LEARN ORDER BOOK DEPTH INDEX IN 3 MINUTES ——BLOCKCHAIN 101

The Order Book is the heartbeat of crypto trading. Every time someone places a buy or sell order, their intent gets reflected in the order book of Bitcoin or other crypto assets. And Order Book Depth refers to how many buy and sell orders are placed within a given price range deviation.

The Order Book Depth Index is the quantification of this depth—turning it into a metric that quickly reflects market sentiment and liquidity. If you’re a trader, this index is way more reliable than just staring at candlestick charts and yelling “Pump incoming!”

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Why Should You Care About the Order Book Depth Index?

Ever jumped into a price surge only to get wrecked by a “fake breakout”? Or tried to buy a dip but ended up suffering insane slippage?That’s all tied to the depth of the order book.

Put simply:

-

When depth is strong, you can buy/sell quickly without huge price movement.

-

When depth is weak, even a single whale order can move the price by dozens of dollars.

The Order Book Depth Index is your tool for monitoring the market’s ability to absorb trades—its “carrying capacity.”

Understanding the Order Book Depth Index

1. Order Book Basics Recap

The order book is a data board recording all open buy and sell orders. It consists of two sides:

-

Bids: Buy orders — the price and quantity people are willing to buy (usually sorted high to low)

-

Asks: Sell orders — the price and quantity people are willing to sell (usually sorted low to high)

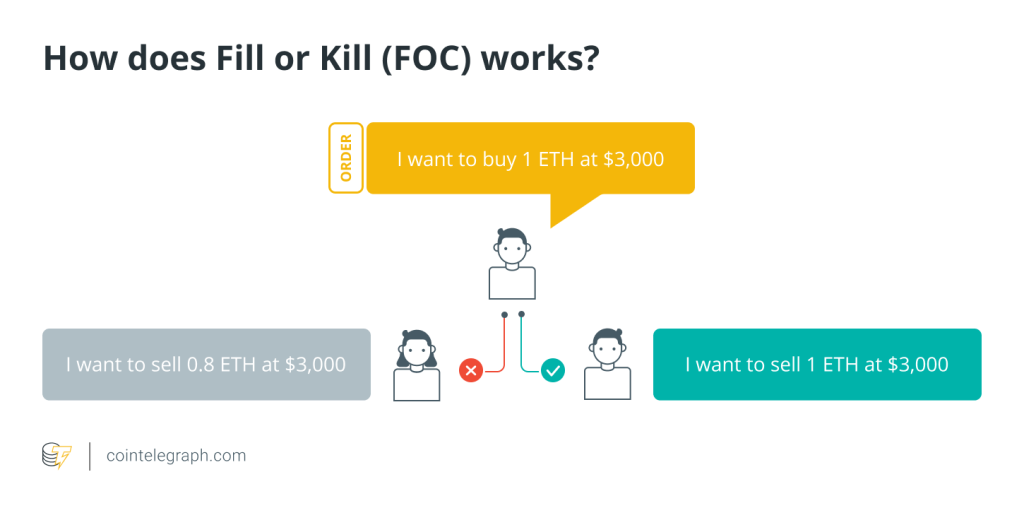

When you place an order, it sits in the book until someone matches your price. Only then is it executed.

2. How Is the Order Book Depth Index Calculated?

Here’s a standard approach:

✅ Choose a price deviation range, like ±2% or ±1%

✅ Calculate the total buy and sell orders within that range (in USD or token amount)

✅ You get two values: Buy Depth and Sell Depth

✅ Apply standardization to derive the Depth Index

Some platforms use more advanced algorithms, factoring in time-weighted orders, order stability, and liquidity distribution.

3. How to Read the Order Book Depth Index?

Example:You check a trading platform and see Order Book Depth Index = $10M (Buy), $8M (Sell) ,This means within a ±2% price band, there’s $10M in buy orders and $8M in sell orders.

Interpretation:

-

The market leans bullish, with buy-side support.

-

If you’re shorting, beware of potential rebounds.

-

If you’re long, your entry likely won’t move the price much—good for stability.

But if the values are low—say, both buy and sell depths are below $1M—watch out: weak depth = poor liquidity = potential for “waterfalls” or “rockets” with small movements.

4. Real-World Scenarios

Scenario 1: Trader Judging Breakout Reliability

A token suddenly surges 5%. You’re suspicious it’s a fakeout. You check the Order Book Depth Index:

-

Before the rise: Buy depth < $500K, Sell depth = $3M

-

During the rise: Half the sell orders vanish, but buy depth remains thin

-

Conclusion: This is likely a whale-led trap. Avoid chasing.

Scenario 2: Institutional Order Placement

You’re an OTC desk planning to buy 100 BTC on SuperEx. You check the Depth Index:

-

Within ±1%, buy depth = $1M USDT, sell depth = $1.5M

-

You realize this order would move the market significantly.

You must split it into smaller chunks or find a platform with deeper liquidity.

The Value of the Depth Index Goes Beyond Trading Strategy

✅ It reflects exchange health: If a platform’s depth index stays low for extended periods, it signals weak participation and inactive market makers.

✅ It reveals liquidity risk: Especially in DeFi or low-cap tokens, liquidity “mirages” are common. The Depth Index helps you assess “can I exit safely?”

✅ It provides entry/exit timing cues: In short-term trading, you’ll notice: candlesticks show results, but the Depth Index shows the process. If a whale is prepping to dump, depth data often gives you the first clue.

Pro Tips: 3 Ways to Use the Depth Index Smarter

-

Use it with candlestick charts: If a key resistance is about to break, check the sell depth—if it’s thick, be alert for a fakeout.

-

Set depth alerts: Many platforms let you set alerts. E.g., when buy depth > $X, you get notified—could signal “bulls are reloading.”

-

Combine with whale address tracking: Large-scale accumulation usually coincides with depth increases across multiple platforms. Address tracking + Depth Index = more accurate analysis.

Summary

The Order Book Depth Index gives you a second-level view that cuts through market noise.It doesn’t predict the future—but it shows you the current stability, how much capital is supporting the market, and whether your orders will slip or get caught in someone else’s dump.And that insight is more valuable than anything else.

Responses