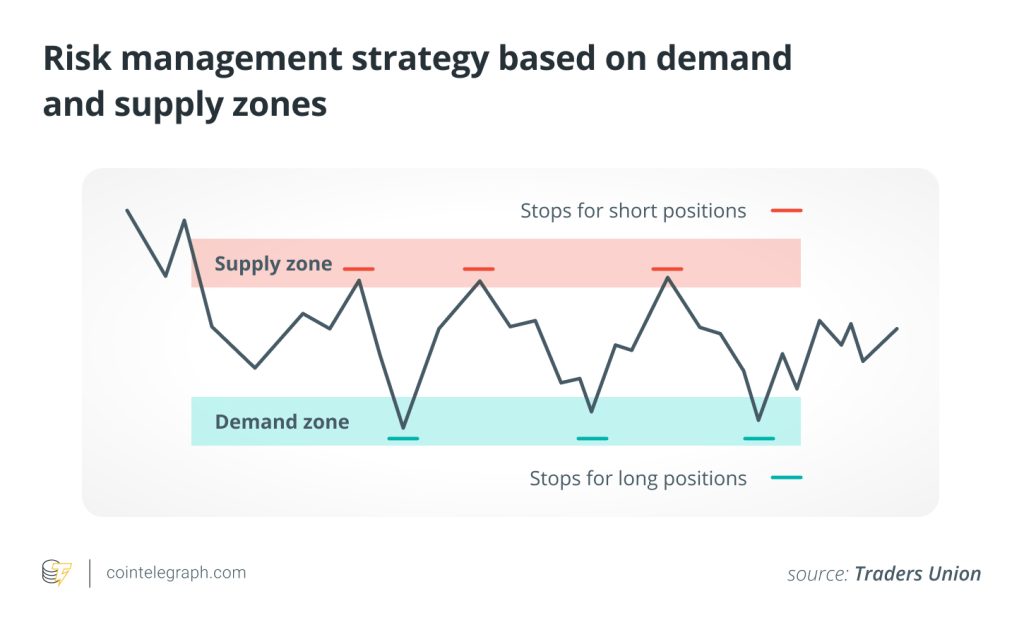

In the crypto world, price movements depend not only on demand but also on how many coins are actually available for sale on the market.

-

When illiquid supply is high: There’s less sell-side pressure. If new capital enters the market, prices can rise more easily.

-

When illiquid supply is low: A large number of coins could be sold at any time. With ample supply, it’s harder for prices to move up.

For example:

Say Bitcoin’s total supply is 21 million, and 70% is locked in cold wallets by long-term holders. That means only 30% of BTC is actively circulating and available for trading. If demand surges, the price could skyrocket in a “supply squeeze” scenario.

How to Read This Indicator?

-

Bullish Signal: When illiquid supply increases, it means more investors are choosing to hold long-term. This is often interpreted as a bullish sign or rising market confidence.

-

Bearish Signal: If long-term holders start moving assets to exchanges and illiquid supply drops, it may indicate upcoming selling pressure—a possible warning of correction.

-

Professional investors often combine Illiquid Supply Index with Exchange Reserve (amount of assets held on exchanges) and On-chain Activity to assess market supply-demand dynamics.

Why Is It Smarter Than Traditional Indicators?

Because Illiquid Supply is calculated from on-chain data—which is transparent and tamper-proof—it’s not easily manipulated like traditional market indicators. It’s more like a “market sedimentation meter,” revealing the actual holding behavior behind the scenes.

The Formula Behind the Illiquid Supply Index

-

The simplified formula is:

Illiquid Supply Index = Illiquid Supply ÷ Circulating Supply

-

Illiquid Supply: Calculated by tracking the flow activity of all on-chain addresses, flagging those with minimal selling behavior (long-term holding addresses).

-

Circulating Supply: The portion of total crypto supply that has been issued and is currently in circulation.

So, if you see Illiquid Supply Index = 0.75, it means 75% of the circulating tokens are held by long-term investors and unlikely to be sold in the short term.

-

Liquidity classification logic:

All addresses are categorized into three types:

-

Highly Liquid: Frequent outbound transactions; high chance of short-term selling.

-

Liquid: Occasional trading activity, but not too frequent.

-

Illiquid: Mostly inflows, barely any outflows—indicating strong long-term holding intent.

The Illiquid Supply refers to the total token holdings of the third category.

Future Applications

For major cryptocurrencies like Bitcoin and Ethereum, the Illiquid Supply Index is widely used by institutions and analysts as a core metric for assessing mid- to long-term trends. As on-chain analytics platforms like Glassnode continue to evolve, this index will play an increasingly important role in asset valuation, price prediction, and risk management.

Conclusion

The Illiquid Supply Index is like a “reservoir gauge” for the market. It tells us how much “water” (liquidity) is actively flowing and how much is locked up.If you want to truly understand crypto market supply and demand, this is one indicator you absolutely need in your toolbox.

Scam this site