LEARN MINER POSITION INDEX IN 3 MINUTES ——BLOCKCHAIN 101

-INDEX-IN-3-MINUTES@2x.jpg)

In the world of Bitcoin, miners are like the “infrastructure builders” of the blockchain. They process transactions, maintain the network, and — most importantly for this discussion — they hold a lot of Bitcoin. That’s why the Miner Position Index (MPI) is such a powerful on-chain metric. It’s basically a sneak peek into what miners are doing with their BTC — whether they’re selling or holding.

You’ve probably heard of indicators like NVT, SOPR, MVRV, etc., but MPI is especially straightforward. It tells you one thing: Are miners dumping their BTC or HODLing?

So let’s break down this indicator in plain English. Give me 3 minutes, and I’ll show you how to use MPI like a pro.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

-INDEX-IN-3-MINUTES@2x.jpg)

What Is the MPI, and Why Does It Matter?

MPI (Miner Position Index) = BTC sent by miners to exchanges / 1-year moving average of that value

In simple terms: MPI shows whether miners are actively sending BTC to exchanges, which usually means they’re preparing to sell.

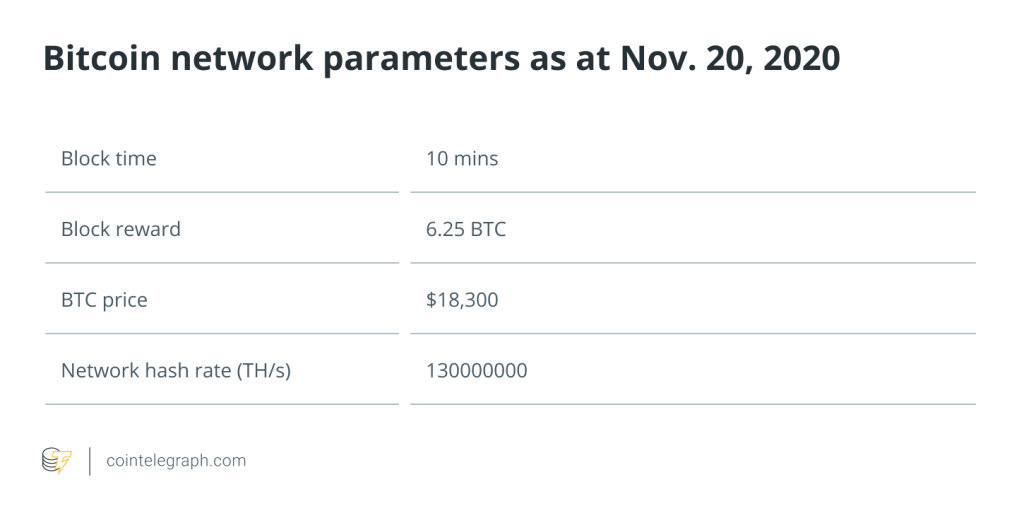

We all know miners earn BTC by securing the network. Once they get their coins, they face two choices:

- Sell BTCto cover expenses like electricity and hardware;

- Hold BTCin hopes of higher future prices.

MPI tells us which way miners are leaning — are they selling, or are they chilling?

- High MPI (much greater than 0): Miners are transferring lots of BTC to exchanges — warning sign!

- Low or negative MPI: Miners are keeping their BTC in cold storage — bullish signal.

Easy Analogy: Miners and Pizza Shops

Imagine your neighborhood pizza shop gets 100 pizzas daily. Normally, they sell 70 and keep 30 in storage for later.One day, the owner starts selling 95 pizzas a day, even digging into his storage. That could mean he expects demand to drop — or that he desperately needs cash.

Miners do the same thing: when they suddenly move more BTC to exchanges, it’s often a sign of changing expectations or financial stress.

MPI is the on-chain version of watching that pizza shop owner’s behavior.

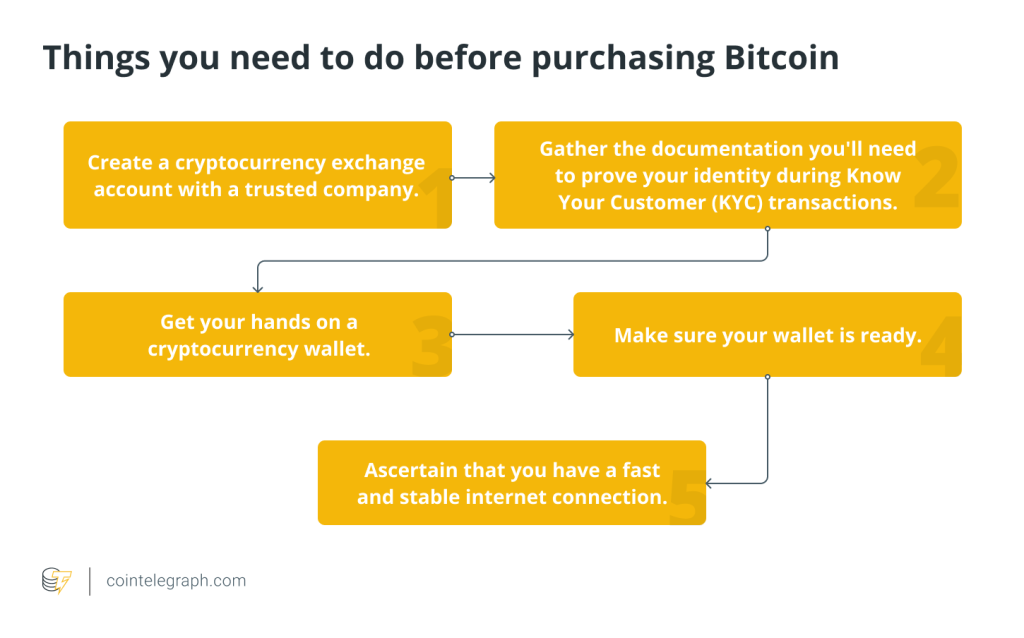

MPI Thresholds: What the Numbers Mean

MPI isn’t just about being high or low — it’s about context. Here’s a basic cheat sheet:

- MPI > 2: Caution! Miners may be preparing for large-scale selling. Potential local top.

- MPI ≈ 0–1: Neutral zone. No significant sell pressure from miners.

- MPI < 0: Bullish. Miners aren’t sending BTC to exchanges — maybe even accumulating.

A few historic examples:

- During Bitcoin’s peak near $60k in 2021, MPI surged past 3 — a sign miners were offloading.

- In the depths of the 2022 bear market, MPI hovered near 0 — miners had stopped selling, indicating market bottom formation.

Is MPI a Leading or Lagging Indicator?

This one’s tricky — it depends.

Miners are sensitive players in the market. Their margins are tight, and their decisions are often based on profitability. So:

- In late-stage bull markets, MPI rises as miners start to offload at high prices.

- In bear markets, MPI stays low — miners stop selling because it’s unprofitable.

In short, MPI can signal tops and bottoms — but you need to look at the bigger picture too.

Don’t Rely on MPI Alone

MPI is helpful, but not perfect. There are a few things to keep in mind:

1. Miners ≠ Biggest Sellers

These days, institutions and ETFs control far more BTC than miners. So while MPI is useful, it doesn’t cover the entire supply side.

2. Transaction Routing Tricks

Some miners move BTC between wallets before sending to exchanges. That can distort MPI readings.

3. Market Mood Still Matters

A high MPI doesn’t always lead to a price drop — and a low MPI doesn’t guarantee a rally. Combine it with technical analysis and sentiment.

How to Use MPI in Real Trades

Here’s how you might apply MPI in your trading:

Scenario A: MPI spikes + price is rising fast

- Potential warning. Miners are likely selling into strength.

- Action: Consider taking profits or reducing risk.

Scenario B: MPI flat/low + price consolidating

- Low sell pressure from miners. Market may be absorbing supply.

- Action: Watch for signs of a breakout or accumulation.

Scenario C: MPI jumps + large on-chain transfers

- Could be panic selling, regulation news, or a miner capitulation.

- Action: Be cautious; observe volume and other metrics before acting.

Conclusion: Who Should Use MPI?

MPI is not a high-frequency trading tool. It’s best for swing traders, position traders, and long-term analysts who want to understand on-chain supply pressure.In traditional finance, you might watch insider trading or fund flows. In crypto, you watch the miners — the OGs of BTC distribution.So next time you’re wondering whether Bitcoin is in a good place to buy or sell, pull up the MPI chart. Ask yourself: What are the miners doing?

Responses