LEARN FUTURES BASIS INDEX IN 3 MINUTES —— BLOCKCHAIN 101

Ever wondered how professional traders always seem to predict bull or bear trends ahead of everyone else?You’ve probably heard the term “Futures Basis” thrown around, but never really understood what the Futures Basis Index is actually good for?

Don’t worry—this short article is made just for you.We’re going to talk about one simple yet extremely useful indicator: Futures Basis Index. It’s not complicated, but it reveals real market sentiment, capital structure, and can even help you figure out whether a rally is real—or just a fake breakout.

Spend 3 minutes to grasp it, and your crypto investing mindset will instantly level up.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

What Is the Futures Basis Index?

Let’s start with a question:

Spot BTC is $105,000, while a quarterly futures contract is priced at $101,500.(This is not an actual price—just for example.)So, does this $1,000 difference mean someone is bullish on the future?

Exactly. That’s the original definition of Futures Basis:Futures Basis = Futures Price – Spot Price

The Futures Basis Index is simply a standardized version of this difference—an index that lets you easily track its level and trend over time.

The most common form is the annualized basis, and it’s calculated like this:

Annualized Basis = (Futures – Spot) / Spot × (365 / Days Until Expiry)

For example, if BTC spot is $105,000, the quarterly contract has 90 days left, and it’s priced at $101,500:

Annualized Basis = (1,000 / 105,000) × (365 / 90) ≈ 38.62%

This means long traders are willing to pay an annualized cost of 38% to “lock in” future Bitcoin. Why?They could be betting on a bull run, institutional accumulation, or arbitrage opportunities.

That’s the logic behind the Futures Basis Index.

What Can the Futures Basis Index Reveal?

You might ask: okay, I get what it is—but what can it actually show me? Can I really use it to make money?

The answer is: yes—and it’s crucial.

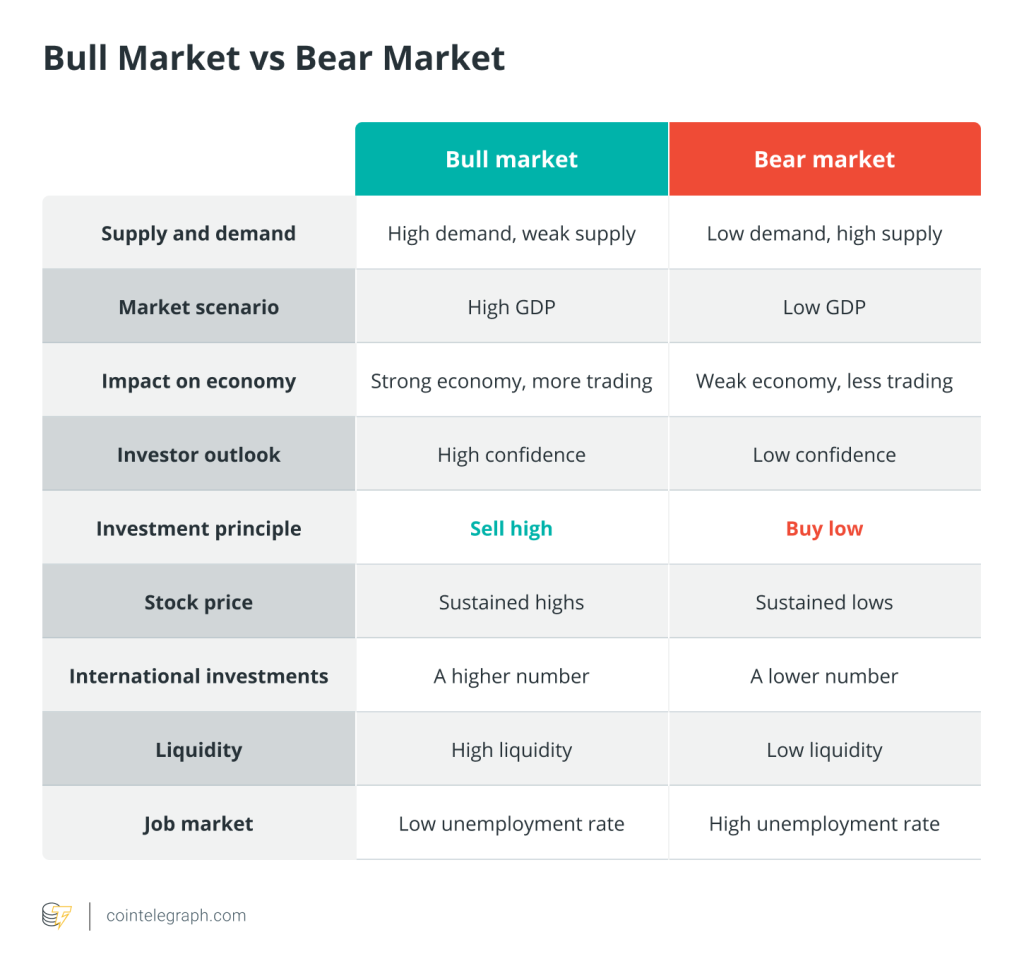

1. Gauge Market Sentiment

-

Positive Basis (Contango): Futures > Spot → Bulls in control → Market optimism

-

Negative Basis (Backwardation): Futures < Spot → Bears in control → Market fear or panic

Example:If BTC spot is $105,000 but futures are only $100,000, it means no one wants to bet on the future.Instead, people are dumping futures at a discount—a sign of fear.

2. Spot Institutional Activity

When the basis widens, it often means:

-

Arbitrage traders are actively executing “cash and carry” (buying spot + shorting futures)

-

Or institutions are buying futures to hedge spot positions (e.g. ETF accumulation)

High basis ≈ active institutional presence

So tracking the Futures Basis Index is a powerful way to monitor if “smart money” is entering the game.

3. Detect Potential Risk

Sometimes the basis spikes rapidly—for example, jumping from 5% to 20% annualized.

That’s a red flag:It could mean the market is overheating, futures prices are disconnected from reality, and a bubble is forming. Combine this with high leverage and soaring open interest (OI), and you’ve got the recipe for sharp corrections or liquidations.

How to Use the Futures Basis Index for Trading?

Now that you know the theory, let’s talk practical use cases.

Use Case 1: Spotting Fake Rallies

Say BTC surges 10% over a few days, but the Futures Basis Index drops—what does that tell you?

-

Price went up, but futures lagged behind → Capital isn’t convinced.

-

This is like a volume-price divergence—the rally might be fake, and could reverse soon.

-

In contrast, if BTC rises and the basis expands at the same time → that’s a healthy trend, with traders willing to “pay a premium for the future.”

Use Case 2: Futures Arbitrage (Advanced Strategy)

This is a favorite of whales and institutions.

When you see the Futures Basis Index is high (e.g. >10% annualized), you can:

-

Buy spot BTC

-

Short an equal amount of futures

-

Wait until expiry to settle or hedge → collect the basis as profit

This is a classic hedged arbitrage strategy—very effective during mid-to-late bull cycles.

Of course, it requires:

-

Low fees

-

Minimal slippage

-

And the ability to lock up capital for a while

Watch Out: Don’t FOMO Into High Basis, and Don’t Ignore Negative Basis

Futures Basis Index is powerful, but don’t blindly trust it. Here are key tips:

-

High basis ≠ guaranteed pump: Might just mean too many arbitrageurs—fragile bubble

-

Negative basis ≠ guaranteed dump: Could signal oversold panic—great for bottom fishing

-

Different contracts = different basis norms: Don’t confuse perpetuals with quarterlies

-

Percentages need time context: 20% annualized sounds high, but if the contract expires in 3 days, the actual gain is tiny

Conclusion: Futures Basis Index Is the “Sentiment Thermometer” of On-Chain Capital

To sum it up in one line:

-

Futures Basis Index shows you: where the money’s betting, how much, and whether it’s driven by greed or fear.

-

It’s a trend indicator, not a buy signal; a tool to spot institutional intent, not a trading holy grail.

-

But once you understand it, you’ll have a new benchmark in your toolkit—no longer swayed by surface-level price charts or FOMO sentiment.

Responses